Market Overview

The Philippines Moisturizing Dermatology Creams Market operates inside a beauty & personal care space now worth about USD ~ billion, while the dedicated skincare sector for face and body products is tracking toward roughly USD ~ billion. Within this, clinically oriented moisturizers benefit from a young, urbanizing population (over 110 million people, with a median age near 25), rising GDP per capita above USD 4,000, and robust economic growth momentum highlighted by the IMF and World Bank. These macro tailwinds, combined with dermatology guidelines that emphasize daily emollient use for atopic dermatitis and barrier repair, are structurally expanding demand for therapeutic moisturizers in the country.

Demand for moisturizing dermatology creams is heavily concentrated in highly urbanized, higher-income centers led by Metro Manila (NCR), followed by Cebu City and Davao City. NCR alone accounts for more than a third of national GDP and has the country’s highest per-capita income, creating strong purchasing power for premium dermocosmetics. Cebu and Davao, each with populations approaching or exceeding 1 million residents and serving as regional commercial hubs, are rapidly expanding modern retail and dermatology clinic networks. These urban clusters also exhibit higher internet penetration and e-commerce adoption, amplifying access to imported dermocosmetic moisturizers and locally formulated barrier-repair creams.

Market Segmentation

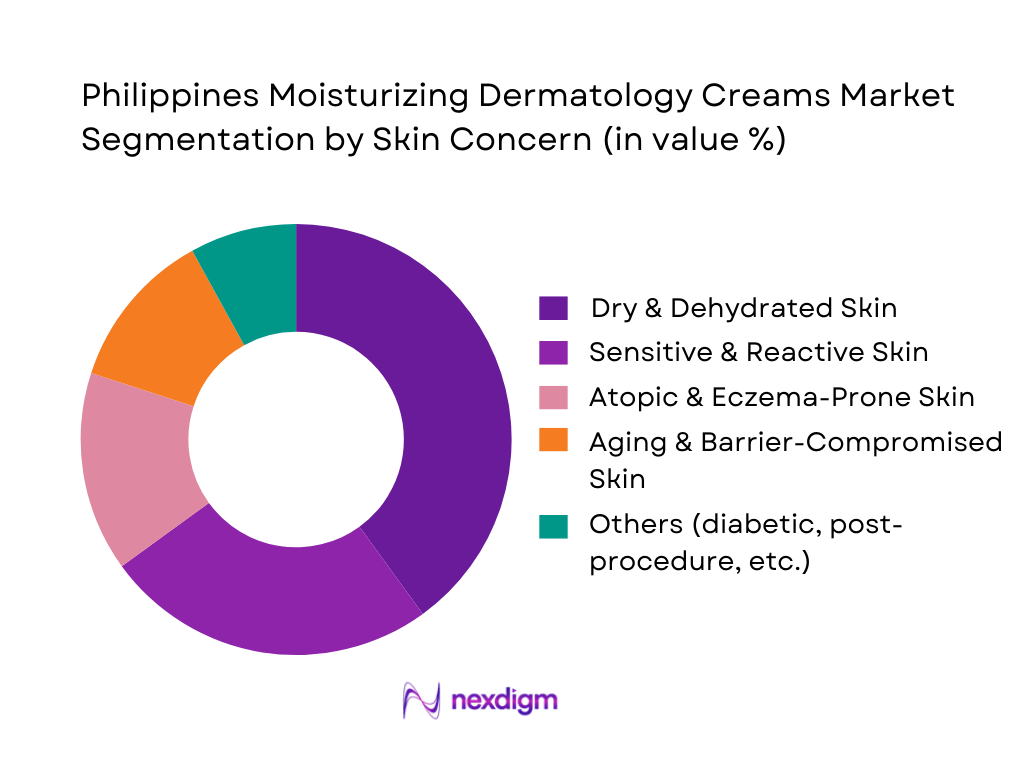

By Skin Concern

The Philippines Moisturizing Dermatology Creams Market is segmented into dry & dehydrated skin, sensitive & reactive skin, atopic & eczema-prone skin, aging & barrier-compromised skin, and other specific indications. Dry & dehydrated skin–focused products currently dominate this segmentation. Despite the country’s humid tropical climate, a combination of air-conditioned indoor environments, high UV exposure, and urban air pollution weakens the skin barrier and drives chronic dryness. Philippine dermatology societies and clinics increasingly recommend fragrance-free, ceramide-rich moisturizers as first-line maintenance for dry, irritated and post-inflammatory skin.

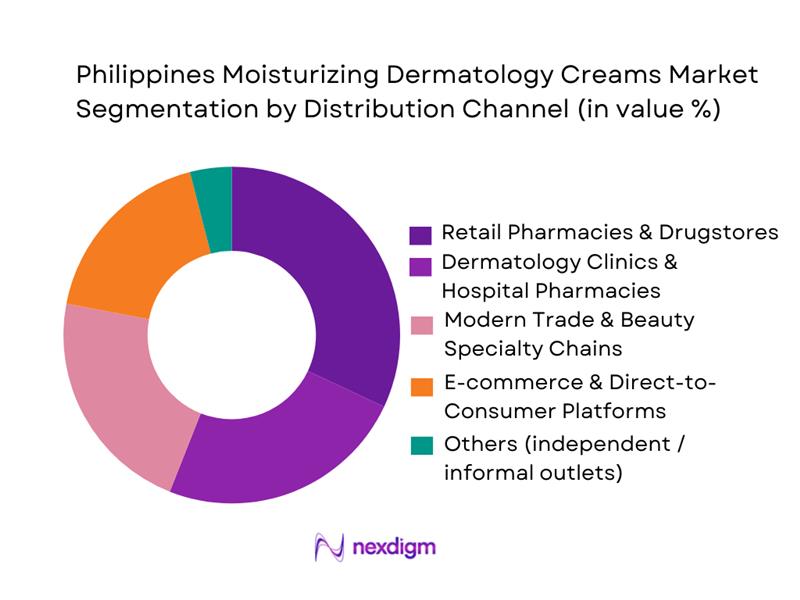

By Distribution Channel

The Philippines Moisturizing Dermatology Creams Market is segmented into retail pharmacies & drugstores, dermatology clinics & hospital pharmacies, modern trade & beauty specialty chains, e-commerce & D2C, and others. Retail pharmacies and drugstores are the leading channel due to their nationwide footprint and strong consumer trust in health-linked purchases. Chains such as Watsons, Mercury Drug and Rose Pharmacy combine dermatologist-recommended brands like Cetaphil, CeraVe, Eucerin and Physiogel with local dermo-brands such as Céleteque and VMV Hypoallergenics, making them the primary touchpoint for clinically oriented moisturizers.

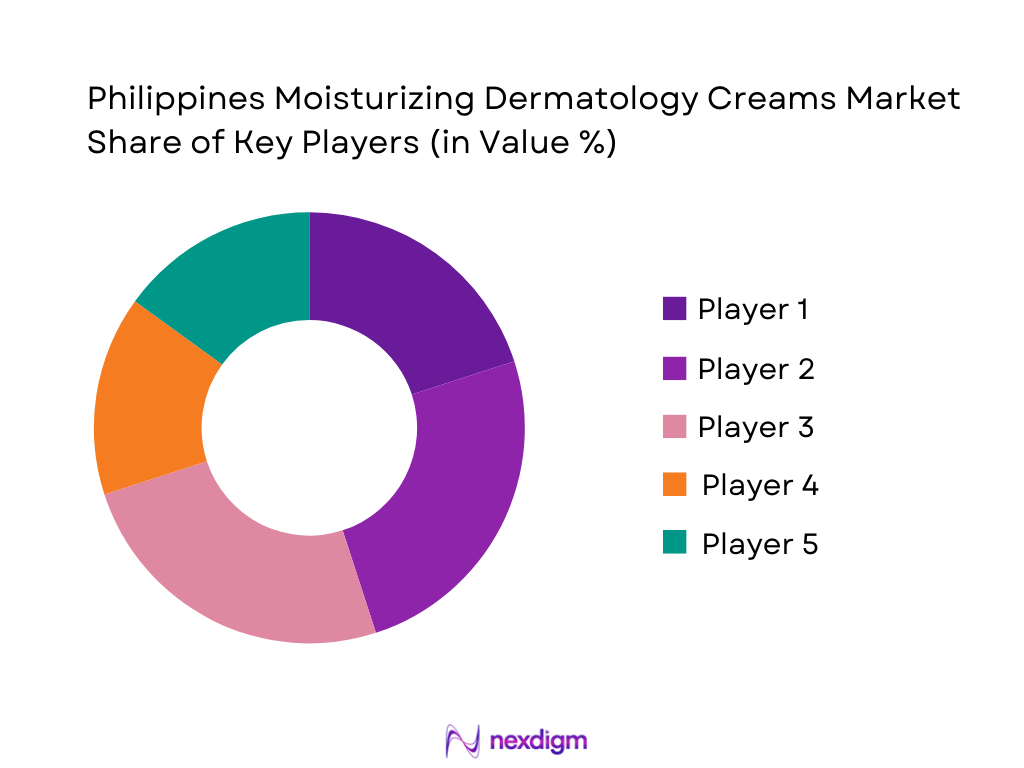

Competitive Landscape

The Philippines Moisturizing Dermatology Creams Market is shaped by a hybrid mix of multinational dermocosmetic brands and strong local dermatology-driven players. Global sensitive-skin leaders such as Cetaphil (Galderma), CeraVe (L’Oréal), Aveeno (Kenvue), Eucerin (Beiersdorf) and Neutrogena (Kenvue) leverage science-backed barrier-repair formulations, deep dermatologist engagement and broad distribution across pharmacies and online channels. Local players like VMV Hypoallergenics, Céleteque and Belo Essentials compete on hypoallergenic credentials, tropical-climate suitability and strong endorsement from Philippine dermatologists. Overall, the landscape is moderately concentrated in clinical and pharmacy channels, but fragmented online, where Korean, Japanese and indie brands add competitive pressure.

| Company | Establishment Year | Global HQ (Country) | Core Moisturizing Focus in PH | Hero Moisturizing Range (PH) | Key Dermatology / Medical Tie-Ins | Primary PH Channels | Positioning in PH Market |

| Cetaphil (Galderma) | 1947 | Switzerland / US | ~ | ~ | ~ | ~ | ~ |

| CeraVe (L’Oréal) | 2005 | United States | ~ | ~ | ~ | ~ | ~ |

| Aveeno (Kenvue) | 1945 | United States | ~ | ~ | ~ | ~ | ~ |

| Eucerin (Beiersdorf) | 1902 | Germany | ~ | ~ | ~ | ~ | ~ |

| VMV Hypoallergenics | 1979 | Philippines | ~ | ~ | ~ | ~ | ~ |

Philippines Moisturizing Dermatology Creams Market Analysis

Growth Drivers

Skin Disease Burden

The Philippines has a population of 115,843,670 people, creating a very large base of consumers exposed to chronic skin issues in a hot, humid tropical climate. National health spending reached the equivalent of about USD 194 per person in recent data, with PHP ~ trillion in total health outlays and PHP ~ billion paid out-of-pocket by households, indicating strong self-medication and OTC treatment behavior. A recent national mapping identified 1,345 practicing board-certified dermatologists with a density of only 1.19 per 100,000 people, showing constrained specialist capacity and pushing patients toward moisturizing dermatology creams for day-to-day management of xerosis, eczema and irritant dermatoses.

Climate-Induced Xerosis

The Philippines’ mean annual temperature is around 26.6 °C based on long-term PAGASA monitoring, with recent climate bulletins showing a warmer mean of about 27.76 °C, making one recent year the second warmest since 1991. Annual rainfall averages roughly 2,772mm, with many regions experiencing prolonged wet seasons and high relative humidity, frequently above 78.9 %. These hot-humid yet intermittently over-air-conditioned environments cause barrier disruption and climate-induced xerosis, especially among urban populations in Metro Manila, Cebu and Davao. Combined with a population above 112,892,781 in the dermatology mapping period, this climate stress amplifies everyday demand for clinically positioned moisturizing creams targeting barrier repair, sweat-salt irritation and post-inflammatory dryness.

Market Challenges

Regulatory Claims

The Philippine Food and Drug Administration (FDA) classifies moisturizers and dermatology creams as cosmetics or drugs depending on therapeutic claims, and regularly issues public health warnings against unnotified products that make whitening, anti-acne or medicated claims without authorization. Recent advisories list multiple unregistered creams and lotions, reflecting intensified market surveillance in line with broader national health expenditure of about USD ~ billion. At the same time, per-capita spending of roughly USD 194 and high household out-of-pocket payments of PHP ~ billion show Filipino consumers are highly exposed to OTC products and marketing claims. Stricter enforcement forces moisturizing cream brands to invest in dossier preparation, dermatological testing and claim substantiation, lengthening time-to-market and raising compliance costs.

Ingredient Shortage

Moisturizing dermatology creams rely heavily on imported emollients, humectants and specialty actives. Chemical products are among the Philippines’ top merchandise imports, with inbound “chemical products” valued around USD ~ billion in recent trade data and total merchandise imports near USD ~ billion for one recent year. One chemical sub-group alone—HS 28 inorganic chemicals—accounts for about 0.613% of total imports, underscoring the role of foreign suppliers in the local formulation ecosystem. Any disruption in exporting hubs such as China, Japan and the United States, cited among top chemical partners, squeezes availability of glycerin, ceramides and dermatology-grade silicones. This raises formulation risk and encourages companies to rationalize SKUs or reformulate moisturizing creams around more readily accessible regional inputs.

Opportunities

Barrier Repair Innovation

With a warm-humid climate and rising temperatures, as evidenced by a mean annual temperature of 27.76°C versus the historic 26.6°C norm, Filipino skin is subject to repeated barrier disruption from sweating, cleansing, air-conditioning and UV exposure. Total current health expenditure of around USD ~ billion and per-capita outlays near USD 194 show meaningful spending headroom for evidence-based dermocosmetics. Dermatologist density is highest in NCR at roughly 4.8 per 100,000, allowing fast adoption of ceramide-rich, niacinamide-based and urea-containing barrier-repair creams that can then cascade to provincial markets via GP recommendations and pharmacy chains. These conditions create room for premium and mid-tier moisturizing creams marketed around microbiome support, barrier lipids and repair index scores aligned with local climatic stress profiles.

Hypoallergenic Products

The combination of large population (115,843,670 people), dense urbanization and increasing internet use (about 83.8 % of residents online) has made ingredient awareness and “sensitive skin” narratives highly visible in the Philippines. Health spending of PHP 1.26 trillion and out-of-pocket payments of PHP ~ billion reflect strong consumer willingness to invest in preventive skincare that avoids hospital visits. Yet dermatologist access remains skewed, with only 1.19 specialists per 100,000 people nationwide and densities as low as 0.04 in BARMM. This structural gap drives demand for hypoallergenic, fragrance-free moisturizing creams endorsed by dermatology societies and compliant with stricter FDA cosmetic regulations, particularly for infants, children, pregnant women and patients with chronic dermatoses who seek safer daily moisturization options.

Future Outlook

Over the next planning horizon, the Philippines Moisturizing Dermatology Creams Market is expected to outpace the broader beauty and personal care sector, backed by macroeconomic resilience, a young consumer base and medicalization of skincare. World Bank and IMF outlooks show the Philippine economy maintaining real GDP expansion close to the mid-single-digit range with GDP nearing USD ~ billion, supporting steady income gains and beauty spending. Rising skin-disease burden in humid, high-UV environments, combined with climate-driven barrier disorders and pollution exposure, will continue to push dermatologists and consumers toward daily use of clinically tested moisturizers.

Major Players

- Cetaphil

- CeraVe

- Aveeno

- Eucerin

- La Roche-Posay

- Neutrogena

- Nivea

- VMV Hypoallergenics

- Céleteque DermoScience

- Belo Essentials

- Human Nature

- Physiogel

- Bioderma

- Eau Thermale Avène

Key Target Audience

- Dermatology Clinics and Skin Centers

- Multispecialty Hospitals and Specialty Medical Centers

- Retail Pharmacy and Drugstore Chains

- Modern Trade Retailers and Beauty Specialty Chains

- Online Marketplaces and D2C Beauty Platforms

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Ingredient, Packaging and OEM / ODM Manufacturers

Research Methodology

Step 1: Identification of Key Variables

The initial step involves mapping the full ecosystem of the Philippines Moisturizing Dermatology Creams Market, including dermatologists, hospitals, retail pharmacy chains, modern trade, e-commerce platforms and brand owners (global and local). Extensive desk research using secondary databases, company annual reports, dermatology society publications and regulatory filings (FDA Philippines) is undertaken to identify critical variables such as patient load for chronic skin conditions, prescription patterns, product pricing tiers, and channel penetration.

Step 2: Market Analysis and Construction

In this phase, we compile historical data for beauty & personal care and skincare spending in the Philippines, alongside macro indicators like GDP, private consumption and urban population. Using bottom-up modeling, we aggregate revenues from leading dermocosmetic and local clinical brands, allocate shares to moisturizers/creams based on SKU-level audits, and map distribution splits by channel. This is cross-checked with dermatologist surveys on product recommendations by skin concern (dry, sensitive, atopic, aging), ensuring realistic revenue and volume estimations for 2024.

Step 3: Hypothesis Validation and Expert Consultation

Preliminary hypotheses on market size, structure and growth outlook are validated through computer-assisted telephone interviews (CATI) and online depth interviews with dermatologists, hospital procurement teams, category buyers at pharmacy chains, and brand managers of key players. Discussions focus on mix of OTC vs prescription-linked moisturizers, price-tier movement, patient adherence, and regional demand clusters (NCR vs Visayas vs Mindanao). Inputs from these practitioners refine our assumptions on channel weights, dominant indications and the impact of macroeconomic trends on premium vs mass-market adoption.

Step 4: Research Synthesis and Final Output

The final stage integrates all data points into a reconciled market model, combining top-down (beauty & personal care spend, skincare share, global dermocosmetic benchmarks) and bottom-up (brand-level revenues, SKU audits, channel splits) perspectives. Scenario analysis is applied to derive a base-case CAGR for 2024–2030, alongside conservative and aggressive cases based on GDP growth, disposable income trajectories and regulatory shifts affecting dermatology products. The synthesized output is then translated into business-oriented insights, highlighting white-space opportunities by skin concern, channel, price tier, and potential partnership models for investors, brand owners and healthcare providers.

- Executive Summary

- Research Methodology (Market Definitions & Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Primary & Secondary Research Triangulation, Diagnosis-Prevalence Based Calculation, Retail Channel Audits, Physician Interviews, Limitations & Future Considerations)

- Definition & Scope

- Pathophysiology & Dermatology Relevance

- Market Genesis & Evolution

- Moisturization Science

- Product Lifecycle & Formulation Innovation Cycle

- Growth Drivers

Skin Disease Burden

Climate-Induced Xerosis

Dermatologist Prescription Habits

OTC Skincare Boom - Market Challenges

Regulatory Claims

Ingredient Shortage

Counterfeit Products

Sensitivity Issues - Opportunities

Barrier Repair Innovation

Hypoallergenic Products

Natural Moisturizers

Derma-Cosmetic Expansion - Trends

Ceramide Boom

Dermocosmetic Brands Surge

Fragrance-Free Demand

E-Commerce Dermatology Brands - Government & Regulatory Landscape

FDA Cosmetics Act

ASEAN Cosmetic Directive Compliance - Stakeholder Ecosystem

- Porter’s Five Forces

- Competition Ecosystem

- Dermatology Clinic Influence Mapping

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Dermatological Skin Concern (in Value %)

Xerosis

Atopic Dermatitis

Psoriasis-Related Dryness

Seborrheic Dermatitis Dryness

Diabetic Skin Dryness - By Ingredient Technology (in Value %)

Ceramide-Dominant

Hyaluronic Acid-Based

Urea-Based

Glycerin-Dominant

Petrolatum/Mineral Oil Occlusives - By Formulation Type (in Value %)

Creams

Lotions

Ointments

Balms/Barrier Repair Formulas

Gel-Creams - By Distribution Channel (in Value %)

Dermatologist Clinics

Hospital Pharmacies

Retail Pharmacies

Modern Trade (Watsons, Mercury Drug, Robinsons)

E-Commerce (Shopee, Lazada, Brand D2C) - By End-User Group (in Value %)

Adults

Geriatric Population

Children & Infants

Dermatology Patients (Prescription-linked)

Beauty & Personal Care Consumers - By Region (in Value %)

Luzon

Visayas

Mindanao

- Market Share of Major Players (Value/Volume)

Market Share by Dermatological Concern

Market Share by Ingredient Technology - Cross Comparison Parameters (Dermatology Endorsement Strength, Formulation Complexity, Clinical Testing & Sensitivity Score, E-Commerce Penetration & Digital Share, Distribution Breadth, Innovation Pipeline, Brand Recall Value in Dermatology Clinics, Pricing Ladder Across SKUs & Format Innovation)

- SWOT Analysis of Major Players

- Pricing Analysis by SKUs

- Detailed Competitive Profiles

Cetaphil

CeraVe

Aveeno

Physiogel

Eucerin

Bioderma

La Roche-Posay

Nivea

Human Nature Philippines

Zenutrients

The Ordinary

Olay Moisturizers

VMV Hypoallergenics

Garnier

Belo Essentials

- End-User Demand Behaviour

- Dermatologist Prescription Insights

- Patterns & Allergen Avoidance Requirements

- Branding Recall, Product Affinity & Perception Mapping

- OTC vs Prescription Moisturizers

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030