Market Overview

The Philippines Roof Panels Market is valued at USD ~ in 2024. This market is driven by increasing construction activities across residential, commercial, and industrial sectors. The growing urbanization, coupled with rising demand for durable and energy-efficient roofing materials, has further contributed to the market’s expansion. Roof panels in the Philippines are particularly critical due to the country’s vulnerability to typhoons and tropical storms. As a result, materials such as metal roofing systems have gained prominence due to their strength, energy efficiency, and resistance to harsh weather conditions.

Metro Manila, Cebu, and Davao are the primary cities driving demand within the Philippines Roof Panels Market. Metro Manila, as the country’s economic center, sees the highest demand for roof panels due to its ongoing urban expansion, which includes both residential and commercial buildings. Cebu and Davao also see significant demand due to increasing investments in infrastructure and housing, supported by both private and public sector initiatives. These regions dominate because of their centralized roles in construction activities and substantial economic growth.

Market Segmentation

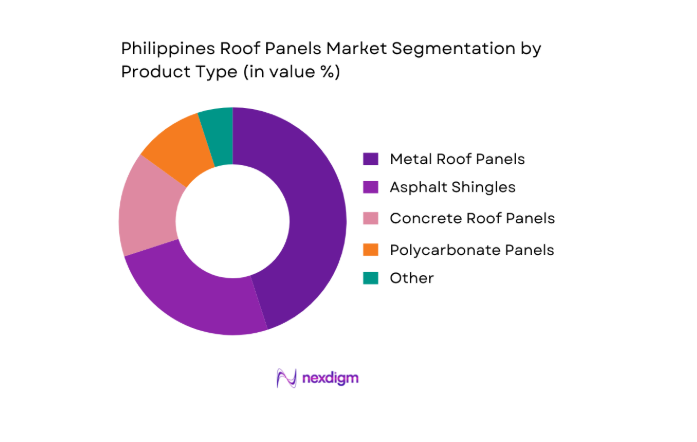

By Product Type

The Philippines Roof Panels Market is predominantly segmented into metal roof panels, asphalt shingles, concrete roof panels, polycarbonate panels, and others. Among these, metal roof panels hold the dominant position in the market. The primary reason for this is the strong demand for materials that offer durability, energy efficiency, and resistance to extreme weather, especially in the Philippines’ tropical climate. Metal roof panels, such as galvanized steel and aluminum, are widely used in residential and commercial construction. Their ability to withstand typhoons and high winds makes them the preferred choice in areas prone to natural disasters. Companies like Colorsteel and Philsteel are heavily focused on enhancing the properties of metal panels, offering various coatings and finishes that improve durability and aesthetics.

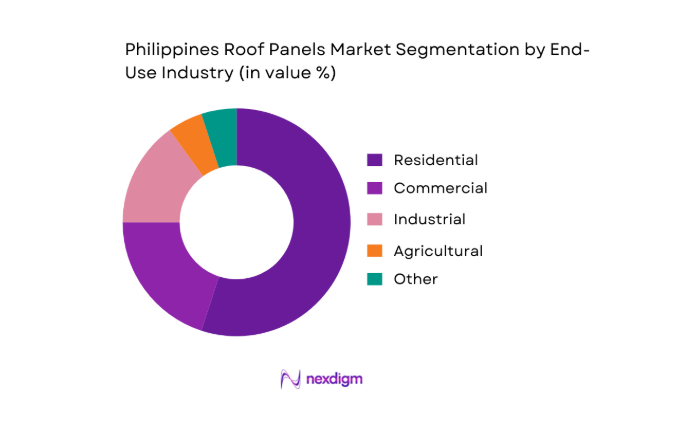

By End-Use Industry

In the Philippines, the residential roofing segment holds the largest market share. This segment benefits from the rapid growth in housing demand, driven by both private sector developments and government-sponsored housing programs aimed at improving living conditions for the growing population. Additionally, remittances from overseas Filipino workers (OFWs) have played a significant role in financing housing projects across the country. Roof panels, particularly metal panels, are favored in residential construction due to their affordability, durability, and ease of installation. These panels also provide better thermal insulation, making them suitable for tropical climates.

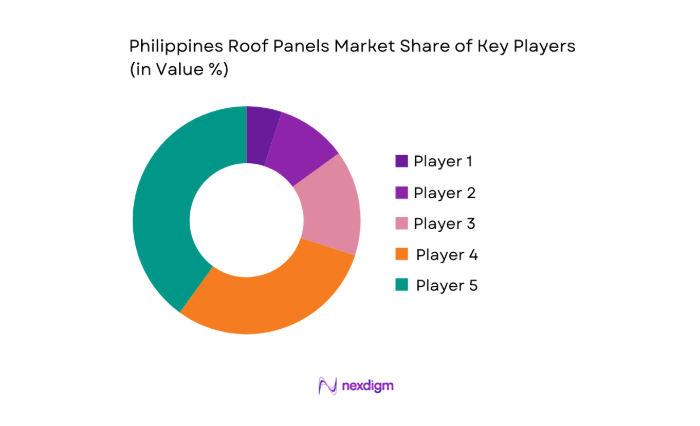

Competitive Landscape

The Philippines Roof Panels market is dominated by a few major players, including Colorsteel Systems Corporation and global brands like Philsteel Holdings Corporation, Union Galvasteel, and Jacinto Color Steel. This consolidation highlights the significant influence of these key companies in driving innovation, expanding their distribution networks, and maintaining strong brand loyalty across the market.

| Company | Establishment Year | Headquarters | Product Type | Market Reach | Capacity (m²) | Innovation Focus |

| Colorsteel | 1985 | Quezon City, Philippines | ~ | ~ | ~ | ~ |

| Philsteel | 1979 | Pasig City, Philippines | ~ | ~ | ~ | ~ |

| Union Galvasteel | 1991 | Caloocan City, Philippines | ~ | ~ | ~ | ~ |

| Sheehan Inc. | 1990 | Makati City, Philippines | ~ | ~ | ~ | ~ |

| Jacinto Color Steel | 1988 | Makati City, Philippines | ~ | ~ | ~ | ~ |

Philippines Roof Panels Market Analysis

Growth Drivers

Housing Backlog and Subdivision Development Activity

The growing housing backlog and increased subdivision development activities are significant drivers for the demand for construction materials, including steel panels and building components. As urbanization continues and housing demand outpaces supply, there is a strong push to develop more residential communities to address the backlog. Subdivision developers require efficient and cost-effective building materials to complete housing projects at scale, which drives the need for high-quality steel products like roofing and wall panels. This increased housing development activity ensures a steady demand for construction materials, creating a consistent market opportunity for steel product suppliers.

Warehouse Logistics Expansion and Industrial Estate Growth

The rapid expansion of warehouse logistics and industrial estates further fuels demand for construction materials, particularly for steel-based structures. The growing e-commerce sector, increasing trade volumes, and the need for larger distribution centers are leading to the development of modern logistics infrastructure. Industrial estates, which require high-quality building materials for warehouses, manufacturing plants, and storage facilities, are expanding as well. This trend is a key growth driver for the steel industry, as these developments demand durable, reliable, and cost-effective materials like insulated panels and structural steel for large-scale industrial buildings and warehouses.

Challenges

Steel Price Volatility and Import Exposure

One of the key challenges facing the steel industry is the volatility in steel prices, which can be influenced by fluctuations in raw material costs, transportation fees, and global supply chain disruptions. Steel is often imported, and international price variations can lead to significant price hikes, affecting cost predictability for construction projects. These price changes can make it difficult for manufacturers and developers to budget effectively, which impacts the overall profitability of projects. The reliance on steel imports also exposes the market to potential risks, including tariffs, trade restrictions, and currency fluctuations, further complicating the cost structure for end-users.

Quality Variation and Counterfeit Risks in Retail Channels

The presence of quality variation and counterfeit products in retail channels poses a significant challenge to the steel industry. In some markets, lower-quality or counterfeit steel panels and materials are being sold as authentic products, undermining the reputation of legitimate suppliers and impacting customer trust. These substandard products often fail to meet safety or durability standards, leading to issues in construction projects, including poor insulation performance, structural failures, and higher maintenance costs. For consumers and contractors, the risk of purchasing low-quality or counterfeit materials becomes a major concern, making it difficult to distinguish between reliable and unreliable suppliers in the marketplace.

Opportunities

Premiumization through Insulated Sandwich Panels

The trend toward premiumization offers significant opportunities in the market for steel-based materials, particularly through the adoption of insulated sandwich panels. These panels offer excellent thermal insulation properties and are ideal for use in both residential and commercial construction, particularly in regions with extreme weather conditions. Insulated sandwich panels provide better energy efficiency, soundproofing, and overall comfort, which are increasingly in demand by consumers and businesses alike. By offering high-quality, energy-efficient building materials, manufacturers can tap into the growing trend for sustainable and cost-saving solutions, increasing the appeal of their products to environmentally-conscious builders and developers.

Local Roll Forming Capacity Expansion and Customization Services

Expanding local roll forming capacity and offering customization services presents an opportunity for growth in the steel industry. Roll forming allows manufacturers to produce steel panels and other components in various shapes and sizes, meeting specific customer requirements for both commercial and residential construction. By investing in local production capabilities, companies can reduce lead times, lower transportation costs, and offer tailored solutions to meet the needs of developers, contractors, and manufacturers. Providing customized products that cater to specific project requirements not only enhances product appeal but also gives manufacturers a competitive edge in the marketplace, catering to a growing demand for personalized construction materials.

Future Outlook

Over the next few years, the Philippines Roof Panels Market is expected to experience steady growth driven by increased urbanization, the expansion of infrastructure projects, and the growing demand for sustainable roofing solutions. As more consumers and businesses prioritize energy efficiency and climate resilience, the adoption of metal and solar-ready roof panels will increase. With a continued focus on affordable housing and government-driven initiatives, the market is well-positioned to grow in the forecast period.

Major Players

- Colorsteel Systems Corporation

- Philsteel Holdings Corporation

- Union Galvasteel Corporation

- Jacinto Color Steel Inc.

- Sheehan Inc.

- Puyat Steel Corporation

- Onduline Philippines

- Metalink Manufacturing Corporation

- Kingspan Group

- Ultra Insulated Panel Systems Corp.

- Terreal Philippines

- Sanlex Roofmaster Center Co Inc.

- Mactan Steel Fabricators, Inc.

- Grandspan Steel Corporation

- Lamyco

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Real estate developers

- Construction contractors

- Retailers and distributors of roofing materials

- Architectural firms

- Energy efficiency consultants

- Roofing installers and maintenance service providers

Research Methodology

Step 1: Identification of Key Variables

This phase involves constructing an ecosystem map encompassing all relevant market drivers, including construction activities, government regulations, and technological advancements in roof panels. Secondary research, supported by public reports and proprietary databases, identifies key market parameters.

Step 2: Market Analysis and Construction

Data on historical market performance, including construction activity and material consumption, is analyzed. This step involves evaluating trends in metal roof panel adoption, end-user demand, and the relationship between material costs and demand growth.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed based on historical data and are further validated through expert interviews with industry stakeholders. These consultations provide insights into current market dynamics, consumer preferences, and the regulatory landscape.

Step 4: Research Synthesis and Final Output

The final stage synthesizes all data, including expert feedback, to generate a comprehensive market analysis. This process involves cross-referencing findings from primary research and secondary data sources to ensure accuracy and reliability.

- Executive Summary

- Research Methodology (Market definitions and scope boundaries, terminology and abbreviations, roof panel product taxonomy and standards mapping, market sizing logic by area installed and average selling price, channel and contractor ecosystem mapping, primary interview program with developers contractors distributors and manufacturers, data triangulation and validation approach, assumptions limitations and data gaps)

- Definition and Scope

- Market Genesis and Evolution of Roof Panel Adoption in the Philippines

- Construction Cycle Linkage and Seasonal Demand Patterns

- Material Preference Drivers for Coastal Humidity Heat and Typhoon Exposure

- Supply Chain Structure Across Importers Mills Rollformers and Distributors

- Growth Drivers

Housing backlog and subdivision development activity

Warehouse logistics expansion and industrial estate growth

Replacement demand from typhoon related roof damage - Challenges

Steel price volatility and import exposure

Quality variation and counterfeit risks in retail channels

Skilled installer shortages and workmanship quality gaps - Opportunities

Premiumization through insulated sandwich panels

Local roll forming capacity expansion and customization services

Specification penetration in green building and energy codes - Trends

Shift toward pre painted corrosion resistant metal roofing

Rising use of insulated panels for thermal comfort and energy savings - Regulatory & Policy Landscape

- SWOT Analysis

- Porter’s Five Forces

- By Value, 2019–2024

- By Area Installed, 2019–2024

- By Average Selling Price, 2019–2024

- By New Build vs Renovation Split, 2019–2024

- By Fleet Type (in Value %)

Residential housing

Commercial buildings

Industrial facilities and warehouses - By Application (in Value %)

New construction roofing

Retrofit and re roofing

Roof insulation and thermal upgrades

Storm damage replacement - By Technology Architecture (in Value %)

Long span roll formed metal roofing

Sandwich panels with insulation core

Standing seam roofing systems

Stone coated steel roofing - By Connectivity Type (in Value %)

Direct to project contractor supply

Distributor and dealer led supply

Retail and hardware channel supply - By End-Use Industry (in Value %)

Real estate developers

General contractors and roofing contractors

Manufacturing and logistics operators

Public infrastructure and institutional buyers

- Market share of Major Players

- Cross Comparison Parameters (corrosion resistance grade, coating type and thickness, panel profile and span capability, thermal performance and insulation core options, wind uplift rating suitability, warranty length and claim terms, lead time and custom length capability, installed cost per square meter)

- SWOT analysis of major players

- Pricing and benchmarking

- Detailed Profiles of Major Companies

Puyat Steel Corporation

DN Steel Group

Union Galvasteel Corporation

Boral Roofing Philippines

BlueScope Lysaght Philippines

SteelAsia Manufacturing Corporation

Apo Cement and Building Solutions

Bostik Philippines

Patents and Proprietary Roofing Systems Philippines

Republic Steel and Roofing Supply

MC Home Depot Roofing Supply Network

CitiHardware Roofing and Building Materials

Wilcon Depot Roofing and Building Materials

Matimco Incorporated

Topline Steel and Roofing Center

- Developer specification drivers and project procurement models

- Contractor selection criteria and installation workflow preferences

- Homeowner buying behavior across price durability and aesthetics

- Warranty claim drivers and service expectations

- By Value, 2025–2030

- By Area Installed, 2025–2030

- By Average Selling Price, 2025–2030

- By New Build vs Renovation Split, 2025–2030