Market Overview

The Philippines logistics market is valued at USD 55.65 Billion in 2024 with an approximated compound annual growth rate (CAGR) of 6% from 2024-2030, driven by significant growth in e-commerce, rising foreign investments, and enhanced infrastructure development across the country. This market is propelled by improved transportation and communication networks, along with government initiatives aimed at streamlining logistics operations. With an expanding middle class and increased consumer spending, the demand for efficient logistics solutions continues to grow, creating opportunities for service providers.

Major cities such as Manila, Cebu, and Davao dominate the logistics landscape, primarily due to their strategic locations and developed infrastructure. Manila, being the capital, serves as a critical hub for both domestic and international freight activities. Cebu is recognized for its vibrant trade activities, while Davao stands out for agricultural logistics. These cities are pivotal because they encompass significant transport hubs, enhancing connectivity to local and international markets.

Urbanization in the Philippines has seen nearly 47% of its population living in urban areas as of 2023, with projections indicating continued growth. As major urban centers like Metro Manila and Cebu expand, the demand for efficient logistics solutions becomes critical to support urban living. Infrastructure development plays a pivotal role in this transition; the Philippine government has committed approximately USD 25 billion towards key projects such as road networks and ports to enhance transportation links.

Market Segmentation

By Mode of Transport

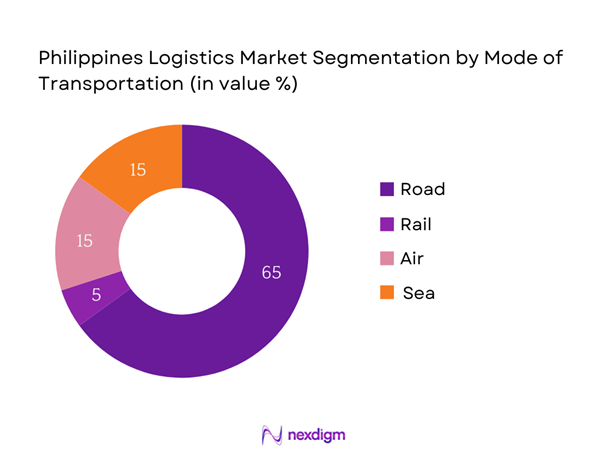

The Philippine logistics market is segmented by mode of transport into road, rail, air, and sea transport. The road transport sub-segment is dominant, accounting for a significant market share due to its extensive network facilitating the movement of goods to urban and rural areas alike. Road transport is favored for its flexibility, accessibility, and ability to adapt to changing demands of the logistics sector.

By Service Type

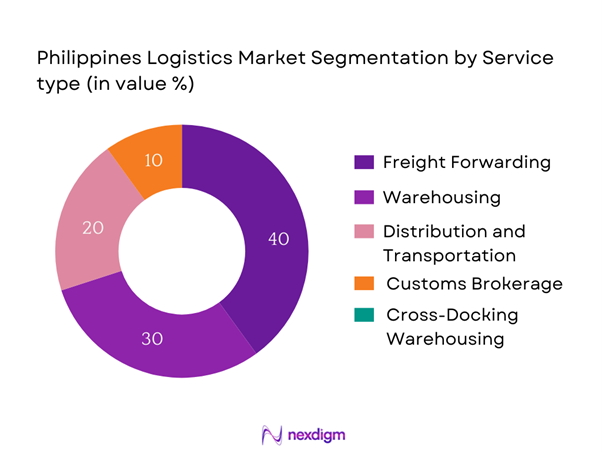

The market is also segmented by service type, including freight forwarding, warehousing, distribution and transportation, and customs brokerage. The freight forwarding sub-segment leads the market, primarily because of the growing complexity of global supply chains and the need for expert management of logistics operations. This service type encompasses a range of activities, making it essential for businesses looking to optimize their supply chain management.

Competitive Landscape

The Philippines logistics market is dominated by a few major players, including Aboitiz Transport System Corporation, 2GO Group, and International Container Terminal Services, Inc. This consolidation highlights the significant influence of these key companies, which have established comprehensive networks and diversified service offerings to meet the growing demands of the logistics sector.

| Company Name | Establishment Year | Headquarters | Freight Services Offered | Warehousing Facilities | Technology Integration | Market Positioning | Key Clients |

| Aboitiz Transport System Corporation | 1999 | Taguig City | – | – | – | – | – |

| 2GO Group, Inc. | 2004 | Pasay City | – | – | – | – | – |

| International Container Terminal Services | 1987 | Manila | – | – | – | – | – |

| DHL Supply Chain Philippines | 2000 | Manila | – | – | – | – | – |

| LBC Express, Inc. | 1945 | Pasay City | – | – | – | – | – |

Philippines Logistics Market Analysis

Growth Drivers

Expanding E-commerce Sector

The e-commerce sector in the Philippines has experienced remarkable growth, with revenues projected to reach USD 17 billion in 2023. The number of internet users is also climbing, with approximately 82 million individuals connected, reflecting an internet penetration rate of about 74%. This digital landscape enables businesses to leverage online platforms for transactions and logistics. Additionally, the flexibility of logistics services tailored for e-commerce is essential in handling last-mile deliveries, which are becoming increasingly crucial. Factors such as an expanding middle class and shifts in consumer behavior further support the robust growth of the e-commerce and logistics sectors, creating significant demand for diverse logistics solutions.

Increase in Foreign Investments

Foreign direct investments (FDI) into the Philippines have surged, with inflows projected to surpass USD 10.5 billion in 2023, driven by the country’s improving business climate and favorable demographic profile. The manufacturing sector attracted a substantial share of these investments, resulting in the establishment of logistics hubs that facilitate trade routes and distribution channels. Moreover, the government has been actively promoting investments in infrastructure, particularly in transport networks that are vital for logistics operations. This influx of capital into various sectors enhances related logistics services and tailors supply chain efficiencies, ultimately fostering superior performance in the logistics market.

Market Challenges

Regulatory Compliance Issues

Regulatory compliance remains a significant challenge in the Philippines logistics market. Businesses often grapple with myriad regulations that can complicate logistics operations, such as import/export documentation requirements and transportation safety standards. The Philippines is currently ranked 133 out of 190 in the World Bank’s Doing Business report, indicating hurdles that logistics firms face, particularly when dealing with customs regulations. As companies navigate these compliance measures, the complexities can lead to delays, increased operational costs, and inefficiencies within the logistics chain, impeding potential profitability.

High Transportation Costs

Transportation costs are exceptionally high in the Philippines, primarily due to congestion and inadequate infrastructure. The Logistics Performance Index ranks the country relatively low at 60th globally, portraying inefficiencies in logistics and transportation systems. Average shipping costs within the archipelago can reach USD 500 to USD 1,000 for inter-island transportation, largely due to fuel prices heavily influenced by global markets. This situation not only affects logistics service providers’ operational margins but also translates to heightened costs for consumers, complicating the competitive landscape for logistics services within the market.

Opportunities

Growing Demand for Last-Mile Delivery

The demand for last-mile delivery is rapidly increasing, fueled by the booming online shopping habit among Filipinos, which has grown significantly in recent years. In 2023, last-mile delivery services catered to a population of approximately 41 million online shoppers, resulting in a considerable uptick in demand. Retailers are now recognizing the need for streamlined last-mile logistics as a crucial differentiator in customer satisfaction and retention. As urban areas continue to expand, efficient last-mile delivery services tailored to customer needs represent a robust growth opportunity for logistics providers seeking to innovate their offerings and cater to specific consumer preferences.

Advances in Technology and Automation

Technological advancements in logistics are paving the way for efficiency and enhanced service offerings. The incorporation of automation and artificial intelligence is expected to revolutionize inventory management and shipping processes, with estimates suggesting that logistics companies investing in technology will see operational efficiencies boost by 15-20% in 2023. Companies are adopting integrated software solutions to optimize supply chain operations and enhance real-time tracking capabilities. This transformation not only improves productivity but also elevates customer satisfaction, making technology adoption pivotal for logistics firms aiming to maintain a competitive edge in the market.

Future Outlook

Over the next five years, the Philippines logistics market is expected to show significant growth driven by continued government support, enhancements in transportation infrastructure, and increasing consumer demand for efficient logistics solutions. The ongoing expansion of the e-commerce sector will further fuel this growth, creating opportunities for logistics service providers to innovate and optimize their operations through technology. Rising urbanization and improvements in telecommunication will also contribute positively, solidifying the logistics industry’s role in the country’s economic development.

Major Players

- Aboitiz Transport System Corporation

- 2GO Group, Inc.

- International Container Terminal Services, Inc.

- DHL Supply Chain Philippines

- LBC Express, Inc.

- XPO Logistics

- Kuehne + Nagel

- Tiong Nam Logistics Solutions

- APL Logistics

- Geodis

- UPS Supply Chain Solutions

- FedEx

- TNT Express

- CEVA Logistics

- Jollibee Foods Corporation (JFC Logistics)

Key Target Audience

- Logistics Service Providers

- Retail Corporations

- Manufacturing Companies

- E-commerce Companies

- Transportation Companies

- Government and Regulatory Bodies (Philippine Ports Authority, Department of Transportation)

- Investments and Venture Capitalist Firms

- International Trade Agencies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Philippines logistics market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the Philippines logistics market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics is conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATI) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple logistics service providers to acquire detailed insights into product segments, service performance, customer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the Philippines logistics market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Expanding E-commerce Sector

Increase in Foreign Investments

Urbanization and Infrastructure Development - Market Challenges

Regulatory Compliance Issues

High Transportation Costs - Opportunities

Growing Demand for Last-Mile Delivery

Advances in Technology and Automation - Trends

Integration of AI and IoT in Logistics

Shift towards Sustainable Logistics - Government Regulation

Transportation Policies

Environmental Regulations - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Mode of Transport (In Value %)

Road

– Last-Mile Delivery

– Inter-Island Trucking (via RoRo)

– Urban Cargo Transport

Rail

– Bulk Cargo Rail Services

– Container Rail Logistics (limited in Philippines)

Air

– Express Air Cargo

– Scheduled Freight Services

– Charter Air Freight

Sea

– RoRo Services (Roll-on/Roll-off)

– Container Shipping

– Bulk Shipping (Dry/Liquid) - By Service Type (In Value %)

Freight Forwarding

– Domestic Freight

– International Freight

Warehousing

– Bonded Warehouses

– Cold Storage Warehouses

– General Dry Warehousing

Distribution and Transportation

– Linehaul Services

– Regional/Provincial Distribution

– 3PL & 4PL Distribution Solutions

Customs Brokerage

– Import/Export Documentation Handling

– Tariff Classification and Valuation

– Customs Clearance Services - By End-User Industry (In Value %)

Retail

– Modern Trade

– Traditional Trade

Manufacturing

– Automotive Parts

– FMCG (Fast-Moving Consumer Goods)

– Industrial & Construction Materials

E-commerce

– Fulfillment Centers

– Reverse Logistics

Healthcare

– Pharma Distribution

– Medical Equipment Delivery - By Region (In Value %)

Luzon

Visayas

Mindanao - By Technology Adoption (In Value %)

Traditional Logistics

– Manual Inventory & Fleet Management

– Paper-Based Tracking Systems

Digital Logistics

– Warehouse Management Systems (WMS)

– Transport Management Systems (TMS)

– IoT-Enabled Tracking

– Blockchain for Documentation

– AI and Predictive Analytics in Routing & Scheduling

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Logistics Service, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Revenues by Type of Service, Number of Touchpoints, Distribution Channels, Number of Dealers and Distributors, Margins, Logistics Capacity, Unique Value Offering and others)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Aboitiz Transport System Corporation

2GO Group, Inc.

International Containers Terminal Services, Inc.

Jollibee Foods Corporation (JFC Logistics)

DHL Supply Chain Philippines

LBC Express, Inc.

XPO Logistics

Kuehne + Nagel

Tiong Nam Logistics Solutions

APL Logistics

Geodis

UPS Supply Chain Solutions

FedEx

TNT Express

CEVA Logistics

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030