Market Overview

The Philippines patient-provider communication platforms market is experiencing strong growth, primarily driven by increased government focus on improving healthcare access and quality. With a growing demand for efficient healthcare communication solutions, the market is valued at approximately USD ~ million in 2025, projected to reach USD ~ million in 2025. Factors such as the expansion of telemedicine services, rising healthcare needs, and the government’s push for digital healthcare infrastructure are fueling this market’s growth.

Metro Manila leads the market in the Philippines, driven by its high population density, healthcare infrastructure, and advanced technology adoption. Cities like Quezon City, Makati, and Taguig dominate the market due to their robust healthcare systems and growing telemedicine adoption. Metro Manila’s hospitals and clinics are increasingly using digital communication platforms to enhance patient engagement and improve access to healthcare. The government’s initiatives to enhance healthcare systems in urban areas are helping accelerate platform adoption in these regions.

Market Segmentation

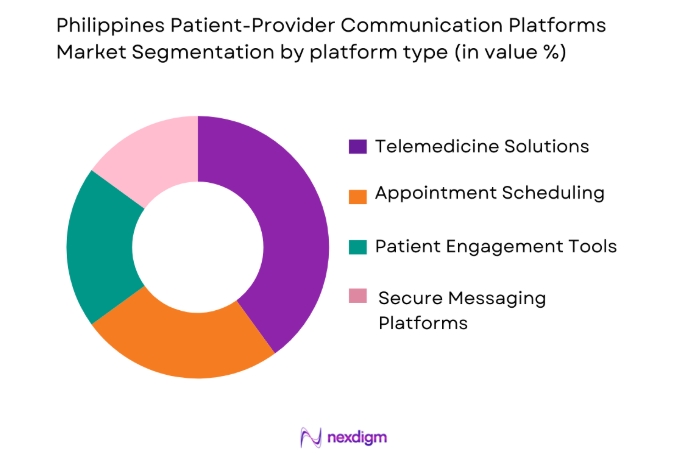

By Platform Type

The Philippines patient-provider communication platforms market is segmented by platform type into telemedicine solutions, appointment scheduling platforms, patient engagement tools, and secure messaging platforms. Telemedicine solutions dominate the market due to the increased acceptance and demand for remote consultations in urban and rural areas. As of 2025, the telemedicine platform share is estimated to be ~%. The rapid adoption of telemedicine by healthcare providers in response to growing patient demand for accessible healthcare, coupled with government support, has cemented its dominance in the market.

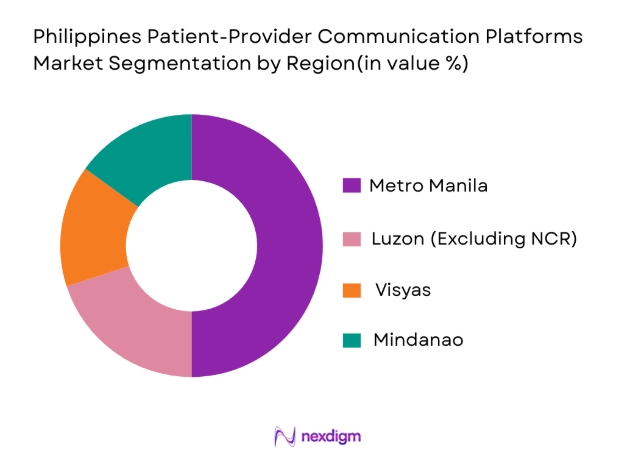

By Region

Geographically, the market is segmented into Metro Manila, Luzon, Visayas, and Mindanao. Metro Manila holds the largest share due to the high concentration of healthcare facilities and tech-savvy population. The region is also home to several digital healthcare initiatives, fostering the rapid adoption of patient-provider communication platforms. In 2025, Metro Manila accounted for ~% of the market share.

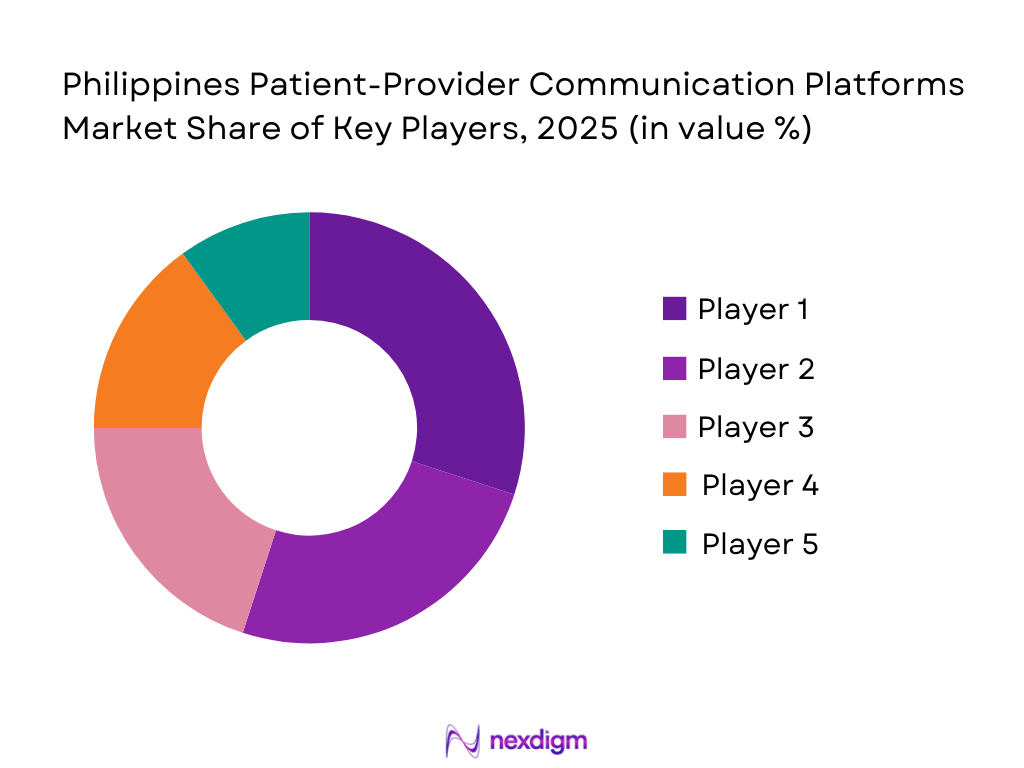

Competitive Landscape

The Philippines patient-provider communication platforms market is characterized by a mix of local startups and international players offering advanced healthcare communication solutions. Leading players include telemedicine platforms like KonsultaMD, HealthNow, and TeleMedica, as well as appointment scheduling and patient engagement tool providers. The competition is intensifying as these platforms expand their services to remote areas, offering both mobile and web-based solutions. The consolidation of these platforms reflects the market’s demand for integrated healthcare communication systems, which can support both public and private healthcare providers.

| Company | Establishment Year | Headquarters | Platform Type | Target Market | Key Features | Technological Integration |

| KonsultaMD | 2016 | Manila, Philippines | ~ | ~ | ~ | ~ |

| HealthNow | 2015 | Manila, Philippines | ~ | ~ | ~ | ~ |

| TeleMedica | 2017 | Davao, Philippines | ~ | ~ | ~ | ~ |

| MyPocketDoctor | 2018 | Manila, Philippines | ~ | ~ | ~ | ~ |

| Medifi | 2019 | Manila, Philippines | ~ | ~ | ~ | ~ |

Philippines Patient-Provider Communication Platforms Market Analysis

Growth Drivers

Urbanization

Urbanization in the Philippines is driving the adoption of patient-provider communication platforms, as urban areas are experiencing rapid population growth. As of 2023, approximately 56% of the Philippines’ population lives in urban areas, with Metro Manila being the most densely populated region. This urbanization trend has increased the demand for efficient healthcare solutions to manage patient-provider interactions. Furthermore, urban areas are witnessing a surge in healthcare services, leading to the adoption of telemedicine and digital communication platforms for better access to care.

Industrialization

Industrialization is another significant driver for the market, particularly in sectors contributing to increased health issues and the need for effective healthcare communication systems. As of 2025, the industrial sector contributes about ~ % to the country’s GDP. The rapid industrial growth has led to environmental concerns, particularly air pollution, which in turn is increasing respiratory and other chronic diseases among the population. This has created a demand for digital healthcare solutions, including platforms for patient communication to manage chronic conditions and improve health outcomes.

Market Challenges

High Initial Costs

One of the primary restraints in the adoption of patient-provider communication platforms is the high initial investment required for infrastructure, software development, and training. The setup cost for telemedicine platforms can range from PHP ~ to PHP ~ million, depending on the scale and sophistication of the system. The lack of sufficient funding from small healthcare providers and rural areas poses a challenge for the widespread adoption of these technologies. Financial constraints limit the ability of many healthcare providers to invest in these solutions, particularly in the public sector.

Technical Challenges

The implementation of patient-provider communication platforms in the Philippines faces significant technical challenges. A major issue is the country’s inconsistent internet infrastructure, with rural areas often experiencing low connectivity. According to the National Telecommunications Commission (NTC), only 60% of the population had access to stable internet in 2023, which limits the effectiveness of telemedicine solutions in remote locations. Additionally, integrating new digital platforms with existing healthcare infrastructure requires technical expertise, which is scarce in many healthcare institutions.

Opportunities

Technological Advancements

Technological advancements in healthcare IT, such as the integration of artificial intelligence (AI), blockchain, and cloud computing, present significant opportunities for the growth of patient-provider communication platforms. In 2025, the Philippines saw an increased adoption of AI-driven solutions for diagnostics and patient management. These advancements are helping healthcare providers streamline communication and improve patient outcomes. As digital health solutions evolve, they offer more efficient and scalable communication tools, making them more attractive to healthcare providers in both urban and rural areas.

International Collaborations

International collaborations offer substantial growth opportunities for patient-provider communication platforms in the Philippines. Partnerships with global telemedicine providers and health tech firms allow local companies to leverage advanced technologies and expand their service offerings. In 2025, the Philippine government announced collaborations with international tech firms to enhance telemedicine services, particularly in rural areas, through better connectivity and digital health infrastructure. These partnerships help local firms access cutting-edge technology and increase the adoption of patient-provider communication while promoting public health through improved environmental quality. As part of this initiative, the government has partnered with healthcare providers to implement telemedicine platforms that can help individuals monitor and manage their health, particularly in urban areas affected by air pollution. This regulatory push is expected to drive the demand for communication platforms that offer preventive healthcare services.

Future Outlook

Over the next 5 years, the Philippines patient-provider communication platforms market is expected to continue its rapid growth, driven by advances in telemedicine, government support for digital healthcare, and increasing adoption in rural areas. The continued rollout of 5G networks and the government’s push for digital health initiatives will enhance the availability and accessibility of healthcare services across the country. As more healthcare providers integrate digital solutions into their workflows, the demand for patient-provider communication platforms will increase, making them a core component of the country’s healthcare infrastructure.

Major Players

- KonsultaMD

- HealthNow

- TeleMedica

- MyPocketDoctor

- Medifi

- AIDE Health

- Lifetrack Medical Systems

- Medgate Philippines

- Doctor Anywhere

- SeriousMD

- TeleConsult

- Medilink

- HealthHub

- Docquity

- HealthX

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (PhilHealth, Department of Health)

- Private Healthcare Providers

- Public Healthcare Providers

- Healthcare Software Developers

- Telemedicine Service Providers

- Insurance Companies

- Healthcare Facility Managers

Research Methodology

Step 1: Identification of Key Variables

This phase involves collecting data from healthcare providers, technology vendors, and industry reports to identify the key factors influencing the patient-provider communication platforms market. Research will include secondary data collection from governmental bodies and healthcare industry reports.

Step 2: Market Analysis and Construction

The research focuses on analyzing current market dynamics, technological trends, and the regulatory landscape. Key metrics like adoption rates, infrastructure readiness, and platform usage across different healthcare facilities will be assessed to build the market model.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses based on initial findings will be validated through in-depth consultations with industry experts from leading healthcare organizations and technology companies, helping refine the market outlook and projections.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing data and insights collected to formulate a comprehensive report that presents a clear picture of the market size, segmentation, competitive landscape, and future trends in patient-provider communication platforms.

- Executive Summary

- Research Methodology (Market Definitions and Scope Mapping, Automotive Frame Classification Logic, Abbreviations, Market Sizing Framework, Bottom-Up Production Capacity Assessment, Import–Export Mapping, OEM & Tier-1 Interview Framework, Dealer & Fabricator Survey Approach, Validation Through Vehicle Production & Sales Correlation, Assumptions, Limitations, and Analyst Conclusions)

- Definition and Scope

- Market Genesis and Development

- Timeline of Major Players and Innovations

- Business Cycle & Adoption Patterns

- Supply Chain and Value Chain Analysis (Technology Providers, Healthcare Providers, Patient Touchpoints)

- Growth Drivers

Increasing Health Awareness

Government Initiatives in Telehealth

Rise in Chronic Diseases

Technological Advancements - Market Challenges

Regulatory and Compliance Barriers

Infrastructure Challenges

Data Privacy Concerns - Opportunities

Rural Healthcare Integration

Mobile Health Solutions

Cross-Border Healthcare Solutions - Trends

Telemedicine and Video Consultations

Integration with Electronic Health Records (EHR)

AI-Powered Communication Tools - Government Regulation

Data Privacy Laws and Health Information Standards

Telemedicine Accreditation

PhilHealth’s Role in Telemedicine Regulation - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- Competition Ecosystem

- By Value, 2019-2025

- By Volume, 2019-2025

- By Average Price of Platforms/Services, 2019-2025

- By Platform Type (In Value %)

Secure Messaging Platforms

Teleconsultation & Video Interaction Platforms

Appointment Scheduling and Reminders Platforms

Patient Engagement and Feedback Systems - By Deployment Model (In Value %)

Cloud-Based Platforms

On-Premise Platforms

Hybrid Deployment - By End-User (In Value %)

Public Hospitals

Private Hospitals

Clinics and Primary Care Centers

Telemedicine Providers

Diagnostic Centers - By Communication Channel (In Value %)

SMS/USSD-Based Platforms

Mobile Applications

Web-Based Portals

Hybrid Communication Solutions - By Region (In Value %)

Metro Manila

Luzon

Visayas

Mindanao

- Market Share of Major Players (By Value/Volume, 2024)

Market Share by Platform Type

Market Share by Region - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Distribution Channels, Revenues by Platform Type, Market Penetration, Unique Value Proposition, and Technology Integration)

- SWOT Analysis of Major Players

- Pricing Analysis by Platform Type and Service Offering

- Detailed Profiles of Major Companies

TeleMedica

KonsultaMD

HealthNow

Medifi

SeriousMD

AIDE Health

MyPocketDoctor

Lifetrack Medical Systems

Medgate Philippines

Doctor Anywhere

Medilink

Medtech Inc.

Docquity

TeleConsult

HealthHub

- Demand and Utilization Patterns

- Budget Allocations and Purchasing Power

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- Future Market Size by Value, 2026-2030

- Future Market Size by Volume, 2026-2030

- Average Frame Cost Outlook, 2026-2030