Market Overview

The Philippines medical devices market is valued at USD 669.32 million, supported by rising awareness and a growing elderly population driving demand for prosthetics, hearing aids, and implantable devices. This historical analysis includes data up to 2023 and 2024.

Market dominance is concentrated in Metro Manila and Luzon-based metropolitan areas, where higher healthcare infrastructure density, private hospital expansion, and stronger purchasing power converge. The US and Germany dominate as supplier countries owing to advanced technological portfolios and established regulatory relationships with the FDA Philippines.

Market Segmentation

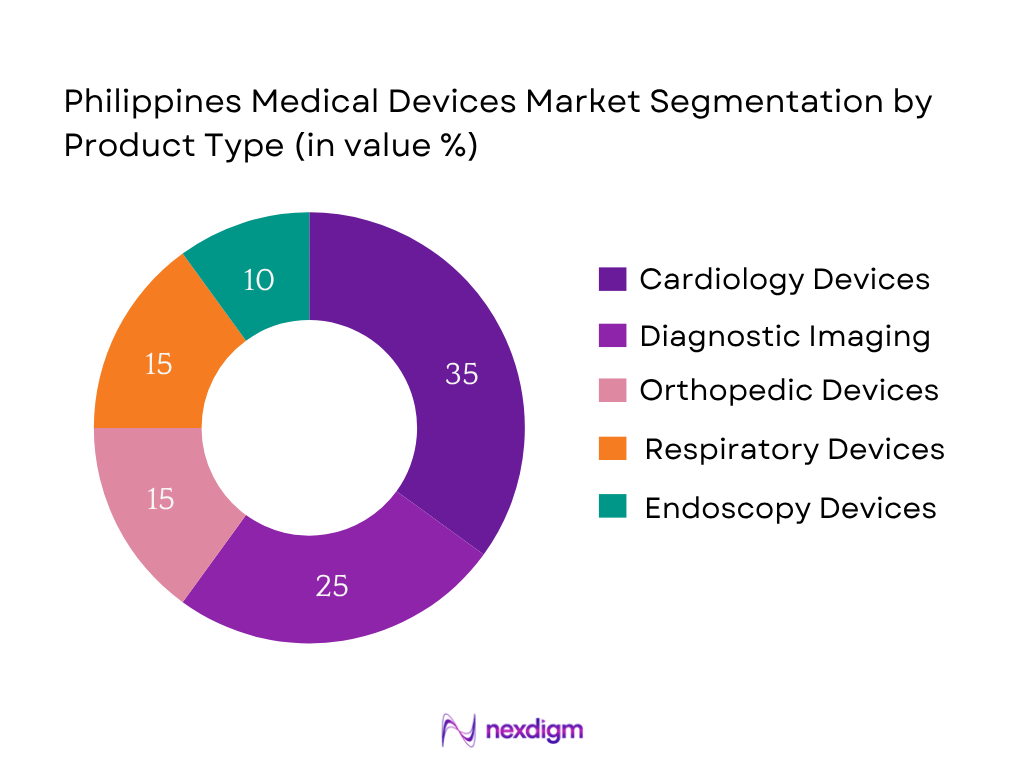

By Product Type

Cardiology devices dominate the market, driven by the high prevalence of cardiovascular diseases—among the leading causes of mortality—and robust hospital investment in pacemakers, stents, and imaging tools.

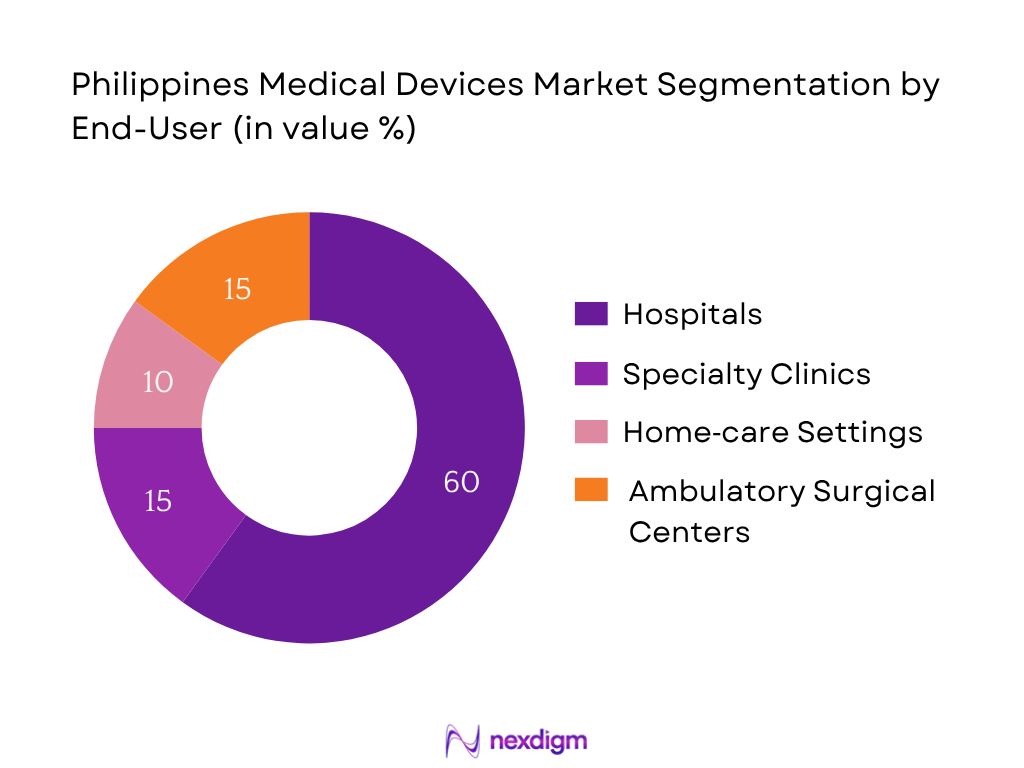

By End‑User

Hospitals dominate, due to centralized procurement budgets, complex case treatment capacity, and preference for advanced device portfolios. High-volume institutional contracts with trusted suppliers reinforce this dominance.

Competitive Landscape

Philippines’ market is shaped by a handful of global and regional players with extensive local operations. The market is consolidated, with dominant players such as Medtronic, Johnson & Johnson MedTech, and Fresenius Medical Care shaping innovation, pricing, and distribution. Their influence stems from broad portfolios, strong after-sales infrastructure, and alignment with local healthcare needs.

| Company | Establishment Year | Headquarters | Product Portfolio Breadth | Local Distribution Network | Regulatory Approvals | After‑Sales Support | Technological Innovation |

| Medtronic | — | Global (USA) | – | – | – | – | – |

| Johnson & Johnson MedTech | — | Global (USA) | – | – | – | – | – |

| Fresenius Medical Care | — | Global (Germany) | – | – | – | – | – |

| Abbott | — | Global (USA) | – | – | – | – | – |

| GE Healthcare Philippines | — | Global (USA) | – | – | – | – | – |

Philippines Medical Devices Market Analysis

Growth Drivers

Rise in Non‑Communicable Diseases and Aging Population

The aging segment—those aged 65 and above—constitutes 6,362,058 persons, representing about 5.49 percent of the total population in 2024, up from 5.26 percent in 2023 and 5.04 percent in 2022. This demographic shift increases demand for chronic‑care devices for conditions like cardiovascular disease, diabetes, and dialysis. Non‑communicable diseases remain the leading cause of mortality; while exact percentages for the Philippines aren’t directly available, regional reports confirm that NCDs dominate the disease burden. As the elderly population grows in numeric terms—over 6.36 million individuals—the requirement for hospital-grade medical devices such as heart monitors, insulin pumps, and dialysis machines becomes more pronounced. These demographic and health dynamics provide a strong, data‑backed foundation for the increasing consumption of medical devices.

Public Health Investments under Universal Health Care Act

Government healthcare funding is rising: in 2023, government health expenditure accounted for PhP 550.2 billion, representing 44.4 percent of current health expenditure. In 2024, primary healthcare spending alone reached PhP 748.80 billion, with government share hitting 44.7 percent of total health expenditure. This clear increase in public investment under the UHC framework signals a deeper commitment to expanding infrastructure, services, and medical systems. These budget increments translate into higher procurement budgets for healthcare facilities, particularly in public hospitals and clinics, which in turn drive purchase and deployment of medical devices ranging from diagnostic tools to patient monitoring systems.

Challenges

Heavy Reliance on Imports and FX Exposure

Imports dominate the local medical device landscape: almost 100 percent of medical equipment and about 50 percent of medical disposables are imported, with high-cost equipment such as imaging systems, dialysis machines, and linear accelerators sourced almost entirely from abroad. In 2020, the Philippines imported USD 105.93 million worth of instruments and appliances used in medical care, with top providers being Germany (USD 31.78 million), Singapore (USD 20.79 million), Japan (USD 12.21 million), and the United States (USD 9.53 million). This heavy import dependence exposes the sector to foreign exchange volatility—Philippine peso fluctuations against the USD or EUR directly impact procurement costs for distributors and healthcare facilities.

Lengthy FDA Approval and Licensing Delays

The Philippines FDA’s device registration process remains sluggish. For Class A devices, approval generally takes 3 to 6 months, whereas Class B to D products—higher-risk devices—may require up to 9 to 12 months. The transition to the ASEAN Medical Device Directive (AMDD) has also introduced bureaucratic hurdles: understaffed FDA centers and frequent “Notices of Deficiency” due to product classification errors have exacerbated delays. These extended timelines delay market entry and revenue realization for manufacturers and importers.

Opportunities

Growth in Telemedicine and Home‑Based Care Devices

Digital infrastructure is gaining traction: approximately 70 percent of healthcare facilities now have electronic health records (EHR) systems, covering around 60 percent of the population. This digital penetration offers a strong foundation for home-based diagnostic tools and remote monitoring systems. As EHR coverage expands, there is growing potential for connected medical devices (e.g., smart patient monitors, teleconsultation modules) to integrate seamlessly into healthcare workflows, optimizing patient outcomes and improving system efficiency.

Future Outlook

Over the next period, the Philippines medical devices market is expected to display robust growth driven by continued regulatory reforms, expanding universal healthcare coverage, and public investments in health infrastructure. Additionally, the aging population and rising chronic disease burden will elevate demand for cardiovascular, diagnostic, and home‑care devices. The market is forecast to grow at a CAGR of approximately 9%, positioning the industry for significant expansion.

Major Players

- Medtronic plc

- Johnson & Johnson MedTech

- Fresenius Medical Care AG & Co.

- Abbott Laboratories Philippines

- GE Healthcare Philippines

- Siemens Healthineers Philippines

- Philips Healthcare Philippines

- Braun Medical Supplies

- Terumo Philippines

- Roche Diagnostics Philippines

- Canon Medical Systems Philippines

- Olympus Philippines

- Zimmer Biomet Philippines

- Fujifilm Philippines

- Draeger Medical

Key Target Audience

- Hospital procurement directors

- Private hospital chains

- Medical device importers and distributors

- Manufacturing investors and venture capital firms

- Department of Health (Philippines)

- FDA Philippines (Center for Device Regulation, Radiation Health and Research)

- Insurance providers and PhilHealth administrators

- Medical tourism facilitators

Research Methodology

Step 1: Data Collection & Variable Mapping

An ecosystem map of the Philippines medical devices market—including manufacturers, distributors, hospitals, and regulators—is developed through secondary research (industry databases, government reports). Key market drivers, device categories, and regulatory dimensions are identified.

Step 2: Historical Market Analysis

Historical data (2018–2024) are collated across value, volume, and pricing metrics. Trends such as import reliance and disease prevalence are analyzed to ensure accuracy in market sizing.

Step 3: Stakeholder Engagement & Validation

Market assumptions are validated through interviews with industry stakeholders (importers, hospital procurement managers, regulatory officials), supplemented by C-level expert consultations to refine and triangulate findings.

Step 4: Forecast Modelling & Synthesis

A bottom‑up forecasting model combines demand drivers (aging population, healthcare spending, policy support) with supply‑side insights. Forecast outputs are then cross‑checked with expert feedback to deliver a robust and credible market outlook.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis and Evolution

- Timeline of Policy and Regulatory Changes

- Medical Devices Ecosystem in the Philippines

- Import Dependency and Domestic Manufacturing Gap

- Medical Equipment Lifecycle in Hospital and Homecare Settings

- Supply Chain and Value Chain Analysis

- Growth Drivers

Rise in Non-Communicable Diseases and Aging Population

Public Health Investments under UHC Act

Medical Tourism Development

Expansion of Private Healthcare Networks

Technological Integration – IoMT, AI Diagnostics, Remote Monitoring - Market Challenges

Heavy Reliance on Imports and FX Exposure

Lengthy FDA Approval and Licensing Delays

Price Sensitivity in Government Procurement

Low Penetration in Rural Healthcare Facilities - Opportunities

Growth in Telemedicine and Home-based Care Devices

Local Manufacturing Support under “Balik-Scientist” and “Startup” Programs

ASEAN Harmonization Benefits for Export-Oriented Production - Market Trends

Digitization of Health Infrastructure

Modular and Mobile Health Equipment Demand

AI Integration in Diagnostics - Regulatory Landscape

FDA Philippines – Device Classification & Licensing

ASEAN Medical Device Directive (AMDD) Influence

PhilHealth and Public Procurement Framework - SWOT Analysis

- Stakeholder Ecosystem (Hospitals, Clinics, Regulators, Manufacturers, Distributors)

- Porter’s Five Forces Analysis

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Selling Price, 2019-2024

- By Product Type (In Value %)

Diagnostic Imaging Equipment

Patient Monitoring Devices

Surgical Equipment

Consumables and Disposables

Orthopedic and Rehabilitation Devices - By End User (In Value %)

Public Hospitals

Private Hospitals and Clinics

Diagnostic Laboratories

Home Healthcare

Specialty Clinics - By Import vs Local Manufacturing (In Value %)

Fully Imported Devices

Locally Assembled Devices

Fully Manufactured in the Philippines - By Distribution Channel (In Value %)

Direct Hospital Procurement

Medical Distributors & Agents

Online B2B Platforms

Government Tenders (DOH, PhilGEPS) - By Region (In Value %)

National Capital Region (NCR)

Central Luzon

CALABARZON

Visayas

Mindanao

- Market Share of Major Players (In Value and Volume)

- Cross Comparison Parameters (Company Overview, Revenue from Medical Devices (Philippines-specific), Regional Coverage in Philippines, Product Portfolio Breadth (Class I, II, III Devices), Certifications and Regulatory Approvals (FDA, ISO), Local Partnerships or Distributors, After-Sales Support Network, Technological Innovations and IoT Adoption)

- SWOT Analysis of Major Players

- Price Positioning Analysis by Product Category and Brand

- Detailed Profiles of Major Companies

GE Healthcare Philippines

Siemens Healthineers Philippines

Philips Healthcare Philippines

Mindray Medical International

Medtronic Philippines

B. Braun Medical Supplies

Terumo Philippines

Roche Diagnostics Philippines

Abbott Laboratories Philippines

Johnson & Johnson Medical Devices

Canon Medical Systems

Olympus Philippines

Zimmer Biomet Philippines

Fujifilm Philippines

Draeger Medical

- Institutional Buying Behavior and Lifecycle Management

- Budget Allocation Trends in Public vs Private Sector

- Key Pain Points: Maintenance, Warranty, After-Sales Support

- Physician Preferences and Influence in Procurement

- Decision-Making Dynamics in Government vs Private Hospitals

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030