Market Overview

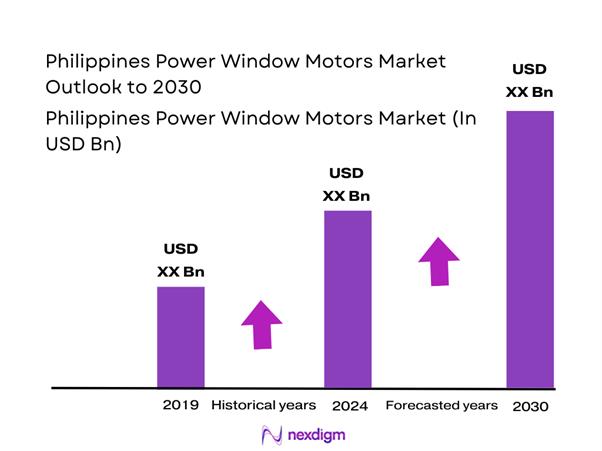

The Philippines Power Window Motors market is valued at approximately USD ~ million, based on consolidated OEM production data, vehicle import volumes, and aftermarket replacement demand triangulated from automotive trade statistics, customs import data, and supplier disclosures. Market size expansion is driven by the sustained rise in passenger vehicle registrations exceeding ~ units, increasing penetration of power windows as standard features even in entry-level models, and higher electrical content per vehicle. The aftermarket contributes meaningfully due to frequent motor failures linked to humidity exposure, road conditions, and prolonged urban vehicle usage.

The market is primarily concentrated in Metro Manila, Calabarzon (Cavite–Laguna–Batangas–Rizal–Quezon), and Central Luzon, owing to high vehicle density, presence of OEM assembly and distribution hubs, and concentration of authorized service centers and fleet operators. Japanese and Korean vehicle brands dominate the installed vehicle base, which structurally supports steady demand for compatible power window motor replacements. Urban congestion, high door-cycle usage, and fleet operations in logistics and ride-hailing further reinforce dominance of these regions.

Market Segmentation

By Vehicle Type

Passenger cars hold the dominant share due to their sheer volume in the national vehicle parc and higher replacement frequency of window motors. Urban driving conditions in the Philippines involve frequent stop-and-go traffic, toll booth usage, parking access, and ride-hailing operations, leading to repetitive window operation cycles. Additionally, compact and mid-size passenger cars increasingly ship with power windows across all trims, unlike earlier manual variants. High exposure to moisture and dust further accelerates motor wear, creating sustained aftermarket demand concentrated in this segment.

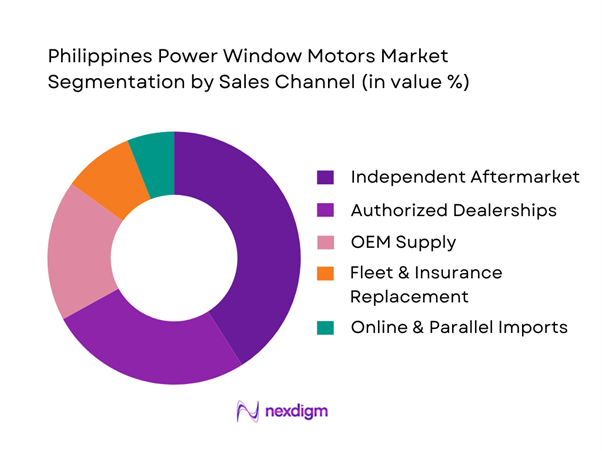

By Sales Channel

Independent aftermarket channels dominate due to high price sensitivity among vehicle owners and the extended average vehicle age in the Philippines. Many consumers prefer non-OEM replacements once vehicles exit warranty periods, especially for components like power window motors that are considered semi-critical rather than safety-critical. The widespread presence of multi-brand repair workshops, availability of imported compatible motors, and faster replacement turnaround times reinforce this channel’s leadership. Additionally, fleet operators frequently bypass dealerships to reduce downtime and maintenance costs, further strengthening independent aftermarket demand.

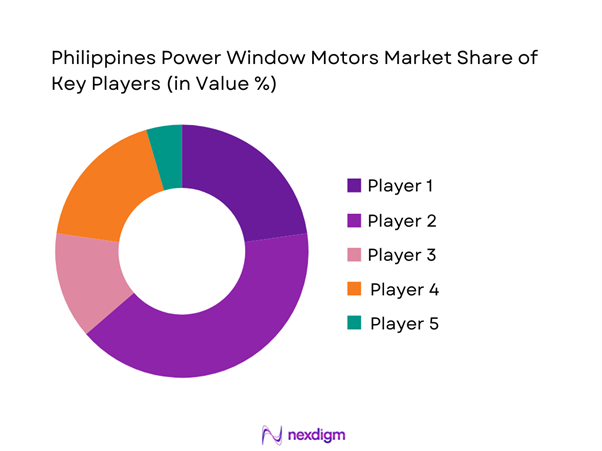

Competitive Landscape

The Philippines Power Window Motors market shows moderate consolidation, with global Tier-1 suppliers dominating OEM supply and a fragmented base of Asian manufacturers serving the aftermarket. OEM contracts are typically locked-in at the vehicle platform level, while aftermarket competition is driven by pricing, availability, and compatibility breadth.

| Company | Est. Year | Headquarters | OEM Presence | Aftermarket Reach | Product Breadth | Anti-Pinch Capability | Noise Control | Local Distribution |

| Denso Corporation | 1949 | Japan | ~ | ~ | ~ | ~ | ~ | ~ |

| Mitsuba Corporation | 1946 | Japan | ~ | ~ | ~ | ~ | ~ | ~ |

| Brose Fahrzeugteile | 1908 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| Johnson Electric | 1959 | Hong Kong | ~ | ~ | ~ | ~ | ~ | ~ |

| Mabuchi Motor | 1954 | Japan | ~ | ~ | ~ | ~ | ~ | ~ |

Philippines Power Window Motors Market Dynamics and Performance Analysis

Growth Drivers

Increasing Power Feature Penetration

Power window motor demand in the Philippines is fundamentally pulled by the expanding passenger-vehicle parc and higher take-up of comfort/electrical features in new registrations and replacement cycles. The total number of registered vehicles increased to ~ units from ~ units, supporting a larger in-use base where window motor failures translate into recurring aftermarket pull. In parallel, new vehicle sales reached ~ units, reinforcing OEM-fit volumes and accelerating the “feature-per-vehicle” trend as buyers shift toward higher trims in mass segments. Macro tailwinds matter too: the Philippines’ GDP increased to USD ~ billion from USD ~ billion, improving affordability for feature-rich vehicles and supporting credit-driven retail demand that lifts power accessory penetration and service volumes.

Urban Vehicle Usage Patterns

Urban stop-and-go usage accelerates wear on window regulators and motors (frequent up/down cycles, heat load, dust ingress, and door-slam vibration), pushing higher replacement intensity in dense metro corridors. This is structurally reinforced by urban concentration: the Philippines’ urban population reached ~ people, while the total population stood at ~, indicating a very large city-based mobility footprint that sustains high utilization rates for daily commuting and point-to-point errands. On the infrastructure side, the national road network length was reported at ~ kilometers, with ~ kilometers paved, supporting high vehicle circulation and service activity across major islands—conditions that typically amplify the installed-base service economy (including door electrical repairs). Coupled with the registered vehicle base moving from ~ to ~ units, urban usage keeps power window motor demand “always on” through repair shops, parts retailers, and online channels.

Challenges

High Import Dependence

Power window motors in the Philippines are heavily tied to imports because the broader automotive parts ecosystem relies on inbound supply for both OEM and aftermarket channels. This dependence is reflected in parts trade indicators: the Philippines imported USD ~ million of “motor vehicle parts & accessories,” and imported USD ~ million of “other motor vehicle body parts & accessories,” categories that commonly feed door hardware/electrical assemblies and aftermarket replacements. When supply chains tighten (port congestion, FX movement, documentation delays), workshops and retailers face intermittent availability issues that can shift demand to substitute brands or non-genuine parts. The macro backdrop matters because import-heavy categories are sensitive to currency and logistics: a large national economy at USD ~ billion supports scale, but also means high aggregate demand for imported components across many vehicle systems, increasing competition for inventory and raising stock-out risk in fast-moving SKUs like window motors for popular models.

Counterfeit Motor Penetration

Counterfeit and substandard automotive parts remain a structural risk in the Philippines, especially where consumers prioritize low out-of-pocket repair bills and online channels make listings easy to scale. Enforcement data shows the broader counterfeit economy is sizable: reported seizures of counterfeit products worth PHP ~ billion in one year, while a major operation seized counterfeit goods worth ~PHP ~ billion in a single case. Separately, government updates on enforcement highlight large seizures of smuggled goods worth PHP ~ billion, with counterfeit goods among the top categories. In an automotive context, these enforcement magnitudes signal persistent availability of illicit supply that can leak into parts channels—including “window motor” SKUs that visually resemble OEM but fail early (brush wear, weak gearsets, poor sealing), causing repeat failures, customer distrust, and higher warranty-like returns for sellers.

Opportunities

Aftermarket Replacement Demand

A growing vehicle parc creates a durable, multi-year replacement runway for wear-prone electromechanical parts like window motors, especially as vehicles age into higher failure probability bands. The Philippines’ registered vehicles increased to ~ units from ~ units, while new vehicle sales reached ~ units—together expanding the installed base that will cycle into regulator/motor replacements (front doors first, then rear). Urbanization supports dense repair economics: an urban population of ~ people sustains high workshop density and faster parts turnover, which benefits distributors that can ensure SKU availability for the most common Japanese and Asian nameplates. Import data also signals channel throughput capacity: the Philippines imported USD ~ million of vehicle parts & accessories, indicating a sizable, active parts inflow that can be leveraged for higher-quality, OEM-equivalent window motor portfolios (sealed motors, improved brushes, better gear materials) positioned against counterfeit risk and repeat failures.

Anti-Pinch Upgrade Cycles

Anti-pinch and smarter window systems (integration with body control modules, auto-up/down, jam protection) create a premium replacement and upgrade pathway—particularly for owners moving from basic motor replacements to improved regulators/switch modules that enhance safety and user experience. The opportunity is supported by a clear rise in newer vehicles entering the parc: ~ units of new sales add more electronics-rich platforms into circulation, and the total fleet at ~ vehicles increases the absolute number of vehicles that will eventually require door electrical servicing. Safety and quality awareness is rising in the market environment, as shown by large-scale recall activity, which tends to increase consumer receptiveness to verified, compliant parts and workshop-grade installations over unknown online parts. For suppliers, the practical play is to bundle “anti-pinch capable” regulator assemblies, OE-grade switches, and verified harness connectors, targeting metro workshops serving dense urban users (urban population ~) where window usability and passenger safety carry high perceived value.

Future Outlook

The Philippines Power Window Motors market is expected to experience stable and structurally supported growth. Continued urbanization, rising vehicle ownership in secondary cities, and increasing reliance on power features as standard equipment will sustain baseline demand. Technological shifts toward quieter, more durable motors and gradual integration with vehicle body control modules will enhance average selling values. While import dependency remains high, distribution optimization and aftermarket branding will become key competitive levers.

Major Players

- Denso Corporation

- Mitsuba Corporation

- Brose Fahrzeugteile

- Valeo

- Bosch

- Aisin Corporation

- Johnson Electric

- Mabuchi Motor

- Nidec Corporation

- Hi-Lex Corporation

- Continental Automotive

- Hella

- Mitsui High-Tec

- Ningbo Tuopu Group

Key Target Audience

- Automotive OEMs and vehicle assemblers

- Tier-1 and Tier-2 automotive component suppliers

- Independent automotive aftermarket distributors

- Fleet operators and mobility service providers

- Automotive dealership groups

- E-commerce automotive parts platforms

- Investment and venture capital firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

The study begins with ecosystem mapping covering OEMs, suppliers, distributors, and service networks. Secondary research is conducted using automotive trade databases, customs data, and proprietary sources to define variables impacting demand and pricing.

Step 2: Market Analysis and Construction

Historical vehicle parc data, replacement cycles, and motor failure rates are analyzed using bottom-up modeling. OEM production and import statistics are cross-validated to construct market volume and value estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions are validated through structured interviews with distributors, service workshop operators, and supplier executives using computer-assisted telephone interviews to confirm demand patterns.

Step 4: Research Synthesis and Final Output

Findings are triangulated across supply-side and demand-side inputs to finalize market sizing, segmentation, and competitive positioning with high confidence.

- Executive Summary

- Research Methodology (Market Definitions and Scope Delineation, Assumptions and Exclusions, Abbreviations, Market Sizing Logic, Bottom-Up Demand Estimation, Top-Down Vehicle Parc Validation, Primary Interview Framework, OEM–Tier Mapping Logic, Data Triangulation Approach, Limitations and Confidence Levels)

- Definition and Scope

- Industry Evolution in the Philippines Automotive Ecosystem

- Power Window Penetration Transition (Manual-to-Power Conversion Dynamics)

- Business Cycle Assessment

- Automotive Electrical Value Chain Analysis

- Growth Drivers

Increasing Power Feature Penetration

Urban Vehicle Usage Patterns

SUV and Pickup Demand

OEM Feature Bundling

Rising Electrical Content per Vehicle - Challenges

High Import Dependence

Counterfeit Motor Penetration

Price Sensitivity in Aftermarket

Limited Local Manufacturing

Warranty Claim Volatility - Opportunities

Aftermarket Replacement Demand

Anti-Pinch Upgrade Cycles

Fleet Retrofit Opportunities

EV Platform Adoption

Smart Door Module Integration - Trends

Shift Toward Brushless Motors

Noise Reduction Engineering

Lightweight Motor Housing

ECU-Linked Window Control

Safety-Embedded Systems - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- By Volume, 2019–2024

- By Average Realization Price, 2019–2024

- By Technology Architecture (in Value %)

DC Brushed Motors

DC Brushless Motors

Integrated Motor–Regulator Assemblies

Anti-Pinch Enabled Motors

Smart Motor Modules with ECU Interface - By Application (in Value %)

Passenger Cars

SUVs and Crossovers

Light Commercial Vehicles

Pickup Trucks

Utility and Fleet Vehicles - By End-Use Industry (in Value %)

OEM Supply

Authorized Dealership Aftermarket

Independent Aftermarket

Fleet and Insurance Replacement

E-commerce and Parallel Imports - By Connectivity Type (in Value %)

Cable-Driven Motors

Scissor-Type Motors

Bowden Cable Systems

Smart Mechatronic Modules

CAN-Bus Integrated Motors - By Region (in Value %)

Japanese OEM Vehicles

Korean OEM Vehicles

Chinese OEM Vehicles

American OEM Vehicles

European OEM Vehicles

- Market Share Analysis

Market Share by Vehicle Type

Market Share by Sales Channel - Cross Comparison Parameters (Motor Torque Output, Noise and Vibration Control, Anti-Pinch Reliability, Product Localization Depth, OEM Approval Status, Aftermarket SKU Breadth, Import Lead Time Efficiency, Warranty Failure Rate)

- SWOT Analysis of Major Players

- Pricing Analysis by Motor Type and Vehicle Segment

- Detailed Profiles of Major Companies

Denso Corporation

Mitsuba Corporation

Brose Fahrzeugteile

Valeo

Bosch

Aisin Corporation

Johnson Electric

Mabuchi Motor

Nidec Corporation

Hi-Lex Corporation

Continental Automotive

Hella

Mitsui High-Tec

Ningbo Tuopu Group

- Demand Intensity by Vehicle Category

- Purchasing Behavior and Replacement Cycles

- OEM vs Aftermarket Decision Framework

- Failure Modes and Pain Point Analysis

- Brand Sensitivity and Warranty Expectations

- By Value, 2025–2030

- By Volume, 2025–2030

- By Average Price, 2025–2030