Market Overview

The Philippines pharmaceutical market is valued at USD ~ billion, based on industry data for the base year in 2024. The growth of this market is driven by increasing access to healthcare, expanding insurance coverage via the Universal Health Care (UHC) legislation, and growing demand for chronic-therapeutics such as oral drug solutions. Additionally, rising non-communicable disease burden and sizeable out-patient drug consumption contribute to expanded volumes of oral dosage forms. Data from 2023 continue to reflect robust demand for maintenance therapies in retail pharmacy channels.

Metro Manila and the Luzon island group dominate the Philippines oral drug solutions market because of high concentration of tertiary hospitals, major pharmaceutical distributors, and retail pharmacy chains. These urban centres feature well-developed logistics and cold-chain infrastructure, stronger per-capita healthcare expenditure, and higher rate of prescription drug usage. The private sector in Manila also drives high adoption of branded and generic oral therapies, making it the top region for oral drug solutions deployment and market innovation.

Philippines Oral Drug Solutions Market

Market Segmentation

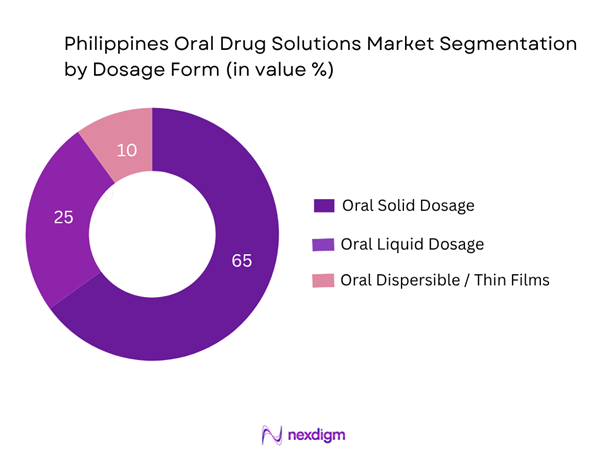

By Dosage Form

Among the dosage forms, the Oral Solid Dosage sub-segment dominates the Philippines oral drug solutions market. This dominance is driven by widespread physician and pharmacy preference for tablets and capsules in both outpatient and institutional settings, cost-efficient manufacturing and distribution, deep penetration into retail pharmacies numbering over 29,000 stores as of recent data. Further, locally manufactured generics and branded-solid dosage products have gained stronger footing, reducing dependency on imports and enabling higher volumes across the country’s archipelago.

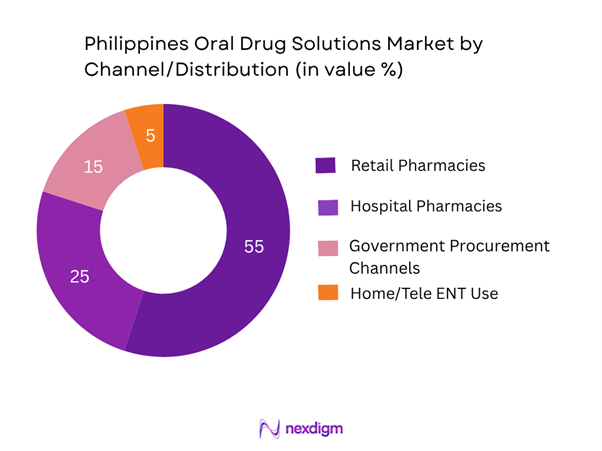

By Channel / Distribution

The Retail Pharmacies & Drug Stores channel leads the Philippines oral drug solutions market, as it captures the majority of outpatient prescription refills and maintenance therapies. With the Philippines having around 29,000 pharmacies from historical data and strong retail presence especially in urban centres, this channel benefits from consumer convenience, high foot traffic, and diversified product assortments including generics and branded oral solutions. Moreover, retail pharmacies enable immediate access for patients managing chronic conditions, making this channel especially relevant for oral drug solutions.

Competitive Landscape

The competitive environment for the Philippines oral drug solutions market comprises global pharmaceutical firms, local manufacturers, and regional generics producers. This mix results in moderate market consolidation, competitive pressures on pricing, and increasing focus on distribution efficiencies.

| Company | Establishment Year | Headquarters | Philippines Presence | Oral Drug Solutions Focus | Local Manufacturing / Import Status | Distribution Channel Coverage | Recent Strategic Initiative |

| Pfizer Inc. | 1849 | New York, USA | – | – | – | – | – |

| Novartis AG | 1996 (merger) | Basel, Switzerland | – | – | – | – | – |

| Sanofi S.A. | 1973 | Paris, France | – | – | – | – | – |

| GlaxoSmithKline plc | 2000 (merger) | Brentford, UK | – | – | – | – | – |

| Unilab, Inc. | 1945 | Mandaluyong, Metro Manila | – | – | – | – | – |

Philippines Oral Drug Solutions Market Analysis

Key Growth Drivers

Rising non-communicable diseases

Non-communicable diseases (NCDs) form the largest share of mortality in the Philippines market for oral drug solutions. For example, data show that NCDs accounted for approximately 918,562 total deaths in the Philippines, of which around 68 % were attributed to NCDs in 2021. This high burden of NCDs such as cardiovascular disease, diabetes and hypertension drives extensive demand for oral drug solutions, both generics and branded, as patients transition to long-term therapy and maintenance dosing.

Generics substitution

Local stakeholders in the Philippines report that domestic pharmaceutical production has increasingly shifted toward generics: local policy documents note that “the role of local firms expanded from 32.4 % to 43.5 % of overall market” over a recent period, highlighting generics adoption. As substitution of branded therapies by generics accelerates, demand for oral drug solutions increases—especially in outpatient and retail sectors where cost sensitivity is high and generics penetration is strong, boosting volume growth and accessibility.

Key Market Challenges

High import dependency of APIs

Although the Philippines has a sizeable oral drug solutions market, it remains heavily reliant on imports of active pharmaceutical ingredients (APIs). Policy findings report that “raw materials are almost 98 % imported” for local manufacturers. This dependence elevates exposure to foreign currency fluctuations, global supply disruptions and regulatory complexities, thereby creating cost pressures and supply-chain bottlenecks for domestic oral drug solutions producers and suppliers across the archipelago.

Price-control regulation

The Philippine government regulates prices of medicines through essential-medicines lists and public procurement frameworks, which places margin pressure on manufacturers of oral drug solutions. Industry commentary notes that control mechanisms and pricing variance issues are systemic. Given that oral drug solutions often fall under public procurement and tender frameworks, regulated pricing reduces ability to raise prices, compresses profitability and makes entry of premium or novel formulation oral solutions more challenging — especially in price-sensitive channels.

Emerging Opportunities

Fixed-Dose Combination Therapies

The Philippines oral drug solutions market presents a strong opportunity with fixed-dose combination (FDC) therapies because the country’s licensed pharmaceutical manufacturing base already includes 435 manufacturing and packaging businesses. With FDC therapies increasingly recommended for chronic conditions and oral treatments, local manufacturers have a foundation for development and formulation of combined oral drugs. The large production capacity and regulatory ecosystem support FDC introduction, enabling pharmaceutical companies to capture incremental value and meet evolving physician prescribing patterns in the Philippines.

Oral Dispersible Film Innovation

Innovation in orally-dispersible films (ODFs) offers a valuable opportunity in the Philippines oral drug solutions market due to increasing demand for patient-friendly dosage forms. The Philippines pharmaceutical manufacturing industry is a key manufacturing node in Southeast Asia and counts “over 150 pharmaceutical manufacturing facilities” in major hubs such as Cebu and Metro Manila. Given this industrial presence, pharmaceutical firms can leverage local formulation capabilities to develop ODF products for populations with swallowing difficulties, paediatric markets and outpatient settings—thus expanding oral drug solutions beyond standard tablets into novel formats.

Future Outlook

Over the next several years, the Philippines oral drug solutions market is expected to maintain stable growth, supported by the expansion of universal healthcare access, increasing chronic-disease prevalence, and rising consumer penetration in both urban and semi-urban regions. Growth opportunities will stem from generics substitution, digitisation of pharmacy channels, and increasing local manufacturing. However, pricing pressure, regulatory reforms, and logistical challenges across remote islands will impose strategic constraints. Manufacturers and distributors with strong local networks and channel-covering capabilities will be best positioned to capture growth in underserved segments.

Major Players

- Pfizer Inc.

- Novartis AG

- Sanofi S.A.

- GlaxoSmithKline plc

- Bayer AG

- Takeda Pharmaceutical Company Limited

- Unilab, Inc.

- The Cathay Drug Co., Inc.

- Ajanta Pharma Limited

- Mercury Drug Corporation

- The Generics Pharmacy (TGP)

- Robinsons Retail (Pharma Division)

- RiteMED Philippines, Inc.

- Unipharm, Inc.

Key Target Audience

- Pharmaceutical manufacturers of oral dosage-forms

- Generic drug producers and local-manufacturers

- Retail pharmacy chains & drug-store networks

- Private hospital chains and institutional pharmacy groups

- Investments & venture-capitalist firms (pharmaceutical/therapeutics space)

- Government and regulatory bodies (Philippine Food and Drug Administration, Department of Health Philippines)

- E-pharmacy and online drug-distribution platforms

- Public procurement agencies and large outpatient service networks

Research Methodology

Step 1: Identification of Key Variables

This phase entailed mapping the ecosystem of the Philippines oral drug solutions market—stakeholders including manufacturers, distributors, pharmacies, hospitals, government procurement agencies and patients. Desk-research from industry reports, government statistics and trade databases was used to define dosage-form segments, therapeutic areas, channel types, regional distribution segments and pricing tiers.

Step 2: Market Analysis and Construction

Historical data were compiled for the Philippines pharmaceutical market size (e.g., USD 3.30 billion for 2024) and annual growth trends. Unit volumes, value segments (oral solids/liquids), average selling-prices and channel shares were estimated through bottom-up modelling (volume × ASP) and top-down allocation from national market data.

Step 3: Hypothesis Validation and Expert Consultation

Preliminary market hypotheses (e.g., dominance of oral solid dosage, retail pharmacy lead channel) were validated via interviews with key stakeholders including pharmacy chain executives, local manufacturers, hospital pharmacy buyers and national procurement officials. These helped refine assumptions on distribution reach, logistics constraints in remote islands and generics vs branded mix.

Step 4: Research Synthesis and Final Output

The final step involved integrating all data—segmentation, competitive profiling, channel dynamics, regional distribution and future projections—into a coherent structure. Forecast modelling for 2024-2030 was developed, incorporating macro-trends, healthcare reforms, generics substitution and distribution innovations to ensure actionable insights for business-professionals in the Philippines oral drug solutions market.

- Executive Summary

- Research Methodology (Market Definitions & Assumptions [oral drug solutions = oral solid dosage, oral liquid dosage, oral dispersible films], Abbreviations, Market-Sizing Approach [top-down & bottom-up], Consolidated Research Approach [supply-side, demand-side, trade flows], Primary Research & In-Depth Interviews, Limitations & Future Considerations)

- Definition & Scope

- Market Genesis & Evolution

- Timeline of Regulatory & Approval Milestones

- Supply Chain & Value Chain Analysis

- Business Cycle & Life-Cycle of Oral Drug Solutions

- Growth Drivers

Rising non-communicable diseases

Generics substitution

Local manufacturing incentives - Market Challenges

High import dependency of APIs

Price-control regulation

Logistics across archipelago - Opportunities

Fixed-dose combinations,

Oral dispersible film innovation,

E-pharmacy growth - Trends

Increasing generics share

Outsourcing of manufacturing,

Shifts in channel mix - Regulatory & Reimbursement Landscape

Philippine FDA regulation,

Essential medicines list,

Public procurement guidelines - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value (USD million), 2019-2024

- By Volume (Number of Units/Dosage Forms), 2019-2024

- By Average Selling Price (ASP) per dosage form segment, 2019-2024

- By Dosage Form (In value %)

Oral Solid Dosage (tablets/capsules)

Oral Liquid Dosage (syrups, suspensions)

Oral Dispersible/Orally-Thin Films - By Therapeutic Area (In value %)

Cardiovascular & Metabolic

Anti-infectives

Respiratory

CNS & Pain Management

Gastrointestinal - By Channel/Distribution (In value %)

Hospital Pharmacies (in-patient/institutional)

Retail Pharmacies & Drug Stores

E-Pharmacy/Online Pharmacies

Government Tender/Procurement Channels - By Geography – Region/Island Group (In value %)

Luzon

Visayas

Mindanao

Remote Islands & Rural Areas - By Price Tier/Segment (In value %)

Premium Branded Oral Drugs

Branded Generics Oral Drugs

Unbranded/Low-Cost Generics

- Market Share of Major Players (by value / volume)

- Cross-Comparison Parameters (Company Overview, Business Strategy, Recent Developments, Strengths, Weaknesses, Philippines Revenue, Revenue by Dosage Form, Number of SKUs in Philippines, Distribution Channel Reach, Local Manufacturing Footprint, Margin Structure, Service/Support Infrastructure)

- SWOT Analysis of Major Players

- Company Profiles of Major Companies

Pfizer Inc.

Novartis AG

Sanofi S.A.

GlaxoSmithKline plc

Bayer AG

Takeda Pharmaceutical Company Limited

Unilab, Inc.

The Cathay Drug Co., Inc.

Ajanta Pharma Limited

Mercury Drug Corporation

Generic Drug Manufacturer (local major)

Distributor/Wholesaler Major (local)

Island-Region Specialist Distributor

E-Pharmacy Platform Major

New Entrant/Contract-Manufacturer Major

- Demand & Utilisation Patterns

- Purchasing Power & Budget Allocations

- Patient & Prescriber Insights Key Buying Criteria & Decision-Making Process

- Access & Distribution Barriers

- By Value (USD million), 2025-2030

- By Volume (Units/Dosage Forms), 2025-2030

- By Average Selling Price (ASP), 2025-2030