Market Overview

The Philippines smartwatches market is valued at approximately USD ~ million in 2024. This market growth is primarily driven by increasing health and fitness consciousness, a growing middle-class population, and the rapid adoption of wearable technologies. The Philippines is seeing a rising trend in both health and tech, with consumers focusing more on fitness and personal well-being. Coupled with the boom in e-commerce, where brands like Xiaomi, Garmin, and Apple have gained strong traction, the demand for smartwatches continues to rise, supported by affordable models and more specialized features.

Metro Manila, Cebu, and Davao dominate the Philippine smartwatch market due to their high urbanization levels, rising disposable incomes, and increasing consumer demand for tech gadgets. Metro Manila, being the country’s capital, leads the market because of its advanced infrastructure and higher consumer spending power, particularly among the youth and working professionals. Cebu and Davao, major hubs for trade and commerce, are also seeing growing adoption of smartwatches due to the increasing awareness of fitness and wellness in these regions. These cities also benefit from easy access to online retail platforms.

Market Segmentation

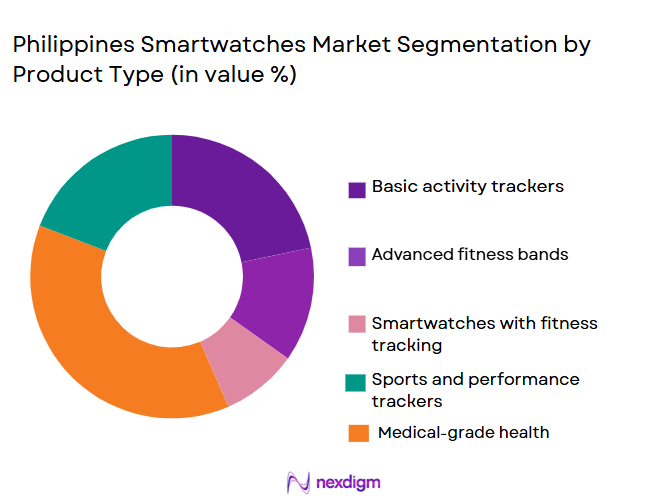

By Product Type

The Philippine smartwatch market is segmented by product type into fitness-focused smartwatches, hybrid smartwatches, and premium smartwatches. Fitness-focused smartwatches dominate the market due to their widespread appeal among health-conscious consumers who prioritize features such as heart rate monitoring, step tracking, and sleep analysis. These devices are often more affordable and are particularly popular among Filipinos aged ~, who actively participate in fitness-related activities. Brands like Xiaomi, Fitbit, and Garmin are major players in this segment, as their products cater to both fitness enthusiasts and casual users looking for budget-friendly options with essential features.

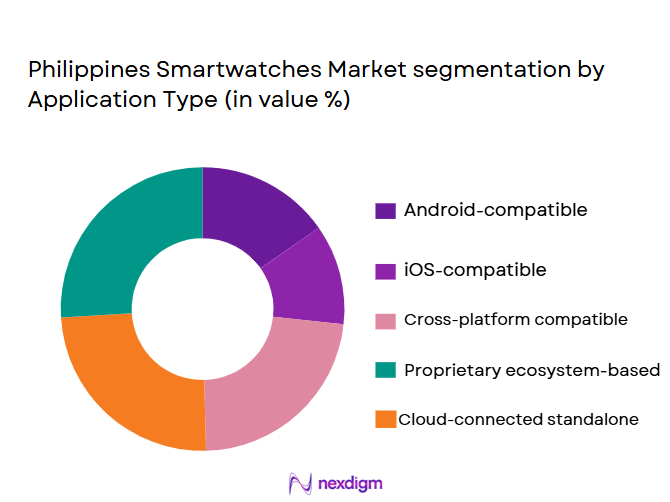

By Application Type

The smartwatch market in the Philippines is segmented into health and fitness tracking, mobile connectivity, and payments. Health and fitness tracking is the dominant application segment, driven by the growing focus on personal well-being, especially during the pandemic. Consumers are increasingly using smartwatches to track fitness activities such as walking, running, and cycling, in addition to monitoring heart rate, sleep patterns, and stress levels. Fitness-focused smartwatches, such as those from Fitbit and Xiaomi, have capitalized on this trend, offering specialized features like exercise recognition and hydration tracking. This segment is poised to continue dominating due to the increasing number of fitness apps and health-conscious consumers.

Competitive Landscape

The Philippines smartwatch market is competitive, with both global brands like Apple, Samsung, and Garmin, as well as local players like Xiaomi and Realme making significant strides. The market is dominated by a few major players, each offering different smartwatch models to cater to various price segments. Apple and Samsung maintain strong brand loyalty, especially in the premium smartwatch segment, due to their established ecosystems in mobile technology and smart devices. On the other hand, brands like Xiaomi and Garmin cater to the growing fitness-conscious consumer base with affordable, feature-rich options that appeal to a wider demographic.

| Company | Year Established | Headquarters | Product Range | Distribution Channels | Retail Presence | Revenue (approx.) |

| Apple | 1976 | USA | ~ | ~ | ~ | ~ |

| Samsung | 1938 | South Korea | ~ | ~ | ~ | ~ |

| Garmin | 1989 | USA | ~ | ~ | ~ | ~ |

| Xiaomi | 2010 | China | ~ | ~ | ~ | ~ |

| Fitbit | 2007 | USA | ~ | ~ | ~ | ~ |

Philippines Smartwatches Market Analysis

Growth Drivers

Increasing Health Awareness

Health awareness in the Philippines is a significant driver of smartwatch adoption, particularly fitness-oriented models. In 2024, over ~ million Filipinos engage in fitness activities like walking, running, and cycling, contributing to the demand for health-monitoring devices. Additionally, ~% of Filipinos aged ~ now prefer using wearables for tracking health metrics such as heart rate and activity levels, a reflection of the growing fitness culture. The Philippines government’s focus on improving public health also plays a role, with health initiatives like the “Healthy Pilipinas” campaign encouraging the adoption of lifestyle monitoring tools, thus further accelerating smartwatch usage among Filipinos.

Tech-Savvy Consumer Base

The rise of tech-savvy consumers, especially millennials and Gen Z, significantly contributes to smartwatch adoption. In 2024, over ~ million Filipinos are classified as active internet users, with the majority belonging to the ~age group. This demographic is keen on adopting wearable technology, including smartwatches, for both convenience and health tracking. As smartphone penetration increases, with ~% of Filipinos owning a smartphone, the demand for wearables that integrate seamlessly with mobile devices has surged. The continuous adoption of smartphones sets the foundation for increased smartwatch uptake, especially with the growing appeal of smartwatch apps that complement daily activities.

Market Challenges

High Initial Cost for Premium Devices

One of the key challenges in the Philippines smartwatch market is the high cost of premium devices, particularly from well-known brands such as Apple and Samsung. Premium smartwatches typically cost between PHP ~ to PHP ~, which is a considerable investment for many Filipinos. Despite the growing demand for fitness trackers and smartwatches, the high upfront cost of premium models restricts market penetration, particularly in lower-income groups. In 2024, the average annual income per Filipino household is PHP ~, with many families prioritizing basic needs over expensive technological products. The economic disparity limits accessibility to more expensive smartwatches and thus hinders broader adoption.

Data Privacy and Security Concerns

With the increased use of smartwatches to monitor sensitive health data, concerns over data privacy and security have emerged as significant barriers. In 2024, approximately ~ million Filipinos are reported to use health and fitness apps that integrate with wearables. These apps often collect personal health information such as heart rate, sleep patterns, and exercise data. However, with limited data protection laws for wearable devices, there is a growing fear that personal health data may be at risk. The Philippine National Privacy Commission has expressed concerns about data breaches and unauthorized access to personal information, which could undermine consumer confidence in wearable technology. This highlights the critical need for enhanced privacy measures and regulations to ensure that consumer data remains secure.

Opportunities

Integration with Healthcare Systems

The integration of smartwatches with healthcare systems represents a key opportunity for growth in the Philippines smartwatch market. Currently, over 3.6 million Filipinos suffer from chronic conditions such as diabetes, hypertension, and heart disease, all of which can benefit from continuous health monitoring. There is a growing trend toward digital healthcare solutions, with healthcare providers showing increasing interest in integrating wearables for remote monitoring and disease management. In 2024, approximately ~ million individuals in Metro Manila are enrolled in corporate health insurance programs, where smartwatches are being used for tracking medical metrics and providing insights into individual health statuses. This integration between wearables and healthcare systems provides a scalable model for improving patient outcomes while offering new revenue streams for smartwatch manufacturers.

Growth in Corporate Wellness Programs

Corporate wellness programs in the Philippines are increasingly adopting smartwatches as part of their health initiatives. In 2024, over ~ companies have implemented wellness programs for their employees, and ~% of these companies have integrated wearables such as smartwatches to promote physical activity and health awareness among their workforce. This growing trend is driven by the Philippines’ expanding corporate sector and the need for businesses to reduce healthcare costs by promoting healthier lifestyles. With an estimated ~ million employees in the country, the potential for smartwatch adoption through corporate wellness programs is significant. By providing wearables for employees, companies can foster a culture of health and wellness, thus driving further market penetration for smartwatches.

Future Outlook

Over the next five years, the Philippines smartwatch market is expected to experience significant growth. Key factors such as increasing health awareness, the rising popularity of fitness tracking, and the growing adoption of wearable technologies across various demographics are expected to drive the market. Additionally, as smartwatches continue to evolve and integrate with other technologies like mobile payments, mobile health applications, and personal fitness data tracking, the demand for these devices will continue to expand. Furthermore, advancements in battery life, affordability, and functionality will make smartwatches more accessible to a larger population, especially in regional areas where e-commerce penetration is growing.

Major Players

- Apple

- Samsung

- Garmin

- Xiaomi

- Fitbit

- Huawei

- Amazfit

- Realme

- Oppo

- Fossil Group

- Suunto

- Withings

- Honor

- Misfit

- TicWatch

Key Target Audience

- Health-Conscious Consumers

- Fitness Enthusiasts

- Investments and Venture Capital Firms

- Technology Integrators (Smartwatch Manufacturers, App Developers)

- Retailers (Electronics, Fitness Equipment, Online Retailers)

- Corporate Wellness Program Managers =

- Technology Distributors and Dealers

- Government and Regulatory Bodies

Research Methodology

Step 1: Identification of Key Variables

The first step involves defining the key market variables such as product types (e.g., fitness-oriented, hybrid, premium smartwatches), distribution channels (online vs. retail), and demographics (young adults, middle-aged, seniors). This phase uses a combination of desk research from secondary data sources and proprietary industry databases.

Step 2: Market Analysis and Construction

In this phase, historical data will be gathered and analyzed to understand the market trends, consumer adoption rates, and the overall growth trajectory. This includes assessing product demand, regional penetration, and the role of distribution channels in shaping market dynamics.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed based on available data and validated through consultations with key industry experts. Interviews will be conducted with major manufacturers, retailers, and technology developers to gain deeper insights into consumer behavior and trends.

Step 4: Research Synthesis and Final Output

After gathering data and expert opinions, a comprehensive market model will be developed. This will include recommendations for market entry strategies, growth opportunities, and key risks for stakeholders involved in the smartwatch industry in the Philippines.

- Executive Summary

- Philippines Smartwatches Market Research Methodology

Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising adoption of connected consumer electronics

Growing awareness of health and fitness monitoring

Increasing affordability of feature-rich smartwatches - Market Challenges

Short product replacement cycles impacting margins

Battery life limitations in advanced smartwatches

Intense price competition from low-cost brands - Market Opportunities

Integration of smartwatches with digital health platforms

Expansion of LTE-enabled smartwatches

Rising demand for localized apps and services - Trends

Shift toward health-centric and ECG-enabled devices

Premiumization through design and materials

Growing demand for customizable and modular designs - Government Regulations & Defense Policy

FDI Rules

Offset Obligations

Export Licenses - SWOT Analysis (Capability Strengths, Cost Vulnerabilities, Competitive Pressures)

Porter’s Five Forces (Procurement Power, Supplier Concentration, Substitutes, Barriers to Entry)

- By Market Value 2019–2024

- By Installed Units 2019–2024

- By Average System Price 2019–2024

- By System Complexity Tier 2019–2024

- By System Type (In Value%)

Basic notification smartwatches

Fitness-focused smartwatches

Advanced health monitoring smartwatches

Premium lifestyle smartwatches

Rugged and outdoor smartwatches - By Platform Type (In Value%)

Android-compatible smartwatches

iOS-compatible smartwatches

Cross-platform smartwatches

Proprietary OS smartwatches

Cellular-enabled standalone smartwatches - By Fitment Type (In Value%)

Rectangular dial smartwatches

Circular dial smartwatches

Hybrid analog-digital smartwatches

Slim and lightweight smartwatches

Customizable strap-based smartwatches - By EndUser Segment (In Value%)

Urban professionals

Fitness and wellness users

Tech-savvy youth consumers

Health-conscious middle-aged users

Outdoor and adventure enthusiasts - By Procurement Channel (In Value%)

Online marketplaces

Brand-exclusive retail outlets

Consumer electronics chains

Telecom operator retail channels

Corporate and institutional purchases

- Market Share Analysis

- Cross Comparison Parameters

(Product innovation, Price positioning, Platform compatibility, Distribution network, Brand strength) - SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Apple

Samsung

Huawei

Xiaomi

Garmin

Fitbit

Amazfit

Oppo

Realme

Honor

OnePlus

Fossil

Polar

Suunto

Withings

- Users prioritize multifunctionality and design aesthetics

- Health features influence purchase decisions across age groups

- Young consumers favor app ecosystem compatibility

- Professionals seek productivity and communication features

- Forecast Market Value 2025–2030

- Forecast Installed Units 2025–2030

- Price Forecast by System Tier 2025–2030

- Future Demand by Platform 2025–2030