Market Overview

The Philippines Pharmaceutical Labelling Market is a relatively small but fast-formalising niche within the wider pharmaceutical and packaging ecosystem. The overall pharmaceutical market is valued at about USD ~ billion, based on a five-year historical analysis of drug sales in the country. Per-capita spend on pharmaceuticals in dosage form has risen from USD ~ to USD ~ over the most recent two years of available data, indicating steady volume growth and higher value mixes. In parallel, the Philippines pharmaceutical packaging market stands at around USD ~ million ex-factory, underscoring the growing importance of compliant packs and labelling in the country’s medicine value chain.

Demand in the Philippines Pharmaceutical Labelling Market is concentrated in the major urban and manufacturing hubs—Metro Manila, adjoining CALABARZON (Region IV-A) and Central Luzon—where most pharma plants, contract packers and large hospital chains are located. Government sources and investment promotion agencies highlight that the Philippines is now the third-largest pharmaceutical market in ASEAN, reflecting clustering of production and distribution in these regions. These corridors host vertically integrated drug makers, multinational generic players, and large pharmacy chains, all of which require high-volume, DSCSA-style serialized and multilingual labels for solid-oral, injectable, and OTC lines.

Market Segmentation

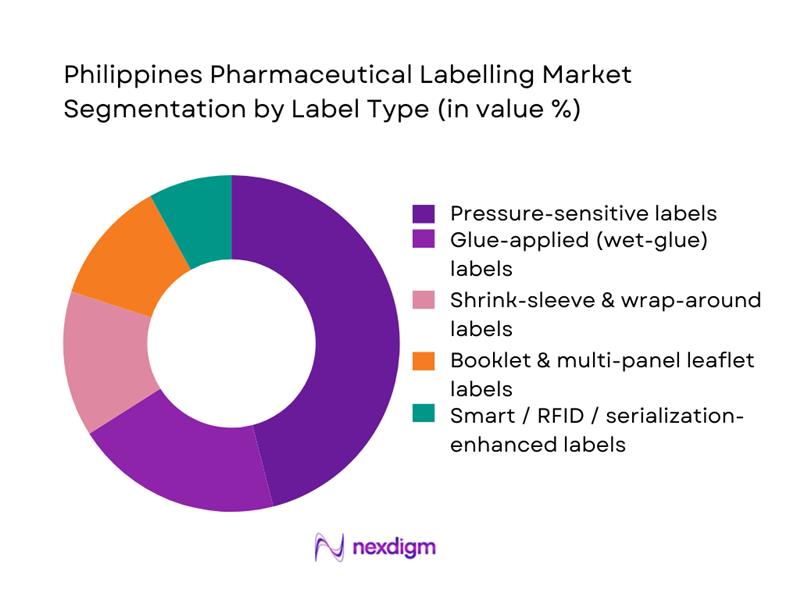

By Label Type

The Philippines Pharmaceutical Labelling Market is segmented by label type into pressure-sensitive labels, glue-applied labels, shrink-sleeve & wrap-around labels, booklet & multi-panel leaflet labels, and smart/RFID labels. Pressure-sensitive labels hold the leading share in 2024, mirroring global packaging-labels trends where this format accounts for over 40% of label revenues due to versatility and print quality. In the Philippines, pressure-sensitive formats are preferred for solid-oral bottles, blister cartons, and many OTC SKUs, enabling short-run digital printing, tamper-evident features, and 2D barcodes for track-and-trace. Local converters such as Bestpak and Netpak have invested in flexographic and digital lines tailored to these labels, making them the default for compliance-driven hospital and pharmacy channels.

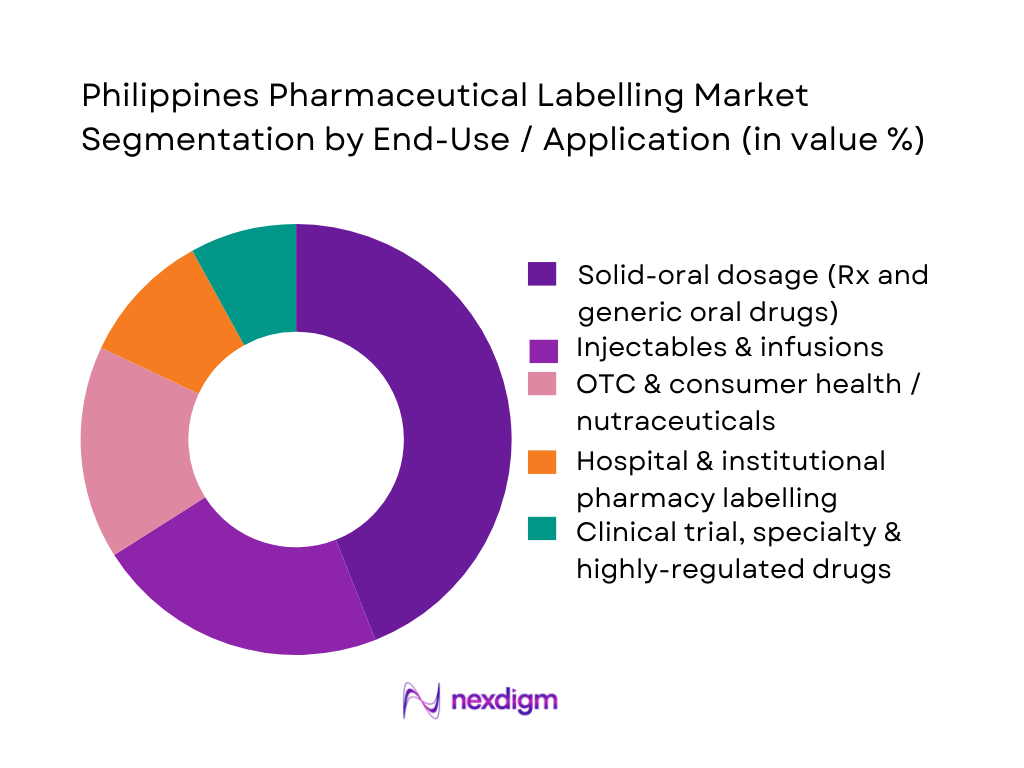

By End-Use / Application

The Philippines Pharmaceutical Labelling Market is segmented into solid-oral dosage, injectables & infusions, OTC & consumer health, hospital & institutional pharmacy labelling, and clinical trial/specialty therapies. Labels for solid-oral dosage products dominate, reflecting the structure of the Philippines pharmaceutical market where tablets, capsules and oral liquids make up the bulk of prescriptions and OTC sales. Government and industry data point to strong growth in generics, with generic drug expenditure alone projected to reach USD ~ billion regionally, supported by policy shifts toward affordable oral medicines. This high volume of oral packs — blisters, HDPE bottles and unit-dose packs — drives recurring demand for batch-coded, multilingual labels, warning statements and patient-friendly instructions, making solid-oral labelling the anchor revenue pool for local converters and in-house print shops.

Competitive Landscape

The Philippines Pharmaceutical Labelling Market is closely intertwined with the country’s pharmaceutical packaging sector. A cluster of local converters and regional packaging majors dominate supply, including Amcor Flexibles Philippines Corp., Berry Global, Bestpak, Netpak, GL Otometz, Merfel and Versa Group, which collectively service pharma manufacturing, contract packers and large pharmacy/hospital networks. Competition increasingly centres on capabilities such as high-resolution flexo/digital printing, tamper-evident and child-resistant features, serialization readiness, and the ability to integrate QR/NFC or RFID into labels for track-and-trace, authentication and patient engagement.

| Company | Establishment Year (Group) | Headquarters (Group) | Core Role in PH Pharma Labelling | Pharma Focus & Customer Base | Key Technical Capabilities | Regulatory / Quality Credentials | Local Footprint & Manufacturing Model | Differentiators in Labelling & Coding |

| Amcor Flexibles Philippines Corp. | 1860 (Amcor origins) | Zurich, Switzerland | ~ | ~ | ~ | ~ | ~ | ~ |

| Berry Global Group Inc. | 1967 | Evansville, USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Bestpak Packaging Solutions, Inc. | 1990s | Quezon City, Philippines | ~ | ~ | ~ | ~ | ~ | ~ |

| Netpak Phils., Inc. | 1992 | Cavite, Philippines | ~ | ~ | ~ | ~ | ~ | ~ |

| GL Otometz Corporation | 1990s | Bulacan, Philippines | ~ | ~ | ~ | ~ | ~ | ~ |

Philippines Pharmaceutical Labelling Market Analysis

Growth Drivers

Expansion of Local Drug Manufacturing, Generics and Contract Packaging

The macroeconomic backdrop supports rapid expansion of pharmaceutical manufacturing in the Philippines. In 2024, the Philippines GDP reached approximately USD ~ billion, reflecting robust economic activity and increased industrial capacity. The country’s population stands at about ~ million in 2024. As disposable incomes rise and health-care access improves under national coverage, demand for affordable generics escalates. Growing consumption of generics drives local drug manufacturing, and in turn fuels demand for high-volume packaging and labelling. Local contract manufacturers and packaging houses benefit from economies of scale, producing batches for both domestic and export markets. The increased throughput of tablets, capsules and other solid-oral dosage forms necessitates large volumes of compliant labels, multilingual instructions, batch codes and expiry details — all propelling the labelling market upward in line with overall pharma output growth.

Rising Regulatory Stringency on Labelling Accuracy, Warnings and Multilingual Content

Regulatory oversight in the Philippines continues to tighten, particularly regarding patient safety, readability, and information integrity. As the economy grows (with 2024 nominal GDP at USD ~ billion), the public health system expands alongside it. To ensure equitable access and clarity of drug information across diverse linguistic groups, regulatory agencies increasingly require labels with precise dosage instructions, safety warnings, storage guidance, batch and expiry codes, and multilingual or local-language content. This imposes higher demands on label design, artwork management, printing quality, and verification processes. As a result, pharmaceutical manufacturers and contract packers must invest in more sophisticated labelling workflows and materials to meet compliance — driving higher demand (and value) for advanced labelling solutions.

Challenges

Evolving Drug and Device Labelling Regulations and Change-Management Complexity

While regulatory stringency drives demand, it also introduces complexity and uncertainty. As laws and guidelines evolve — varying requirements for font size, warning placement, local-language instructions or device labelling — manufacturers and packers must repeatedly update label artwork, print runs and compliance documentation. The frequent changes create operational burdens and administrative overhead. Given the Philippines’ 2024 GDP of USD ~ billion and expanding pharmaceutical activities, large volumes of SKUs may be affected. This regulatory churn makes sustaining a stable label stock supply challenging, especially for smaller converters who lack robust artwork management or version-control systems. The risk of non-compliance, delays or rework increases, putting pressure on margins and reliability.

High Capital and Operating Costs for Advanced Printing and Inspection Technologies

Meeting advanced labelling requirements — serialization, tamper-evidence, variable-data printing, small-batch runs — demands significant investment. Converters must install high-resolution digital or hybrid printing presses, inline inspection systems, serial-number encoding units, and data management infrastructure. For a developing economy with nominal GDP USD ~ billion, these represent substantial capital outlays that may deter small and medium-scale converters. Additionally, operating costs rise due to the need for specialized inks, adhesives, skilled operators, and frequent maintenance. These costs may not easily scale down for low-volume or generic producers, potentially leading to consolidation or exit of smaller players, raising barriers for new entrants and restricting supply-chain flexibility.

Opportunities

Development of Serialization-Ready and Anti-Counterfeit Label Portfolios

With rising integration of the Philippine pharmaceutical market into global supply chains and increasing exports, there is strong demand for serialization-ready, tamper-evident and anti-counterfeit labels. Given the national economy’s decent size (GDP USD ~ billion) and growing pharmaceutical manufacturing base, this creates an opportunity for local converters to offer advanced label products. Serialized labels with unique batch/lot codes, QR codes or barcodes enhance traceability, prevent diversion, and support regulatory compliance. As drug security becomes a concern globally, suppliers who can provide validated, anti-counterfeit label solutions — including tamper-evident seals or security inks — will find growing demand. This opens a value-added segment in the labelling market beyond commodity labels, allowing converters to differentiate, increase per-unit margins, and build long-term contracts with manufacturers producing high-value or export-oriented drugs.

Smart and Connected Labels for Cold-Chain and High-Value Therapies

As demand increases for biologics, vaccines, and cold-chain dependent therapies, there is an emerging opportunity for smart and connected labels — e.g., labels with embedded NFC tags, QR codes linked to patient information, temperature-stability indicators, or tamper sensors. With the Philippines population exceeding ~ million and macroeconomic growth underpinning investments in healthcare infrastructure, adoption of such labels can enhance supply-chain integrity and patient safety. Smart labels allow end-to-end visibility in cold-chain logistics, enable digital verification by hospitals or pharmacies, and support pharmacovigilance and traceability in export markets. Converters and packaging houses that invest now in smart-label technology are well positioned to capture this growing segment as biologic and specialty therapy volumes continue to rise.

Future Outlook

Over the next decade, the Philippines Pharmaceutical Labelling Market is expected to expand faster than the country’s packaging market overall, supported by steady pharma volume growth, expansion of generics, and tightening expectations around patient information quality. Rising generic penetration, sustained government focus on universal health coverage, and growing chronic-disease prevalence will reinforce demand for compliant, language-appropriate labels across therapeutic areas and price tiers. At the same time, the advance of e-pharmacy, mail-order and hospital automation will push label specifications toward higher data density, integration with pharmacy information systems, and machine-readable symbologies.

Regulatory developments, including ongoing alignment with international pharmacovigilance and labelling norms, will gradually raise the bar on font sizes, warning hierarchy, tamper-evidence and traceability. This favours converters and packaging partners that can offer validated artwork management, robust version control, and in-line inspection systems. Finally, the global shift towards sustainability — recycled label stocks, wash-off adhesives and materials compatible with PET/HDPE recycling streams — will increasingly shape material choices and supplier selection in the Philippines, especially for export-oriented manufacturers and multinational affiliates.

Major Players

- Amcor Flexibles Philippines Corp.

- Berry Global Group Inc.

- Bestpak Packaging Solutions, Inc.

- Netpak Phils., Inc.

- GL Otometz Corporation

- Merfel Plastic Manufacturing Inc.

- Versa Group Philippines Corporation

- Swiss Pac Philippines

- Shandong Pharmaceutical Glass Co., Ltd.

- Euro-Med Laboratories Philippines Inc.

- Plastic Container Packaging Corporation

- APO International Marketing Corporation

- Robicel Trading

- DTM Print & Labels Specialist Inc.

Key Target Audience

- Branded and generic pharmaceutical manufacturers

- Contract manufacturing and contract packaging organisations

- OTC, consumer health and nutraceutical brand owners

- Hospital, institutional and retail pharmacy chains

- Investments and venture capitalist firms

- Government and regulatory bodies

- Technology and equipment suppliers

- Pharmaceutical logistics, cold-chain and e-pharmacy operators

Research Methodology

Step 1: Identification of Key Variables

The initial phase involved mapping the full ecosystem of the Philippines Pharmaceutical Labelling Market, spanning pharma manufacturers, CMOs/CPOs, label converters, packaging suppliers, regulators and distributors. Extensive desk research was carried out using syndicated reports on Philippines pharmaceutical packaging, global pharmaceutical primary-packaging labels, and local pharma-sector guides, alongside World Bank and WHO health-spending datasets. This allowed us to define the critical variables driving demand, such as dosage-form mix, compliance requirements, generic penetration, and localisation of packaging.

Step 2: Market Analysis and Construction

In the second phase, we compiled historical data on the Philippines pharmaceutical and packaging markets, including drug-spend, per-capita dosage value, and ex-factory packaging output. These were combined with global benchmarks for the share of labels within pharmaceutical packaging and the growth of global primary-packaging labels. We used a bottom-up approach, allocating packaging value to label-relevant segments by product type and end-use, and cross-checking against the capacity and capabilities of key Philippine converters and international label players active in the market.

Step 3: Hypothesis Validation and Expert Consultation

From this base, hypotheses were developed on the relative importance of label types (pressure-sensitive vs glue-applied vs booklet/smart), and on which end-use segments (solid-oral, injectables, OTC, institutional) would anchor near-term growth. These hypotheses are typically validated through structured interviews and computer-assisted telephone interviews with stakeholders from pharma manufacturers, CMOs/CPOs, packaging converters and equipment vendors, focusing on volume trends, specification changes, artwork complexity and investment priorities. In a full client engagement, these consultations provide quantitative and qualitative feedback that refines segment splits, growth rates and competitive-positioning assessments.

Step 4: Research Synthesis and Final Output

The final step involves synthesising all validated inputs into an integrated market model and narrative. Label-specific revenues are reconciled with packaging and pharma baselines, while scenario analysis is used to test the impact of regulatory shifts, generic-policy reforms, and e-pharmacy adoption on label volumes and specifications. Company-level intelligence from packaging-company profiles, regulatory filings and public announcements is layered on to map positioning in terms of capabilities, customer segments and investment in smart/sustainable labels. The result is a coherent, auditable view of the Philippines Pharmaceutical Labelling Market, including size, segmentation, competitive dynamics, forward CAGR and strategic implications for stakeholders.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing and Forecasting Approach, Top-Down and Bottom-Up Triangulation, Data Sources and Validation, Primary Expert Interview Framework with Philippine Stakeholders, Secondary Research from Regulatory and Trade Bodies, Sampling Logic for End-Users and Converters, Scenario Building and Sensitivity Checks, Limitations and Future Scope)

- Definition and Scope of Pharmaceutical Labelling in Philippines

- Role of Primary, Secondary and Tertiary Labels in the Drug and Device Supply Chain

- Evolution of Drug and Device Labelling Requirements in Philippines and ASEAN Context

- Business Cycle: From Artwork Brief and Regulatory Approval to Label Printing and Application on Pack

- Supply Chain and Value Chain Analysis for Labels, Cartons and Leaflets in Philippines

- Growth Drivers

Expansion of Local Drug Manufacturing, Generics and Contract Packaging

Rising Regulatory Stringency on Labelling Accuracy, Warnings and Multilingual Content

Adoption of Serialization, Barcoding and Track-and-Trace

Growth in Biologics, Vaccines and Cold-Chain Dependent Therapies

Increasing Exports and Need for Alignment with Global Labelling Standards - Challenges

Evolving Drug and Device Labelling Regulations and Change-Management Complexity

High Capital and Operating Costs for Advanced Printing and Inspection Technologies

Fragmented Supply Chain Across Printers, Packaging Houses and Distributors

Risk of Mislabeling, Artwork Errors and Product Recalls

Volatility in Label Stock, Adhesive and Security-Ink Availability - Opportunities

Development of Serialization-Ready and Anti-Counterfeit Label Portfolios

Smart and Connected Labels for Cold-Chain and High-Value Therapies

Sustainable, Recyclable and Low-Migration Label Materials

Outsourced Artwork and Labelling-as-a-Service Models for Mid-Sized Pharma

Localisation of High-Precision Converting and Finishing Capacity in Philippines - Trends

Label Design

Substrates

Security Features - Regulatory and Compliance Landscape for Drug and Device Labelling in Philippines

- Technology, Automation and Industry 4.0 Adoption in Labelling Lines

- Sustainability, Waste Management and Recycling Readiness of Label Stocks

- Stake Ecosystem and Decision-Making Dynamics

- Porter’s Five Forces Analysis for Philippines Pharmaceutical Labelling

- By Value, 2019-2024

- By Volume , 2019-2024

- By Average Price Realisation, 2019-2024

- By Packaging Level, 2019-2024

- By Label Type (In Value %)

Pressure-Sensitive Labels

Glue-Applied / Cut-and-Stack Labels

Shrink Sleeve and Wrap-Around Labels

In-Mold and Direct-On-Container Pharma Labels

RFID, NFC and Other Smart / Functional Labels - By Material Type (In Value %)

Coated and Uncoated Paper

Polypropylene (PP)

Polyethylene (PE)

Polyester (PET) and Other Specialty Films

Aluminium Foil and Laminate-Based Label Stocks - By Printing Technology (In Value %)

Flexographic Printing

Digital Inkjet and Toner Printing

Offset / Lithographic Printing

Gravure Printing

Screen and Hybrid Printing Technologies - By Application (In Value %)

Prescription Branded and Generic Drugs

Over-the-Counter and Consumer Health Products

Biologics, Vaccines and Temperature-Sensitive Injectables

Medical Devices, Diagnostics and Combination Products

Clinical Trial, Investigational and Compassionate Use Supplies - By End-User Type (In Value %)

Local Pharmaceutical Manufacturers

Multinational Pharmaceutical and Biotech Companies

Contract Manufacturing and Contract Packaging Organizations

Hospitals, Institutional Pharmacies and Specialty Clinics

Retail Pharmacies, Chain Drugstores and E-Pharmacies - By Packaging Level within Pharma Supply Chain (In Value %)

Vial, Ampoule, Syringe and Small-Container Labels

Blister Card, Strip and Sachet Labels

Folding Carton Labels and Extended-Content Booklet Labels

Shipping Case, Pallet and Distribution Labels

Kit, Combo-Pack and Hospital Unit-Dose Labels - By Region (In Value %)

National Capital Region and CALABARZON Pharma-Industrial Corridor

Balance of Luzon

Visayas

Mindanao

Export-Oriented Special Economic Zones and Third-Party Logistics Hubs

- Market Share of Major Players by Value and Volume

Market Share of Major Players by Label Type and Material

Market Share of Major Players by Application and End-User Cluster - Cross Comparison Parameters (Company Overview, Philippines Pharma Label Portfolio Breadth by Packaging Level, Regulatory and GMP / ASEAN Compliance Capabilities, Serialization and Track-and-Trace Readiness, Artwork and Data Management / Error-Reduction Systems, Local Converting / Printing / Distribution Footprint in Philippines, Cold-Chain and Specialty Label Performance Capabilities, Sustainability and Tamper-Evident / Anti-Counterfeit Innovations)

- SWOT Analysis of Major Players in Philippines Pharmaceutical Labelling

- Pricing Analysis Basis SKUs and Print Runs for Key Label Types

- Detailed Profiles of Major Companies

Amcor Flexibles Philippines Corp.

Bestpak Packaging Solutions, Inc.

MM Packaging

PM Labels

Mindware

New Delhi Printers

3M Company

Avery Dennison Corporation

CCL Industries

UPM Raflatac

Schreiner Group

HERMA GmbH

Multi-Color Corporation

Lintec Corporation

- End-User Segmentation and Demand Profiles for Labelling Solutions

- Label Artwork Creation, Review and Approval Workflows by End-User Segment

- Procurement, Qualification and Vendor-Management Practices for Label Suppliers

- Needs, Desires and Pain-Point Analysis (Regulatory, QA, Packaging, Supply Chain, Marketing)

- Budgeting, Cost-Sensitivity and Total Cost of Ownership in Labelling Decisions

- By Value, 2025-2030

- By Volume , 2025-2030

- By Average Price Realisation, 2025-2030

- By Packaging Level, 2025-2030