Market Overview

The Philippines OBD-II Scanners market is valued at USD ~ billion, reflecting a steadily expanding demand base driven by vehicle electrification, higher diagnostic complexity, and the structural shift of automotive servicing toward data-driven maintenance. The market’s scale is underpinned by sustained vehicle registrations, a growing out-of-warranty vehicle pool, and increased reliance on electronic control units across powertrain, safety, and comfort systems. Demand is generated across workshops, fleets, and individual owners, positioning OBD-II scanners as essential diagnostic infrastructure rather than discretionary tools.

Market demand within the Philippines is concentrated in the National Capital Region, CALABARZON, and other industrialized corridors where vehicle density, dealership networks, and logistics fleets are most developed. These regions dominate due to high workshop concentration, superior parts availability, and faster adoption of diagnostic technologies. On the supply side, technology leadership and product standards are influenced by global manufacturing hubs that dictate software protocols, firmware updates, and coverage breadth, shaping the specifications and capabilities of scanners available to Philippine buyers.

Market Segmentation

By Product Type

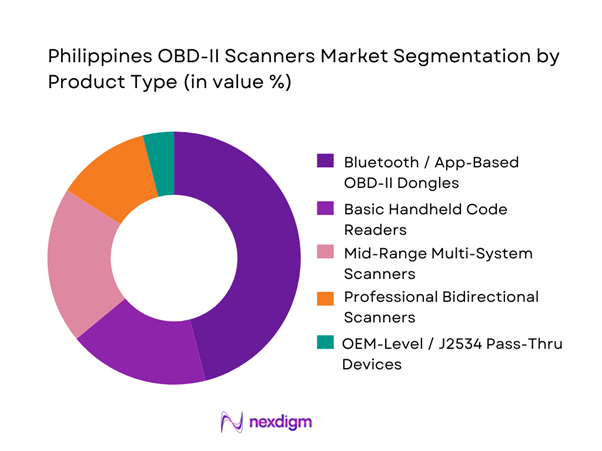

The Philippines OBD-II Scanners market is segmented by product type into Bluetooth/app-based dongles, basic handheld code readers, mid-range multi-system scanners, professional bidirectional scanners, and OEM-level pass-thru devices. Bluetooth/app-based dongles dominate this segmentation due to their affordability, accessibility through e-commerce channels, and compatibility with smartphones that are already widely used by technicians and vehicle owners. These devices provide essential diagnostic functions such as fault code reading, live data access, and readiness checks, which satisfy the majority of routine diagnostic needs. Their low upfront cost enables rapid adoption by small workshops and DIY users, while app ecosystems allow incremental upgrades without replacing hardware. This combination of low entry barrier, functional adequacy, and digital distribution makes app-based dongles the most widely adopted product category.

By End-Use Customer Type

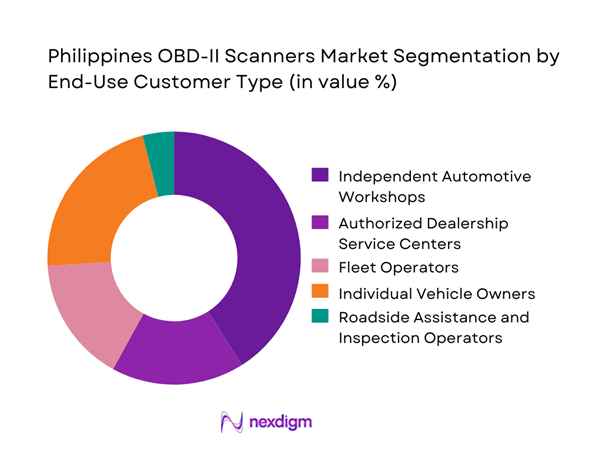

The market includes independent automotive workshops, authorized dealership service centers, fleet operators, individual vehicle owners, and roadside assistance operators. Independent automotive workshops hold the dominant position in this segmentation because they service a diverse mix of vehicle brands and models, particularly those outside warranty coverage. These workshops require flexible diagnostic tools capable of handling multiple systems efficiently to maintain throughput and profitability. Unlike dealerships with OEM-specific tools, independent workshops depend on versatile scanners that balance cost and functionality. Their high daily diagnostic frequency, coupled with repeat tool upgrades as vehicle electronics evolve, sustains consistent demand. Additionally, workshops increasingly position diagnostics as a billable service, further reinforcing their central role as primary purchasers of OBD-II scanners.

Competitive Landscape

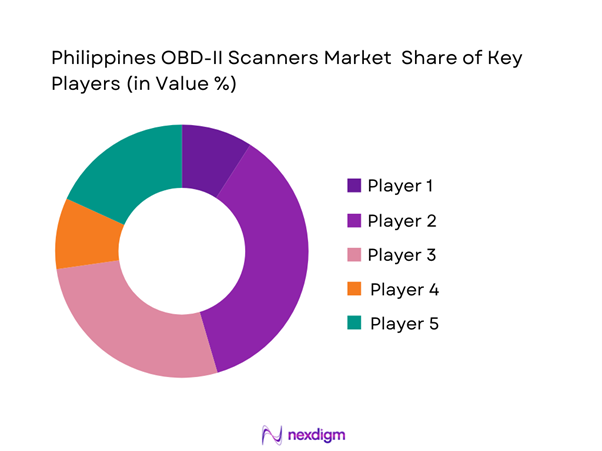

The Philippines OBD-II Scanners market is dominated by a few major players, including Autel and global or regional brands like Launch Tech, Bosch, Snap-on, and Thinkcar. This consolidation highlights the significant influence of these key companies.

| Company | Established | Headquarters | Core Product Range Fit (PH) | Strength in Asian Make Coverage | Bidirectional Capability | Update Model | Typical Buyer Segment | Local Channel Dependence | After-sales & Training Readiness |

| Autel | 2004 | Shenzhen, China | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| LAUNCH Tech | 1992 | China (global operations; Shenzhen-centric) | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Bosch | 1886 | Gerlingen, Germany | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Snap-on | 1920 | Kenosha, Wisconsin, USA | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Thinkcar | 2018 | Shenzhen, China | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

Philippines OBD-II Scanners Market Analysis

Growth Drivers

Rising Vehicle Parc and Aging Fleet

The continuous expansion of the national vehicle parc combined with the aging profile of in-use vehicles is a fundamental driver for OBD-II scanner demand in the Philippines. A large proportion of vehicles transition out of manufacturer warranty coverage within a few years, shifting maintenance and diagnostics toward independent workshops. As vehicles accumulate higher mileage, electronic issues such as sensor failures, emission-related faults, misfires, and transmission errors become more frequent. Modern vehicles rely heavily on electronic control units, making manual diagnostics increasingly ineffective. Workshops are therefore required to perform regular scanning not only for fault detection but also for preventive checks before failures escalate. This environment increases daily diagnostic volumes per workshop, reinforcing recurring demand for scanners, periodic upgrades, and multi-vehicle compatibility tools to manage mixed-brand repair inflows efficiently.

Digitalization of Independent Workshops

Independent workshops across the Philippines are gradually adopting digital tools to remain competitive against dealership service centers. This shift includes digital job cards, standardized diagnostic workflows, electronic fault histories, and faster repair decision-making. OBD-II scanners sit at the center of this transformation, serving as the primary interface between vehicles and digital repair processes. Technicians increasingly rely on scan data to reduce diagnostic time, improve repair accuracy, and justify recommendations to customers. As workshop owners seek consistency across technicians and service bays, scanner standardization becomes essential rather than optional. The move toward electronics-heavy vehicles further accelerates this transition, as mechanical-only expertise is no longer sufficient. Digitalization also supports better customer trust and repeat business, reinforcing scanner adoption as a long-term operational necessity rather than a one-time purchase.

Challenges

High Price Sensitivity of Buyers

Price sensitivity remains a significant challenge in the Philippines OBD-II scanners market due to tight operating margins among workshops and service providers. Many independent garages prioritize short-term cash flow over long-term productivity investments, making them cautious about higher upfront costs. Ongoing expenses such as paid software updates, licensing fees, and accessory add-ons further influence purchase decisions. This behavior often leads buyers to delay upgrades or select entry-level devices that may lack advanced functionality. Even when workshops recognize the benefits of bidirectional controls or expanded vehicle coverage, cost considerations can override performance advantages. As a result, adoption of higher-end scanners progresses slowly, and replacement cycles are extended beyond optimal periods. Vendors must therefore navigate a market where value perception is closely tied to immediate affordability rather than lifetime performance.

Proliferation of Counterfeit Devices

The widespread availability of counterfeit and cloned diagnostic scanners presents a structural challenge for the market. These devices are often sold through informal channels and online marketplaces at significantly lower prices, attracting cost-conscious buyers. However, counterfeit scanners typically suffer from unstable software, limited vehicle coverage, and unreliable diagnostics, leading to inconsistent repair outcomes. This undermines user confidence not only in specific brands but in scanner investments overall. Workshops that experience failures with cloned tools may become reluctant to invest in professional-grade solutions. Additionally, counterfeit products distort pricing expectations, making it difficult for legitimate vendors to justify premium positioning. The presence of such devices also complicates after-sales support and training efforts, as users may unknowingly operate unsupported or unauthorized hardware.

Opportunities

Workshop Modernization Programs

The ongoing modernization of automotive workshops creates a strong opportunity for OBD-II scanner vendors to move beyond standalone product sales. Programs focused on upgrading workshop capabilities—through training, financing support, and service integration—can significantly accelerate adoption of advanced diagnostic tools. Vendors that bundle scanners with technician training, extended warranties, and structured upgrade paths can address both skill gaps and affordability concerns. Financing models such as installment-based purchases or tool-as-a-service subscriptions further reduce entry barriers. Modernization initiatives also encourage workshops to standardize equipment across service bays, increasing unit demand per location. By positioning scanners as part of a broader productivity and quality improvement solution, vendors can shift buyer focus from price to operational value and long-term efficiency gains.

Fleet Preventive Maintenance Adoption

Fleet operators in logistics, transportation, and mobility services increasingly prioritize preventive maintenance to minimize unplanned downtime and operational disruptions. OBD-II scanners play a critical role in enabling condition-based maintenance by identifying early warning signals such as emission anomalies, sensor degradation, or performance inefficiencies. Regular scanning allows fleet managers to schedule repairs proactively, extend vehicle uptime, and optimize maintenance planning. This creates consistent and recurring demand for diagnostic tools rather than sporadic purchases. Unlike small workshops, fleet buyers often seek standardized tools with reporting capabilities and multi-vehicle compatibility, making them attractive customers for mid- to high-tier scanners. As fleet sizes expand and utilization intensity rises, diagnostic scanning becomes embedded in daily operations, strengthening long-term demand from this segment.

Future Outlook

The Philippines OBD-II Scanners market is expected to strengthen structurally as vehicles become more software-driven and diagnostic-intensive. Market momentum will favor scalable platforms that combine hardware, software updates, and cloud connectivity. Vendors that align pricing models with local affordability while maintaining strong after-sales ecosystems are best positioned to capture sustained growth.

Major Players

- Autel

- Launch Tech

- Bosch

- Snap-on

- Thinkcar

- TOPDON

- Foxwell

- ANCEL

- iCarsoft

- Innova Electronics

- OBDLink

- Actron

- BlueDriver

- XTOOL

- Carly

Key Target Audience

- Independent automotive workshop chains

- Authorized dealership service networks

- Fleet owners and fleet management companies

- Ride-hailing and delivery fleet operators

- Automotive aftermarket distributors and retailers

- Roadside assistance service providers

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

The study begins with mapping the diagnostic tools ecosystem, identifying stakeholders, product categories, and buyer segments influencing demand.

Step 2: Market Analysis and Construction

Historical indicators related to vehicle density, workshop distribution, and diagnostic intensity are analyzed to construct market structure.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions are validated through expert consultations with distributors, workshops, and fleet operators to ensure practical alignment.

Step 4: Research Synthesis and Final Output

All findings are triangulated and synthesized into a cohesive market model emphasizing accuracy and client usability.

- Executive Summary

- Research Methodology (Market Definitions and Inclusions/Exclusions, Abbreviations, Topic-Specific Taxonomy, Market Sizing Framework, Revenue Attribution Logic Across Use Cases or Care Settings, Primary Interview Program Design, Data Triangulation and Validation, Limitations and Data Gaps)

- Definition and Scope

- Market Genesis and Evolution

- Usage and Value-Chain Mapping

- Business Cycle and Demand Seasonality

- Philippines Automotive Service Delivery Architecture

- Growth Drivers

Rising Vehicle Parc and Aging Fleet

Digitalization of Independent Workshops

Expansion of Fleet-Based Mobility Services

Increased Electronic Content per Vehicle

Growth of Automotive E-Commerce - Challenges

High Price Sensitivity of Buyers

Proliferation of Counterfeit Devices

Skills Gap in Advanced Diagnostics

Compatibility Issues with Mixed Vehicle Imports

Recurring Software Update Costs - Opportunities

Workshop Modernization Programs

Fleet Preventive Maintenance Adoption

Integration with Mobile and Cloud Platforms

Growing Hybrid and EV Diagnostics Demand

Value-Added Training and Subscription Models - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- By Volume, 2019–2024

- By Average Selling Price (ASP) and Price Banding, 2019–2024

- By Product Type (in Value %)

Bluetooth / App-Based OBD-II Dongles

Basic Handheld Code Readers

Mid-Range Multi-System Scanners

Professional Bidirectional Scanners

OEM-Level / J2534 Pass-Thru Devices - By End-Use Customer Type (in Value %)

Independent Automotive Workshops

Authorized Dealership Service Centers

Fleet Operators

Individual Vehicle Owners

Roadside Assistance and Inspection Operators - By Technology and Diagnostic Capability (in Value %)

Generic OBD-II Diagnostics

Multi-ECU System Diagnostics

Bidirectional Control and Actuation

Service Reset and Calibration Functions

Advanced Coding and Programming - By Distribution Model (in Value %)

E-Commerce Platforms

Offline Automotive Tool Retail

Direct Distributor Sales

Workshop Bundling and Subscriptions - By End-Use Vehicle Category (in Value %)

Passenger Cars

Light Commercial Vehicles

Heavy Commercial Vehicles

Hybrid Vehicles

Battery Electric Vehicles - By Region (in Value %)

National Capital Region

CALABARZON

Central Luzon

Visayas

Mindanao

- Competition ecosystem overview

- Cross Comparison Parameters (vehicle coverage depth, protocol compatibility, bidirectional functionality, software update cadence, pricing flexibility, distributor strength, after-sales support, training availability)

- SWOT analysis of major players

- Pricing and commercial model benchmarking

- Detailed Profiles of Major Companies

Autel

Launch Tech

Bosch

Snap-on

Thinkcar

TOPDON

Foxwell

ANCEL

iCarsoft

Innova Electronics

OBDLink

Actron

BlueDriver

XTOOL

Carly

- Buyer personas and decision-making units

- Procurement and contracting workflows

- KPIs used for evaluation

- Pain points and adoption barriers

- By Value, 2025–2030

- By Volume, 2025–2030

- By Average Selling Price (ASP) and Price Banding, 2025–2030