Market Overview

The Philippines Remote Diagnosis market is valued at USD ~ billion, driven by factors such as the increasing penetration of internet connectivity, the adoption of digital health platforms, and the growing demand for accessible healthcare solutions in rural and underserved regions. The market is being propelled by the government’s push to integrate telemedicine services into the healthcare system, which aims to enhance patient care and reduce healthcare access barriers. Furthermore, the rising prevalence of chronic diseases such as diabetes and hypertension contributes to the market’s expansion, as remote patient monitoring systems become integral to managing these conditions.

The National Capital Region (NCR) of the Philippines dominates the Remote Diagnosis market due to its advanced healthcare infrastructure, higher internet penetration, and greater adoption of digital health solutions. The region is home to several large hospitals, telemedicine companies, and healthcare providers that integrate remote diagnosis services. Other areas like Cebu and Davao also show significant growth, driven by expanding healthcare accessibility through mobile health applications and government-led initiatives to boost telehealth services in these regions. These urban hubs are central to the market’s growth, fostering innovation and widespread adoption.

Philippines Remote Diagnosis Market Segmentation

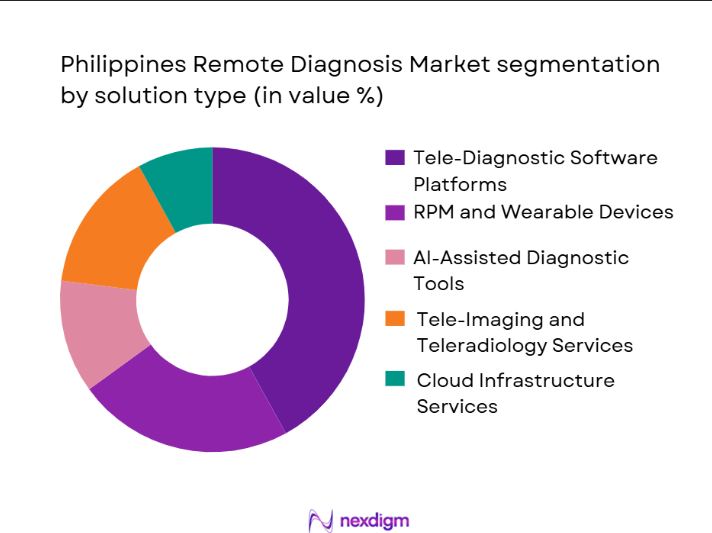

By Solution Type

The Philippines Remote Diagnosis market is segmented by solution type into tele-diagnostic software platforms, RPM & wearable devices, AI-assisted diagnostic tools, tele-imaging & teleradiology services, and cloud infrastructure services. Among these, tele-diagnostic software platforms dominate the market due to their widespread adoption by healthcare providers and the growing demand for teleconsultations. These platforms offer a convenient, cost-effective way for patients to access healthcare remotely, especially during the COVID-19 pandemic and beyond. Teleconsultation services, coupled with regulatory support, have made tele-diagnostic platforms indispensable for both private and government healthcare institutions. The use of mobile apps and web portals for virtual consultations has further fueled the growth of this segment.

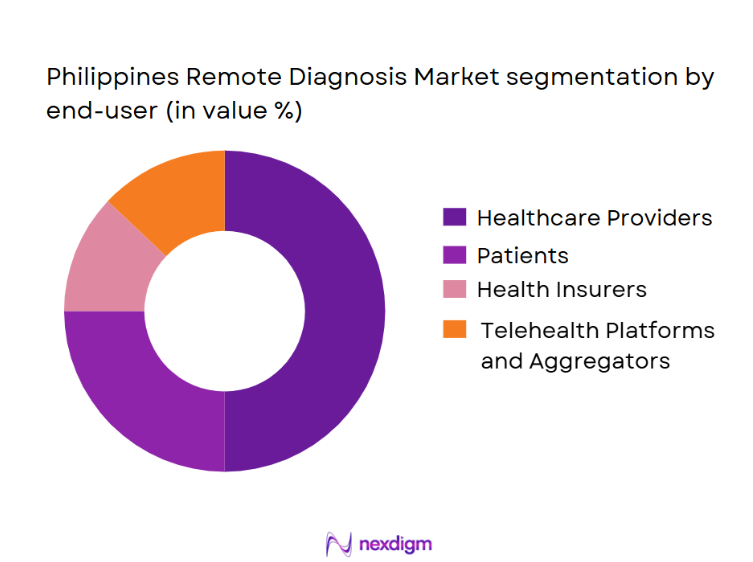

By End-User

The market is also segmented by end-user into healthcare providers (hospitals, clinics), patients (self-directed RPM users), health insurers, and telehealth platforms & aggregators. Among these, healthcare providers hold a dominant position in the market, as they represent the largest adopters of remote diagnosis solutions. Hospitals and clinics are integrating tele-diagnostic platforms and RPM devices to manage patient care more efficiently, especially for patients with chronic conditions. The increasing demand for healthcare accessibility, especially in rural areas, is also prompting healthcare providers to implement telemedicine systems. As the healthcare industry in the Philippines modernizes, the shift towards digital health solutions has accelerated, making healthcare providers the dominant end-users.

Competitive Landscape

The Philippines Remote Diagnosis market is dominated by a mix of local and international players, including both healthcare providers and technology solutions firms. Leading companies such as KonsultaMD, AIDE Health, and Medgate Philippines have established a strong foothold in the market, providing integrated telemedicine platforms and remote patient monitoring systems. These companies, along with global players like Philips Healthcare and Medtronic, are shaping the future of remote healthcare in the Philippines. The market is characterized by intense competition, with players continuously innovating and expanding their service offerings to capture a larger market share.

| Company Name | Establishment Year | Headquarters | Telemedicine Solutions | RPM Devices | AI Capabilities | Cloud Solutions | Distribution Channels | Regulatory Compliance | Patient Volume Managed |

| KonsultaMD | 2019 | Manila, Philippines | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| AIDE Health | 2017 | Quezon City, Philippines | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Medgate Philippines | 2018 | Manila, Philippines | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Philips Healthcare | 1891 | Amsterdam, Netherlands | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Medtronic | 1949 | Minneapolis, USA | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

Market Analysis

Growth Drivers

Government Support and Policy Initiatives

The Philippine government has been actively promoting digital health solutions, including remote diagnosis, through various initiatives and regulatory frameworks such as the Telemedicine Act and Department of Health (DOH) policies. This support is encouraging healthcare providers to adopt remote diagnostic technologies and services, particularly in underserved regions, which significantly boosts market growth.

Increasing Chronic Disease Prevalence and Aging Population

The rise in chronic diseases such as hypertension, diabetes, and cardiovascular diseases, along with an aging population, has created a growing demand for continuous monitoring and remote healthcare services. Remote diagnosis technologies, including RPM devices, are critical in managing long-term health conditions, thus driving adoption among patients and healthcare providers.

Market Challenges

Connectivity Issues in Rural Areas

Despite the rise in digital health services, many rural areas in the Philippines still face challenges related to poor internet connectivity and infrastructure. These limitations hinder the widespread adoption of remote diagnosis solutions, particularly in underserved areas, reducing the market’s full potential.

Data Security and Privacy Concerns

As remote diagnosis involves the transmission of sensitive health data, concerns regarding data security and patient privacy are significant barriers to market expansion. Strict adherence to data protection regulations and establishing secure communication channels are necessary to address these challenges and build consumer trust.

Opportunities

Partnerships with Telecommunications Providers

Collaborating with telecom companies offers a unique opportunity for market players to expand their reach, especially in rural areas where internet access is limited. By providing bundled packages that combine mobile data and telemedicine services, companies can increase adoption and accessibility for remote diagnosis.

Technological Advancements in AI and Wearables

With the advancement of artificial intelligence (AI) and wearable devices, there is a growing opportunity to enhance the accuracy and efficiency of remote diagnosis. AI-driven diagnostic tools, combined with wearable health monitoring devices, can offer real-time data analysis, improving patient care and providing healthcare providers with better decision-making tools, driving further market growth.

Future Outlook

Over the next 5 years, the Philippines Remote Diagnosis market is expected to experience substantial growth. Driven by increasing government support for digital health initiatives, technological advancements in remote monitoring and telehealth services, and an escalating demand for healthcare accessibility, the market is set to grow significantly. Additionally, the expanding use of AI-based diagnostic tools and wearable devices for managing chronic diseases will contribute to the continued growth of the market. As the healthcare infrastructure in the Philippines evolves, the adoption of remote diagnosis technologies is expected to become even more prevalent, transforming the healthcare landscape.

Major Players in the Market

- KonsultaMD

- AIDE Health

- Medgate Philippines

- Philips Healthcare

- Medtronic

- SeeYouDoc

- Lifetrack Medical Systems

- SeriousMD

- Teladoc Health

- MyDocNow

- Globe Telecom KonsultaMD

- HealthNow Philippines

- Siemens Healthineers

- Cigna Healthcare

- UnitedHealth Group

Key Target Audience

- Healthcare Providers

- Telemedicine Solution Providers

- Health Insurance Companies

- Government and Regulatory Bodies

- Healthcare Technology Ventures

- Investments and Venture Capitalist Firms

- Medical Device Manufacturers

- Telehealth Platform Aggregators

Research Methodology

Step 1: Identification of Key Variables

The first phase involves gathering data on the key variables influencing the Remote Diagnosis market in the Philippines. This includes understanding market drivers, technological advancements, regulatory frameworks, and demographic data. Extensive desk research is conducted using secondary databases to provide a comprehensive picture of market trends.

Step 2: Market Analysis and Construction

This phase involves collecting and analyzing historical data on the Philippines Remote Diagnosis market, including market adoption rates, service usage, and the economic impact of telehealth services. Data from various sources will be combined to evaluate growth potential and future market direction.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be validated through expert consultations, including interviews with industry stakeholders, healthcare providers, and technology developers. These insights will offer real-world validation of market trends and projections.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing data from interviews, market reports, and secondary research. Insights will be integrated and analyzed to produce an accurate and reliable market outlook for the Philippines Remote Diagnosis sector, ensuring data accuracy and relevance.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach by Value and Usage Metrics, TopDown and BottomUp Approach, Remote Diagnostic Efficacy Metrics, Remote Patient Monitoring Data Sources, Primary Research Approach, Limitations and Future Metrics Integration)

- Market Definition and Diagnostic Scope

- Market Genesis & Evolution of Remote Care Strategies

- Regulatory & Policy Timeline

- Healthcare Delivery Ecosystem

- Remote Diagnostics Integration with Traditional Care

- Supply Chain & Value Chain

- Growth Drivers

Rising Telemedicine Adoption & Digital Health Penetration

Increase in Chronic Disease Load & RPM Demand

Government Digital Health Initiatives & Insurance Alignment - Key Restraints

Rural Connectivity Limitations

Regulatory Uncertainties in Reimbursement - Market Challenges

Data Security & Interoperability Barriers

Physician Workflow Integration - Opportunities

AIEnabled Diagnostic Scaling

Partnership Models with Telcos & Payors - Industry Trends

Cloud & Edge Diagnostics

Wearable & IoT Device Adoption Growth - Regulatory Landscape

Telehealth Governance & Licensing

Data Privacy

- Market Value – TeleDiagnostic Revenue, 2019-2025

- RPM Device & Software Revenue, 2019-2025

- Teleconsult Volume Metrics, 2019-2025

- Average Price per Remote Diagnostic Session, 2019-2025

- Hospital vs HomeBased Remote Diagnosis Adoption, 2019-2025

- By Solution Type (Revenue %)

TeleDiagnostic Software Platforms

RPM (Remote Patient Monitoring) & Wearable Devices

AIAssisted Diagnostic Tools

TeleImaging & Teleradiology Services

Cloud Infrastructure Services - By Delivery Mode (Usage %)

Mobile App Platforms

Web Portals

CallCenter Based Systems

Integrated Hospital EHR Systems

- By Application (Diagnostic Workload %)

Chronic Disease Monitoring (Diabetes, CVD)

Acute Illness Assessment

Preventive Screening & Early Detection

Specialist Remote Assessment - By EndUser (Adoption %)

Healthcare Providers (Hospitals, Clinics)

Patients (SelfDirected RPM Users)

Health Insurers/Payors

Telehealth Platforms & Aggregators - By Region (Coverage %)

National Capital Region (NCR)

Visayas

Mindanao

Luzon (Excluding NCR)

Rural/Underserved Provinces

- Market Share Analysis

- Cross Comparison Parameters: (Company strategy, Platform ecosystem, Diagnostic AI Capabilities, RPM Portfolio Breadth, Regulatory Compliance, Clinical Partnerships, Pricing Models, Regional Operations, Customer Retention Metrics)

- SWOT of Key Players

- Pricing & Subscription Models by SKU/Service Type

- Detailed Profiles of Major Companies

- Competitive Players:

KonsultaMD

AIDE Health

SeeYouDoc

HealthNow Philippines

mWell Philippines

Lifetrack Medical Systems

SeriousMD

Teladoc Health

Medgate Philippines

Globe Telecom KonsultaMD

MyDocNow

Philips Healthcare

Medtronic

GE Healthcare

Siemens Healthineers

- Remote Diagnosis Efficacy Benchmarks

- Purchasing Behavior (Providers & EndUsers)

- Pain Points & Decision Triggers

- Reimbursement & Insurance Modelling

- By Revenue & Adoption Metrics, 2026-2030

- RPM & Software Usage Projections, 2026-2030

- Average Cost of Remote Diagnosis Forecast, 2026-2030