Market Overview

The Philippines Mobility-as-a-Service (MaaS) platforms market is valued at USD ~ billion, supported by rapid digitization of trip discovery, booking, and payment across ride-hailing, taxi e-booking, and bundled “super-app” mobility experiences. The demand base is reinforced by a large online population: internet users increased from ~ million in the prior year to ~ million in the latest year, strengthening the addressable base for app-led mobility subscriptions, passes, and on-demand bookings.

Dominant demand nodes for MaaS platforms are concentrated in Metro Manila (National Capital Region), followed by major regional engines such as Cebu (Central Visayas) and Davao (Davao Region), because these cities combine dense commuting flows, high trip frequency, airport and tourism demand, and strong acceptance of app-based bookings. In the taxi and app-enabled booking proxy market, Metro Manila is the leading geography due to population density, continuous activity zones, and multi-purpose trip demand (commute, airport, errands), while Visayas shows strong expansion momentum tied to tourism hubs and airport-linked mobility needs.

Market Segmentation

By Booking Type

The MaaS monetization pool in the Philippines still reflects a “hybrid booking reality” where offline and online demand coexist—important for platform strategy because MaaS platforms increasingly win by converting habitual offline trips into trackable, app-booked journeys through incentives, reliability, and integrated payments. In the Philippines taxi market proxy, offline booking remains the largest share, reflecting continued street-hail behavior, uneven connectivity in some peri-urban corridors, and preference for immediate availability during peak congestion. However, platforms are accelerating online conversion through clearer ETAs, cashless payment options, route visibility, and in-app service recovery (refunds/support), which makes “digital booking” structurally advantaged as smartphone use deepens.

By Customer Segment

Within MaaS platforms, residential / everyday user trips dominate because day-to-day mobility (work, school, errands, family obligations) creates repeat usage that platforms can retain using subscriptions, wallet credits, loyalty, and bundled services (mobility + delivery + payments). In the Philippines taxi market proxy, residential demand leads as the most consistent trip generator; it is less seasonal than tourism and less policy-sensitive than government procurement cycles. This dominance also aligns with platform economics: frequent short-to-mid distance trips help stabilize driver utilization and enable bundling (e.g., ride vouchers, “ride packs,” wallet incentives). Meanwhile, the combined bucket of leisure/tourism and other non-residential usage remains strategically important because it tends to have higher willingness-to-pay for reliability (airport transfers, tourist multi-stops), which MaaS platforms monetize through premium tiers, pre-booking, and multi-service itineraries.”

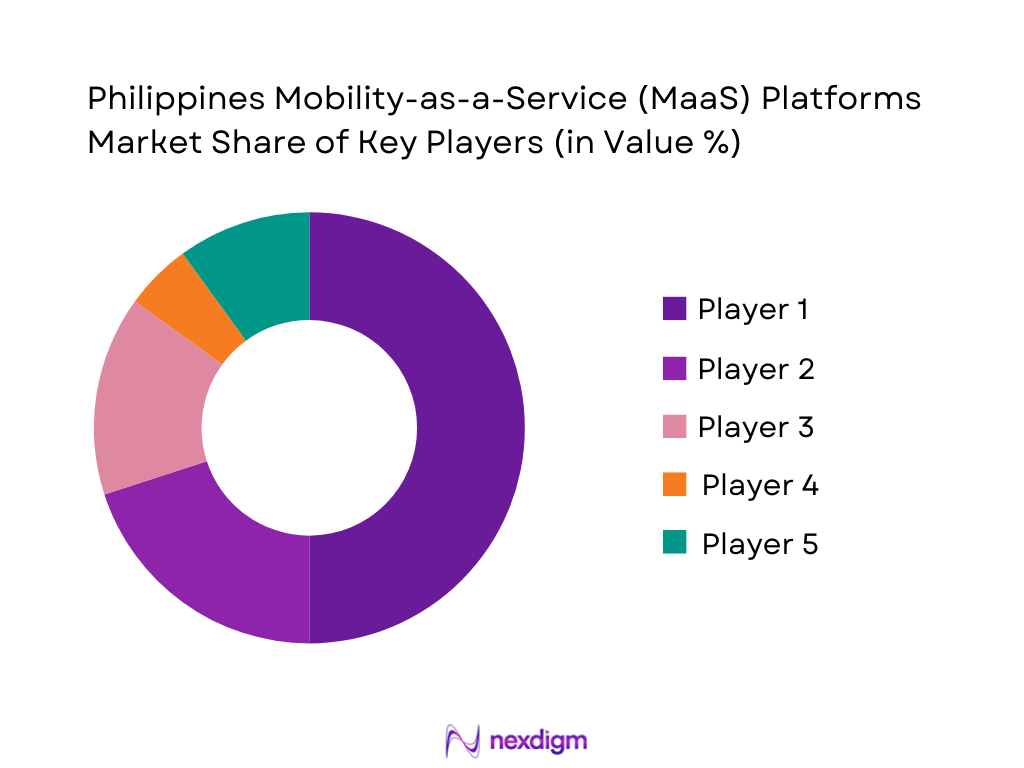

Competitive Landscape

The Philippines MaaS platforms market is shaped by super-app ecosystems and mobility-first specialists. Competition centers on coverage density (supply), service reliability (ETAs/cancellations), pricing governance (surge guardrails), payment acceptance (cash + wallets), and the ability to integrate across modes (taxi/ride-hail/motorcycle mobility, and in some cases public transport planning and ticketing partnerships). In the app-enabled taxi and ride ecosystem, the market shows consolidation forces where larger platforms benefit from network effects, but challengers expand by focusing on specific modes (e.g., two-wheel mobility), local partnerships, and differentiated driver economics.

| Company | Established | Headquarters | Core MaaS Modes in PH | Coverage Focus | Payment Options | Supply Strategy | Compliance Posture | Differentiation Levers |

| Grab | 2012 | Singapore | ~ | ~ | ~ | ~ | ~ | ~ |

| JoyRide | 2019 | Philippines | ~ | ~ | ~ | ~ | ~ | ~ |

| Angkas | 2016 | Philippines | ~ | ~ | ~ | ~ | ~ | ~ |

| Move It | 2022 | Philippines | ~ | ~ | ~ | ~ | ~ | ~ |

| inDrive | 2013 | US / global operations | ~ | ~ | ~ | ~ | ~ | ~ |

Philippines Mobility-as-a-Service (MaaS) Platforms Market Analysis

Growth Drivers

Superapp behavior

The Philippines’ MaaS adoption is accelerated by “superapp” behavior where mobility, food, parcels, and bill-pay happen inside the same daily-used app, reducing friction for multimodal trip planning and in-app payments. This is supported by strong consumer digital reach: the economy is valued at USD ~ billion and USD ~ GDP per capita, giving scale for platform-led service bundling, while population scale is ~ million. On the demand side, the country had ~ million internet users (January) and internet users increased by ~ million versus the prior year—expanding the addressable base for app-based mobility discovery, promotions, and account-based loyalty. On the payments side (a core “superapp” glue), the central bank’s quarterly inclusion dashboard shows ~ million registered e-money accounts and ~ million active e-money accounts, reflecting how a single wallet can fund multiple “daily life” categories that MaaS platforms plug into. This superapp pattern matters for MaaS because it normalizes “one login / one wallet / many services,” enabling faster user acquisition for ride-hailing, micromobility, and transit add-ons without requiring separate onboarding for each mode.

Commuter digitization

MaaS growth is fundamentally driven by commuter digitization—people shifting trip decisions (when to leave, which route, which mode) onto phones. The macro base is large and “platform-ready”: USD ~ billion economy size and ~ million population mean that even incremental shifts in daily commuting behavior translate into large absolute trip volumes. In Metro Manila, rail usage alone shows scale for digital journey planning and service alerts: MRT-3 served ~ passengers and averaged ~ passengers daily, creating strong demand for real-time disruptions, alternative routing, and last-mile options when rail is crowded or delayed. This digitization also depends on broad internet reach—~ million internet users—which supports consistent access to maps, push notifications, and in-trip sharing (family tracking, meeting coordination). As commuting digitizes, MaaS platforms become not only “booking” tools but also “decision engines” that help commuters reduce uncertainty: arrival-time expectations, multimodal trade-offs, and route recommendations based on service status. Rail and road congestion in the same urban corridors further pushes users to consult apps before committing to a mode; MaaS platforms that integrate rail advisories with first/last-mile options can capture that pre-trip decision moment repeatedly across the week.

Challenges

Regulatory constraints (TNVS/MC taxi)

Regulatory clarity directly affects MaaS expansion because platform scale depends on who can legally operate, where they can operate, and under what licensing structure. The LTFRB’s accreditation process has expanded transport network participation, with media reporting ~ ride-hailing companies approved—but the existence of many accredited operators also underscores the need for consistent enforcement and standardized operating requirements across platforms. Motorcycle taxi regulation remains a key constraint: LTFRB has publicly discussed ending the motorcycle taxi pilot program, illustrating that “pilot-based” operations create uncertainty for MaaS players building long-term supply, safety standards, and insurance coverage models. These constraints matter in a large macro setting—USD ~ billion GDP and ~ million population—because the potential trip volume is high, but regulatory uncertainty can delay investment in driver onboarding, fleet expansion, and deeper integrations (e.g., with payments and identity). For MaaS platforms, uncertain regulation increases compliance costs (documentation, audit trails, geo-fencing rules) and can fragment user experience when certain modes are available only in limited corridors or under temporary frameworks. The market impact is practical: platforms may optimize for permitted services rather than the most efficient mode for the commuter, weakening the “mobility-as-a-service” promise of giving the best mode for the trip.

Safety & trust

Safety and trust are major adoption barriers because MaaS platforms require users to rely on unknown drivers or vehicles, share location data, and shift payments into digital channels. The scale of road risk is material: around ~ road accidents were recorded nationwide with ~ fatalities. These are not MaaS-only incidents, but they shape public perception of everyday mobility risk—especially for motorcycles and late-night trips where MaaS is often used. In a macro context of USD ~ billion GDP and a population base of ~ million, even small improvements in perceived safety can unlock large absolute increases in trips, but weak trust can cap adoption even when the service is available. Trust is also operational: incidents raise pressure for stricter identity verification, route tracking, emergency response workflows, and insurance partnerships—features that add cost and complexity to platforms and to smaller operators trying to digitize. For users, safety risk increases the “mental cost” of booking, reducing MaaS frequency. For platforms, the trust problem is compounded by multi-operator environments where user experience varies; one incident can affect perception of the broader category.

Opportunities

AFC/ticketing partnerships

Automated fare collection (AFC) and ticketing partnerships are a major MaaS opportunity because they enable true multimodal bundling—one account that covers rail, bus, and first or last-mile, with unified receipts and easier transfers. The macro base supports scale partnerships: USD ~ billion GDP and a large commuter population create strong throughput for account-based payments. On the public transport side, rail demonstrates consistent mass volume—MRT-3 carried ~ passengers and averaged ~ daily riders—and these high-frequency commuters are prime candidates for interoperable payment that reduces queueing and top-up friction. On fare media, rail services cite a growing card base of ~ million cards issued, indicating an existing installed base that MaaS platforms can integrate through ticketing APIs and product bundles. In addition, automated fare systems support contactless credit, debit, and prepaid bank cards, which is strategically important for MaaS: open-loop payment reduces dependence on single proprietary cards and allows MaaS apps to act as the “mobility wallet” while still accepting bank cards. The opportunity is not about future projections; it is about converting existing, very large daily ridership and existing fare media into MaaS-integrated products—reducing transfer friction and making multimodal trips easier to plan, pay, and expense.

Enterprise commute programs

Enterprise commute programs are a strong MaaS opportunity because they aggregate demand, stabilize trip volumes, and encourage cashless, scheduled usage—improving platform economics and service reliability without relying on consumer-by-consumer marketing. The macro context is supportive: a USD ~ billion economy with a large working population generates dense commuting flows into business districts and industrial parks, where employers care about punctuality, attendance, and employee safety. Government-linked ecozone development also signals concentrated employment hubs: approvals include ~ projects in a half-year period and the creation of over ~ jobs, indicating sustained growth of employer clusters that can be served by structured commute offerings (shuttles, pooled rides, first or last-mile to rail). From a payments standpoint, enterprise programs align naturally with the country’s large-scale digital wallet layer—~ million active e-money accounts—because employers can subsidize travel through wallets, issue digital allowances, and require digital receipts for policy compliance. For MaaS platforms, enterprise commuting creates operational advantages: predictable peak demand windows, repeat riders on fixed routes, and the ability to negotiate service-level agreements that justify investments in better routing, safety tooling, and multimodal integrations. Importantly, this opportunity is grounded in current numbers—existing job creation in organized zones and existing mass digital finance capability—rather than speculative future forecasts.

Future Outlook

Over the next five-to-six years, the Philippines MaaS platforms market is expected to expand through deeper online booking conversion, wider mode coverage (two-wheel + car + taxi e-booking + select intercity use cases), and stronger payments-led retention via wallet ecosystems and subscription-like ride packs. Growth is also supported by policy modernization that clarifies platform operations and encourages more structured, trackable mobility supply. In the taxi market proxy, online booking and ride-sharing segments are highlighted as faster-growth pockets, indicating that platforms that improve digital fulfillment (dispatch quality, driver ETAs, safety and service recovery) will capture disproportionate upside.

Major Players

- Grab

- JoyRide

- Angkas

- Move It

- inDrive

- Hirna

- Sakay.ph

- Beep

- GCash

- Maya

- Moovit

- Transportify

- Owto

- Fleet-focused dispatch/telematics-enabled operators

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Super-app and MaaS platform strategy teams

- Two-wheel mobility operators and rider supply networks

- Fintech and digital wallet providers

- Airports, tourism boards, and destination developers

- Large enterprises and BPO/industrial parks

Research Methodology

Step1: Identification of Key Variables

We construct the MaaS ecosystem map for the Philippines covering platforms, fleet operators, driver and rider supply, payment rails, regulators, and city-level demand centers. This is supported by structured desk research using credible secondary sources and platform disclosures to define the variables that move price, utilization, supply density, and booking conversion.

Step 2: Market Analysis and Construction

We compile historical signals that explain demand and monetization patterns (online vs offline booking, residential vs non-residential demand, city concentration, and mode availability). We then build a market model that reconciles platform-led ride fulfillment with taxi e-booking and app-enabled mobility value pools.

Step 3: Hypothesis Validation and Expert Consultation

We validate market hypotheses through expert consultations across platform operators, fleet owners, driver communities, payment partners, and corporate mobility buyers. These interactions refine operational parameters such as dispatch constraints, cancellation drivers, fare mechanics, and buyer procurement behavior.

Step 4: Research Synthesis and Final Output

We triangulate bottom-up findings with published market proxies and segment indicators, ensuring consistency across value pools and segmentation logic. The final output integrates segmentation, competitive benchmarking, and go-to-market implications for stakeholders evaluating entry, expansion, partnerships, or investment.

- Executive Summary

- Research Methodology (market definitions & MaaS boundary (planner vs booking vs ticketing), assumptions, abbreviations, market sizing approach (GMV vs net revenue), triangulation framework, primary interviews (operators/platforms/regulators), demand-side surveys (commuter cohorts), supply-side validation (fleet & operator mapping), limitations & sensitivity checks)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Superapp behavior

Commuter digitization

Wallet ecosystems

Operator digitization

Route intelligence demand - Challenges

Regulatory constraints

Safety & trust

Fragmented public transport supply

Cash dependence

Data quality for routes - Opportunities

AFC/ticketing partnerships

Enterprise commute programs

City mobility analytics

Micromobility hubs

Airport/terminal multimodal bundles - Trends

Multiservice mobility superapp

Bundled subscriptions

Intermodal routing with fare estimation

Safety and insurance add-ons

Greener fleet shift - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- By Value, 2019–2024

- By Volume, 2019–2024

- By Average Price / Take Rate, 2019–2024

- By Fleet Type (in Value %)

Trip Planning & Route Intelligence

Booking & Dispatch

Payments & Wallet Layer

Ticketing / Fare Media Enablement

B2B / B2G Mobility Management & Analytics - By Application (in Value %)

Car Ride-hailing

Motorcycle Taxi

Taxi Aggregation

Public Transport Planning

Micromobility - By Technology Architecture (in Value %)

Daily Commuters

Students

Tourists & Occasional Riders

Corporate / Enterprise Accounts

Public Sector / Transit Authorities - By Connectivity Type (in Value %)

Cash-heavy Workflows

Mixed

Fully Cashless

Transit Fare Media Integration

Subscription / Pass-led Models - By Region (in Value %)

NCR / Metro Manila

Mega Cebu / Central Visayas Urban Core

Davao Urban Core

Emerging Cities

Tourism-Driven Nodes

- Market Share of Major Players on the Basis of Value/Volume

- Cross Comparison Parameters (Mode breadth, City coverage depth, Regulatory status and accreditation posture, Pricing mechanism and compliance, Payments integration including wallet and QR, Ticketing and AFC readiness, Safety stack including verification and insurance, Fleet and partner network scale)

- SWOT Analysis of Major Players

- Pricing Analysis

- Detailed Profiles of Major Companies

Grab Philippines

JoyRide PH

Angkas

Move It

Sakay.ph / Sakay Mobility Solutions

Moovr PH

inDrive

Moovit

Google Maps

AF Payments Inc.

GCash

Maya

Visa

Mastercard

RideON PH

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025–2030

- By Volume, 2025–2030

- By Average Price / Take Rate, 2025–2030