Market Overview

The Philippines Roll Cages market current size stands at around USD ~ million, reflecting steady expansion driven by logistics modernization and organized retail growth. Recent market valuation has moved from USD ~ million to USD ~ million, indicating rising institutional demand from distribution networks and fulfillment operators. Deployment levels have crossed ~ units across large retail chains and parcel hubs, supported by replacement cycles and operational efficiency programs. Growth momentum is reinforced by increasing warehouse automation initiatives and the transition from disposable handling solutions to reusable transport equipment across major supply chains.

Market demand is primarily concentrated in Metro Manila, Central Luzon, and CALABARZON due to dense retail networks, proximity to ports, and advanced logistics infrastructure. These regions benefit from higher concentration of distribution centers, third-party logistics operators, and e-commerce fulfillment hubs. The presence of organized retail formats, pharmaceutical distributors, and cold chain operators further accelerates adoption. Supportive local government initiatives for logistics parks and industrial zones have strengthened ecosystem maturity, encouraging standardized material handling solutions and consistent fleet upgrades.

Market Segmentation

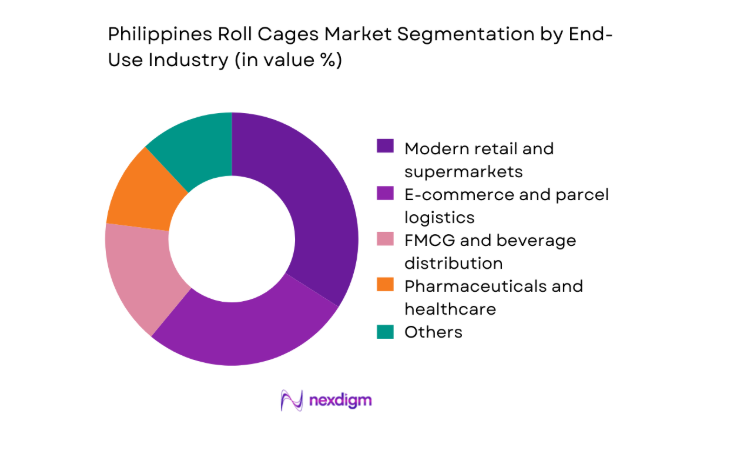

By End-Use Industry

The modern retail and supermarket segment dominates the Philippines Roll Cages market due to high-frequency store replenishment cycles and centralized distribution models. Large grocery chains operate regional hubs supplying ~ outlets daily, creating sustained demand for durable and standardized cages. E-commerce and parcel logistics follow closely, driven by last-mile efficiency requirements and reverse logistics volumes. Pharmaceutical distribution is gaining traction as compliance-driven handling practices favor enclosed and hygienic transport solutions. Hospitality and commercial laundry operators contribute niche demand, while manufacturing facilities adopt roll cages mainly for internal material movement and assembly line support.

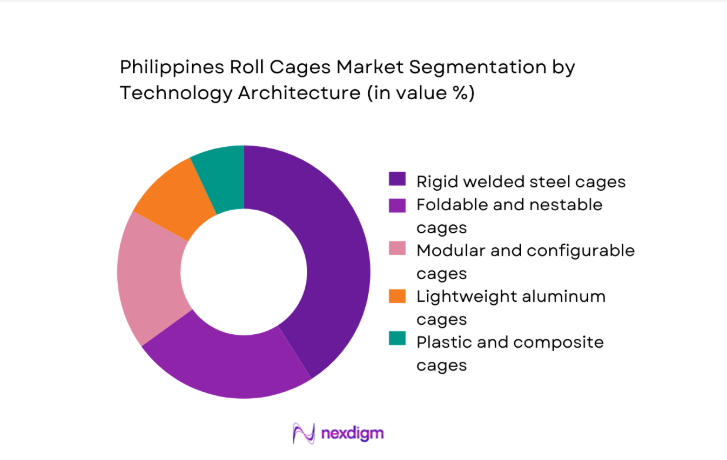

By Technology Architecture

Rigid welded steel cages currently lead adoption due to durability and cost efficiency in high-impact logistics environments. Foldable and nestable designs are gaining share as space optimization becomes a priority in urban backrooms and micro-fulfillment facilities. Modular and configurable cages are increasingly preferred by third-party logistics operators managing multi-client operations, enabling flexible reconfiguration. Lightweight aluminum cages are seeing selective uptake in high-frequency manual handling settings to reduce worker fatigue. Plastic and composite cages remain limited to hygiene-sensitive applications such as pharmaceuticals and food service distribution.

Competitive Landscape

The Philippines Roll Cages market shows moderate concentration, with a mix of global material handling solution providers and regional suppliers serving organized retail and logistics clients. Competition is shaped by product durability, customization capability, and local service presence rather than price leadership alone. Large buyers favor vendors offering standardized fleets, reliable delivery timelines, and strong after-sales support, while smaller distributors rely on importers and local fabricators for cost-efficient alternatives.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| SSI Schaefer | 1937 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| Schoeller Allibert | 1966 | Netherlands | ~ | ~ | ~ | ~ | ~ | ~ |

| ORBIS Corporation | 1849 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Wanzl Metallwarenfabrik | 1947 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| Nilkamal Material Handling | 1981 | India | ~ | ~ | ~ | ~ | ~ | ~ |

Philippines Roll Cages Market Analysis

Growth Drivers

Expansion of modern retail and organized warehousing

The rapid expansion of organized retail networks has significantly increased demand for standardized handling equipment across distribution and store replenishment operations. Large retail groups now operate centralized hubs processing over ~ units of goods daily, requiring consistent cage fleets for outbound and inbound flows. The transition from manual handling to semi-automated sorting has also increased replacement cycles for durable cages. Between recent operating periods, fleet additions have exceeded ~ units among top retailers, reflecting growing reliance on reusable transport solutions to reduce packaging waste and improve operational turnaround time.

Rapid growth of e-commerce and parcel delivery volumes

The surge in e-commerce activity has reshaped logistics workflows, increasing the need for efficient material handling at fulfillment centers and cross-dock facilities. Parcel operators handling over ~ shipments daily now depend on roll cages to streamline batch sorting and last-mile staging. Recent capacity expansions have added ~ systems of cage-based handling across urban hubs. This growth has driven higher utilization rates and accelerated procurement cycles, as operators prioritize asset standardization to support multi-shift operations and minimize handling time per consignment.

Challenges

High upfront cost of durable roll cage fleets

The acquisition of high-quality roll cages represents a significant capital commitment for logistics providers and mid-sized retailers. Initial deployment of ~ units can require investment levels reaching USD ~ million, making budget approvals complex for cost-sensitive operators. Smaller distributors often delay upgrades, relying on aging fleets that increase maintenance frequency. This cost barrier slows market penetration beyond tier-one buyers and limits adoption in secondary cities, where operational volumes may not yet justify large-scale fleet investments.

Loss, theft, and damage in open logistics networks

Asset loss remains a persistent issue in decentralized logistics environments where cages circulate across multiple handover points. Annual attrition levels of ~ units have been reported in large distribution networks, driven by inadequate tracking and accountability. Damage rates also remain high due to improper stacking and overloading, reducing effective fleet life. These factors increase replacement spending and discourage some operators from investing in premium cages, reinforcing a preference for lower-cost alternatives with shorter service lifecycles.

Opportunities

Growth of pooled asset models for shared cage fleets

Shared equipment pooling presents a strong opportunity to lower entry barriers for smaller logistics operators and retailers. Pooling programs managing ~ units across multi-client networks enable users to access standardized cages without heavy upfront investments. Early pilots in urban distribution corridors have demonstrated improved utilization rates and reduced loss levels through centralized asset management. As awareness of total lifecycle cost benefits increases, pooled models are expected to attract regional distributors seeking flexibility and scalability without long-term capital lock-in.

Adoption of RFID and IoT for asset visibility

The integration of RFID tags and IoT sensors into roll cages offers a pathway to address loss, misuse, and inefficient circulation. Recent deployments have connected ~ systems across large fulfillment centers, enabling real-time location tracking and utilization monitoring. These solutions have helped reduce annual shrinkage by ~ units in pilot programs while improving turnaround time between facilities. As technology costs decline, smart cage adoption is expected to expand beyond top-tier logistics operators into mid-sized retail supply chains.

Future Outlook

The Philippines Roll Cages market is set to evolve alongside the country’s logistics and retail transformation agenda. Continued growth of e-commerce, regional distribution hubs, and cold chain infrastructure will sustain demand for durable and standardized handling solutions. Over the coming years, greater emphasis on asset visibility, sustainability, and shared equipment models will redefine procurement strategies. Market participants that align with operational efficiency and service reliability expectations are likely to strengthen their long-term positioning.

Major Players

- SSI Schaefer

- Schoeller Allibert

- ORBIS Corporation

- Wanzl Metallwarenfabrik

- Nilkamal Material Handling

- Tosca

- K. Hartwall

- Dematic

- Daifuku

- Jungheinrich

- Toyota Material Handling

- Kardex

- Interroll

- GWP Group

- Creform Corporation

Key Target Audience

- Organized retail chains and supermarket groups

- E-commerce fulfillment and parcel logistics operators

- Third-party logistics service providers

- Pharmaceutical and healthcare distributors

- Hospitality and commercial laundry operators

- Manufacturing and assembly plant managers

- Investments and venture capital firms

- Government and regulatory bodies including the Department of Trade and Industry and the Board of Investments

Research Methodology

Step 1: Identification of Key Variables

Core market variables were defined around application demand, fleet deployment patterns, and technology adoption levels. Emphasis was placed on understanding operational workflows in retail, logistics, and healthcare distribution. Key performance indicators were structured to capture utilization intensity and replacement cycles.

Step 2: Market Analysis and Construction

Data points were organized across supply and demand dimensions to build a consistent market framework. Segmentation logic was aligned with end-use behavior and technology preferences. Trend mapping focused on logistics modernization and asset management practices.

Step 3: Hypothesis Validation and Expert Consultation

Industry inputs were used to validate assumptions around growth drivers, cost barriers, and technology adoption. Operational insights helped refine market dynamics and buyer behavior patterns. Feedback loops ensured alignment with real-world procurement and deployment conditions.

Step 4: Research Synthesis and Final Output

Findings were consolidated into an integrated market narrative supported by structured analysis. Strategic implications were distilled for stakeholders across the value chain. Final outputs were reviewed for consistency, clarity, and decision-oriented relevance.

- Executive Summary

- Research Methodology (Market definitions and scope boundaries, roll cage taxonomy across motorsport off road and performance safety applications, market sizing logic by vehicle build volume and kit penetration rates, revenue attribution across materials fabrication and installation services, primary interview program with fabricators motorsport teams and performance workshops, data triangulation validation assumptions and limitations)

- Definition and Scope

- Market evolution

- Usage pathways across retail and logistics

- Ecosystem structure

- Supply chain and channel structure

- Regulatory environment

- Growth Drivers

Expansion of modern retail and organized warehousing

Rapid growth of e-commerce and parcel delivery volumes

Shift toward reusable transport equipment for cost efficiency

Rising labor costs driving demand for ergonomic handling solutions

Improvement in cold chain and pharma distribution networks

Increased outsourcing to third-party logistics providers - Challenges

High upfront cost of durable roll cage fleets

Loss, theft, and damage in open logistics networks

Limited standardization across retailers and logistics firms

Import dependency for premium cage designs

Low awareness of lifecycle cost benefits among SMEs

Space constraints in urban backrooms and DCs - Opportunities

Growth of pooled asset models for shared cage fleets

Adoption of RFID and IoT for asset visibility

Rising demand from dark stores and micro-fulfillment centers

Localization of manufacturing and assembly in the Philippines

Customization for temperature-controlled and pharma logistics

Sustainability-driven shift from single-use packaging to reusable cages - Trends

Move toward foldable and space-saving cage designs

Integration of asset tracking in large retail chains

Increasing use of aluminum for lightweight handling

Standardization of cage footprints in regional DCs

Partnerships between logistics firms and equipment suppliers

Growing emphasis on ergonomic and safety-certified designs - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2019–2024

- By Volume, 2019–2024

- By Installed Base, 2019–2024

- By Average Selling Price, 2019–2024

- By Fleet Type (in Value %)

Owned fleets

Rental and leasing fleets

Third-party logistics pooled fleets

Retailer-managed shared fleets - By Application (in Value %)

Store replenishment and backroom handling

Distribution center picking and sorting

Last-mile delivery and returns

Laundry and linen transport

Waste and recycling collection - By Technology Architecture (in Value %)

Rigid welded steel cages

Foldable and nestable cages

Modular and configurable cages

Lightweight aluminum cages

Plastic and composite cages - By End-Use Industry (in Value %)

Modern retail and supermarkets

E-commerce and parcel logistics

FMCG and beverage distribution

Pharmaceuticals and healthcare

Hospitality and commercial laundries

Manufacturing and assembly plants - By Connectivity Type (in Value %)

Non-connected standard cages

Barcode and asset-tagged cages

RFID-enabled tracking cages

IoT and sensor-integrated smart cages - By Region (in Value %)

National Capital Region

Luzon excluding NCR

Visayas

Mindanao

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (product durability, customization capability, local service presence, delivery lead time, pricing competitiveness, after-sales support, sustainability credentials, fleet management solutions)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

SSI Schaefer

Schoeller Allibert

ORBIS Corporation

K. Hartwall

Wanzl Metallwarenfabrik

Nilkamal Material Handling

Tosca

Dematic

Daifuku

Jungheinrich

Toyota Material Handling

Kardex

Interroll

GWP Group

Creform Corporation

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2025–2030

- By Volume, 2025–2030

- By Installed Base, 2025–2030

- By Average Selling Price, 2025–2030