Market Overview

The Philippines pharmaceutical packaging market is estimated to be USD ~ million in 2024. This valuation reflects a robust growth in pharmaceutical production, especially in local generic-drug manufacturing and increasing domestic consumption. The surge in demand for oral solid dose forms, sterile injectables, and compliance-driven packaging (e.g., tamper-evident bottles, blister packs) has fueled the rise in primary packaging requirements, as manufacturers scale up production and adopt packaging that ensures drug safety and regulatory compliance.

The market is largely driven by pharmaceutical manufacturing clusters majorly concentrated around the National Capital Region (NCR, Metro Manila) and neighbouring industrial provinces such as Laguna and Central Luzon, as well as export-oriented economic zones. These regions dominate due to their dense concentration of pharmaceutical companies, favourable logistics infrastructure, proximity to distribution networks, and access to regulatory authorities and raw-material supply.

Market Segmentation

By Primary Pack Type

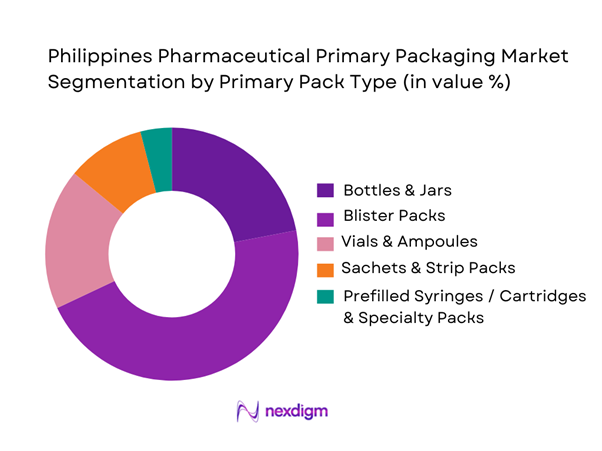

The market is segmented into bottles & jars, blister packs, vials & ampoules, sachets/strip packs, and prefilled syringes/cartridges (plus specialty packs). Bottles & jars currently lead with 21.56% share in 2024. This dominance is due to high demand for oral liquid formulations and syrups, consumer familiarity, cost-effectiveness, ease of production, and robustness of plastic or glass bottles. Meanwhile, blister packs and vials/ampoules hold major portions of the remaining primary-pack share because of the extensive use of tablets, capsules and sterile injectables in both domestic and export-oriented pharma production.

By Material Type

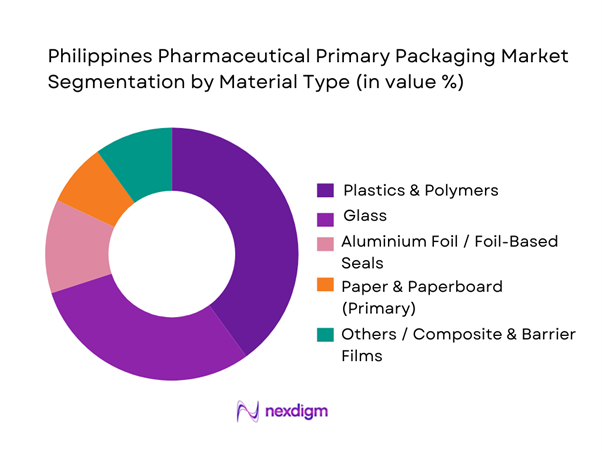

Plastics & polymers lead the material-type segmentation with roughly 40.3% share in 2024. The preference stems from their affordability, ease of processing, light weight, and versatility for bottles, vials, blister films and lightweight containers. Glass remains relevant (especially for vials, ampoules and injectable packaging) because of its excellent chemical inertness and sterility compliance. Paper/foil composites and barrier films are also used, particularly in blister lidding, foil-sealed sachets, or for blister packs requiring moisture and oxygen barriers.

Competitive Landscape

The Philippines pharmaceutical packaging market remains moderately fragmented but features a handful of large multinational and domestic converter/packaging-supply firms that hold a prominent position due to their broad product portfolios, compliance credentials, and relationships with major pharma manufacturers.

| Company | Establishment Year | Headquarters | Primary Product Pack Types Served | Material Capabilities | Compliance Certifications / Regulatory Readiness | End-User Focus / Client Base | Key Strategic Strength |

| Amcor Plc | 1860s (global) | Switzerland / Global HQ | ~ | ~ | ~ | ~ | ~ |

| Berry Global Group Inc. | 1967 (global) | United States | ~ | ~ | ~ | ~ | ~ |

| Netpak Phils., Inc. | Local | Philippines | ~ | ~ | ~ | ~ | ~ |

| GL Otometz Corp. | Local | Philippines | ~ | ~ | ~ | ~ | ~ |

| Bestpak Packaging Solutions, Inc. | Local | Philippines | ~ | ~ | ~ | ~ | ~ |

Philippines Pharmaceutical Primary Packaging Market Analysis

Growth Drivers

Expansion of Local Branded Generics & DOH Procurement Programs

The Philippines’ pharmaceutical primary packaging demand is closely tied to expanding branded generics and a large public sector medicines budget. The Department of Health’s line item for Purchase and Allocation of Drugs, Medicines and Vaccines alone amounts to ₱44,556,286,000, signalling large-volume flows of tablets, syrups and injectables that must be packed in blisters, bottles and vials. The same budget document earmarks ₱1,768,099,817 for the National Cancer Control Program and ₱1,250,000,000 for the Cancer Assistance Fund, further increasing oncology and chronic-therapy volumes requiring higher-spec blister and parenteral packs. At the same time, health spending per person has risen from USD 182.93 to USD 194.06, indicating more medicines consumption and, by extension, higher demand for compliant primary packs across public and private channels.

Rising Burden of Chronic Diseases and Long-term Therapies

Noncommunicable diseases (NCDs) such as cardiovascular disease, cancer, diabetes and chronic lung disease are responsible for 74% of all deaths worldwide, with the majority occurring in low- and middle-income countries, a group that includes the Philippines. This global pattern is mirrored locally, where parliamentary analysis notes that NCDs account for 8 of the 10 leading causes of death in the country, underscoring the dominance of long-term therapies over acute, short-course treatments. Chronic regimes in hypertension, diabetes and oncology require sustained supplies of blistered solid doses, multi-dose vials, prefilled syringes and long-shelf-life oral liquids, all of which drive higher-spec stability and barrier requirements in primary packaging. Rising health expenditure per capita in the Philippines, from USD ~ to USD ~, indicates that more financial resources are flowing into managing these long-term conditions, supporting structural growth in compliant, child-resistant, and protection-optimized primary packs for chronic therapies.

Market Challenges & Constraints

Volatility in Polymer and Glass Feedstock Costs and Currency Exposure

Primary pharmaceutical pack makers in the Philippines rely heavily on imported resins, films and glass tubing, leaving them exposed to global commodity and FX swings. A detailed analysis of plastic policies in the Philippines notes that by 2022 the country had a negative trade balance in plastics and plastic-related goods of about USD 4.3 billion, with roughly USD 2.3 billion in plastic products imported, underlining dependence on foreign resin-intensive inputs. At the macro level, inflation averaged 5.8 in 2022 and 6.0 in 2023, driven partly by fuel and imported commodity costs, while the peso ended 2024 at PHP 57.84 per USD, weaker than PHP 55.38 per USD a year earlier. These macro trends raise local costs for bottles, closures, blister films and vials, compressing converter margins and making long-term supply contracts for pharmaceutical primary packaging more complex to price and hedge.

High Capex for Cleanroom, Sterile & ISO-Compliant Primary Pack Lines

Supplying vials, ampoules and prefilled packaging for vaccines and injectables in the Philippines requires ISO-class cleanrooms, validated washing and depyrogenation lines, and strict environmental monitoring. While specific line-item capital costs are confidential, macro indicators give a sense of the investment pressure. Health spending per capita in the Philippines has risen from USD 182.93 to USD 194.06, but remains lower than in many upper-middle-income peers, suggesting limited headroom for rapid price increases to cover capex. At the same time, DOH appropriations direct over ₱44.5 billion to medicines and vaccines and nearly ₱3 billion combined to cancer programs, which encourages higher specifications for sterile primary packs but does not automatically guarantee higher unit margins. For local converters, this combination of growing technical requirements and constrained price absorption makes it challenging to justify upgrades to ISO-compliant vial, ampoule and prefilled-syringe capacity without long-term volume commitments from anchor pharmaceutical clients or public procurement frameworks.

Opportunities

Localisation of High-Value Glass and High-Barrier Primary Packs

Structural demand for higher-spec sterile and barrier primary packs is emerging, while trade data show a heavy reliance on imports. The plastics policy review for the Philippines documents a USD ~ billion negative trade balance in plastics and related goods in 2022, including USD 2.3 billion in plastic product imports, indicating substantial opportunity to substitute some high-value components with domestic capacity. At the same time, the pharmaceuticals sector guide reports 435 licensed pharmaceutical manufacturing and packaging businesses, pointing to a sizeable captive customer base for locally-made high-barrier blisters, sterile vials and ampoules. When combined with the DOH’s ₱44.5-billion medicines and vaccines appropriation and oncology-focused budgets exceeding ₱3 billion, this creates both volume and complexity that can justify investments in local Type I glass conversion, coated blister films and cyclic-olefin polymer device assembly—reducing lead times and FX risk for Philippine pharma while deepening the capabilities of the domestic packaging ecosystem.

Sustainable and Recyclable Primary Packaging

The regulatory and policy environment in the Philippines is turning decisively toward plastics reduction and circularity, creating a strong pull for recyclable primary packs, lighter formats and mono-material solutions for pharmaceutical use. The plastic policies report estimates that plastic products imports reached USD 2.3 billion, and plastics-related goods together deepened the country’s trade deficit by about USD 4.3 billion, highlighting both environmental and economic pressures to redesign packaging. The Extended Producer Responsibility Act (RA 11898) requires large companies to recover at least 20% of their plastic packaging footprint in the early years of implementation, rising to 80% by 2028, pushing brand owners to seek recyclable HDPE, PP and PET primary packs and more easily recoverable laminates. Combined with health spending per capita rising to USD 194.06, indicating growing pharmaceutical throughput, this creates a window for converters who can offer recyclable bottles, reduced-foil blisters and take-back-ready primary packs that meet DOH/FDA quality requirements while aligning with EPR obligations and corporate sustainability commitments.

Future Outlook

Over the next few years, the Philippines pharmaceutical primary packaging market is expected to grow steadily, driven by continued expansion in generic drug manufacturing, increasing adoption of sterile injectables and biologics, rising demand for patient-centric packaging (blisters, unit-dose, tamper-evident bottles), and regulatory pressure for safety and traceability. Additionally, rising interest in sustainable materials and eco-friendly packaging will likely shape investment and innovation in the converter sector.

Projected growth sees the market advancing from its 2024 base to reach approximately USD ~ million by 2032, implying a CAGR of around 4.7–4.9% over the forecast period.

Major growth tailwinds will include expansion of contract manufacturing organisations (CMOs) serving both domestic and regional export markets, regulatory adoption of serialization and tamper-evident standards, and rising demand for high-barrier blister films and prefilled syringes for biologics. However, supply-chain constraints (raw polymer and glass feedstock, currency fluctuations) and cost pressures may moderate upside, underscoring the need for localisation and sustainable material adoption.

Major Players

- Amcor Plc

- Berry Global Group Inc.

- Netpak Phils., Inc.

- GL Otometz Corp.

- Bestpak Packaging Solutions, Inc.

- Merfel Plastic Manufacturing Inc.

- SwissPac Philippines

- Anglo Watsons Glass Inc.

- Arcya Glass Corporation

- SGD Pharma

- Gerresheimer AG

- Schott AG

- Nipro PharmaPackaging

- Versa Group Philippines Corporation

- GL Plastics & Packaging

Key Target Audience

- Pharmaceutical manufacturing companies

- Contract manufacturing & contract packaging organisations

- Biologics and injectable drug manufacturers

- Regulatory and government bodies

- Investors and venture-capital firms evaluating packaging-tech or pharma CMO investments

- Raw material suppliers and resin/glass producers targeting pharma-packaging converters

- Hospital chains and large pharmacy chains procuring secondary packaging services

- Importers/Exporters and logistics integrators focusing on pharma supply chain

Research Methodology

Step 1: Identification of Key Variables

The initial phase involved mapping the entire pharmaceutical packaging ecosystem in the Philippines — including primary pack types, material types, dosage-form mix, regulatory compliance requirements, domestic manufacturing bases and converter capabilities. Secondary databases such as published industry reports, trade data, and regulatory sources were used to outline key variables influencing packaging demand.

Step 2: Market Analysis and Historical Data Construction

We compiled historical data for packaging demand, pharmaceutical production output, generic vs branded ratio, and dosage-form mix spanning the preceding years. Using bottom-up estimation (per-unit packaging consumption x pharmaceutical output), we constructed revenue and volume estimates, cross-validated by aggregate industry-level published data.

Step 3: Hypothesis Validation and Expert Consultation

We engaged with industry experts — packaging converters, pharma plant procurement leads, regulatory compliance managers — through structured interviews to validate assumptions about pack-type mix, material preferences, cleanroom capacity, and growth drivers. Their operational and procurement insights refined the bottom-up estimates and added real-world context.

Step 4: Research Synthesis and Forecasting

Finally, we synthesized data and expert feedback to produce forecast scenarios. We modeled base-case growth (steady generic expansion), and alternative scenarios considering packaging upgrades (sterile injectables, prefilled syringes) and sustainability shifts. The projections were stress-tested for risks such as feedstock cost volatility and regulatory changes.

- Executive Summary

- Research Methodology (Market definition by primary pack level, Rx vs OTC volume split, Philippine pharma manufacturing footprint, import–export balance of primary packs, regulatory and GMP filter, bottom-up SKU mapping, channel triangulation with pharma plants and CMOs, risk & sensitivity checks, primary expert validation across Luzon–Visayas–Mindanao)

- Definition and Scope

- Role of Primary Packaging within Philippines Pharma Value Chain

- Market Structure by Packaging Level

- Supply Chain and Value Chain Mapping

- Regulatory & Compliance Overview

- Growth Drivers

Expansion of Local Branded Generics & DOH Procurement Programs

Rising Burden of Chronic Diseases and Long-term Therapies

Shift toward Patient-Centric and Convenience Packaging

Growth in Biologics, Vaccines and Sterile Injectables

Strengthening Regulatory Oversight on Labelling, Tamper-Evidence and Child-Resistance - Market Challenges & Constraints

Volatility in Polymer and Glass Feedstock Costs and Currency Exposure

High Capex for Cleanroom, Sterile & ISO-Compliant Primary Pack Lines

Dependence on Imported Vials, Ampoules and Specialist Barrier Packs

Fragmented Converter Base for Small-batch and Niche Dosage Forms

Compliance, Documentation and Validation Burden for DOH/FDA Approvals - Opportunities

Localisation of High-value Glass and High-Barrier Primary Packs

Sustainable and Recyclable Primary Packaging

Expansion of Contract Manufacturing & Contract Packaging for Regional Export

Anti-Counterfeit Features, Smart and Connected Primary Packaging

Patient-Support & Adherence-focused Pack Designs for Chronic Therapy Lines - Trends

Migration to High-Barrier Blister Films, Eco-Barrier Bottles and Desiccant Systems

Growth of Ready-to-Use Vials, Prefilled Syringes and Cartridges

Shift toward Smaller Pack Sizes and Unit-dose Formats in Retail Pharmacy

Integration of Serialisation Codes and QR-based Patient Information at Primary Pack Level - Regulatory, Quality and Compliance Landscape

- Stakeholder Ecosystem Mapping

- Porter’s Five Forces Analysis

- Technology & Automation Landscape

- Sustainability & Circularity Assessment

- By Value, 2019-2024

- By Volume, 2019-2024

- Average Realised Price per Primary Pack, 2019-2024

- Primary Packaging Share of Total Pharma Packaging Expenditure, 2019-2024

- By Primary Pack Type (in Value %)

Blister Packs

Bottles & Jars

Vials & Ampoules

Prefilled Syringes & Cartridges

Sachets & Strip Packs - By Material Type (in Value %)

Plastics & Polymers

Glass

Metals

Paper & Paperboard-based Primary

Hybrid & Barrier Structures - By Drug Dosage Form Encapsulated (in Value %)

Solid Orals

Liquid Orals

Sterile Injectables

Topical, Dermal & Mucosal

Ophthalmic, Otic & Nasal Preparations - By Route of Administration (in Value %)

Oral Drug Delivery

Parenteral Drug Delivery

Topical & Transdermal Delivery

Inhalation & Respiratory Delivery

Ophthalmic / Otic / Nasal Delivery - By End-User Type (in Value %)

Local Branded Generics & Ethical Manufacturers

Multinational Innovator & Regional Pharma Affiliates

Contract Manufacturing & Contract Packaging Organizations

Government & Public Sector Procurement

Hospital Pharmacies, Chain Drugstores and Independent Retail Pharmacies - By Region within Philippines (in Value %)

National Capital Region Manufacturing & Distribution Cluster

Balance of Luzon

Visayas

Mindanao

Export-oriented Economic Zones & Contract-fill Sites

- Market Share of Major Players

- Cross Comparison Parameters (Philippines primary-pack format breadth, material capability mix, dosage-form coverage, sterile & cold-chain readiness, local manufacturing & ISO/GMP accreditation footprint, integration with pharma clients’ filling and packing lines, sustainability & circularity initiatives, anti-counterfeiting and serialisation capability)

- Strategic Positioning and Competitive Strategies

- SWOT Analysis of Major Players

- Detailed Profiles of Major Companies

Amcor Plc

Berry Global Group Inc.

Bestpak Packaging Solutions Inc.

Netpak Phils. Inc.

GL Otometz Corp.

Merfel Plastic Manufacturing Inc.

Versa Group Philippines Corporation

Swiss Pac Philippines

San Miguel Yamamura Packaging Corporation

Anglo Watsons Glass Inc.

Arcya Glass Corporation

SGD Pharma 8.5.13 Gerresheimer AG

Schott AG

- Local Branded Generics Manufacturers

- Multinational Pharma Affiliates and Regional Hubs

- CMOs and Contract Packagers Serving Domestic and Export Markets

- Public Sector Institutions (DOH hospitals, LGU facilities, tender-based buying)

- Private Hospital Chains, Chain Pharmacies and Independent Drugstores

- By Value, 2025-2030

- By Volume, 2025-2030

- Forecast Average Price per Primary Pack, 2025-2030

- Scenario-wise Outlook, 2025-2030