Market Overview

The Philippines pistons market is valued at approximately USD ~ million based on the Southeast Asia automotive pistons market estimate for 2024, which includes the Philippines as part of the region. In 2023 the market for piston sets in the Philippines saw about 4,888 import shipments from Oct 2023–Sep 2024, supplied by 373 exporters to 282 buyers. Key drivers include rising vehicle and motorcycle production, strong aftermarket replacement demand, and regional foundry expansion. These dynamics support the current valuation and future expansion potential of the pistons market in the Philippines.

In the Philippines pistons market, major manufacturing hubs such as Metro Manila (Luzon), Cebu (Visayas) and Davao (Mindanao) dominate component assembly and aftermarket distribution because of their strong industrial clusters, access to port infrastructure and skilled labour. Additionally, countries exporting pistons like Japan, Thailand and Indonesia play key roles—Japan supplies advanced piston technologies, Thailand supports regional OEMs and Indonesia provides high-volume shipments to the Philippines. These supply-chain centres dominate due to logistic advantages, mature foundry capacity and established trade ties.

Market Segmentation

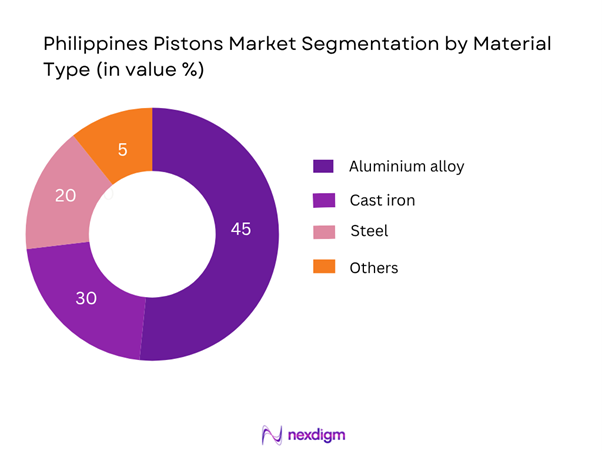

By Material Type

The Philippines pistons market is segmented by aluminium alloy, cast iron, steel and others. Recently, aluminium alloy pistons have a dominant share in the Philippines, largely because OEMs favour lightweight materials to improve fuel efficiency and meet tightening emission norms. The growth in passenger vehicles, motorcycles and LCVs has triggered adoption of aluminium pistons. In addition, foundries in the ASEAN region increasingly support aluminium casting capacity, making it cost-effective and accessible for Philippines manufacturers and importers, thus accounting for its dominant share.

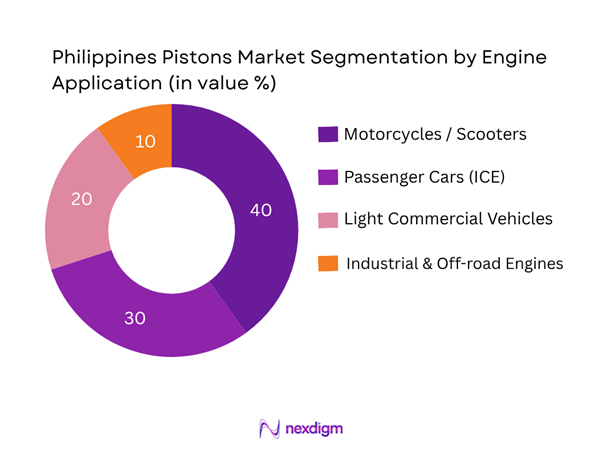

By Engine Application

The Philippines pistons market is segmented into motorcycles/scooters, passenger cars (ICE), light commercial vehicles & pick-ups and industrial/off-road engines. Among these, the motorcycles/scooters sub-segment dominates in the Philippines owing to the country’s high two-wheeler penetration and replacement part demand. Many piston imports are linked to piston-set imports for motorbike engines (as indicated by the 4,888 shipments Oct 2023–Sep 2024), The lower cost of two-wheelers and high turnover for replacement parts support frequent piston demand, making this application sub-segment the largest contributor in the local market.

Competitive Landscape

The Philippines pistons market features a mix of global piston-component manufacturers and regional import/trade firms. Consolidation is moderate, with several major players controlling material technology and global OEM supply.

| Company | Establishment Year | Headquarters | Material Technology Focus | Philippines Presence | After-market vs OEM Ratio | Export / Domestic Mix | Foundry / Casting Capacity |

| MAHLE GmbH | 1920 | Stuttgart, Germany | – | – | – | – | – |

| Aisin Corporation | 1949 | Kariya, Japan | – | – | – | – | – |

| Shriram Pistons & Rings Ltd. | 1985 | India | – | – | – | – | – |

| Ross Racing Piston | 1960s | Grand Rapids, USA | – | – | – | – | – |

| India Pistons Limited | 1984 | Uttarakhand, India | – | – | – | – | – |

Philippines Pistons Market Analysis

Growth Drivers

Rising Domestic Vehicle and Motorcycle Production Volume

Domestic vehicle production in the Philippines stood at 110,350 units in December 2023, up from 92,223 units in December 2022. Additionally, motorcycle registrations and sales remain robust, with the two-wheeler market tracking over 2.3 million units in 2024 according to industry commentary. These high volumes of new vehicles and motorcycles create demand for pistons — both for original-equipment and replacement use. As engine block and piston manufacturing must keep pace with production, this rise supports stronger consumption of pistons in the OEM supply chain as well as the aftermarket. Moreover, the rebound from earlier production dips and sustained manufacturing capacity in Luzon and Visayas strengthens the driver. For piston manufacturers and suppliers, this means increased throughput of casting, machining and assembly aligned with rising vehicle output, making the production volume growth a key structural support for the pistons market.

Growth in Internal Combustion Engine (ICE) Retention and Vehicle Longevity

Although electrification is gaining attention, the Philippines continues to rely heavily on internal combustion engine (ICE) vehicles, especially motorcycles and light commercial vehicles. Registered motor vehicles as of May 2022 numbered over 5.8 million, with motorcycles/tricycles representing approximately 60 % of that stock. The large installed base of ICE engines implies ongoing needs for piston replacement, re-machining and maintenance beyond the new-vehicle market. With vehicles in operations for extended cycles due to cost constraints, durability requirements, and limited replacement budgets, pistons and piston sets remain critical components. This longevity of ICE applications enhances aftermarket demand and supports manufacturers of pistons, coatings, machining and remanufacture services, positioning the market favourably despite headwinds from electric vehicles.

Market Challenges

Dependence on Imported Pistons and Raw Materials

The Philippines’ trade data shows significant import dependence for materials relevant to piston manufacturing. For instance, imports of “Other articles of iron or steel” (HS 7326) reached USD 372 million in 2023, up from USD 340 million in 2022. Similarly, aluminium-articles imports were about USD 567 million in 2024. This import-intensity means piston manufacturers and component suppliers in the Philippines face vulnerability to foreign supply disruptions, shipment delays and tariff/FX shifts. For OEMs and foundries, securing reliable raw-material flows and piston sets becomes challenging when domestic capacity is limited. The reliance on imports constrains flexibility and increases risk for local piston-value chain participants.

Volatility in Global Aluminum and Steel Prices

As piston manufacturing depends on aluminium alloy and cast-iron/steel materials, global price volatility of these metals exerts cost pressure and margin risk. The Philippines steel market size in 2024 was USD 19,488 million, signifying major material flows in the economy. Though specific metal-price figures for pistons are not always available, such large market size indicates the scale of steel inputs and thus exposure to upstream price swings. When raw-material costs rise, piston casting and machining operations must absorb cost creep or pass it to OEMs and aftermarket clients — a challenge in competitive markets and price-sensitive applications such as motorcycles.

Market Opportunities

Rise in Automotive Remanufacturing and Piston Reconditioning Services

With an extensive stock of motorcycles and ICE vehicles in the Philippines, remanufacturing and piston-reconditioning services offer significant growth avenues. For example, motorcycle annual sales in the first half of 2025 reached 1.2 million units in the Philippines. Older vehicles often undergo overhauls rather than full replacements, creating demand for rebuilt piston assemblies, refurbishment services and aftermarket parts. Piston manufacturers and service firms can capitalize on this by offering reconditioned piston sets, aftermarket upgrades (e.g., coated pistons), and tailored services for commercially used fleets (delivery, ride-share). This opportunity taps a cost-sensitive user base and extends the lifecycle of ICE engines even as new-vehicle ICE demand evolves.

Opportunities in Lightweight Alloy Pistons for Efficiency Enhancement

As fuel-efficiency and emission-compliance standards tighten, drivetrain component makers are increasingly adopting lightweight materials such as aluminium alloys and advanced cast irons for pistons. The Philippines imported USD 567 million worth of aluminium-articles in 2024. This import flow reflects material availability and willingness of market to invest in advanced alloys. Piston manufacturers carrying out aluminium-piston production or retrofits can serve OEMs and aftermarket alike — offering performance upgrades in motorcycles, passenger cars and commercial vehicles. This trend opens high-value segment opportunities within the pistons market in the Philippines.

Future Outlook

Over the next six years, the Philippines pistons market is expected to maintain steady growth driven by the continuing replacement cycle of internal combustion engine vehicles, increasing light-vehicle and motorcycle production, and rising demand for lightweight piston materials. While electrification poses a transition risk, ICE and hybrid engines will remain significant in the Philippines for the foreseeable future. Advancements in foundry and machining technologies, as well as export opportunities to neighbouring ASEAN markets, will create new growth paths for piston manufacturers and suppliers.

Major Players

- MAHLE GmbH

- Aisin Corporation

- Shriram Pistons & Rings Ltd.

- Ross Racing Piston

- India Pistons Limited

- Capricorn Automotive Ltd.

- Art-Serina Piston Co. Ltd.

- AISIN Asia (Philippines / SEA operations)

- Walker Precision Castings (Philippines / SEA operations)

- Compact Powertrain Inc.

- BorgWarner Inc. (Piston / Powertrain Division)

- KSPG AG (Kolbenschmidt)

- Federal-Mogul / Tenneco (Piston & Engine Systems)

- Clevite Division of GGB/Precision Castparts

- Local Philippines piston manufacturer

Key Target Audience

- OEM vehicle manufacturers of passenger cars, motorcycles and LCVs (Philippines)

- Tier-1 & Tier-2 piston component manufacturers and foundries

- Investments and venture capitalist firms (targeting advanced piston materials, manufacturing technologies)

- Government and regulatory bodies (e.g., Department of Trade and Industry Philippines, Board of Investments Philippines)

- After-market parts distributors & remanufacturing firms in Philippines and ASEAN region

- Export management companies and global sourcing divisions of automotive groups

- Raw-material suppliers ( aluminium, CGI-iron, steel for piston manufacturing )

- Logistics, supply-chain and warehousing service providers specialising in automotive components

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing major stakeholders within the Philippines pistons market: vehicle OEMs, aftermarket distributors, piston manufacturers, foundries, material suppliers and logistics partners. This uses extensive desk research, secondary databases and trade import data (e.g., piston-set import shipments) to identify critical variables influencing market dynamics.

Step 2: Market Analysis and Construction

In this phase we compile and analyse historical data pertaining to the Philippines pistons market: piston-set import volumes, local vehicle & motorcycle production figures, foundry capacity and material type distribution. We evaluate OEM vs aftermarket split, material shifts (aluminium vs cast iron) and distribution channels to build reliable value and volume estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses (e.g., dominance of aluminium pistons, aftermarket motorcycles sub-segment) are validated by interviews with industry experts: piston-component manufacturers, importers/exporters, Philippine vehicle OEM powertrain managers and foundry operators. These provide operational, regional and cost-structure insights that refine model assumptions and triangulate results.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing the data into a structured report, applying forecasting using bottom-up volume × ASP modelling and top-down triangulation using regional piston market data (e.g., Southeast Asia estimate USD 164.7 M in 2024) from credible sources. This step verifies and validates statistics to ensure a comprehensive, accurate analysis of the Philippines pistons market.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations and terminologies used, Market Sizing Approach, Consolidated Research Approach, Market Potential through In-Depth Industry Interviews, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis and Evolution

- Timeline of Major Industry Developments

- Supply Chain & Value-Chain Analysis

- Regulatory Landscape

- Macroeconomic Context in Philippines

- Growth Drivers

Rising Domestic Vehicle and Motorcycle Production Volume

Growth in Internal Combustion Engine (ICE) Retention and Vehicle Longevity

Expansion of Local Foundries and Aluminum Casting Facilities

Increasing Aftermarket and Replacement Demand - Market Challenges

Dependence on Imported Pistons and Raw Materials

Volatility in Global Aluminum and Steel Prices

Gradual Shift Toward Electrification and Hybrid Engines

Limited Local Manufacturing Technology for Precision Components - Market Opportunities

Rise in Automotive Remanufacturing and Piston Reconditioning Services

Opportunities in Lightweight Alloy Pistons for Efficiency Enhancement

Integration with Regional OEM Supply Chains

Establishment of Local Foundries and Component Machining Hubs - Emerging Trends

Adoption of Compacted Graphite Iron (CGI) and Forged Alloy Pistons

Rising Use of PVD / DLC Coatings for Low Friction Performance

Shift Toward CNC Precision Machining and Additive Manufacturing

Integration of Smart Manufacturing & Predictive Maintenance in Foundries - SWOT Analysis

- Porter’s Five Forces Analysis

- Stakeholder Ecosystem (foundries, piston manufacturers, engine OEMs, aftermarket distributors)

- By Value (USD million), 2019-2024

- By Volume (units – thousands / millions), 2019-2024

- By Average Selling Price (ASP) across segments, 2019-2024

- By Material Type (Material-type segmentation)

Alloy Aluminium

Cast Iron

Compacted Graphite Iron (CGI)

Steel

Others (composites / hybrid materials) - By Vehicle/Engine Application (Application-segmentation)

Passenger Cars (ICE)

LCVs & Pick-ups

Motorcycles / Scooters

Industrial Engines & Off-road

Aftermarket Replacement - By Distribution Channel (Channel-segmentation)

OEM Supply

Aftermarket Parts

Export / Re-export of Pistons

- Market Share of Major Players (by value/volume, 2024)

- Cross-Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Manufacturing Capacity, Material Technology, ASP, Number of Customers, Export Reach, R&D Investment)

- SWOT Analysis of Key Players

- Pricing Analysis by SKU/Product Tier (premium vs standard piston)

- Detailed Profiles of Major Companies:

MAHLE GmbH

Aisin Corporation

Kolbenschmidt Pistons

Federal-Mogul Corporation

Shriram Pistons & Rings Ltd.

India Pistons Limited

Capricorn Automotive Ltd.

Ross Racing Piston

AISIN Asia (Philippines / Southeast Asian Manufacturing)

Art-Serina Piston Co. Ltd.

Philippine Piston Industries Inc.

Manila Powertrain Components Corp.

Walker Precision Castings

Compact Powertrain Inc.

BorgWarner Inc.

- Demand by Engine Type

- Usage by Replacement Cycle / Wear & Tear patterns

- Budget Allocation & Purchasing Behaviour

- Pain-points, Needs & Decision-making Process of End-Users

- Service Lifetime and Remanufacture Potential

- By Value (USD million), 2025-2030

- By Volume (units), 2025-2030

- By Average Selling Price (ASP), 2025-2030