Market Overview

The Philippines Smart Clothing Market is valued at USD ~ million, based on a multi-year historical assessment of wearable electronics shipments, smart textile imports, and retail sales performance. The market expanded from USD ~ million due to rising health awareness, with over ~ million Filipinos actively using fitness or health-tracking devices. The strong growth is supported by increased disposable income in urban centers, growing adoption of mobile health applications, and rising consumer comfort with connected wearables embedded directly into garments rather than standalone devices.

Metro Manila dominates the Philippines Smart Clothing Market due to its concentration of higher-income consumers, strong retail infrastructure, and dense presence of fitness studios, hospitals, and technology adopters. Cities such as Quezon City, Makati, Taguig, and Pasig lead adoption due to proximity to premium malls and e-commerce fulfillment hubs. Cebu follows as a secondary hub, driven by sports tourism, a growing fitness culture, and expanding private healthcare facilities. These regions benefit from superior digital connectivity, logistics readiness, and brand exposure.

Market Segmentation

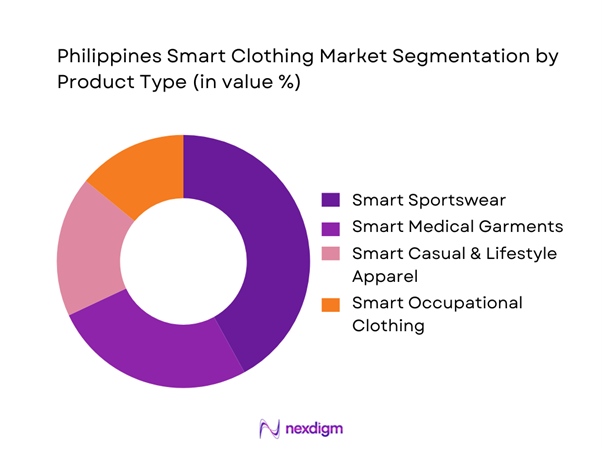

By Product Type

The Philippines Smart Clothing Market is segmented by product type into smart sportswear, smart medical garments, smart casual apparel, and smart occupational clothing. Among these, smart sportswear dominates the market, accounting for the largest share in ~. Smart sportswear leads due to its strong alignment with fitness tracking behaviors already familiar to Filipino consumers through smartwatches and bands. Products such as biometric shirts, sensor-enabled leggings, and posture-monitoring tops integrate seamlessly with mobile fitness applications. The rapid expansion of commercial gyms, running clubs, and recreational sports leagues has accelerated adoption. Additionally, sportswear brands have been more aggressive in launching affordable smart variants compared to medical-grade garments, improving accessibility and repeat purchase cycles.

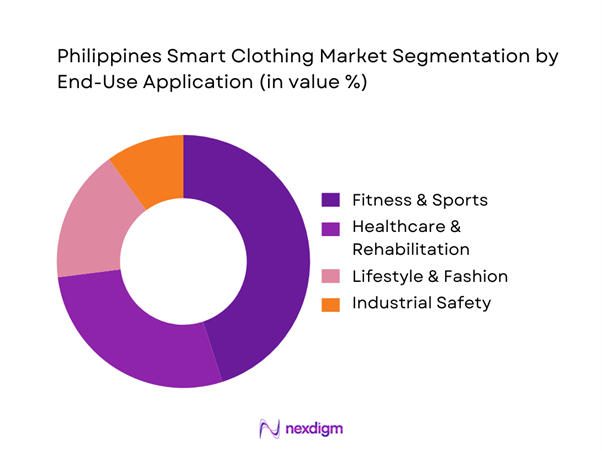

By End-Use Application

Based on end-use application, the market is segmented into fitness & sports, healthcare & rehabilitation, lifestyle & fashion, and industrial safety. Fitness & sports applications dominate the market. The dominance of fitness and sports applications is driven by the Philippines’ young demographic profile and high engagement with digital fitness ecosystems. More than ~ million Filipinos fall within the ~ age bracket, representing the core consumer base for connected fitness apparel. Smart shirts and compression wear that track heart rate, calories, and muscle activity offer real-time feedback without requiring additional devices. The integration with smartphones and fitness platforms enhances usability, while social fitness trends encourage sustained usage. Compared to healthcare, fitness applications face fewer regulatory barriers, enabling faster commercialization.

Competitive Landscape

The Philippines Smart Clothing Market is moderately consolidated, with global smart apparel innovators and large sportswear brands dominating premium segments, while regional distributors manage market access. International brands benefit from advanced sensor integration, strong brand equity, and established supply chains, whereas local players focus on distribution partnerships and private-label offerings.

| Company | Est. Year | HQ | Core Product Focus | Sensor Integration Level | Primary End-Use | Distribution Model | App Ecosystem | Manufacturing Approach |

| Hexoskin | 2006 | Canada | ~ | ~ | ~ | ~ | ~ | ~ |

| Sensoria | 2013 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Athos | 2013 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Under Armour | 1996 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Adidas | 1949 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

Philippines Smart Clothing Market Analysis

Growth Drivers

Rising Fitness Participation Rates

Government-led mass-participation sports events have been scaling up, creating bigger “use moments” for heart-rate shirts, posture tops, compression + sensor leggings, and recovery wear that syncs to apps. For example, ~ runners joined the International Marathon hosted in Iloilo City, signaling deeper endurance-sport participation beyond Metro Manila. In parallel, national-level and local government “sports-for-all” programming has normalized wearable tracking in fun runs, cycling events, and community fitness days, especially where hydration and heat stress monitoring is valued. This is reinforced by the Philippines’ consumption and lifestyle base, where inflation declined to ~ on average from ~ previously, supporting discretionary purchases like performance wearables when prices stabilize. The population series shows a very large consumer base of over ~ people, supporting a critical mass for smart-athleisure retail and event-driven demand spikes such as training blocks, race weeks, and corporate wellness challenges. These conditions collectively widen the addressable audience for smart clothing from niche athletes toward office workers and students participating in organized fitness.

Smartphone Penetration Linkage

Smart clothing adoption depends on “phone-as-hub” readiness, including Bluetooth pairing, companion apps, firmware updates, and cloud dashboards. Government survey outputs show this foundation is now broad, with ~ million individuals reporting internet usage and ~ million households having internet access at home, indicating large-scale app connectivity potential for smart apparel analytics and after-sales support such as setup, calibration, and updates. On the network side, telecom subscription depth matters for always-on tracking, with about ~ million mobile-cellular subscriptions supporting multi-device usage and SIM-enabled wearables that pair with smart garments. Macro stability also supports device-linked apparel upgrades, as improving disinflation conditions enable non-essential consumer electronics and premium sportswear purchases. Taken together, tens of millions of internet users plus deep mobile subscription availability allow smart clothing brands to rely on app-led onboarding, digital coaching, and data-driven upsell, accelerating repeat purchases and ecosystem lock-in.

Challenges

Cost Sensitivity of Consumers

Smart clothing competes with “good enough” alternatives such as standard athleisure, low-cost wearables, and imitation smart garments, so affordability remains a gatekeeper in the Philippines. Poverty and essential-spend pressure provide a hard constraint, with ~ million people living below the poverty line, which limits the addressable market for premium sensor-embedded apparel unless brands offer financing, modular upgrades, or enterprise procurement models. Price stability helps but does not eliminate sensitivity, as inflation easing from ~ to ~ improves sentiment, yet smart clothing still sits above basic clothing budgets for many households. Even internet access costs matter for app-reliant garments, as household spending barriers such as subscription and equipment costs persist. The result is a bifurcated market, with urban professionals and fitness enthusiasts able to pay for premium value, while mass consumers require entry price points, bundles, or employer-sponsored distribution. To grow despite sensitivity, suppliers must localize products for the Philippines, offer sensor-as-accessory upgrades, and build institutional channels that shift costs from consumers to employers.

Washability and Durability Constraints

In the Philippines, durability is not cosmetic and is adoption-critical. High humidity, frequent laundering, and daily commuter use put pressure on conductive yarns, sensor seams, and detachable modules. The constraint is amplified when consumers rely on home washing rather than specialized garment care, increasing returns risk and warranty cost for brands. On the supply side, limited depth in advanced textile capability compounds the challenge, with ~ companies engaged across stages of textile manufacturing and more than ~ workers in the textile industry, representing a useful industrial base but not yet a scale that guarantees abundant local suppliers for washable conductive textiles at high volume. This means many smart clothing systems depend on imported components or small-batch local production, slowing durability iteration. Macroeconomic variability also affects material substitution decisions, potentially impacting durability consistency if supplier qualification is weak. For buyers, washability uncertainty directly reduces willingness to pay, reinforcing consumer skepticism. Brands must prioritize removable electronics, publish care protocols aligned to typical Filipino laundry behaviors, and validate durability under local conditions before scaling retail distribution.

Opportunities

Local Sportswear Brand Partnerships

Partnerships with Filipino sportswear and uniform brands can unlock scale by combining local fit and comfort knowledge with sensor-module capability, while leveraging the Philippines’ fast-growing digital reach for distribution. National ICT results show ~ million internet users and ~ million connected households, supporting influencer-led launches, app onboarding at scale, and direct-to-consumer replenishment of sensor modules or subscriptions. The opportunity is also supported by the local textile ecosystem, with ~ textile-manufacturing-stage companies and more than ~ workers, providing an industrial base for co-development of performance fabrics, local assembly, and testing partnerships even if conductive-textile specialization remains limited. Macroeconomic stability supports mid-premium positioning, and remittance inflows of USD ~ billion provide household spending power that can be channeled into health and fitness upgrades, especially in urban areas. Co-branding with established local labels can reduce trust barriers, accelerate mall placement, and enable team sales into schools, clubs, and corporate wellness programs. The near-term growth engine is current digital reach and existing textile capacity structured into localized partnerships.

Smart Uniforms for BPO and Industrial Workforce

Smart uniforms represent a strong enterprise pathway for the Philippines because they shift smart clothing from optional lifestyle spend to operational expenditure tied to safety, productivity, and wellness. The scale base is clear, with ~ million beneficiaries integrated into formal healthcare touchpoints, allowing employers to align uniform-based wellness programs with screenings, preventive programs, and benefits navigation. Connectivity readiness supports enterprise rollout across distributed sites, with ~ million internet users and ~ million mobile-cellular subscriptions enabling app-based dashboards, HR analytics, and training content across facilities. Operational conditions also justify monitoring, as measurable power interruption durations underline the importance of designing uniforms with sufficient battery resilience for shift work and contingency scenarios. Privacy and governance can be built into procurement from day one, which is important given publicly tracked breach-notification reporting across sectors. For BPOs, smart clothing can focus on posture and fatigue; for industrial sites, heat stress and ergonomic risk; and for security and facilities, location-aware safety features. The growth here is enabled by workforce scale, digital connectivity, and healthcare system breadth rather than speculative projections.

Future Outlook

Over the next several years, the Philippines Smart Clothing Market is expected to expand steadily as smart textiles transition from niche products to mainstream apparel categories. Advancements in flexible electronics, washable sensors, and battery-free textile technologies will reduce cost and improve durability. Increased integration with telehealth platforms and workplace safety monitoring systems will open new demand channels beyond fitness. As consumer trust in wearable data accuracy improves, smart clothing adoption is expected to move from discretionary fitness use toward daily lifestyle and preventive healthcare applications.

Major Players

- Hexoskin

- Sensoria Inc.

- Athos

- Wearable X

- Myant

- OMsignal

- AiQ Smart Clothing

- Xenoma

- Siren Care

- Under Armour

- Adidas

- Nike

- Ralph Lauren

- Xiaomi Ecosystem Partners

Key Target Audience

- Apparel and sportswear manufacturers

- Consumer electronics and wearable device companies

- Healthcare providers and rehabilitation centers

- Fitness chains and professional sports organizations

- E-commerce and omnichannel retailers

- Industrial safety and uniform procurement firms

- Investment and venture capital firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

This phase involved mapping the smart clothing ecosystem, including apparel brands, sensor manufacturers, and digital health platforms. Secondary research from wearable electronics databases and textile trade sources was used to identify key demand and supply variables.

Step 2: Market Analysis and Construction

Historical shipment data, retail sales trends, and import statistics were analyzed to construct market size. Adoption intensity across fitness, healthcare, and lifestyle segments was evaluated to validate revenue generation logic.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were validated through structured interviews with apparel distributors, wearable technology specialists, and fitness industry stakeholders to refine segment-level insights.

Step 4: Research Synthesis and Final Output

Insights from bottom-up and top-down approaches were synthesized to ensure data accuracy, consistency, and relevance to the Philippines Smart Clothing Market.

- Executive Summary

- Research Methodology (Market Definitions and Scope Boundaries, Smart Textile Taxonomy and Assumptions, Abbreviations, Market Sizing Logic, Demand–Supply Mapping Approach, Technology Adoption Curve Assessment, Primary Interview Framework Across Apparel Brands OEMs and Tech Integrators, Validation Through Wearable Ecosystem Experts, Limitations and Forward Assumptions)

- Definition and Scope

- Evolution of Smart Apparel and Textile Electronics

- Historical Commercialization Milestones in the Philippines

- Market Maturity and Adoption Lifecycle

- Smart Clothing Value Chain and Ecosystem Mapping

- Growth Drivers

Rising Fitness Participation Rates

Smartphone Penetration Linkage

Expansion of Digital Health Ecosystems

Workplace Safety Compliance Push

Youth-Driven Tech Fashion Adoption - Challenges

Cost Sensitivity of Consumers

Washability and Durability Constraints

Limited Local Manufacturing of Smart Textiles

Battery Life Limitations

Data Accuracy Concerns - Opportunities

Local Sportswear Brand Partnerships

Smart Uniforms for BPO and Industrial Workforce

Rehabilitation-Focused Apparel Adoption

Export-Oriented Smart Garment Manufacturing

Telco-Wearable Bundling - Trends

Flexible Electronics Integration

AI-Driven Apparel Analytics

Subscription-Based Smart Apparel Services

Sustainable and Wash-Resistant Smart Fabrics - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- By Value, 2019–2024

- By Unit Shipments, 2019–2024

- By Average Selling Price Evolution, 2019–2024

- By Application (in Value %)

Smart Sportswear

Smart Casual and Lifestyle Apparel

Smart Workwear and Industrial Apparel

Smart Medical and Therapeutic Garments

Smart Military and Tactical Clothing - By Technology Architecture (in Value %)

Biometric Sensors Heart Rate Respiration Muscle Activity

Motion and Posture Sensors

Temperature and Thermal Regulation Modules

Haptic and Feedback Systems

Flexible Displays and E-Textiles - By Connectivity Type (in Value %)

Bluetooth-Enabled Smart Clothing

NFC-Integrated Apparel

App-Synchronized Wearable Garments

Standalone Offline Smart Apparel

Cloud-Connected Smart Clothing Systems - By End-Use Industry (in Value %)

Sports and Fitness Ecosystem

Healthcare and Rehabilitation

Defense and Tactical Applications

Corporate and Industrial Safety

Fashion and Lifestyle Consumers - By Region (in Value %)

Metro Manila

CALABARZON

Central Luzon

Visayas

Mindanao

- Market Share Analysis of Key Players

- Cross Comparison Parameters (Product Category Coverage, Sensor Integration Depth, Connectivity Architecture, Data Analytics Capability, Washability and Durability Standards, Battery and Power Management Design, Local Distribution Footprint, Strategic Partnerships and Collaborations)

- SWOT Analysis of Key Players

- Pricing and Positioning Analysis

- Detailed Company Profiles

Hexoskin

Sensoria Inc.

Athos

Wearable X

Myant

OMsignal

AiQ Smart Clothing

Siren Care

Xenoma

Carre Technologies Hexoskin

Under Armour Connected Apparel Portfolio

Nike Smart Apparel and Sensor-Enabled Lines

Adidas Smart Sportswear Integration

Ralph Lauren PoloTech Smart Shirts

- Adoption Drivers by User Segment

- Spending Behavior and Budget Allocation Patterns

- Feature Prioritization and Performance Expectations

- Pain Points and Usage Barriers

- Purchase Decision-Making Dynamics

- By Value, 2025–2030

- By Unit Shipments, 2025–2030

- By Average Selling Price Evolution, 2025–2030