Market Overview

The Philippines Smart Blood Pressure Monitors market is valued at USD ~ million, rising to USD ~ million, based on a five-year historical baseline and a forward curve anchored to country statistics (base revenue of USD ~ million with an ~% growth trajectory). These revenues are being propelled by the country’s high hypertension burden and growing normalization of home monitoring (upper-arm cuffs remain the default “trusted” form factor for clinical comparability), alongside rising use of app-enabled tracking for long-term BP diaries and medication adherence.

Demand is concentrated in Metro Manila (NCR), Cebu, and Davao because these urban centers combine higher household purchasing power, dense hospital and clinic networks, and stronger pharmacy + e-commerce fulfillment that supports branded medical devices and warranty handling. The Philippines’ buyer preference also skews toward products that can be physician-recommended and easily validated in clinical workflows, which is more common in large tertiary hospital catchments and specialist cardiology practices typically clustered in major cities. Data privacy and device registration compliance further advantage organized brands with established local distribution.

Market Segmentation

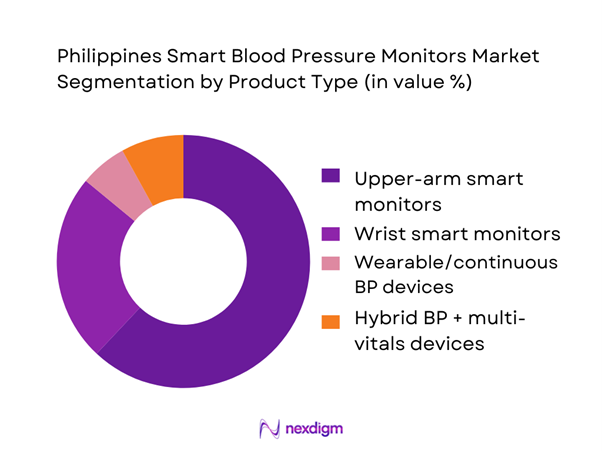

By Product Type

The Philippines Smart Blood Pressure Monitors market is segmented by product type into upper-arm smart monitors, wrist smart monitors, wearable/continuous BP devices, and hybrid BP + multi-vitals devices. Recently, upper-arm smart monitors dominate because they remain the most clinically “trusted” form factor for home use: they align better with standard cuff-based measurement practices, are easier to recommend by clinicians for hypertension management, and are perceived as more reliable than wrist devices in typical household usage. The segment also benefits from the widest SKU availability across pharmacy chains and online platforms, plus stronger after-sales support through authorized distributors—critical in a market where consumers value warranty, cuff replacement, and calibration guidance.

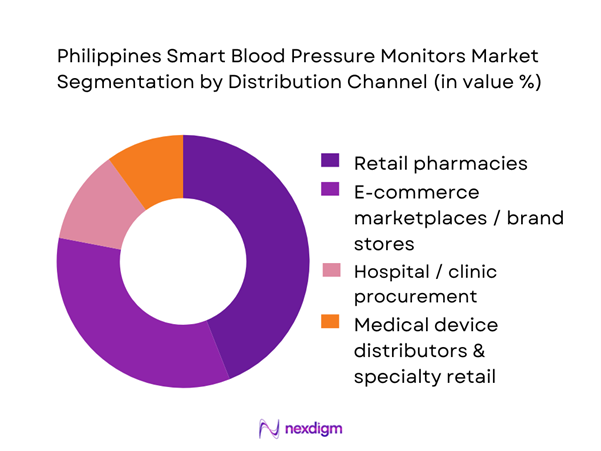

By Distribution Channel

The Philippines Smart Blood Pressure Monitors market is segmented by distribution channel into retail pharmacies, e-commerce marketplaces/brand stores, hospital/clinic procurement, and medical device distributors (B2B and specialty retail). Retail pharmacies lead because they provide immediate availability, installment-friendly purchasing in some outlets, and higher consumer confidence in authenticity—especially for regulated health devices. Pharmacy-led selling also aligns with hypertension medication refills, enabling add-on purchase moments and pharmacist-led guidance on correct cuff sizing and measurement routines. Meanwhile, e-commerce is expanding fastest for branded devices, but many buyers still prefer pharmacy purchase for warranty confidence and to reduce counterfeit risk—a persistent concern in consumer medical devices.

Competitive Landscape

The Philippines Smart Blood Pressure Monitors market is influenced by a mix of global med-tech leaders and consumer electronics brands, with leadership typically held by companies that combine clinically trusted upper-arm devices, strong mobile app ecosystems for trend tracking, and dependable local distribution for authenticity and warranty execution. The competitive field is also shaped by regulatory compliance (device registration pathways) and data protection expectations for app-connected products, which favor brands with mature documentation and localized support readiness.

| Company | Established | Headquarters | Core BP Form Factors | App / Cloud Ecosystem | Clinical Credibility Positioning | Philippines Channel Strength | Warranty / Service Model | Typical Buyer Focus |

| Omron Healthcare | 1933 | Kyoto, Japan | ~ | ~ | ~ | ~ | ~ | ~ |

| Philips | 1891 | Amsterdam, Netherlands | ~ | ~ | ~ | ~ | ~ | ~ |

| Withings | 2008 | Issy-les-Moulineaux, France | ~ | ~ | ~ | ~ | ~ | ~ |

| Microlife | 1981 | Widnau, Switzerland | ~ | ~ | ~ | ~ | ~ | ~ |

| Huawei (Health Ecosystem) | 1987 | Shenzhen, China | ~ | ~ | ~ | ~ | ~ | ~ |

Philippines Smart Blood Pressure Monitors Market Analysis

Growth Drivers

Hypertension Burden

The Philippines has one of the highest burdens of hypertension in Southeast Asia, with ~ million adults aged ~–~ years living with high blood pressure as defined by systolic ≥~ mmHg or diastolic ≥~ mmHg, highlighting a significant pool of individuals requiring regular blood pressure monitoring and care. This figure is supported by hypertension country profile data, which also indicates that millions would need expanded treatment for effective control. Such a substantial hypertensive population directly fuels demand for home-based smart BP monitors as both diagnostic and long-term management tools in a system where clinical follow-up may be sporadic.

Homecare Expansion

Philippine healthcare financing is largely out-of-pocket, with recent reports indicating that household out-of-pocket health spending reached ₱~ billion in ~, representing a significant burden on Filipino families and driving alternative care models such as home healthcare and self-monitoring. This financial pressure pushes patients to adopt at-home devices like smart blood pressure monitors that reduce clinic visits and associated costs. With low universal risk pooling and high personal expenditure, technologies enabling home monitoring offer cost avoidance for chronic disease tracking, particularly where repeated clinical measurements incur travel and consultation fees.

Challenges

Price Sensitivity

The Philippines has a substantial out-of-pocket health cost structure, with ₱~ billion spent directly by households on health in ~, indicating sensitive consumers when it comes to health device spending. With a large portion of healthcare financed privately, consumers often prioritize essential spend such as medications or acute care over higher-priced monitoring devices. Even moderately priced smart BP monitors may exceed the threshold of acceptability for many families, particularly in rural and lower-income segments where disposable income is constrained and health expenditure competes with other necessities like education and food.

Accuracy Trust Issues

Clinical trust is critical in smart BP devices, and Filipino consumers and healthcare professionals remain cautious due to varying measurement accuracy in unmanaged home environments. Studies show a high prevalence of hypertension with limited awareness and treatment among older adults, indicating that misinterpretation or inconsistent readings from inaccurate devices could undermine disease control. This hesitancy is backed by observations in clinical literature that emphasize variability in uncontrolled blood pressure awareness and treatment practices, which in turn influences preference for clinician–administered measurements over consumer devices unless accuracy is assured.

Opportunities

Remote Patient Monitoring Enablement

The telehealth and telemedicine ecosystem in the Philippines shows robust engagement, with the telemedicine market reaching USD ~ million in ~, reflecting clinicians and patients adapting to virtual care. Smart blood pressure monitors integrated with telehealth platforms enhance remote patient monitoring by enabling clinicians to receive accurate home-based readings digitally, reducing the need for frequent in-person visits. As Filipino telemedicine usage grows—accelerated by infrastructure improvement and internet penetration—smart BP devices become high-value tools bridging community health and clinical oversight, particularly for hypertensive patients unable to travel for regular checkups.

Employer-Sponsored Health Programs

Large employers in the Philippines are expanding corporate health initiatives to mitigate productivity loss from chronic diseases such as hypertension. Although precise adoption figures are not routinely published, macro health expenditure trends—with out-of-pocket healthcare costs reaching ₱~ billion—suggest employers have a strong incentive to reduce absenteeism and healthcare costs through preventive monitoring programs. Smart BP monitors can be embedded into workplace health plans, enabling biometric tracking and early interventions. Employers’ rising focus on employee well-being alongside the high cost burden on workers presents a compelling case for integrating smart BP tech into corporate wellness.

Future Outlook

Over the next five years, the Philippines Smart Blood Pressure Monitors market is expected to expand steadily as home-based chronic disease management becomes more routine, and as care pathways increasingly blend clinic visits with remote tracking. Growth will be supported by better consumer familiarity with measurement technique, improving app experiences (multi-user, medication reminders, trend dashboards), and stronger availability of authentic devices through organized retail and verified e-commerce storefronts. Compliance maturity around medical device registration and personal data protection will increasingly differentiate “trusted” brands.

Major Players

- Omron Healthcare

- Philips

- Withings

- Microlife

- Beurer

- Rossmax

- Xiaomi

- Huawei

- iHealth Labs

- A&D Medical

- Welch Allyn (Hillrom)

- ForaCare Suisse

- Yuwell Medical

- Citizen Systems

Key Target Audience

- Medical device manufacturers and brand owners

- Philippines importers and authorized distributors of regulated medical devices

- Retail pharmacy chains and pharmacy procurement heads

- E-commerce marketplaces and official brand-store category leaders

- Hospital groups and tertiary care procurement teams

- Private health insurers and corporate HMO administrators

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

We construct an ecosystem map covering manufacturers, authorized importers, distributors, pharmacy chains, marketplaces, hospitals, and service partners relevant to the Philippines Smart Blood Pressure Monitors market. This step is supported by structured desk research across regulatory portals, company disclosures, and channel mapping to define the critical market variables and purchase drivers.

Step 2: Market Analysis and Construction

We compile historical market signals around device availability, channel breadth, and technology mix (upper-arm vs wrist; Bluetooth vs cloud-enabled). We assess sell-in/sell-through indicators through channel checks and triangulate with published country market outlook anchors to build a consistent market model.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses on segment dominance (product type and channel) are validated through structured discussions with distributors, pharmacy buyers, and category managers, complemented by clinician perspectives on device trust and patient adherence. Inputs are used to refine segment splits, adoption constraints, and competitive positioning.

Step 4: Research Synthesis and Final Output

We consolidate findings via triangulation across published market outlook statistics, regulatory context, and stakeholder interviews. Final outputs include segment narratives, competitive benchmarking, and actionable implications for go-to-market, channel strategy, and compliance readiness in the Philippines Smart Blood Pressure Monitors market.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Scope Delimitation, Device Classification Logic, Market Sizing Framework, Primary Interview Framework, Demand-Side Validation, Supply-Side Validation, Data Triangulation, Limitations and Assumptions)

- Definition and Scope

- Evolution of Digital Blood Pressure Monitoring in the Philippines

- Timeline of Smart BP Adoption Across Consumer and Clinical Settings

- Healthcare Delivery Context and Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Hypertension Burden

Homecare Expansion

Telemedicine Adoption

Smartphone Penetration

Preventive Healthcare Awareness - Challenges

Price Sensitivity

Accuracy Trust Issues

Device Calibration Awareness

Counterfeit Imports

Limited Reimbursement - Opportunities

Remote Patient Monitoring Enablement

Employer-Sponsored Health Programs

Insurance-Linked Monitoring

Community Health Screening - Trends

App-Centric Monitoring

Multi-User Household Devices

Cloud Dashboards for Physicians

Subscription-Based Health Platforms - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- By Unit Shipments, 2019–2024

- By Average Selling Price Band, 2019–2024

- Installed Base of Smart BP Devices, 2019–2024

- Replacement and Upgrade Demand Dynamics, 2019–2024

- By Fleet Type (in Value %)

Upper-Arm

Wrist

Wearable/Continuous BP

Hybrid BP + Other Vitals

- By Connectivity Type (in Value %)

Bluetooth-Only

Bluetooth + Cloud Sync

Wi-Fi Enabled

App-Agnostic Devices

- By End-Use Industry (in Value %)

Homecare Patients

Hospitals

Clinics

Corporate Wellness Programs

Insurance-Linked Programs

- By Distribution Channel (in Value %)

Retail Pharmacies

Hospital Pharmacies

E-Commerce Platforms

Medical Device Distributors

Corporate Procurement

- By Region (in Value %)

NCR

Luzon Non-NCR

Visayas

Mindanao

- Competitive Positioning of Major Players

- Cross Comparison Parameters (Regulatory Approval Status, Device Accuracy Claims, App Ecosystem Strength, Local Distribution Depth, After-Sales Support Model, Price Band Positioning, Institutional Penetration, Data Privacy Readiness)

- SWOT Analysis of Major Players

- Pricing Analysis by Key SKUs and Channel Type

- Detailed Profiles of Major Companies

Omron Healthcare

Philips Healthcare

Withings

Microlife

Beurer

Rossmax

Xiaomi

Huawei

iHealth Labs

A&D Medical

Greater Goods

Welch Allyn

Citizen Systems

Yuwell Medical

- Usage Patterns and Monitoring Frequency

- Purchasing Power and Affordability Thresholds

- Trust Drivers

- Pain Points and Unmet Needs

- Decision-Making Process Across Consumer and Institutional Buyers

- By Value, 2025–2030

- By Unit Shipments, 2025–2030

- By Average Selling Price, 2025–2030

- Installed Base Expansion Outlook, 2025–2030

- Replacement and Upgrade Demand Dynamics, 2025–2030