Market Overview

The Philippines Road Sign Recognition Systems Market is valued at USD ~ million. This market is growing rapidly due to the increasing demand for road safety, efficient traffic management, and smart infrastructure. The recognition systems are primarily driven by advancements in AI and machine learning technologies, enabling real-time sign recognition and better traffic control. In addition, government policies aimed at enhancing road safety and urban mobility further contribute to the market’s expansion. As smart cities evolve, the need for automated solutions to monitor and manage road signs and traffic flow becomes critical, supporting the growth of this market.

The dominant regions driving the demand for road sign recognition systems in the Philippines are Metro Manila, Cebu, and Davao. Metro Manila, being the capital region, leads in terms of infrastructure development, particularly with government-led smart city initiatives. Additionally, Metro Manila’s high traffic volume and congestion issues make it a key area for the deployment of road sign recognition systems to improve traffic management and road safety. Similarly, other major cities like Cebu and Davao are adopting these systems as part of their urban mobility solutions. These cities are also influenced by global leaders in road safety technologies, such as the United States, Germany, and Japan, where advanced traffic management and autonomous vehicle technologies are driving global trends.

Market Segmentation

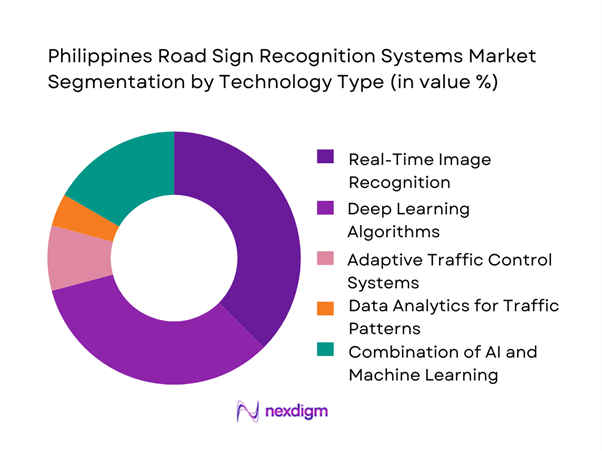

By Technology Type

The Philippines Road Sign Recognition Systems Market is segmented by technology type, with AI-powered road sign recognition systems leading the market. These systems are gaining dominance due to their superior capabilities in real-time sign detection and interpretation. They offer enhanced accuracy in recognizing a wide range of road signs under various environmental conditions, including adverse weather. The growing integration of AI into various transportation technologies is fueling the growth of AI-powered systems, which are becoming indispensable in the development of autonomous vehicles and smart city infrastructure.

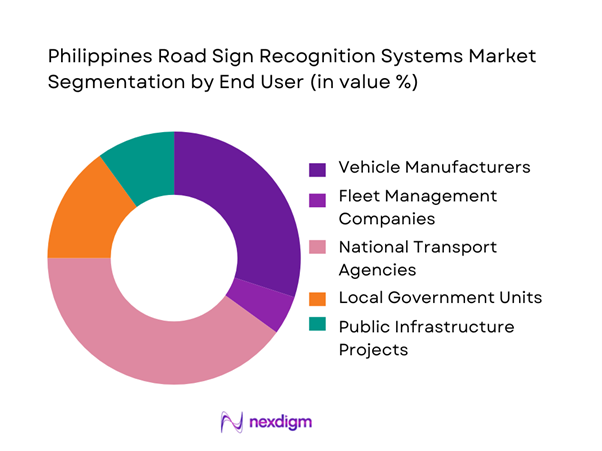

By End-Use

The end-user segment of the Philippines Road Sign Recognition Systems Market is dominated by government and regulatory agencies. These agencies are heavily investing in smart infrastructure and traffic management systems as part of their road safety initiatives. They are driving the adoption of these systems through government funding, public-private partnerships, and regulatory mandates. With the increasing focus on improving traffic management and road safety, government bodies are the key stakeholders in deploying road sign recognition systems across urban centers and highways.

Competitive Landscape

The Philippines Road Sign Recognition Systems Market is dominated by a few major players, including Sensys Gatso Group and global brands like Kapsch TrafficCom, Siemens Mobility, and FLIR Systems. This consolidation highlights the significant influence of these key companies. Their partnerships with government agencies and automotive OEMs, coupled with their technological advancements, have allowed them to maintain strong positions in the market. These companies are continuously innovating their product offerings to meet the growing demand for smart infrastructure and autonomous vehicle integration in the Philippines.

| Company Name | Establishment Year | Headquarters | Technology Type | Revenue | Product Portfolio |

| Sensys Gatso Group | 1957 | Netherlands | ~ | ~ | ~ |

| Kapsch TrafficCom | 1980 | Austria | ~ | ~ | ~ |

| Siemens Mobility | 1847 | Germany | ~ | ~ | ~ |

| FLIR Systems | 1978 | USA | ~ | ~ | ~ |

| Swarco AG | 1969 | Austria | ~ | ~ | ~ |

Philippines Road Sign Recognition Systems Market Analysis

Growth Drivers

Increased Government Investments in Smart Infrastructure

The Philippines government has been prioritizing smart city initiatives and infrastructure upgrades to enhance urban living. A key part of this vision includes adopting intelligent transportation systems (ITS) to improve traffic flow, reduce congestion, and increase public safety. Road sign recognition systems are integral to these projects, helping to automate traffic management and ensure compliance with road signs. By investing in these advanced technologies, the government is facilitating safer roads and more efficient urban mobility. These efforts are accelerating the deployment of road sign recognition systems across cities, creating substantial growth opportunities for technology providers in the market.

Growth in Autonomous Vehicle Adoption

The rapid growth in autonomous vehicle technology is significantly impacting the demand for road sign recognition systems in the Philippines. As self-driving cars become more common, there is a growing need for vehicles to navigate roads safely and efficiently. Road sign recognition plays a pivotal role in enabling autonomous vehicles to detect and respond to traffic signs, ensuring the vehicle adheres to traffic rules. As the adoption of autonomous vehicles accelerates, the integration of advanced recognition systems will be crucial. This growing trend is expected to boost demand for road sign recognition technology in both private and commercial fleets.

Challenges

High Initial Capital Investment

The high initial capital investment required for road sign recognition systems remains a significant barrier to their widespread adoption in the Philippines. These systems require advanced technologies, including artificial intelligence (AI), machine learning, and high-resolution cameras or sensors. The costs associated with procuring, installing, and maintaining these systems can be substantial, especially for smaller cities or local government units with limited budgets. While the long-term benefits of enhanced road safety and traffic management may justify the investment, the upfront costs can still limit broader deployment, especially in less urbanized regions where funding for infrastructure projects is constrained.

Lack of Standardization in Infrastructure

A notable challenge facing the Philippines Road Sign Recognition Systems Market is the lack of standardization in road signage across the country. Different municipalities may have variations in the design, size, or placement of traffic signs, making it difficult for recognition systems to accurately identify them. The absence of a unified standard for road signs across the nation can create integration issues, particularly when implementing road sign recognition technologies in rural or less-developed areas. This lack of consistency in road sign infrastructure limits the effectiveness of the systems and hinders their widespread adoption, complicating deployment and maintenance efforts.

Opportunities

Government Funding for Infrastructure Modernization

The Philippine government’s significant investment in infrastructure modernization presents a key opportunity for the road sign recognition systems market. The government has been prioritizing road safety initiatives as part of its broader urban development strategy, focusing on integrating smart technologies into transportation systems. As part of these efforts, road sign recognition systems are becoming a critical component of smart city projects. With increased funding for infrastructure upgrades and smart transportation solutions, the market for road sign recognition systems is poised for growth, as local governments and private sector partners work to implement these technologies across the country.

Rising Demand for Autonomous Vehicles

The increasing demand for autonomous vehicles is creating a substantial opportunity for the road sign recognition systems market. As the automotive industry accelerates its shift toward self-driving cars, these vehicles require precise and reliable systems to read and interpret road signs in real-time. Road sign recognition systems are essential to enabling autonomous vehicles to navigate safely and comply with traffic regulations. This growing trend offers companies providing these technologies a significant opportunity to supply solutions that enhance the functionality and safety of autonomous vehicles. As more automakers invest in this technology, the demand for road sign recognition systems will continue to rise.

Future Outlook

The future outlook for the Philippines Road Sign Recognition Systems Market is positive, with continued investments in smart city infrastructure and the growing demand for autonomous vehicles. As more cities and regions implement these systems to improve road safety and traffic management, the market will expand. Furthermore, advancements in AI and machine learning technologies will continue to drive innovation and improve system accuracy, making road sign recognition systems more accessible and cost-effective.

Major Players

- Sensys Gatso Group

- Kapsch TrafficCom

- Siemens Mobility

- FLIR Systems

- Swarco AG

- Iteris, Inc.

- Teledyne Technologies

- LG Electronics

- Hikvision Digital Technology

- Continental AG

- Geely Group

- Bosch Mobility Solutions

- Denso Corporation

- Panasonic Corporation

- Hitachi Ltd.

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Automotive Original Equipment Manufacturers

- Technology integrators and system developers

- Road safety and infrastructure agencies

- Smart city project developers

- Telecommunications service providers

- Public transport operators and fleet management companies

Research Methodology

Step 1: Identification of Key Variables

In this phase, we focus on identifying key market drivers, challenges, and trends that influence the Philippines Road Sign Recognition Systems Market. This is achieved through secondary research and expert interviews.

Step 2: Market Analysis and Construction

We analyze historical market data and trends to understand the current market structure and future potential. This involves assessing market penetration and adoption rates of key technologies.

Step 3: Hypothesis Validation and Expert Consultation

We validate our findings through expert consultations with key stakeholders in the transportation and infrastructure sectors. This helps refine our market hypotheses and ensures accuracy in the analysis.

Step 4: Research Synthesis and Final Output

The final step synthesizes all the findings into a comprehensive report that provides actionable insights and strategic recommendations for businesses and policymakers.

- Executive Summary

- Research Methodology (Market Definitions and Inclusions/Exclusions, Abbreviations, Topic-Specific Taxonomy, Market Sizing Framework, Revenue Attribution Logic Across Use Cases or Care Settings, Primary Interview Program Design, Data Triangulation and Validation, Limitations and Data Gaps)

- Definition and Scope

- Market Genesis and Evolution

- Usage / Value-Chain / Care-Continuum Mapping

- Business Cycle and Demand Seasonality

- Philippines Industry / Service / Delivery Architecture

- Growth Drivers

Increased Government Investments in Smart Infrastructure

Growth in Autonomous Vehicle Adoption

Advancements in AI and Machine Learning Technologies

Government Initiatives for Improved Road Safety

Expansion of Smart City and Urban Mobility Projects - Challenges

High Initial Capital Investment

Lack of Standardization in Infrastructure

Technological Integration Complexities

Limited Awareness and Adoption in Rural Areas

Regulatory Compliance and Safety Standards - Opportunities

Government Funding for Infrastructure Modernization

Rising Demand for Autonomous Vehicles

Expansion of Urban Mobility Solutions

Increase in Traffic Safety Concerns and Road Accidents

Growing Public-Private Partnerships for Infrastructure Projects - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- By Volume, 2019–2024

- By Market Penetration Rat, 2019–2024

- By Technology Type (in Value %)

Artificial Intelligence (AI)-Driven Systems

Machine Learning-Based Systems

Hybrid Recognition Systems

Cloud-Based Systems

On-Premise Systems - By End-User Type (in Value %)

Automotive OEMs

Government and Regulatory Agencies

Road Safety and Infrastructure Agencies

Public Transportation Operators

Fleet Management Companies - By Technology / Product / Platform Type (in Value %)

AI-Powered Road Sign Recognition

Camera-Based Systems

LiDAR-Based Systems

Radar-Based Systems

Ultrasonic Sensor Systems - By Deployment / Delivery / Distribution Model (in Value %)

Cloud-Based Delivery

On-Premise Deployment

Hybrid Deployment - By Region (in Value %)

National Capital Region (NCR)

Central Luzon

Southern Luzon

Visayas and Mindanao

- Competition ecosystem overview

- Cross Comparison Parameters (AI Adoption Rate, Technology Integration Complexity, Government Partnerships, System Accuracy, Geographic Reach, Price Sensitivity, R&D Investments, Customer Segmentation)

- SWOT analysis of major players

- Pricing and commercial model benchmarking

- Detailed Profiles of Major Companies

Sensys Gatso Group

Kapsch TrafficCom

Siemens Mobility

FLIR Systems

Swarco AG

Iteris, Inc.

Teledyne Technologies

LG Electronics

Hikvision Digital Technology

Continental AG

Geely Group

Bosch Mobility Solutions

Denso Corporation

Panasonic Corporation

Hitachi Ltd.

- Buyer personas and decision-making units

- Procurement and contracting workflows

- KPIs used for evaluation

- Pain points and adoption barriers

- By Value, 2025–2030

- By Volume, 2025–2030

- By Market Penetration Rat, 2025–2030