Market Overview

The Philippines ride-sharing services market is valued at USD ~ billion based on a five-year historical analysis, led by urban expansion, rising smartphone adoption, and commuter preference for on-demand transportation platforms such as app-based ride-hailing and motorcycle taxi services. This valuation reflects adoption trends as commuters increasingly favor convenient, digital mobility solutions amid persistent traffic and gaps in public transport infrastructure. The growth aligns with the continuous shift from traditional transport to app-enabled ride sharing.

Metro Manila, Cebu, and Davao dominate the ride-sharing market due to high population density, severe traffic congestion, and relatively high disposable income, driving strong reliance on digital mobility options. Metro Manila’s urban sprawl limits the efficiency of conventional transport, while Cebu and Davao’s expanding urban economies and tourism appeal increase commuter demand for reliable, flexible transport services. These urban centers also have higher smartphone penetration and digital payment use, underpinning robust ride-sharing adoption.

Market Segmentation

By Service Type

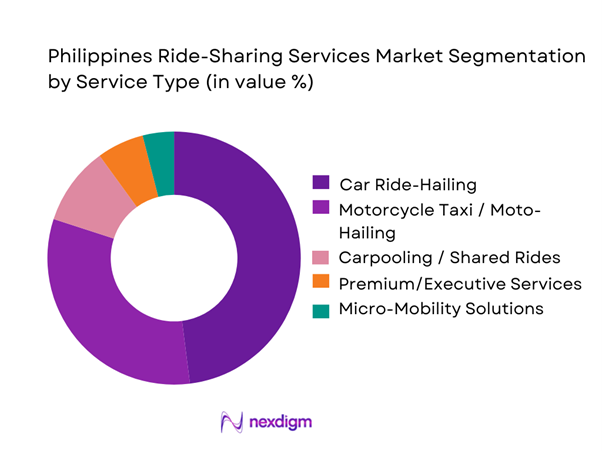

The ride-sharing market is segmented into car ride-hailing, motorcycle taxi (moto-hailing), carpooling or shared services, premium or executive mobility, and micro-mobility such as scooters and smaller on-demand vehicles. In ~, car ride-hailing remains the largest segment, driven by a broad base of consumers using app-based platforms for daily travel across metropolitan areas. This segment’s dominance stems from its versatility in catering to both short and longer intra-city journeys, offering comfort and safety compared with traditional transport. Additionally, car ride-hailing’s integration with digital payment systems and mapping technologies enhances user convenience, further reinforcing its market share. Meanwhile, motorcycle taxi services also hold a substantial share due to their ability to navigate congested urban streets quickly, especially in Metro Manila and Cebu, offering lower fare alternatives and fast point-to-point mobility for commuters seeking time-efficient travel.

By Payment Mode

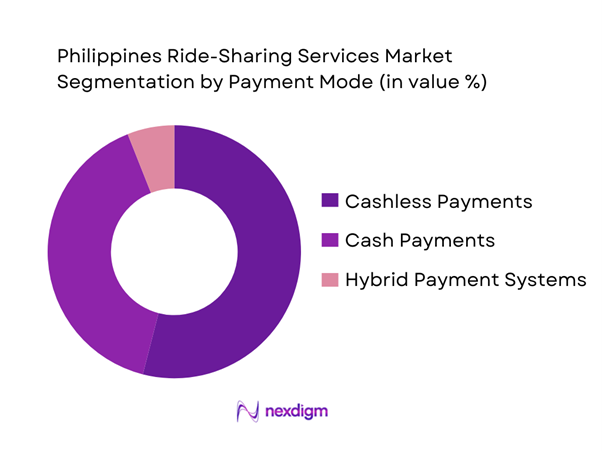

The Philippines ride-sharing market is segmented into cashless payments, cash payments, and hybrid systems. In ~, cashless payments dominate, largely due to the rapid growth of digital wallets which are widely used by riders for their convenience and security. Integration of digital wallets into ride-sharing apps has enabled frictionless transactions, reduced cash handling risks, and shortened boarding times, making them the preferred payment method for urban commuters. Merchants and platforms have also incentivized cashless usage through promotions and loyalty rewards, further driving acceptance. Conversely, cash payments remain significant, especially among occasional users and non-urban commuters who may have limited access to banking or digital payment tools, preserving cash as a familiar and trusted transaction method. Hybrid systems that allow both cash and cashless options cater to diverse user preferences but capture a smaller share as the digital infrastructure strengthens.

Competitive Landscape

The competitive environment in the Philippines ride-sharing market is concentrated among a mix of regional heavyweights and local operators. Grab Philippines remains a dominant force, with a strong brand presence and integrated service offerings that include car and motorcycle options. Emerging players like Angkas and inDrive have increased competitive intensity by leveraging specialized services and flexible pricing. Overall, consolidation among key platforms underscores their influence on mobility trends and consumer preferences.

| Company | Establishment Year | Headquarters | Active User Base | Service Types | Geographic Coverage | Revenue Growth | Customer Satisfaction |

| Grab Philippines | 2012 | Singapore | ~ | ~ | ~ | ~ | ~ |

| Angkas | 2016 | Philippines | ~ | ~ | ~ | ~ | ~ |

| JoyRide | 2019 | Philippines | ~ | ~ | ~ | ~ | ~ |

| inDrive | 2012 | Russia | ~ | ~ | ~ | ~ | ~ |

| Move It | 2019 | Philippines | ~ | ~ | ~ | ~ | ~ |

Philippines Ride-Sharing Services Market Analysis

Growth Drivers

Escalating urban traffic congestion and daily mobility demand

Ride-sharing demand in the Philippines is structurally underpinned by a very large, fast-moving daily mobility base concentrated in dense urban corridors. The country’s total population is ~ people, and the urban population alone is ~, a scale that compresses commuting, errands, and service trips into limited road space and fixed peak periods. The macro backdrop also matters because ride-hailing usage tracks disposable income and employment intensity in large cities, signaling the size of the formal and informal economic activity that must move people around every day. In parallel, public investment to expand capacity is ongoing but incremental relative to demand, improving certain bottlenecks but not eliminating citywide congestion frictions that make door-to-door on-demand trips valuable. In this context, ride-sharing becomes a practical congestion hedge, as users convert time uncertainty into app-managed dispatch, dynamic routing, and multi-option fulfillment across major urban centers. The large urban base also supports high trip frequency for work, education, and services, reinforcing habitual demand patterns even when total road capacity improvements lag overall city growth.

High smartphone penetration and digital payment adoption

Ride-sharing in the Philippines scales because discovery, booking, and payment are now largely digital. A core enabler is broad mobile data reach, indicating a huge addressable base for app-based mobility. On the payments side, national measurement shows monthly retail payments are increasingly cash-lite, with large digital retail payment value and transaction volume. This matters directly for ride-sharing because frictionless checkout supports repeat usage, subscription and loyalty mechanics, and lower cancellation risk at pickup. The operational proof is visible in fast payment rails that power in-app top-ups and peer-to-peer settlement behaviors, reflecting very large-scale real-time transfers that normalize pay-by-phone behavior alongside mobility use cases. Together, high mobile broadband reach plus deepening digital payments create a market where platforms can scale dispatch, identity, and refunds while keeping unit operations efficient, which is critical for dense cities where trip frequency is high and consumer tolerance for checkout delays is low.

Challenges

Regulatory complexity under transport network vehicle service frameworks

Philippine ride-sharing operates inside an evolving, highly managed regulatory perimeter where capacity, operator accreditation, and compliance expectations directly shape supply availability and platform economics. The reported approval of multiple ride-hailing companies illustrates both market opening and oversight complexity, as more accredited entities require increased compliance monitoring, differentiated operating conditions, and broader stakeholder coordination across cities and service types. On the supply side, how many vehicles can legally operate is administratively governed rather than purely market-driven, showing that legal authorization is a hard gate to scale. Regulators also make tactical capacity adjustments ahead of peak-demand seasons, underscoring that supply expansion is often episodic and decision-led rather than continuous. For operators, this environment raises costs in documentation, compliance workflows, driver onboarding, and audit readiness, while for consumers it influences availability and service consistency across metro areas and second-tier cities. The net impact is that regulatory pathway design becomes a primary market variable rather than a background constraint.

Safety, insurance, and rider-driver trust issues

Trust is a core constraint because ride-sharing is an instant access service where consumers accept unknown counterparties and time-sensitive pickups. The formal accreditation of multiple operators expands consumer choice but also increases the need for consistent, auditable safety governance across platforms, including screening standards, incident reporting pathways, and service quality controls. The authorized TNVS base is large, raising the operational burden of ensuring standardized insurance coverage, driver compliance, and passenger protection across thousands of vehicles and driver partners. Digitalization helps but also introduces new trust surfaces, as rapid digital payment flows increase the importance of dispute handling, resolution processes, and fraud controls around mobility wallets and top-ups. At the macro level, the size of the population suggests that even low-incidence safety events can materially affect user perception when amplified through social channels. As a result, safety and insurance are not merely compliance items but brand-defining operating systems influencing repeat usage, driver retention, and regulator confidence.

Opportunities

Electric vehicle integration and sustainable mobility models

The strongest near-term pathway for EV-linked ride-sharing growth in the Philippines is not future EV counts, but the readiness of the country’s digital rails and regulated mobility supply to support new vehicle models, charging-linked payments, and fleet-grade controls. The legal TNVS foundation is already sizable, creating a realistic base for phased electrification through fleet operators, driver-partner financing programs, and city-led pilots. On payments infrastructure, high-volume digital retail payment flows and fast payment systems demonstrate that app-linked transactions are normalized at scale. Urban density strengthens the EV business case because electric vehicle total cost advantages are most meaningful in dense, stop-and-go duty cycles with high daily utilization. Infrastructure upgrades also matter operationally, as improved route continuity supports more predictable EV energy planning for fleets. The opportunity lies in building EV-ready ride-sharing bundles now using current-scale digital and regulatory foundations.

Corporate ride programs and enterprise mobility contracts

Enterprise mobility represents a high-leverage opportunity in the Philippines because it converts volatile consumer demand into contracted trip volumes with tighter service-level control over pickup reliability, safety standards, and reporting. The macro base supports this through a large, formalizing economy with expanding service sectors that generate predictable commuting and client-visit travel needs. Urban concentration strengthens the contractability of demand by creating dense clusters of offices, industrial parks, hospitals, and education hubs where enterprises can standardize mobility corridors and budgets. On the supply side, a regulated TNVS base enables platforms to segment supply for corporate tiers without operating outside the regulatory perimeter. Payment and reconciliation, often the biggest friction in corporate mobility, has become easier due to normalized digital payment infrastructure and real-time fund movement. These conditions allow ride-sharing platforms to sell enterprise contracts that bundle policy controls, duty-of-care features, and consolidated billing, turning mobility into a managed service line item for employers and institutions in major urban centers.

Future Outlook

The Philippines ride-sharing market is expected to grow steadily, propelled by expanding smartphone penetration, increasing preference for cashless transactions, and persistent urban mobility challenges. Operators are likely to enhance platform capabilities through route optimization, in-app safety features, and partnerships with local governments to align with regulatory frameworks. Expansion into tier-two and tier-three cities and service diversification, including electric vehicle integration and corporate mobility solutions, will further broaden user adoption and revenue streams. Evolving consumer expectations around speed, safety, and affordability will drive competitive innovation across platforms, making ride-sharing an integral component of urban transport ecosystems.

Major Players

- Grab Philippines

- Angkas

- JoyRide

- inDrive

- Move It

- Hype

- U-Hop

- Micab

- TaxiGo

- EasyTaxi

- Biyahero

- OWTO

- GoJek

- Lalamove

Key Target Audience

- Ride-Sharing and Mobility Platform Investors

- Transportation Network Companies Strategy Teams

- Public Transport Authorities

- Local Government Units

- Fleet Operators and Vehicle Providers

- Insurance and Financial Services

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

Research Methodology

Step 1: Identification of Key Variables

The initial research phase involved mapping major stakeholders within the ride-sharing ecosystem, including digital platforms, driver partners, and commuter segments. Secondary sources such as industry reports, government statistics, and app usage data were collected to define core market variables influencing revenue and utilization.

Step 2: Market Analysis and Construction

Historical data was compiled to assess revenue generation, service adoption rates, active user growth, and trip volumes. Payment modes, vehicle types, and geographic penetration were examined to derive a comprehensive market overview and ensure accuracy.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were developed and validated through interviews with industry practitioners, transportation policymakers, and mobility platform specialists to refine data accuracy. These interviews provided insights on operational trends and regulatory impacts.

Step 4: Research Synthesis and Final Output

Final insights were synthesized by reconciling primary and secondary findings, cross-verified against published market valuations and industry growth forecasts. This ensured a validated, precise analysis of market dynamics and competitive positioning.

- Executive Summary

- Research Methodology (Definitions, Market Scope & Ride-Sharing Service Criteria, Abbreviations & Industry Terms, Market Sizing Framework, Service Adoption & Utilisation Modeling, Mobile App Penetration & Digital Payment Integration Assumptions, Primary & Secondary Data Sources, Research Limitations & Assumptions)

- Industry Definition and Scope

- Genesis & Evolution of Ride-Sharing in the Philippines

- Transportation Ecosystem in the Philippines

- Ride-Sharing Value Chain & Ecosystem

- Demand-Supply Dynamics & Business Models

- Growth Drivers

Escalating urban traffic congestion and daily mobility demand

High smartphone penetration and digital payment adoption

Shift from traditional public transport to on-demand mobility

Smart mobility initiatives and transport modernization programs - Challenges

Regulatory complexity under transport network vehicle service frameworks

Safety, insurance, and rider-driver trust issues

Price competition and commission pressure on platforms

Urban infrastructure constraints and road congestion - Opportunities

Electric vehicle integration and sustainable mobility models

Corporate ride programs and enterprise mobility contracts

Expansion into tier-2 and tier-3 cities

Advanced data monetization and personalization engines - Trends

Professionalization of motorcycle taxi services

Bundling of mobility, delivery, and financial services

Increased adoption of cashless and wallet-based payments

AI-driven routing and surge pricing optimization - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- Installed Base, 2019–2024

- Service Revenue Mix, 2019–2024

- By Fleet Type (in Value %)

Standard Cars

SUVs and Premium Cars

Motorcycle Taxis

EV and Hybrid Fleets

Accessible and Special Needs Vehicles - By Application (in Value %)

Daily Commuting

Airport Transfers

Corporate and Business Travel

Night-Time and Leisure Travel

On-Demand Parcel and Logistics - By Technology Architecture (in Value %)

App-Based Aggregator Platforms

AI-Based Dynamic Pricing Platforms

Route Optimization and Navigation Engines

Data Analytics and Demand Forecasting Systems

Safety and Verification Technology Stacks - By Connectivity Type (in Value %)

Mobile Internet-Based Platforms

Integrated Digital Wallet Ecosystems

Cloud-Based Dispatch Systems

API-Integrated Super Apps

Standalone Ride-Hailing Applications - By End-Use Industry (in Value %)

Individual Consumers

Corporate Enterprises

Hospitality and Tourism

Retail and E-Commerce

Logistics and Last-Mile Delivery - By Region (in Value %)

Metro Manila

Metro Cebu

Metro Davao

Other Urban Clusters

Emerging Small Cities and Semi-Urban Areas

- Market Share Analysis by Revenue, Trips, and Active Users

- Cross Comparison Parameters (Service portfolio breadth, active driver fleet size, city coverage footprint, average rider ratings and safety scores, app downloads and user growth, customer retention metrics, fare structure and pricing strategy, regulatory compliance strength)

- SWOT Analysis of Major Players

- Pricing and Surge Strategy Benchmarking

- Detailed Company Profiles

Grab Philippines

Angkas

Move It

JoyRide

MiCab

U-Hop

Hype

OWTO

TaxiGo

Biyahero

inDrive

EasyTaxi

TNC

Owlto

- Ride usage patterns and commuter behavior

- Rider cohort profiling and spending bands

- Price sensitivity and loyalty determinants

- Service quality, safety perception, and satisfaction drivers

- Decision-making criteria and platform selection factors

- By Value, 2025–2030

- Installed Base, 2025–2030

- Service Revenue Mix, 2025–2030