Market Overview

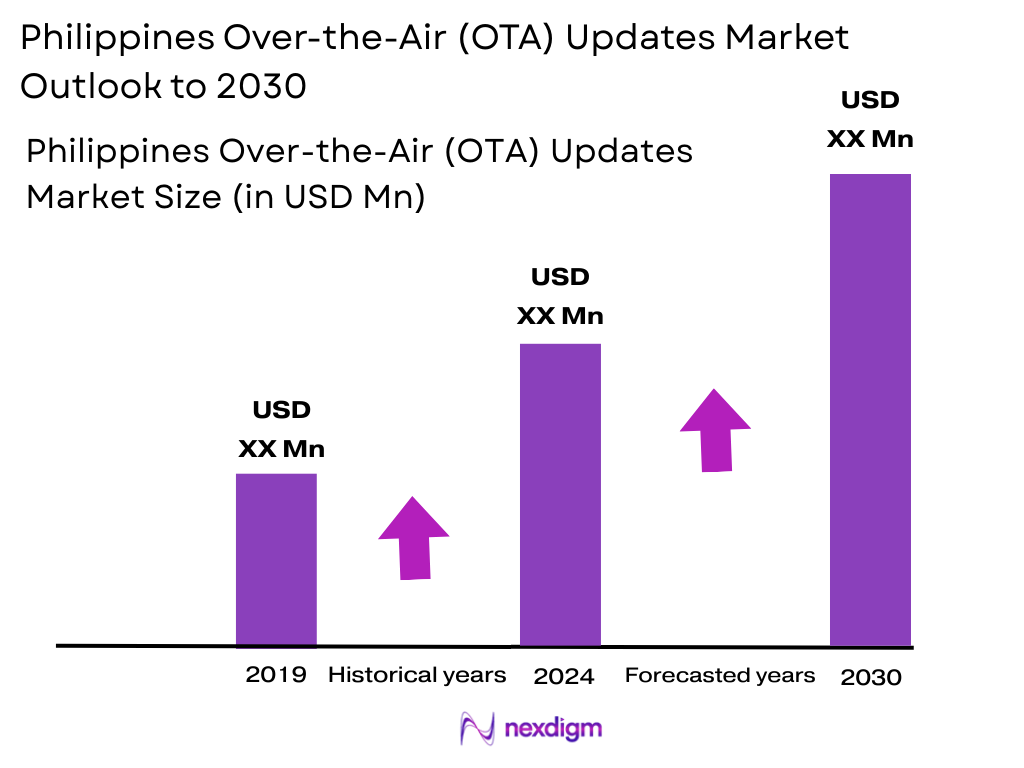

The Philippines Over-the-Air (OTA) Updates Market has been experiencing significant growth, driven by the rising demand for seamless updates across connected devices, particularly in the automotive and consumer electronics sectors. As of 2024, the market is valued at approximately USD ~ million. The rapid adoption of Internet of Things (IoT) devices, smart cars, and smartphones in the country, alongside the increasing need for real-time software updates, is contributing to the market’s growth. Furthermore, government support and improvements in mobile networks like 5G are enhancing OTA capabilities, which are expected to continue driving market expansion.

Metro Manila is the dominant region for the Philippines OTA Updates Market, driven by its status as the economic and technological hub of the country. The region hosts the largest number of connected devices and vehicles, including smart cars and IoT-enabled gadgets, which makes it the primary market for OTA services. Other regions, such as Cebu and Davao, also show increasing demand due to rising urbanization and greater internet connectivity, but Metro Manila remains the center for technological adoption and innovation in the Philippines.

Market Segmentation

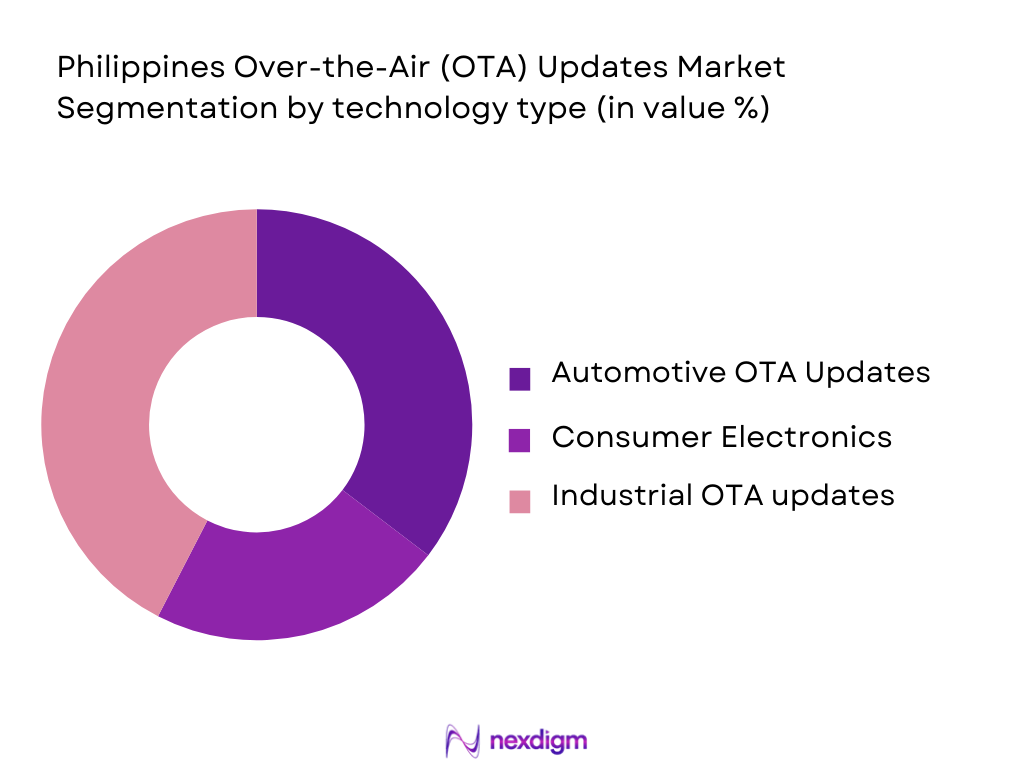

By Technology Type

The Philippines OTA Updates Market is segmented by technology type into automotive OTA updates, consumer electronics OTA updates, and industrial OTA updates. Among these, automotive OTA updates have a dominant market share, owing to the increasing integration of connected technologies in vehicles. As the demand for electric and autonomous vehicles grows, the need for regular updates to onboard systems, including safety features and infotainment systems, has surged. Major automotive companies like Tesla and local manufacturers are driving this growth by incorporating OTA functionality into their vehicles, reducing the need for physical service visits and improving the user experience.

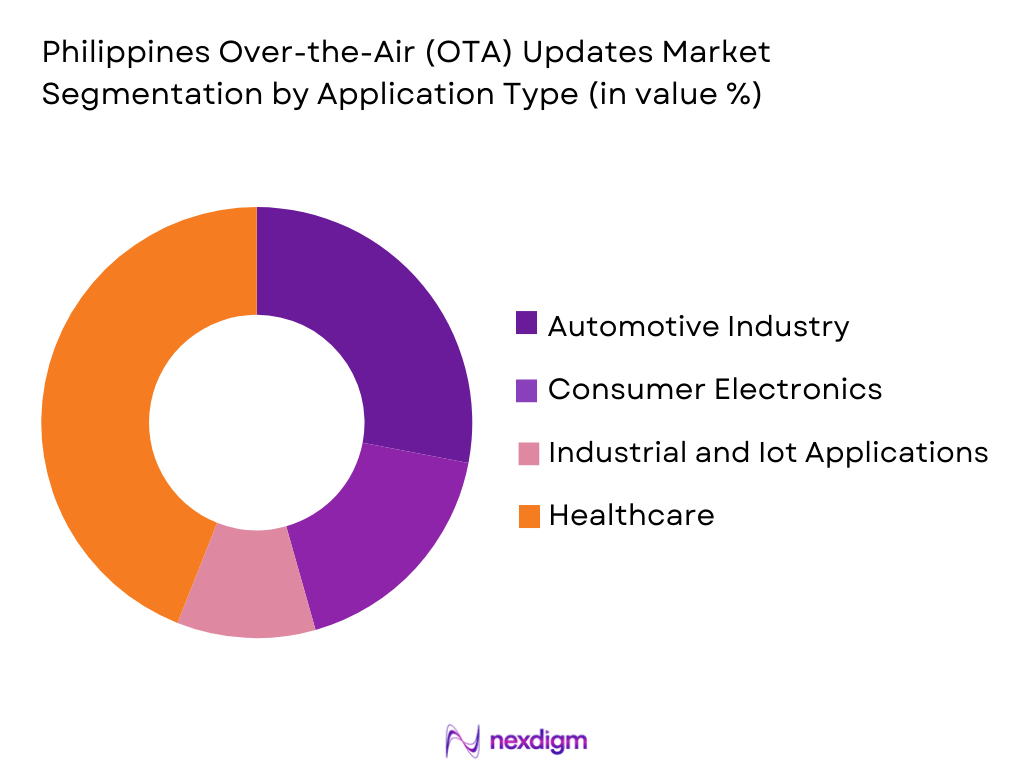

By Application

The market is also segmented by application, including the automotive industry, consumer electronics, industrial and IoT applications, and healthcare. The automotive industry, particularly electric vehicles (EVs) and smart cars, dominates this segment. As more vehicles integrate OTA capabilities for system updates, navigation, and feature enhancements, the automotive sector is becoming a key driver. The growing need for real-time updates in vehicles to ensure system performance and safety makes automotive OTA updates highly valuable. Additionally, the rise of connected homes and smart devices has boosted the demand for consumer electronics OTA updates, though automotive OTA updates continue to lead.

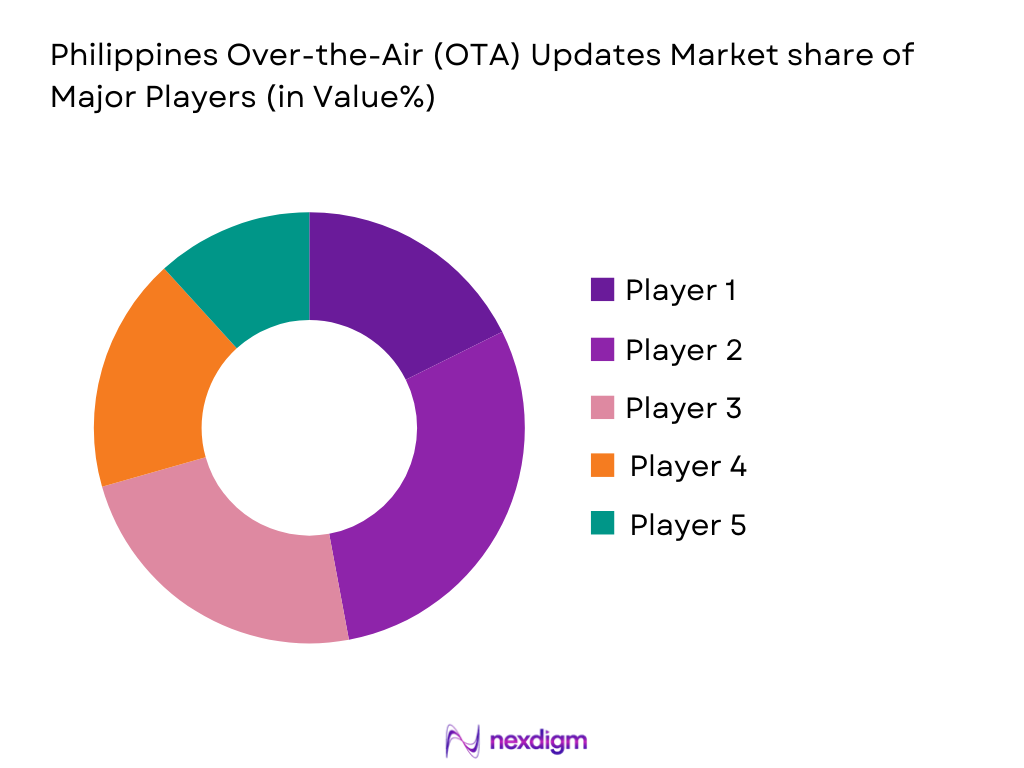

Competitive Landscape

The Philippines OTA Updates Market is dominated by a few major players who provide both hardware and software solutions for OTA implementation. These players include automotive giants like Tesla and local car manufacturers, along with global technology companies such as Qualcomm, Microsoft, and Google. The competitive landscape is characterized by partnerships between car manufacturers, telecom operators, and technology providers, ensuring the rapid deployment and scalability of OTA solutions. Additionally, smaller companies specializing in IoT and consumer electronics OTA are emerging, making the market highly dynamic.

| Company Name | Establishment Year | Headquarters | Technology Focus | Distribution Channels | Partnerships | R&D Investment |

| Tesla | 2003 | Palo Alto, USA | ~ | ~ | ~ | ~ |

| Qualcomm | 1985 | San Diego, USA | ~ | ~ | ~ | ~ |

| Microsoft | 1975 | Redmond, USA | ~ | ~ | ~ | ~ |

| 1998 | Mountain View, USA | ~ | ~ | ~ | ~ | |

| Samsung Electronics | 1969 | Seoul, South Korea | ~ | ~ | ~ | ~ |

Philippines OTA Updates Market Analysis

Growth Drivers

Urbanization

The Philippines has witnessed rapid urbanization, with over ~% of its population residing in urban areas as of 2024. Metro Manila, the country’s economic hub, continues to drive this trend, with an annual population growth rate of ~%. This urbanization is directly contributing to the increased demand for connected devices and over-the-air (OTA) updates, especially in automotive and consumer electronics sectors. The need for smart city initiatives, which rely on IoT technologies, is growing. With ~% of urban households in Metro Manila having access to the internet, the adoption of OTA technology in urban centers is poised to surge.

Industrialization

The Philippines’ industrial sector has been expanding, with the manufacturing industry accounting for approximately ~% of the GDP in 2024. The push towards modernization in industries like automotive manufacturing, consumer electronics, and healthcare is creating a demand for efficient software updates through OTA. Industrial automation and IoT-based systems, essential for enhancing operational efficiency, have contributed to this growth. The Philippine government’s industry development plan has encouraged businesses to adopt cutting-edge technologies, further driving the need for OTA solutions. As of 2024, the Philippines’ industrial production index grew by ~%, reflecting the shift towards automation and technological integration.

Challenges

High Initial Costs

Despite the growing adoption of OTA updates, high initial costs remain a significant barrier for manufacturers and service providers in the Philippines. The capital required for implementing OTA systems, such as IoT infrastructure, cloud computing capabilities, and secure communication networks, is considerable. The automotive industry, for instance, is investing heavily in upgrading vehicle software systems to allow for OTA functionality, with an average expenditure of $1.5 billion for major car manufacturers. These costs are a challenge, especially for smaller players in the market.

Technical Challenges

Technical barriers such as network infrastructure limitations and security risks complicate the widespread adoption of OTA updates. Although 84% of Filipinos have access to mobile broadband as of 2022, the speed and reliability of connections in rural areas remain inconsistent. The need for high-speed internet, such as 5G, for seamless OTA updates has led to challenges in remote areas. Furthermore, device compatibility and ensuring proper testing of software updates pose ongoing technical challenges, limiting the efficient rollout of OTA updates across various devices and industries.

Opportunities

Technological Advancements

The continued advancement of technologies such as 5G, cloud computing, and IoT presents significant opportunities for the OTA updates market in the Philippines. The government’s efforts to expand high-speed internet access, with a target to reach ~% of the population by 2024, will enhance the feasibility and efficiency of OTA updates. The rollout of 5G in key metropolitan areas such as Metro Manila and Cebu is set to provide the required bandwidth to support rapid OTA updates, thereby stimulating market growth.

International Collaborations

Philippine companies, particularly in automotive and telecommunications, are increasingly collaborating with international firms to adopt OTA technology. Global automotive giants such as Tesla and BMW have entered into partnerships with local firms to integrate OTA updates into their vehicles. Such collaborations help local companies overcome technical and infrastructure limitations while fostering market innovation. Moreover, collaborations between telecom companies and international firms are pushing the adoption of cloud-based OTA systems for consumer electronics and IoT devices.

Future Outlook

The Philippines Over-the-Air (OTA) Updates Market is poised for significant growth in the coming years. Over the next five years, the market will benefit from advancements in automotive technology, the expansion of the IoT ecosystem, and the increasing adoption of 5G networks. The automotive industry, especially electric and connected vehicles, will continue to be the dominant sector, with more automakers incorporating OTA capabilities into their vehicles. The rise in demand for smart home devices and connected appliances will also bolster the consumer electronics OTA segment. Additionally, the Philippine government’s focus on improving digital infrastructure will facilitate the widespread adoption of OTA solutions across multiple sectors.

Major Players

- Tesla

- Qualcomm

- Microsoft

- Samsung Electronics

- Audi AG

- BMW Group

- Ford Motor Company

- Volvo Group

- Nvidia Corporation

- Ericsson

- Huawei Technologies

- Panasonic

- Bosch

- Continental AG

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Automotive Manufacturers

- Consumer Electronics Manufacturers

- Telecom Operators

- Cloud and Software Solution Providers

- IoT Solution Providers

- Enterprises in Healthcare and Industrial Automation

Research Methodology

Step 1: Identification of Key Variables

The first phase of the research involves constructing an ecosystem map of key stakeholders within the Philippines OTA Updates Market, including car manufacturers, telecom operators, and software providers. This step is supported by secondary research using trusted databases and industry reports to identify critical market drivers, challenges, and opportunities.

Step 2: Market Analysis and Construction

In this phase, we analyze historical data concerning OTA adoption in the Philippines, including penetration in automotive, consumer electronics, and industrial sectors. The data collected will be used to estimate revenue generation, customer adoption rates, and product segment growth.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be validated through consultations with industry experts, including executives from automotive companies, telecom operators, and technology providers. These consultations provide insights into market dynamics and confirm data reliability, ensuring accurate projections and strategies.

Step 4: Research Synthesis and Final Output

The final stage involves synthesizing all data collected from secondary and primary sources, engaging with industry stakeholders to refine product segment details, consumer preferences, and market growth estimates. This step ensures a comprehensive and validated report for market stakeholders, providing actionable insights.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Adoption of Connected Devices and Vehicles

Rising Demand for Real-Time Software Updates

Technological Advancements in Cloud Computing and IoT - Market Challenges

Security and Privacy Concerns with OTA Updates

High Dependency on Internet Infrastructure

Regulatory Challenges in OTA Updates - Opportunities

Rising Adoption of Electric Vehicles and Smart Cars

Expanding Demand for Remote Software Management in IoT Devices

Collaborations with Telecom Operators for Widespread Adoption - Trends

Increasing Use of AI and Machine Learning for OTA Optimization

Growing Role of 5G in Enhancing OTA Update Speed and Efficiency - Government Regulation

- SWOT Analysis

- Pricing Details

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value 2019-2025

- By Volume 2019-2025

- By Average Price 2019-2025

- By Technology Type (In Value %)

Automotive OTA Updates

Consumer Electronics OTA Updates

Industrial OTA Updates - By Application Type (In Value%)

Automotive Industry

Consumer Electronics

Industrial and IoT Applications

Healthcare - By Distribution Channel (In Value %)

Direct-to-Consumer

Automotive Dealerships

Service Providers - By Region (In Value %)

Metro Manila

Northern Luzon

Visayas

Mindanao - By End-User (In Value %)

Individual Consumers

Enterprises

- Market Share (Value/Volume)

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Organizational Structure, Revenues, Revenues by Type of OTA Service, Number of Touchpoints, Distribution Channels, Margins, Production Plant, Capacity, Unique Value Offering)

- SWOT Analysis of Major Players

- Detailed Profiles of Major Companies

Tesla

General Motors

Ford Motor Company

BMW Group

Volvo Group

Audi AG

Qualcomm

Huawei Technologies

Ericsson

Microsoft

Google

Samsung Electronics

Amazon Web Services

Intel Corporation

Sony Corporation

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Pain Point Analysis

- Decision-Making Process

- By Value, 2026-2030

- By Volume, 2026-2030

- By Average Price, 2026-2030