Market Overview

The Philippines ride-hailing services market has seen substantial growth, driven by factors such as urbanization, rising disposable incomes, and the increasing demand for more convenient transportation solutions. As of 2024, the market is valued at approximately USD~billion. The demand for flexible and affordable commuting options has spurred market expansion, particularly in major metropolitan areas. Additionally, regulatory improvements and support for ride-hailing businesses have contributed to the industry’s growth. The market is expected to continue its upward trajectory with strong support from both government initiatives and technology adoption, including the use of AI and mobile platforms.

Metro Manila, along with Cebu and Davao, dominates the Philippines ride-hailing market due to their higher urban density, substantial economic activity, and increased traffic congestion. These cities benefit from a large base of commuters, including business professionals and tourists. Metro Manila, in particular, remains the epicenter due to its high population and the strong presence of ride-hailing platforms like Grab and Angkas. The need for efficient, affordable transportation options amidst heavy traffic has made these cities the key drivers of the market.

Market Segmentation

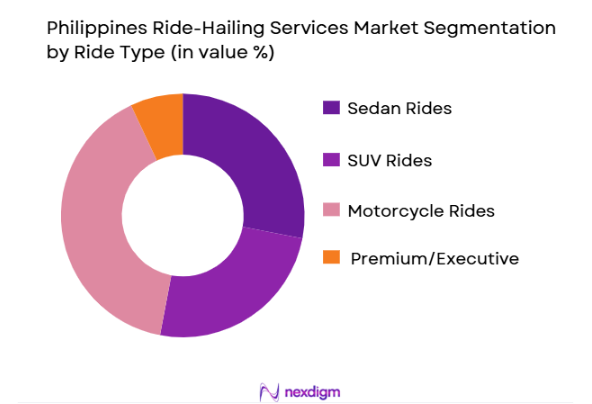

By Ride Type

The market is segmented into various ride types, with sedans, motorcycles, and SUVs forming the primary segments. Motorcycle rides, particularly through platforms like Angkas, have experienced significant demand due to their ability to navigate through dense traffic, making them ideal for short-distance commutes in congested urban areas. The convenience, speed, and affordability of motorcycle rides have propelled them to dominate the market share. Despite the growing popularity of SUVs and sedans, motorcycles continue to hold a dominant position in the Philippines ride-hailing services market.

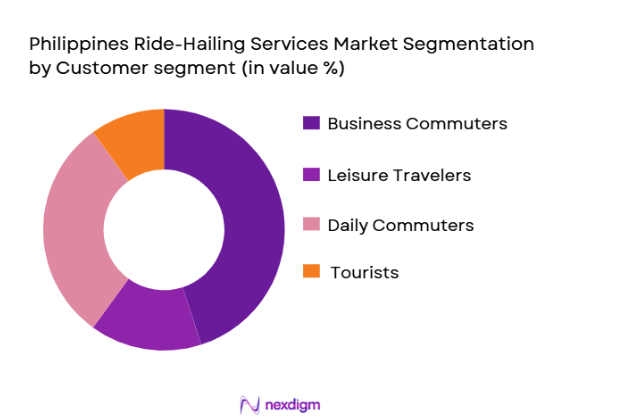

By Customer Segment

The customer segment is divided into business commuters, leisure travelers, daily commuters, and tourists. The business commuter segment leads the market due to the high concentration of professionals in Metro Manila and other major cities. These consumers are often willing to pay a premium for the convenience of reliable, quick transport. This segment continues to grow, driven by an increasing number of office-based professionals and the shift towards flexible work arrangements, where commuting becomes an essential aspect of their daily routine.

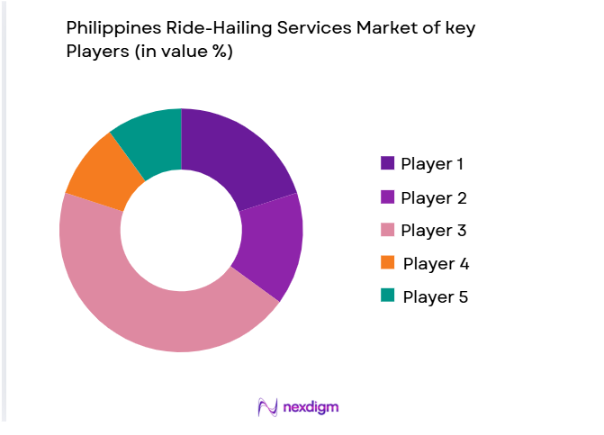

Competitive Landscape

The Philippines ride-hailing services market is characterized by intense competition among a few dominant players. Grab remains the market leader, followed by local players such as Angkas and newer entrants like Joyride and Micab. These platforms offer diverse services, including motorcycles, sedans, and even electric vehicles, catering to the varying needs of urban commuters. The market is highly competitive, with new players constantly entering, striving to capture market share by offering lower prices, superior customer service, and loyalty programs.

| Company | Establishment Year | Headquarters | Ride Types Offered | Technology Integration | Fleet Size | Market Reach |

| Grab | 2012 | Singapore | ~ | ~ | ~ | ~ |

| Angkas | 2016 | Manila, Philippines | ~ | ~ | ~ | ~ |

| Joyride | 2019 | Manila, Philippines | ~ | ~ | ~ | ~ |

| Micab | 2014 | Manila, Philippines | ~ | ~ | ~ | ~ |

| Lyft | 2012 | San Francisco, USA | ~ | ~ | ~ | ~ |

Philippines Ride-Hailing Services Market Analysis

Growth Drivers

Government Incentives

Government incentives are playing a significant role in the expansion of the ride-hailing services market in the Philippines. Policies that promote the growth of the transportation sector, including tax breaks and subsidies for ride-hailing operators, are fostering a favorable business environment. Additionally, regulatory frameworks are being established to better integrate ride-hailing services with traditional transport systems, providing consumers with more affordable and accessible options. These government efforts help improve market penetration, encourage foreign investments, and enhance the competitiveness of domestic players.

Increasing Electric Vehicle Adoption

The increasing adoption of electric vehicles (EVs) is a key driver in the Philippines ride-hailing services market. The shift towards EVs is being fueled by growing environmental awareness, government incentives, and rising fuel prices. EVs present a sustainable alternative to conventional vehicles, reducing emissions and operating costs for ride-hailing companies. As local regulations are being updated to support the transition to greener technologies, ride-hailing services that incorporate EVs are becoming an attractive choice for environmentally-conscious consumers. This shift is expected to enhance the overall market growth in the coming years.

Restraints

High Initial Costs

One of the major challenges in the Philippines ride-hailing services market is the high initial investment required for fleet acquisition and infrastructure setup. Purchasing vehicles, especially electric ones, involves significant capital expenditure. Furthermore, companies face challenges in terms of financing and managing operational costs, including driver compensation, maintenance, and insurance. The financial burden of scaling operations, coupled with the need for competitive pricing models, makes it difficult for smaller ride-hailing companies to gain market traction. This can limit the pace at which the industry evolves, especially for new entrants.

Lack of Charging Infrastructure

The lack of sufficient charging infrastructure is another obstacle hindering the growth of electric vehicle (EV) adoption in the ride-hailing sector. While the government is working to improve infrastructure, the limited number of EV charging stations makes it difficult for ride-hailing companies to rely on electric vehicles for their fleet. The inadequate charging network leads to longer wait times, operational inefficiencies, and additional costs for drivers, all of which hinder the scalability of EV adoption in the market. A more widespread and accessible charging infrastructure is essential for the long-term growth of the sector.

Opportunities

Rise in Demand for Smart Charging Solutions

With the increasing adoption of electric vehicles (EVs) in the ride-hailing sector, there is a growing demand for smart charging solutions. These solutions include advanced charging stations equipped with features such as fast charging, remote monitoring, and automated billing. The rise of smart charging technology presents an opportunity for companies to improve operational efficiency, reduce downtime for EVs, and enhance the overall customer experience. By leveraging smart charging infrastructure, ride-hailing operators can optimize their fleet management and offer more sustainable services to environmentally conscious consumers.

Private-public partnerships (PPPs)

Significant opportunities for the growth and development of the ride-hailing services market in the Philippines. Through these collaborations, ride-hailing companies can work alongside government agencies to address common challenges such as regulatory compliance, infrastructure development, and consumer safety. PPPs can also help in the adoption of green technologies like electric vehicles by facilitating the installation of charging stations and offering financial incentives. These partnerships can help bridge the gap between the public and private sectors, fostering a more sustainable and robust ride-hailing ecosystem.

Future Outlook

The Philippines ride-hailing services market is expected to continue its growth trajectory over the next five years. As urbanization accelerates and traffic congestion worsens, demand for affordable and convenient transportation solutions is set to increase. Innovations in ride-sharing technologies, such as electric vehicles and autonomous cars, will also contribute to market growth. Additionally, government initiatives to regulate the industry and improve infrastructure will further bolster market prospects. The Philippines is expected to see continued expansion of ride-hailing services into suburban and rural areas, increasing the market’s penetration across the archipelago.

Major Players in the Market

- Grab Philippines

- Angkas

- Joyride

- Micab

- Lyft

- SRide

- U-Hop

- Uber (Philippines operations)

- Owto

- Move It

- TaxiPH

- Gokada

- TNC Philippines

- Hype Transport Systems

- MPT Mobility (MPTC Group)

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Land Transportation Franchising and Regulatory Board, Department of Transportation, National Economic and Development Authority)

- Ride-Hailing Companies and Platforms

- Automotive Manufacturers and Suppliers

- Public Transport Operators and Innovators

- Technology Providers (AI, GPS, Mobile App Developers)

- Real Estate and Urban Development Companies

- Logistics and Delivery Companies

Research Methodology

Step 1: Identification of Key Variables

The initial phase focuses on identifying key variables affecting the Philippines ride-hailing market. This includes conducting in-depth secondary research and utilizing industry reports, government data, and company reports to construct a comprehensive understanding of the market’s ecosystem.

Step 2: Market Analysis and Construction

This phase involves analyzing historical data related to market size, fleet adoption, and growth trends. We will evaluate the competition, market penetration, and consumer behavior to form a foundation for the market model.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through consultations with industry experts, including executives from ride-hailing companies, government officials, and industry consultants. This stage ensures that assumptions are grounded in practical insights and industry data.

Step 4: Research Synthesis and Final Output

In the final phase, the findings from secondary research and expert consultations are synthesized to deliver a final market report. This includes cross-referencing data, refining estimates, and ensuring the overall report is aligned with current market trends and future outlooks.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Philippines-Specific Terminologies, Abbreviations, Market Sizing Logic, Bottom-Up & Top-Down Validation, Triangulation Framework, Primary Interviews Across Ride-Hailing Providers, Regulatory Bodies, Government Agencies, and Industry Experts, Demand-Side & Supply-Side Weightage, Data Reliability Index, Limitations & Forward-Looking Assumptions)

- Definition and Scope

- Market Genesis and Evolution Pathway

- Philippines Ride-Hailing Industry Timeline

- Ride-Hailing Business Cycle

- Supply Chain & Value Chain Analysis

- Key Growth Drivers

Urbanization and Increasing Traffic Congestion

Rising Disposable Income and Middle-Class Population

Government Regulations and Support for Ride-Hailing Growth

Technology Advancements in Ride-Hailing Platforms - Market Challenges

Regulatory Challenges and Compliance Costs

Fluctuating Fuel Prices and Operational Costs

Intense Competition Between Local and International Players

Public Perception and Trust in Ride-Hailing Services - Market Opportunities

Expansion into Underserved Regional Markets

Rising Demand for Electric and Eco-Friendly Ride-Hailing Options

Potential for Multi-Modal Transportation Solutions

Growth in Shared Mobility and Ride-Hailing Integration with Public Transport - Key Trends

Adoption of Artificial Intelligence and Machine Learning for Route Optimization

Shift Towards Cashless, Contactless Payments and Digital Wallets

Increasing Popularity of Safety Features

Rise of Subscription Services and Loyalty Programs - Regulatory & Policy Landscape

Philippine Land Transportation Franchising and Regulatory Board Regulations

Government Policies on Ride-Hailing Services and Driver Welfare

Local Government Rules and Taxes Impacting Ride-Hailing Operations - SWOT Analysis (Market Level)

- Stakeholder Ecosystem

- Porter’s Five Forces

- Competition Ecosystem

- By Value, 2019-2025

- By Volume, 2019-2025

- By Average Price, 2019-2025

- By Vehicle Type Adoption, 2019-2025

- By Service Type, 2019-2025

- By Region, 2019-2025

- By Ride Type (In Value %)

Sedan Rides

SUV Rides

Motorcycle Rides

Premium/Executive Rides

Pool Rides - By Customer Segment (In Value %)

Business Commuters

Leisure Travelers

Daily Commuters

Tourists - By Payment Model (In Value %)

Subscription-Based Payment

Pay-As-You-Go Payment

Prepaid Ride Credits - By Vehicle Type (In Value %)

Electric Vehicles (EVs)

Gasoline-Powered Vehicles

Hybrid Vehicles - By Region (In Value %)

Metro Manila

Central Luzon

Visayas

Mindanao

- Market Share Analysis by Value and Volume

Market Share of Major Players by Service Type

Market Share by Region - Cross Comparison Parameters (Product Portfolio Breadth, Technology Integration (Mobile App Features, AI, ML, GPS), Distribution Footprint and Geographic Reach, Regulatory Approvals and Certifications, Strategic Partnerships and Alliances, Customer Reach and Brand Loyalty, Ride-Hailing Service Pricing and Payment Models, Service Reliability and Customer Satisfaction)

- SWOT Analysis of Key Players

- Competitive Benchmarking of Key Players

- Pricing Analysis: Price Trends for Different Ride Types

- Comparison of Pricing Across Major Ride-Hailing Providers in the Philippines

- Detailed Company Profiles

Grab Philippines

Angkas

Lyft Philippines

Uber (in the Philippines Market)

Owto

Hype Transport Systems

Move It

Micab

TNC

Joyride

SRide

U-Hop

Uber Eats

MyTaxi.ph

Philippine Transport Services, Inc.

- Demand Patterns and Utilization Metrics

- Procurement Models and Decision-Making Processes for Ride-Hailing Companies

- Regulatory Compliance and Certification Expectations

- Consumer Needs, Desires & Pain-Point Mapping

- Decision-Making Framework for Service Adoption

- Cost vs. Convenience Trade-offs for Consumers

- By Value, 2026-2030

- By Volume, 2026-2030

- By Average Price, 2026-2030