Market Overview

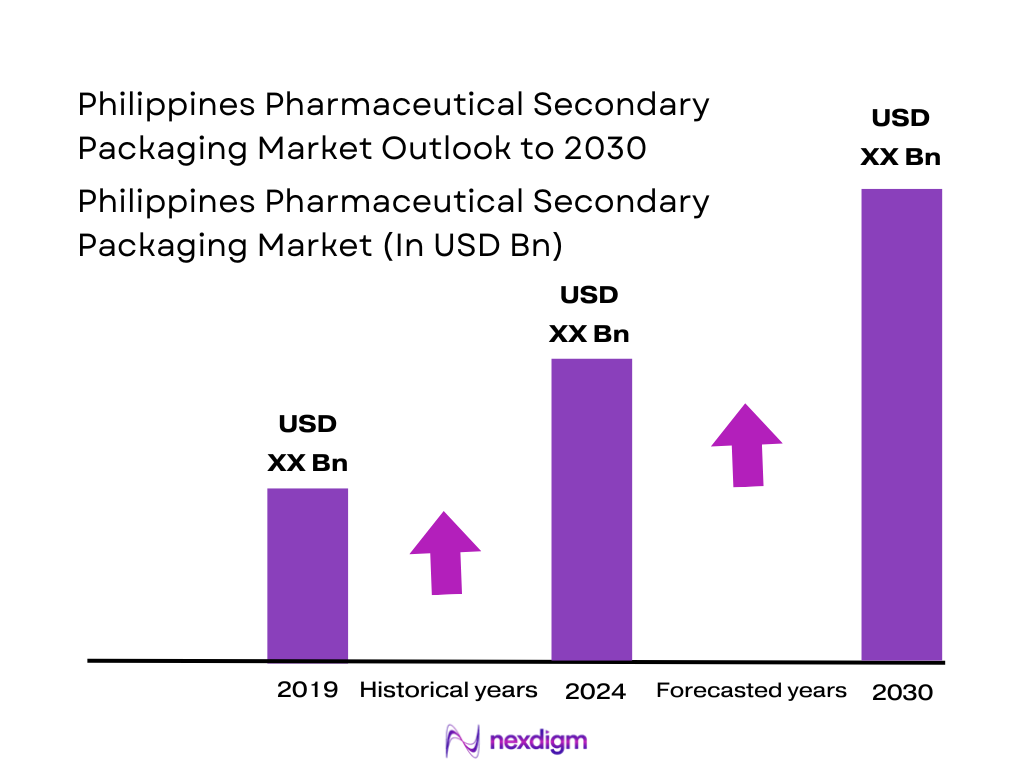

The Philippines pharmaceutical packaging market, which frames the Philippines Pharmaceutical Secondary Packaging Market, is valued at roughly USD ~ million in the latest industry assessments, up from about USD ~ million in the recent past, based on multiple third-party studies of the country’s packaging and pharmaceutical sectors. This growth is underpinned by a pharmaceutical industry that has become one of the largest in ASEAN, with medicines accounting for a substantial share of household health spending and packaging materials representing around 30% of medicine cost structures.

Within the Philippines Pharmaceutical Secondary Packaging Market, demand is concentrated in the Greater Capital Region—National Capital Region, CALABARZON and Central Luzon—which together account for the largest share of health expenditure and host most pharmaceutical manufacturing capacity. These regions combine dense hospital and retail pharmacy networks, mature industrial estates, and pharma-oriented ecozones promoted by PEZA and the Board of Investments. As a result, they attract both multinational brands and local generics players, driving clustering of carton converters, label printers and contract packers that dominate secondary packaging volumes.

Market Segmentation

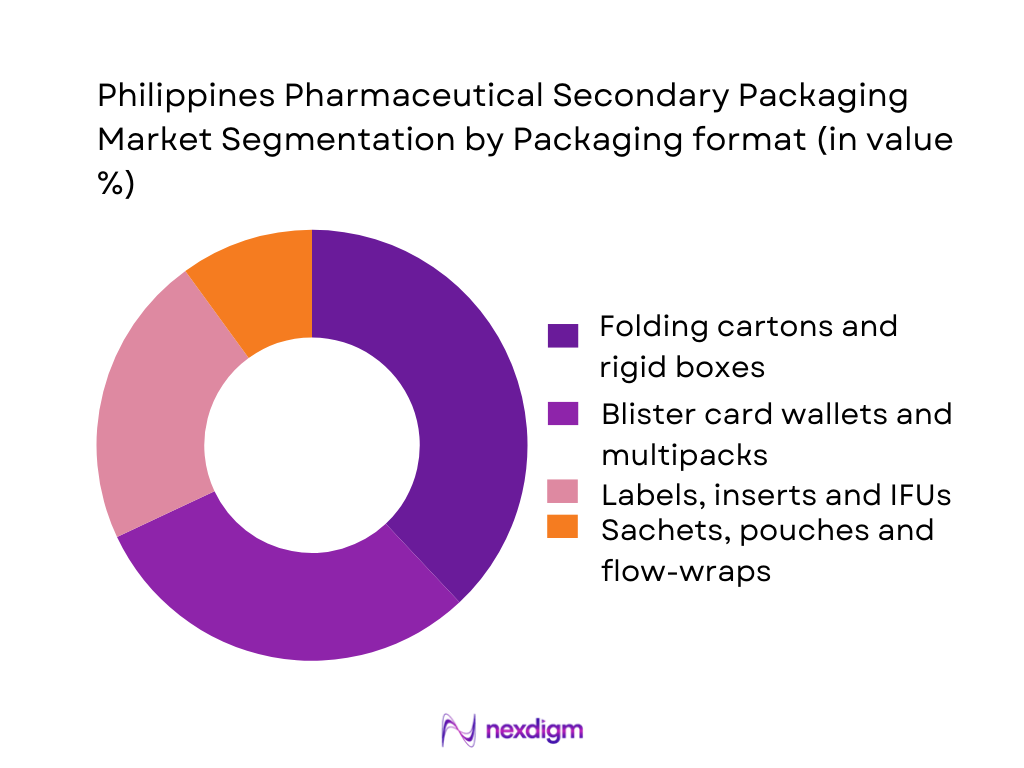

By Packaging Format

The Philippines Pharmaceutical Secondary Packaging Market is segmented into folding cartons and rigid boxes, blister card wallets and multipacks, labels/inserts/IFUs, and sachets, pouches and flow-wraps. Folding cartons currently dominate this segmentation because they are the default format for prescription and over-the-counter medicines sold through community drugstores, hospital pharmacies and modern trade. Carton converters in NCR and CALABARZON are already geared to pharmaceutical-grade work, offering high-precision die-cutting, multi-colour offset printing, Braille, tamper-evident features and serialization-ready designs that align with global secondary-packaging trends. Their compatibility with automated cartoners and ability to carry extensive regulatory text, barcodes and branding make cartons the most versatile and scalable secondary format for the country’s fast-growing generics and branded-generics segments.

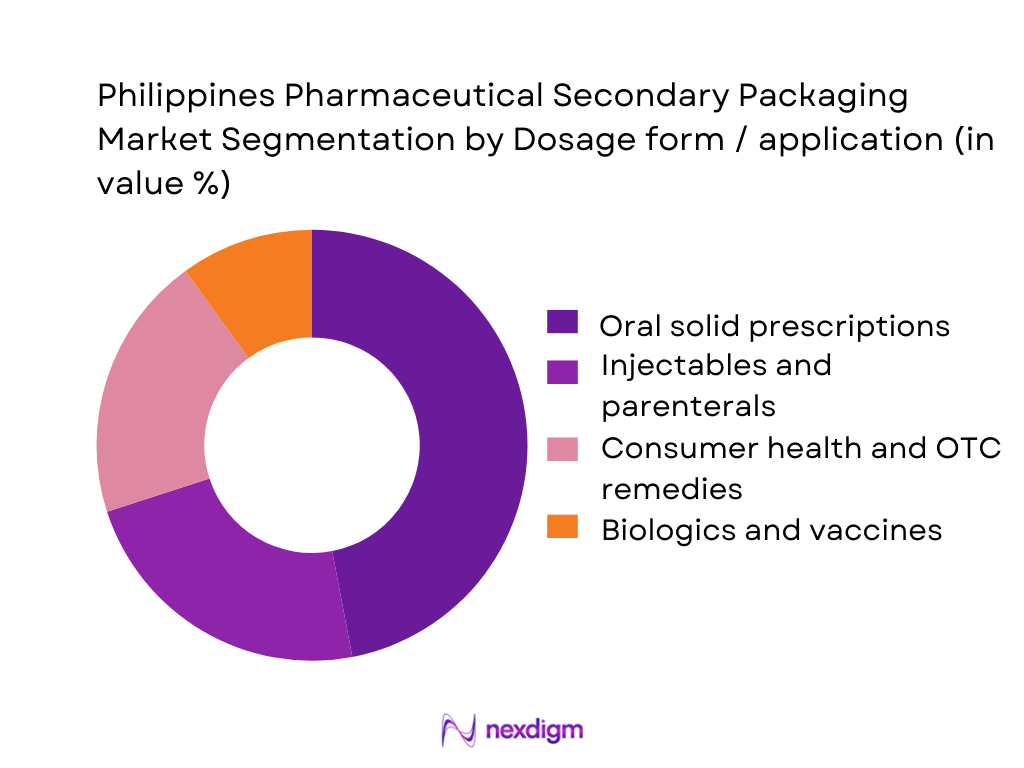

By Dosage Form / Application

The Philippines Pharmaceutical Secondary Packaging Market is segmented into oral solid prescriptions, injectables and parenterals, consumer health and OTC remedies, and biologics and vaccines. Oral solid prescriptions command the largest share because the domestic pharma industry remains heavily skewed toward tablet and capsule production for chronic conditions such as hypertension, diabetes and infectious diseases, which together account for a significant portion of medicine expenditure. These SKUs flow primarily through drugstores and hospital pharmacies where carton-packed, blister-based formats dominate shelves and prescribing habits. High prescription volumes, frequent refills and the need for unit-dose blisters with clear labelling give oral solids an inherently higher “pack count” per patient than injectables or biologics, translating into structurally higher secondary-packaging throughput for this segment.

Competitive Landscape

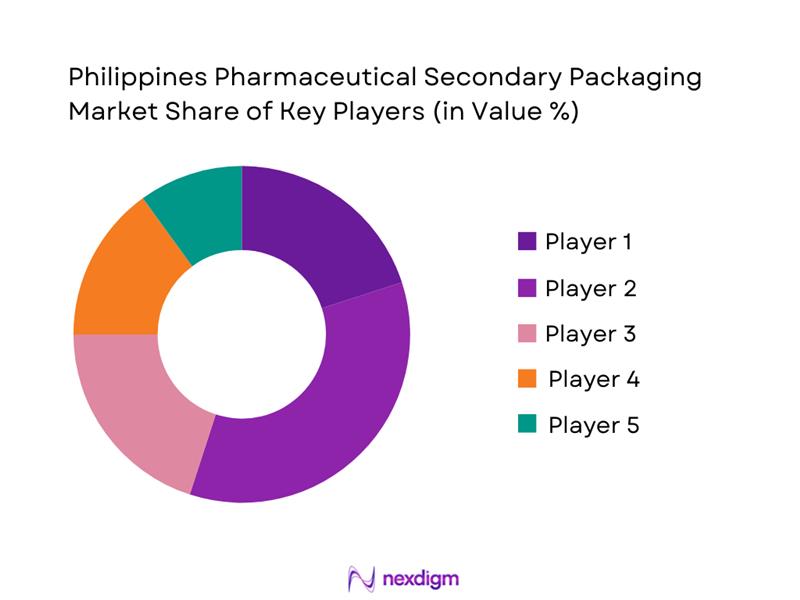

The Philippines Pharmaceutical Secondary Packaging Market is moderately concentrated, with a mix of multinational packaging majors and strong local converters serving both domestic manufacturers and regional export flows. Industry analyses consistently highlight players such as Amcor Flexibles Philippines, Bestpak Packaging Solutions, Netpak Phils., GL Otometz, Berry Global and several local specialists as key suppliers of cartons, labels, bottles and specialty packs to the country’s pharmaceutical and healthcare sectors. Competition increasingly revolves around GMP-compliant facilities, serialization and track-and-trace readiness, pharma-grade quality systems and the ability to support PEZA-based export manufacturers with agile, short-run secondary packaging.

| Company | Establishment year (group) | Headquarters (group) | Philippines presence model | Core secondary-packaging focus | Key pharma / healthcare customer focus | Technical & regulatory capabilities | Sustainability / innovation focus | Example relevance to secondary packaging in PH |

| Amcor Flexibles Philippines Corp. | 1860 (Amcor origins) | Zurich, Switzerland | ~ | ~ | ~ | ~ | ~ | ~ |

| Bestpak Packaging Solutions, Inc. | 1990s (Philippines) | Quezon City, Philippines | ~ | ~ | ~ | ~ | ~ | ~ |

| Netpak Phils., Inc. | 1990s (Philippines) | Cavite, Philippines | ~ | ~ | ~ | ~ | ~ | ~ |

| GL Otometz Corporation | 1990s (Philippines) | Philippines | ~ | ~ | ~ | ~ | ~ | ~ |

| Berry Global / Amcor Healthcare (Group) | 1967 (Berry), later merged | Evansville, USA / Zurich | ~ | ~ | ~ | ~ | ~ | ~ |

Philippines Pharmaceutical Secondary Packaging Market Analysis

Growth Drivers

Expansion of Local Branded Generics and Ethical Pharma Base

The recent growth in healthcare access and demand in the Philippines has accelerated the production of local branded generics and ethical pharmaceuticals, creating increased need for secondary packaging units such as cartons, blisters, labels, and inserts. In 2023, total health expenditure rose to PHP ~ trillion from PHP ~ trillion in 2022, reflecting heightened consumption of medicines and health services. As medicines account for a large proportion of health spending, this increase implies greater production volumes and in turn higher demand for secondary packaging among domestic manufacturers and contract packers.

Shift from Bulk Imports to Local and Regional Fill-Finish

Economic growth in the Philippines, with GDP expanding by 5.6% in 2024, has driven manufacturing and industrial investment in domestic pharmaceutical production and fill-finish operations. This has reduced reliance on fully imported finished drugs, prompting local packaging and converting houses to supply secondary packaging components. The localisation of fill-finishing means more packages processed domestically — cartons, blister packs, labels — boosting demand for secondary packaging infrastructure and services within the country.

Challenges

Input Cost Volatility and Forex Exposure for Board and Films

Secondary packaging relies heavily on imported raw materials such as coated board, specialty papers, films, inks, and laminates, subject to global commodity and freight market fluctuations. As the Philippine peso is exposed to foreign exchange volatility, any devaluation directly increases cost inputs for converters sourcing materials abroad. Given that total health expenditure surged by 17% to PHP ~ trillion in 2023, much of it driven by rising medical costs, converters and packers face pressure to absorb or pass on rising material costs while remaining competitive. This cost instability complicates price negotiations with pharmaceutical clients and squeezes margins for smaller converters.

Capacity Fragmentation Among Small and Mid-Sized Converters

The Philippine secondary packaging landscape includes many small and medium-sized converters, often with limited capacity and older equipment, making it difficult to meet large-scale or high-specification orders. The fragmented nature of this supply base can result in inconsistent quality, varied lead times, and limited ability to support serialization or multi-format packaging. As the national economy continues to grow and demand rises, these smaller players may lack the investment capacity to scale or upgrade, constraining overall sector responsiveness. Data shows manufacturing and industry contributed to growth in 2024, but the benefit likely accrued to larger, well-capitalized entities.

Opportunities

High-Value Niche Formats for Biologics, Vaccines and Specialty Therapies

Although the bulk of pharmaceutical volume remains in oral solids, rising investment in biologics, vaccine programmes, and specialty therapies presents opportunities for advanced secondary packaging formats — for instance, cold-chain enabled cartons, insulated trays, multi-pack kits with syringes or vials, and compliant labelling for multi-dose vials. The national push for universal health coverage and expanded public health infrastructure under DOH initiatives supports delivery of biologics and vaccines via domestic fill-finish networks, increasing demand for specialised secondary packaging beyond standard cartons. Converters capable of delivering compliant, temperature-appropriate, and secure secondary packaging stand to capture high-margin segments.

Smart, Connected and Serialized Secondary Packaging

With regulators and buyers emphasizing traceability, patient safety and anti-counterfeit measures, there’s growing room for secondary packaging embedded with serialization, tamper-evidence, 2D barcodes and possibly smart-label integration. As technology adoption increases globally and digital health trends touch the Philippines, demand for secure, trackable, and patient-centric packaging will grow. Converters who invest in printing, data-management capabilities and compliant serialization infrastructures can gain a competitive edge. Given the ongoing expansion of prescription volumes and broader access to formal healthcare channels, this trend represents a critical growth path for the secondary packaging market.

Future Outlook

Over the next several years, the Philippines Pharmaceutical Secondary Packaging Market is expected to expand steadily, supported by the country’s broader pharmaceutical packaging market, which multiple sources place in the mid-hundreds of millions of US dollars and growing at roughly 4.5–5.0% annually. Rising healthcare expenditure, government roadmaps to raise local production to around 60% of registered medicines, and PEZA-backed pharma ecozones will keep pulling secondary-packaging volumes into domestic industrial clusters.

The Philippines Pharmaceutical Secondary Packaging Market is modelled on a 2024 baseline value of about USD ~ million and an indicative compound annual growth rate of approximately 4.7% through the end of the decade, consistent with published forecasts of 4.48–4.90% for the wider pharmaceutical packaging sector in the country. Under this scenario, total packaging revenues associated with secondary formats could reach the low-USD-~-million range by the early 2030s, driven by generic-drug penetration, chronic-disease prevalence, injectable and vaccine programmes, and increasing requirements for tamper-evidence, serialization and temperature-sensitive logistics.

Major Players

- Amcor Flexibles Philippines Corp.

- Berry Global / Amcor Healthcare

- Bestpak Packaging Solutions, Inc.

- Netpak Phils., Inc.

- GL Otometz Corporation

- SwissPac

- Shandong Pharmaceutical Glass Co., Ltd.

- APO International Marketing Corporation

- Plastic Container Packaging Corporation

- Merfel Plastic Products / Merfel Plastic Manufacturing Inc.

- Robicel Trading

- Euro-med Laboratories Phil., Inc.

- Versa Group Philippines Corporation

- Net-adjacent healthcare and diagnostics packers

Key Target Audience

- Pharmaceutical manufacturers

- Contract manufacturing organisations (CMOs) and contract packaging organisations (CPOs)

- Consumer health and OTC medicine companies

- Hospital and clinic pharmacy chains and institutional buyers

- Retail pharmacy chains and drugstore groups

- Investors and venture capitalist firms

- Government and regulatory bodies

- Industrial park developers and logistics providers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping the ecosystem of the Philippines Pharmaceutical Secondary Packaging Market, covering pharmaceutical manufacturers, CMOs/CPOs, converters, label and leaflet printers, logistics players, ecozone authorities and regulators. This step is anchored in extensive desk research using secondary and proprietary databases to quantify pharmaceutical production, healthcare spending, packaging cost shares and regional manufacturing footprints in NCR, CALABARZON and Central Luzon. The goal is to identify variables that drive secondary-packaging volumes, such as generic-drug penetration, injectable and vaccine uptake, and regulatory demands for serialization.

Step 2: Market Analysis and Construction

In this phase, historical data points for the Philippines pharmaceutical packaging market are compiled, triangulating multiple sources that place the current market around USD ~ million and indicate mid-single-digit growth. This includes assessing the split between primary and secondary packaging, the share of cartons, labels and flexible overwraps, and the relative weight of domestic demand versus export-oriented production. Bottom-up estimates of secondary-packaging value are constructed by combining medicine sales, average packaging intensity per dosage form, and PPMA guidance that packaging can represent roughly 30% of medicine costs.

Step 3: Hypothesis Validation and Expert Consultation

Preliminary hypotheses on format dominance (e.g., folding cartons), regional concentration and the role of contract packers are validated through interviews and structured questionnaires with Philippine-based pharma manufacturers, packaging converters, ecozone locators and regulatory consultants. These consultations provide operational insight into real-world pack configurations, equipment utilisation, outsourcing strategies and expected shifts arising from PEZA’s pharma-zone programme and DOH/FDA policy reforms. Feedback is used to refine allocation of value between primary and secondary packaging, confirm segmentation weights and align growth assumptions with planned capacity additions.

Step 4: Research Synthesis and Final Output

The final phase synthesises top-down market metrics from global and regional packaging reports with bottom-up estimates drawn from Philippine production, import/export flows and price structures. Direct inputs from major players—such as Amcor’s flexible-pack operations, Bestpak’s container business and local carton converters—are used to validate format-level revenue splits and test the robustness of the 2024 baseline and forward CAGR. The result is a consolidated, cross-checked perspective on the Philippines Pharmaceutical Secondary Packaging Market, designed to support investment decisions, capacity planning and go-to-market strategies.

- Executive Summary

- Research Methodology (Market Definitions, Scope and Segment Taxonomy, Data Collection Approach, Market Sizing and Forecasting Framework, Primary Research Approach, Validation, Assumptions and Normalization, Limitations and Sensitivity Scenarios)

- Definition, Scope and Role of Secondary Packaging

- Evolution of Secondary Packaging in Branded Generics, Branded Innovator, OTC and Consumer Health

- Mapping of Pharma Manufacturing and Packing Clusters Across Philippines

- Secondary Packaging Workflow

- Position of Secondary Packaging Within Overall Pharma and Healthcare Spend

- Growth Drivers

Expansion of Local Branded Generics and Ethical Pharma Base

Shift from Bulk Imports to Local and Regional Fill-Finish

Rising Healthcare Access, Insurance Coverage and Script Volumes

Tightening of Quality, Pharmacovigilance and Labelling Norms

Demand for Patient Safety, Adherence and Anti-Counterfeit Features - Challenges

Input Cost Volatility and Forex Exposure for Board and Films

Capacity Fragmentation Among Small and Mid-Sized Converters

Qualification Timelines, Artwork Bottlenecks and Change-Control Burden

Infrastructure, Power Quality and Logistics Constraints

Compliance Risk Across cGMP Printing, Data Integrity and ESG - Opportunities

High-Value Niche Formats for Biologics, Vaccines and Specialty Therapies

Smart, Connected and Serialized Secondary Packaging

Sustainability-Led Redesign and Material Substitution

Contract Packaging, Late-Stage Customisation and Kitting Services

Regional Export Hub Positioning Within ASEAN - Trends

Shift to High-Automation Cartoning, Labelling and Inspection Lines

Digital and Short-Run Printing for High-SKU and Clinical Trial Packs

Co-Development of Packs Between Brand, Converter and Machinery OEMs

Embedding ESG and Circularity into Packaging Briefs - Regulatory and Standards Landscape

- Stakeholder Ecosystem Mapping

- Porter’s Five Forces

- Value Chain and Supply Chain Analysis

- Sustainability and ESG Analysis

- By Value, 2019-2024

- By Volume, 2019-2024

- By Pack Count, 2019-2024

- Average Realisation per Thousand Pack Units by Key Format, 2019-2024

- Share of Secondary Packaging in Total Packaging and Total COGS of Pharma Manufacturers, 2019-2024

- By Secondary Packaging Format (in Value %)

Folding Cartons for Prescription and OTC Brands

Blister Cards, Wallets and Child-Resistant Carded Packs

Sachet Overwraps, Stick Packs and Flow-Wrapped Units

Pressure-Sensitive Labels, Booklet Labels and Auxiliary Stickers

Leaflets, IFUs and Booklets Bundled with Cartons - By Dosage Form and Therapy Presentation (in Value %)

Oral Solid Dosage (Tablets, Capsules) Secondary Packs

Injectable and Parenteral Drug Secondary Packs

Biologics and Vaccine Secondary Packs

Ophthalmic, Otic and Nasal Preparations

Topical, Dermatology and Consumer Health Secondary Packs - By End-User Type (in Value %)

Local Branded Generics and Ethical Pharma Manufacturers

Multinational Pharma Affiliates and Importers

CMOs, CDMOs and Contract Packers

Hospital Pharmacies, Government Medical Warehouses and Tender Business

Chain Drugstores, Independent Pharmacies and E-Pharmacies - By Material Substrate (in Value %)

Folding Boxboard, Coated Duplex and Specialty Boards

Corrugated Shippers Used as Secondary Presentation Packs

Flexible Laminates and Overwrap Films for Secondary Use

Rigid Plastics and Trays Within Secondary Packs

Emerging Fibre-Based and Recycled Content Substrates - By Packaging Functionality and Feature Set (in Value %)

Child-Resistant and Senior-Friendly Secondary Packs

Tamper-Evident and Anti-Pilferage Features

Anti-Counterfeit, Serialization and Track-and-Trace-Enabled Packs

Cold-Chain and Temperature-Sensitive Secondary Packs

Patient Adherence, User Instruction and Smart Packaging Features - By Region and Industrial Cluster (in Value %)

National Capital Region and CALABARZON Pharma Manufacturing Belt)

Central Luzon and Northern Luzon Pharma and Nutraceutical Hubs

Central Visayas and Western Visayas Clusters

Northern Mindanao and Davao Clusters

PEZA Zones and Export-Oriented Industrial Parks

- Market Share of Key Players by Value and Volume

Market Share by Secondary Packaging Format

Market Share by End-User Segment - Cross-Comparison Parameters (company capabilities, service levels and strategic positioning, Philippines pharma client portfolio depth, cGMP and QA certifications, secondary format breadth, localization of board and film sourcing, serialization/anti-counterfeit capability, cold-chain and specialty pack expertise, sustainability credentials and recycled content usage, installed converting capacity and average lead times)

- Detailed Profiles of Major Companies

Amcor Plc

Berry Global Group Inc.

Bestpak Packaging Solutions, Inc.

Netpak Phils., Inc.

Robicel Trading

Euro-med Laboratories Phil., Inc.

Papercon Philippines, Inc.

Moldex Products, Inc.

CCL Healthcare / CCL Label

MM Packaging

Multi-Color Corporation

Smurfit Kappa Group

WestRock Company

Pharma Packaging Solutions

- Demand, Volume and Mix by End-User Category

- Procurement Models, Tendering Practices and Contracting Terms

- Qualification, Regulatory and QA/RA Expectations from Converters

- Pain Points Across Artwork, Lead Times, MOQ and Inventory Risk

- Decision-Making Hierarchy and Influencer Map in Packaging Sourcing

- By Value, 2025-2030

- By Volume, 2025-2030

- By Pack Count, 2025-2030

- Average Realisation per Thousand Pack Units by Key Format, 2025-2030

- Share of Secondary Packaging in Total Packaging and Total COGS of Pharma Manufacturers, 2025-2030