Market Overview

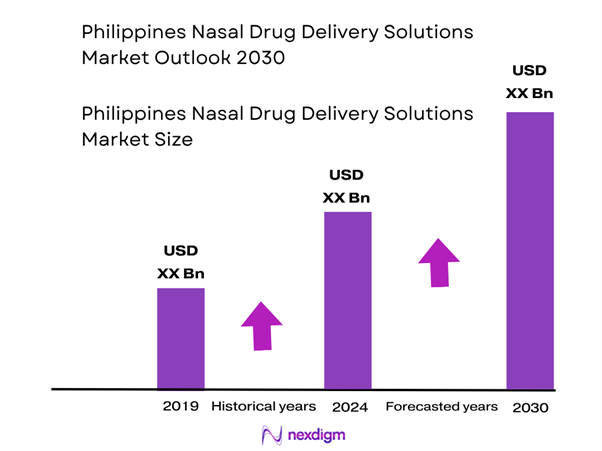

The Philippines nasal drug delivery solutions market is valued at USD ~ million based on anti-pollution nasal spray data for 2024. Growth is driven by increased incidence of respiratory/allergic conditions, rising demand for non-invasive delivery systems (nasal sprays, drops, powders) and heightened patient and physician interest in faster onset, needle-free therapies. The shift toward self-administration and home-care settings further supports uptake of nasal delivery formats.

Major urban centres such as Metro Manila, Cebu‐Metro and Davao dominate the market because of higher healthcare infrastructure, greater access to retail and hospital pharmacies, stronger distribution networks, higher patient awareness of novel drug delivery formats and greater retailer penetration of OTC and prescription nasal therapies. These centres serve as hubs for product launches, device-formulation collaborations and clinical adoption, which then drives spill-over into more rural regions.

Market Segmentation

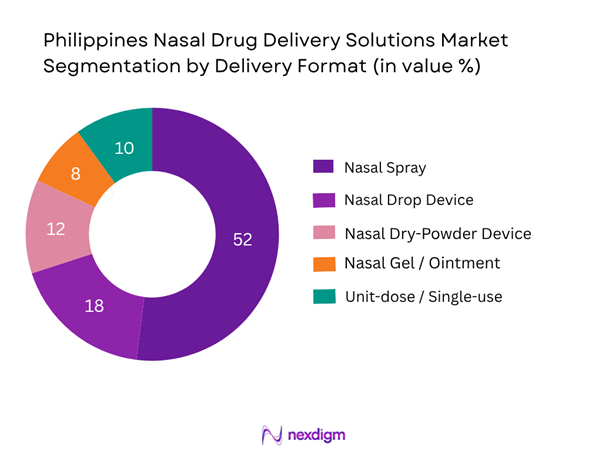

By Delivery Format

The nasal spray format dominates the Philippines nasal drug delivery solutions market, accounting for over half of market value in 2024. This dominance is due to its widespread familiarity among patients and physicians, established regulatory approvals, and ready availability via hospital, retail and online channels. Spray devices offer convenient self-administration, broad therapeutic applicability (allergies, congestion, neurology, emergency rescue) and cost-effective manufacturing scaling. Meanwhile, other formats such as dry-powder and unit-dose devices are emerging but still limited by higher device cost, regulatory novelty and lower patient familiarity.

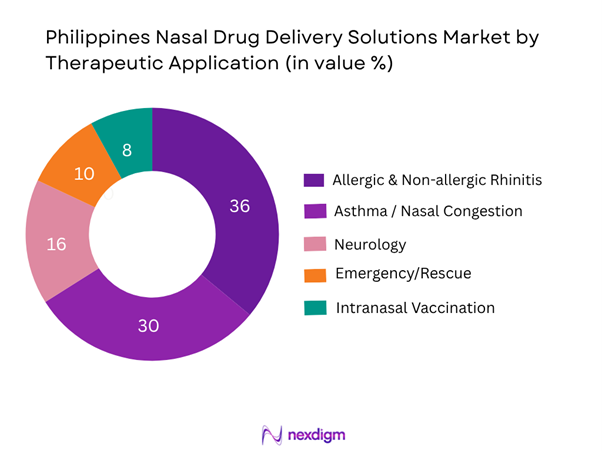

By Therapeutic Application

Allergic and non-allergic rhinitis/nasal congestion dominates the Philippines nasal delivery market, capturing about 45 % of value in 2024. The dominance arises from high prevalence of allergy and rhinitis among Filipino urban populations, widespread OTC availability of nasal sprays, growing patient-awareness of nasal treatments, and a strong presence of retail pharmacies across the country. In contrast, niches like neurology or intranasal vaccination are smaller but poised for growth due to rising interest in non-invasive routes and government interest in immunisation strategies.

Competitive Landscape

The Philippines nasal drug delivery solutions market exhibits a moderate number of global and regional players adapting their devices/formulations for the local market. Major players include those with established nasal therapy franchises, device-OEM partnerships and distribution networks in Southeast Asia.

| Company | Establishment Year | Headquarters | Philippines Local Presence | Nasal Delivery Portfolio (device/formulation) | Manufacturing/Device Capacity (SEA) | Recent Local Initiatives |

| GlaxoSmithKline (GSK) | 2000 (Philippines) | London, UK | – | – | – | – |

| Pfizer Inc. | 1849 | New York, USA | – | – | – | – |

| Aptar Pharma | 1992 | Illinois, USA | – | – | – | – |

| Nemera | 2001 | Geneva, Switzerland | – | – | – | – |

| Kindeva Drug Delivery | 1972 | USA | – | – | – |

Philippines Nasal Drug Delivery Solutions Market Analysis

Growth Drivers

Rising incidence of respiratory/allergy conditions in Philippines

In the Philippines, deaths due to respiratory diseases such as pneumonia increased by 9.1 % during January-to-September inclusive in one recent year, rising from 13,994 deaths to 14,340 deaths for respiratory tuberculosis and a broader increase across “other respiratory diseases” from 4,361 to 4,750 deaths. With a total population of 114.9 million in 2023, as per World Health Organization (WHO) data, the patient base for nasal therapies is expanding significantly. This elevated burden of respiratory illness encourages adoption of nasal-drug-delivery solutions—offering rapid onset of action and non-invasive self-administration—particularly for allergy and congestion treatments where nasal delivery is clinically relevant. Such demand dynamics underpin growth of device-formulation combos in the local market.

Growth of non-invasive delivery

Healthcare trends in the Philippines show increasing interest in treatments that avoid needles or injections, especially given the logistics challenges across the archipelago and home-care shifts. For example, the country’s health expenditure as a share of GDP stood at 5.87 % in 2021 according to WHO data. A lower-invasive delivery route like nasal spray or dry-powder device provides ease of use in outpatient, home-care or retail pharmacy environments. With rising pharmacy chain and online distribution presence, nasal devices capitalize on patient preference for convenience, self-administration and rapid symptom relief—especially in allergy or emergency rescue settings—thereby driving the expansion of nasal drug-delivery solutions in the Philippines.

Market Challenges

Absorption barriers via nasal mucosa

Although the nasal route offers non-invasive administration, the mucosal absorption barrier remains a technical challenge. For the Philippines, limited clinical infrastructure in some regions and high humidity may affect stability and performance of nasal formulations/devices. While specific national numeric data on nasal absorption issues is limited, regulatory guidelines in medical device registration emphasise device-drug compatibility and stability documentation. Device manufacturers must invest in formulation-device optimisation to overcome mucociliary clearance, enzymatic degradation and variable nasal anatomy—all raising development cost and time-to-market in a geography like the Philippines. This technical barrier thereby constrains market growth despite strong therapeutic demand.

Regulatory hurdles in Philippines

In the Philippines, registration of medical devices is governed by the Philippines Food and Drug Administration (FDA) via the CDRRHR (Center for Device Regulation, Radiation, Health & Research). Devices are classified A–D, and higher-risk classes (B, C, D) typically require 6–9 months for evaluation. Additionally, an online “e-notification” portal exists only for Class A devices, whereas higher-risk devices require e-mail submissions, increasing complexity. These regulatory timelines and requirements—especially for combination device-formulation nasal products—pose a challenge for manufacturers aiming to launch in the Philippines quickly. This slows product introduction, restricts the pipeline of novel nasal devices and hence impacts market speed of growth.

Opportunities

Intranasal vaccines rollout

Intranasal vaccine delivery is gaining global interest for its needle-free administration and mucosal immunity benefits. In the Philippines, surveillance of respiratory viruses shows 4,921 positive respiratory-virus samples tested in early 2024, with 284 cases of human metapneumovirus (HMPV) recorded by the Department of Health. These data highlight heightened viral-respiratory disease monitoring and government interest in novel delivery routes. The Philippines’ geographic dispersed island structure and strong public-health vaccination infrastructure present a favourable environment for intranasal vaccine rollout using nasal-delivery devices. For device-formulation manufacturers, collaborating with public vaccine programmes offers a significant opportunity to expand beyond therapeutic nasal sprays into prophylactic delivery via nasal route.

Neurology applications

Given the rising neurology disease burden in the Philippines—where stroke systems of care remain under-resourced and neurologist density is low employing nasal drug-delivery formats (for migraine rescue, epilepsy, Alzheimer’s) offers a compelling opportunity. Nasal delivery bypasses first-pass metabolism enables rapid onset, and suits emergency or outpatient neurology therapy. With local data indicating growing interest in neurology (web-search volumes) device-formulation firms can target this underserved segment in the Philippines. As healthcare infrastructure improves, nasal neurology delivery is positioned to fill a market gap in a cost-sensitive and decentralised setting.

Future Outlook

Over the next six years the Philippines nasal drug delivery solutions market is expected to show strong growth driven by rising incidence of respiratory and allergy conditions, greater self-care adoption, increased public-health interest in intranasal vaccination, and continued device innovation. Key enablers will include expanding online pharmacy penetration, device-formulation partnerships targeted at tropical-climate stability, and increasing local/regional manufacturing/assembly. From a value of circa USD 45.1 million in 2024, the market could grow to ~USD 76 million by 2030 (approx. CAGR 9 %). Companies that secure regulatory approvals, localise device supply chains, partner for therapy diversification (neurology, emergency, vaccination) and build robust distribution in Philippines retail and hospital channels will be best positioned. Challenges remain in regulatory complexity, device cost sensitivity, stability in humid climate and reimbursement constraints for novel intranasal therapies.

Major Players

- GlaxoSmithKline plc

- Pfizer Inc.

- Johnson & Johnson

- Sanofi

- Teva Pharmaceutical Industries Ltd.

- Sun Pharma Industries Ltd.

- Cipla Ltd.

- Aptar Pharma

- Nemera

- Kindeva Drug Delivery

- Amphastar Pharmaceuticals

- BD (Becton, Dickinson & Co.)

- Hovione

- RxPack

- Others (emerging device/formulation SMEs in Southeast Asia)

Key Target Audience

- Pharmaceutical and biotechnology companies (device + formulation)

- Medical device OEMs and nasal-delivery system manufacturers

- Hospital and retail pharmacy chains in Philippines (e.g., major pharmacy networks)

- Investments and venture capital firms (active in drug-delivery/MedTech in ASEAN)

- Government and regulatory bodies (Philippines Department of Health, Food and Drug Administration Philippines)

- Contract manufacturing organisations (CMOs) for nasal delivery solutions

- Distribution and logistics service providers specialising in pharmaceutical device/therapy delivery across Philippines islands

- Hospital networks and private clinic chains deploying nasal therapies and intranasal vaccination

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Philippines nasal drug delivery solutions market—device OEMs, formulation houses, distributors, hospitals/retailers, and regulatory bodies. This step is underpinned by extensive desk research, leveraging secondary data from market-reports, regulatory filings, industry databases and proprietary internal datasets to identify critical variables influencing market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyse historical data (e.g., past 3-5 years) for the Philippines market—covering market revenues, volume units (devices/doses), average selling price, distribution channel share, end-user segmentation, therapeutic application breakdown. We evaluate device penetration, formulation adoption, and therapy transition from oral/injection to nasal route. The bottom-up approach is used to estimate value and volume for core product formats.

Step 3: Hypothesis Validation and Expert Consultation

Key market hypotheses (e.g., growth drivers, format adoption, pricing trends in Philippines) are developed and then validated through structured interviews with industry experts—device OEMs, pharma local affiliates, leading hospital pharmacy heads and regulatory consultants in Philippines. These consultations provide operational, commercial and regulatory insights which refine and corroborate the market model.

Step 4: Research Synthesis and Final Output

The final phase involves integration of secondary and primary research, cross-checking Philippines-specific device/therapy launches, distributor networks, regulatory pathways, pricing and reimbursement, and distribution channel trends. This ensures a comprehensive, accurate and validated analysis of the Philippines nasal drug delivery solutions market.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations and Terminology, Market Sizing Approach, Consolidated Research Approach (primary interviews with device makers, Pharma, regulators in Philippines), Data Validation and Triangulation, Limitations and Future Research Directions)

- Definition and Scope of Nasal Drug Delivery Solutions in the Philippines

- Market Genesis & Evolution

- Regulatory Landscape & Reimbursement Environment

- Supply Chain & Value Chain Analysis

- Stakeholder Ecosystem

- Growth Drivers

Rising incidence of respiratory/allergy conditions in Philippines

Growth of non-invasive delivery

Rising neurology therapeutic burden - Market Challenges

Absorption barriers via nasal mucosa

Regulatory hurdles in Philippines

Device cost

Patient compliance issues - Opportunities

Intranasal vaccines rollout

Neurology applications

Dry-powder nasal devices for tropical climates - Key Trends

Device innovation

Self-administration growth

Digital-connected nasal devices

Local manufacturing/outsourcing in ASEAN - Regulatory & Reimbursement Framework

- SWOT Analysis

- Porter’s Five Forces

- Stakeholder Ecosystem (pharma/biotech, device OEM, distributors, end-user)

- Value-based Market Size (Philippines QAR local currency or USD), 2019-2024

- Volume-based Market Size (units, doses), 2019-2024

- Average Price / Value Per Unit (device + formulation), 2019-2024

- Market Size by Major Delivery Route (nasal sprays vs powders vs drops), 2019-2024

- Market Size by Key Therapeutic Application, 2019-2024

- By Device Delivery Format (In Value %)

Nasal Spray (metered-dose)

Unit-dose spray

Dry Powder Nasal Device

Nasal Drop Device

Nasal Gel/Ointment Device - By Formulation Type (In Value %)

Small Molecule Nasal Drugs

Biologics/Peptide Nasal Drugs

Intranasal Vaccines

Hormone/Nasal Hormone Therapies

Emergency/Rescue Nasal Therapies - By Therapeutic Application (In Value %)

Allergic & Non-Allergic Rhinitis

Asthma/Nasal Congestion

Neurology (migraine/epilepsy/Alzheimer’s)

Emergency (opioid reversal/seizure rescue)

Vaccination (intranasal) - By Distribution Channel (In Value %)

Hospital Pharmacies

Retail Pharmacies

Online Pharmacies

Contract/Out-patient Clinics - By End-User Setting (In Value %)

Hospitals & Clinics

Home-care/Self-administration

Specialty Clinics (neurology/allergy)

Public Health Vaccination Campaigns

- Market Share of Major Players (by value/volume) – Philippines region

- Cross-Comparison Parameters (Company Overview, Business Strategy, Recent Developments, Strengths, Weaknesses, Organisational Structure, Revenues, Revenues by Nasal Delivery Solutions, Number of Touchpoints/Distribution Network in Philippines, Manufacturing/Device Capacity, Unique Value Offering, Pricing Strategy, Regulatory Approvals in Philippines, Partnerships/Collaborations, R&D pipelines, Localisation)

- Detailed Profiles of Major Companies

Aptar Pharma

Nemera

BD (Becton, Dickinson & Co.)

Hovione

Kindeva Drug Delivery

Amphastar Pharmaceuticals

GlaxoSmithKline plc

AstraZeneca plc

Pfizer Inc.

Johnson & Johnson

Sanofi

Teva Pharmaceutical Industries Ltd.

Sun Pharma Industries Ltd.

Cipla Ltd.

RxPack

- Market Demand and Utilization by Setting

- Patient Demographics & Therapy Adoption Patterns in Philippines

- Procurement & Budgeting Behaviour

- Pain-Points, Unmet Needs and Decision-Making Process

- Self-administration and Homecare Trend in Philippines

- By Value (Philippines nasal delivery market), 2025-2030

- By Volume (units/doses), 2025-2030

- By Average Price/Unit (device + formulation), 2025-2030

- By Delivery Format (spray, powder, drop, gel), 2025-2030

- By Therapeutic Application (allergy/respiratory, neurology, emergency, vaccine), 2025-2030