Market Overview

A strong, public proxy for the Philippines’ smart/contactless thermometer demand is the country’s import flow for infrared thermometers: the latest audited reading shows US$~ of infrared thermometer imports and ~ units shipped into the country, reflecting sustained institutional and household demand for rapid, non-contact screening. This demand is reinforced by healthcare and public-setting protocols that explicitly specify non-contact temperature checks in screening and triage workflows, keeping replacement cycles active across hospitals, workplaces, and community settings.

Demand concentrates in Metro Manila and other high-density urban corridors such as CALABARZON, Central Luzon, Cebu, and Davao because these locations host the largest clusters of hospitals, corporate offices, retail footfall, transport nodes, and school systems, each with higher screening throughput and faster device turnover. On the institutional side, public guidance and facility standards reference non-contact thermometers for primary care readiness and screening areas, which drives procurement volumes where health infrastructure and patient loads are highest. The import proxy also shows multi-million unit inflow, consistent with dense urban distribution and retail replenishment.

Market Segmentation

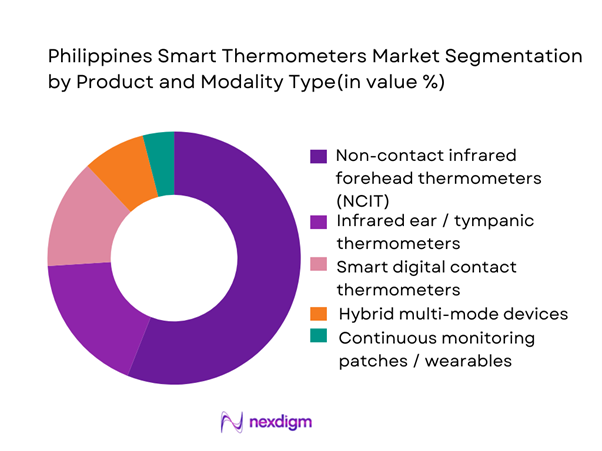

By Product and Modality Type

In the Philippines, non-contact infrared forehead thermometers typically lead unit movement because they align with screening throughput requirements across healthcare entry points and public-facing environments. Screening and triage guidance references non-contact temperature checks as a practical method to reduce contact and speed up flow, which structurally advantages NCIT devices over contact thermometers in institutional deployments. Primary care standards also list non-contact thermometers as required equipment, creating recurring procurement in clinics and community health networks. This workflow-fit advantage is amplified by retail behavior: households prefer fast, hygienic checks for children and elderly family members, while workplaces and schools favor quick scanning at gates. As a result, NCIT devices become the default first thermometer purchase and the most frequently replaced category due to battery degradation, sensor drift, and breakage, sustaining dominance even when app-connected features are not the primary buyer criterion.

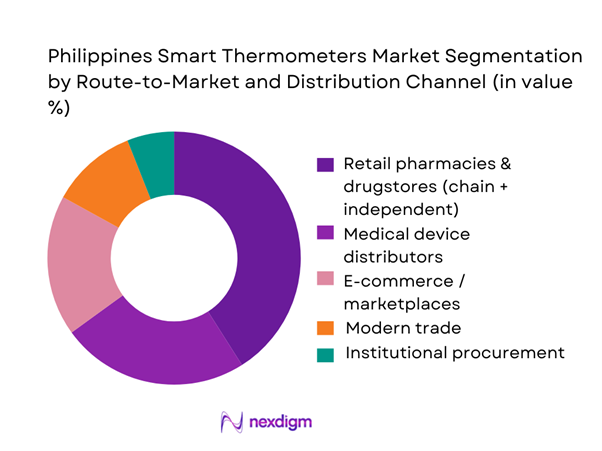

By Route-to-Market and Distribution Channel

For the Philippines smart thermometer market, retail pharmacies and drugstores often dominate value and units because they sit at the intersection of trust, availability, and health-driven impulse purchase. Thermometers are frequently bought during fever episodes, pediatric needs, or travel and work requirements, situations where buyers prioritize immediate access and perceived authenticity. The market also has a documented risk of unregistered or unauthorized medical devices, which pushes consumers toward channels that are viewed as safer and more compliant. On the institutional side, distributor-led B2B remains crucial, especially where facility standards specify non-contact thermometers; however, B2B cycles can be lumpy, while pharmacy channels provide steady throughput. E-commerce grows fast for price-led buyers, but authenticity, warranty clarity, and device registration checks keep pharmacy chains highly competitive for premium and medical-grade SKUs, sustaining channel leadership.

Competitive Landscape

The Philippines smart thermometer market is fragmented, with global brands competing alongside value-focused Asian OEMs and private-label or imported SKUs. Differentiation is concentrated in accuracy validation, speed, durability, regulatory documentation, warranty and service, and channel partnerships such as pharmacy chains, distributors, and hospital procurement. Regulatory scrutiny and periodic public warnings against unregistered medical devices also shape brand trust and purchasing decisions, supporting established brands with clearer compliance positioning.

| Company | Est. Year | HQ | Core modality strength (PH typical) | “Smart/app” ecosystem | PH route-to-market strength | Clinical positioning | Compliance / registration readiness | Warranty & after-sales model |

| Omron Healthcare | 1933 | Japan | ~ | ~ | ~ | ~ | ~ | ~ |

| Braun (thermometry line) | 1921 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| Microlife | 1981 | Switzerland | ~ | ~ | ~ | ~ | ~ | ~ |

| Beurer | 1919 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| Fluke | 1948 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

Philippines Smart Thermometers Market Analysis

Growth Drivers

Public health surveillance emphasis

Public health surveillance and outbreak monitoring keep temperature screening embedded in routine workflows across high-traffic settings in the Philippines. The country operates at scale, with a population of ~ and an economy of US$~, which translates into dense mobility networks, crowded service points, and sustained demand for rapid triage tools that can be deployed by non-specialist staff. Infectious-disease monitoring reinforces this, with national surveillance updates recording ~ dengue cases and ~ deaths within a defined reporting window, requiring ongoing screening discipline in facilities and communities where fever is a trigger symptom. In practice, this makes fast, non-contact thermometry a baseline input for screening desks, school health rooms, workplace clinics, and outpatient entry points, driving replenishment as devices are rotated, battery life degrades, or accuracy drifts. These public-health realities are structurally stronger in metropolitan clusters, where volume throughput is highest and compliance visibility is greater, sustaining repeat procurement through both institutional channels and household spillover demand.

Infection monitoring practices

Infection monitoring practice is a direct driver because fever checks are treated as a practical first filter in clinic triage and community screening when respiratory and vector-borne illnesses rise. The health authority has reported ~ influenza-like illness cases in an official press release, which reinforces routine screening as a risk-reduction habit in healthcare entry points, schools, and workplaces during periods of elevated respiratory symptom load. When a large population base of ~ moves through hospitals, pharmacies, transport terminals, and schools, temperature screening becomes operationally attractive because it is low training, fast, and can be standardized into gate protocols. The macro context supports scale, with a US$~ economy sustaining a large services sector and high-footfall retail environments where preventive screening is institutionalized by corporate and facility operating procedures. This combination of documented illness case loads and high-density service delivery keeps infrared and digital thermometers in steady rotation, with demand anchored more in infection-control routines than in one-time purchases.

Challenges

Price sensitivity

Price sensitivity is a major challenge because the Philippines is a highly price-elastic consumer health market. Buyers will switch brands, downgrade modalities, or delay replacement when budgets tighten, especially for household purchases where thermometers compete with medicines, transport, and food essentials. The macro backdrop provides context: even with a US$~ economy and ~ people, purchasing power is uneven, so the market tends to favor entry-level infrared and basic digital thermometers over premium connected SKUs unless a clear clinical or convenience benefit is perceived. This pressures brands trying to maintain quality, warranty, and regulatory documentation while competing with low-cost imports. At the same time, infection episodes keep demand urgent rather than planned, as reported ~ influenza-like illness cases highlight how consumers often buy thermometers during symptom spikes, when they prioritize availability and low price. That urgency can also push shoppers toward informal channels, creating a cycle where legitimate brands face margin pressure and must invest more in education and authentication to justify price.

Counterfeit imports

Counterfeit and unregistered imports are a direct market friction because they erode trust in category performance and distort fair competition for compliant brands. Regulatory authorities have issued explicit public health warnings against the purchase and use of unregistered infrared thermometers, including advisories focused on specific products, underscoring that unauthorized devices circulate in the market and can reach consumers through informal retail and online listings. This risk becomes more acute at national scale, with ~ people, as counterfeit distribution can spread quickly across regions and buyers often cannot verify registration status at the point of sale. The macro environment, with GDP of US$~, supports high trade volumes and broad retail penetration, but enforcement across many islands and ports remains operationally challenging. When counterfeit devices underperform, they reduce consumer willingness to pay for better SKUs and create thermometer skepticism, forcing legitimate brands and pharmacies to carry a heavier burden of proof through documentation, after-sales clarity, and authenticity assurance.

Opportunities

Connected care adoption

Connected care is a strong opportunity because current infrastructure and current health burdens already support expansion of app-enabled temperature tracking, remote triage workflows, and integration into employer health programs and provider ecosystems. The Philippines’ connectivity base is large, with ~ mobile cellular subscriptions, which enables messaging-based consults, teleconsult scheduling, and app-based symptom logs at scale. With a population of ~, even incremental behavior shifts create large absolute demand for track-and-share devices that can support decision-making during fever episodes. Health burden reinforces the logic, with reported ~ influenza-like illness cases and ~ dengue cases showing that fever-related symptom clusters are materially present, making longitudinal temperature logging useful for families and clinicians. The macro base, with GDP of US$~, supports ongoing digitization in private healthcare, health maintenance organizations, and corporate wellness, translating into bundled device programs and authenticated device distribution through pharmacies and employer channels.

Pediatric-focused devices

Pediatric-focused devices are an opportunity because fever monitoring is a high-frequency need in households with children, and caregivers prefer fast, low-friction readings that reduce distress and improve adherence. The opportunity is strengthened by scale, with a national population of ~ and a broad retail footprint of ~ drugstores creating the distribution and repeat-purchase conditions needed for pediatric thermometry to deepen beyond basic SKUs into better-validated infrared ear and forehead devices, baby-friendly form factors, and potentially app-supported fever diaries. Disease context reinforces pediatric relevance, with national monitoring of ~ dengue cases and ~ deaths highlighting why caregivers treat fever seriously, while reported ~ influenza-like illness cases underscore persistent respiratory symptom pressure that often impacts families with school-aged children. The macro environment, with GDP of US$~, supports growth of premium pharmacy retailing and private pediatric care networks in major cities, which can drive demand for higher-quality pediatric devices with clearer accuracy claims, safer materials, and stronger warranties when sold through trusted channels.

Future Outlook

Over the next several years, the Philippines smart thermometers market will be shaped by institutionalization of screening and triage practices in healthcare and high-traffic environments, stronger procurement discipline in primary care networks, and consumer preference for fast, hygienic, and easy-to-use home monitoring devices. Compliance clarity and authentication through registered devices and traceable warranties will become bigger purchase filters as buyers seek to avoid counterfeit and unregistered SKUs. Continuous monitoring through patches and wearables will remain niche but may expand in hospitals, occupational health, and care management where workflow integration and analytics create return on investment.

Major Players

- Omron Healthcare

- Braun

- Microlife

- Beurer

- Terumo

- Citizen Systems

- Rossmax

- Exergen

- Welch Allyn

- iHealth

- Withings

- Kinsa

- Berrcom

- Xiaomi

Key Target Audience

- Hospital groups and integrated healthcare networks

- Primary care clinic chains and diagnostic networks

- Pharmacy chains and health retail distributors

- E-commerce platforms and authorized brand stores

- Medical device distributors and importers

- Corporate occupational health and EHS buyers

- Insurance administrators and healthcare payers

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

We map the Philippines thermometry ecosystem across hospitals, primary care, retail pharmacies, distributors and importers, and e-commerce. We define variables such as modality mix, replacement cycles, regulatory requirements, and channel concentration, using desk research anchored on government and standards documents.

Step 2: Market Analysis and Construction

We build a market model using bottom-up channel construction and triangulate against external anchors such as import flows for relevant product categories to validate the directionality of volumes and pricing tiers.

Step 3: Hypothesis Validation and Expert Consultation

We validate assumptions through structured interviews with distributors, pharmacy category managers, hospital biomedical engineers, and clinic administrators, focusing on procurement frequency, brand shortlists, failure rates, calibration practices, and warranty and service realities.

Step 4: Research Synthesis and Final Output

We synthesize findings into segment-level narratives, competitive benchmarking, and go-to-market implications, ensuring the final output aligns with Philippines regulatory expectations and buyer decision logic.

- Executive Summary

- Research Methodology (Market definitions & scope boundaries for smart/digital/connected thermometry, Philippines-specific assumptions, abbreviations, triangulated market sizing logic, demand–supply reconciliation approach, primary interviews with hospitals/pharmacies/importers, secondary source mapping, regulatory interpretation methodology, data validation framework, limitations & inference boundaries)

- Definition and Scope

- Market Genesis and Evolution

- Timeline of Product & Technology Adoption

- Industry Business Cycle Characteristics

- Philippines Healthcare Device Supply Chain & Value Chain Mapping

- Growth Drivers

Public health surveillance emphasis

Infection monitoring practices

Urban household penetration

Pharmacy retail expansion

Telehealth enablement - Challenges

Price sensitivity

Counterfeit imports

Calibration trust issues

Uneven rural access

Regulatory compliance costs - Opportunities

Connected care adoption

Pediatric-focused devices

Employer health programs

School health monitoring

Data-enabled home care - Trends

Contactless preference

App-based temperature logs

Bundled wellness devices

Private-label pharmacy SKUs - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- By Volume, 2019–2024

- By Average Selling Price, 2019–2024

- By Fleet Type (in Value %)

Digital Contact Thermometers

Infrared Forehead Thermometers

Infrared Ear (Tympanic) Thermometers

Wearable / Continuous Monitoring Thermometers

App-Connected / Bluetooth Smart Thermometers - By Application (in Value %)

Thermistor-based

Infrared Sensor-based

Multi-sensor Hybrid - By Technology Architecture (in Value %)

Non-connected

Bluetooth-enabled

Wi-Fi–enabled

Cloud-integrated / API-ready - By End-Use Industry (in Value %)

Hospitals & Medical Centers

Clinics & Diagnostic Labs

Home Healthcare / Consumers

Pharmacies & Drugstores

Schools & Institutional Buyers - By Connectivity Type (in Value %)

Hospital Procurement & Tenders

Pharmacy Chains & Independent Drugstores

Medical Device Distributors

E-commerce & Online Marketplaces

Modern Trade / Consumer Electronics Retail - By Region (in Value %)

National Capital Region (NCR)

Luzon (ex-NCR)

Visayas

Mindanao

- Market Share of Major Players

- Cross Comparison Parameters (brand positioning in Philippines, product accuracy certification, FDA Philippines registration depth, price band coverage, distribution reach, pharmacy vs hospital strength, smart/app ecosystem maturity, after-sales & warranty model)

- Competitive Benchmarking Matrix

- Pricing Analysis by Key SKUs

- Detailed Company Profiles

Omron Healthcare

Braun

Microlife

Exergen

Beurer

Xiaomi

iHealth Labs

Rossmax

Citizen Systems

Vicks

Medisana

Jumper Medical

Andon Health

Berrcom

- Demand & Usage Patterns

- Purchasing Behavior & Budget Allocation

- Decision-Making Criteria

- Pain Points & Unmet Needs

- Adoption Barriers & Switching Triggers

- By Value, 2025–2030

- By Volume, 2025–2030

- By Average Selling Price, 2025–2030