Market Overview

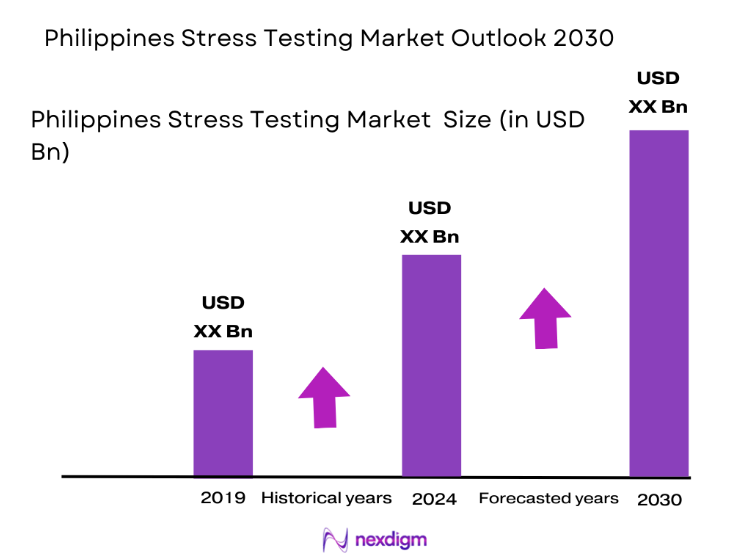

The Philippines Stress Testing market is valued at approximately USD ~ in 2024. The market size is driven primarily by the increasing adoption of stress testing solutions across various sectors, including banking, IT, and healthcare. Financial institutions in the Philippines, under regulatory pressures, are significantly increasing their use of stress testing tools to comply with both local and international guidelines. The adoption of cloud-based stress testing software, coupled with the rising need for operational resilience in a volatile market environment, is helping to propel market growth. Additionally, as more companies migrate to digital platforms, the need for cybersecurity stress testing continues to rise, contributing further to the market expansion.

Metro Manila, as the capital, is the dominant hub for stress testing technologies in the Philippines. The high concentration of financial institutions, government agencies, and multinational corporations in Metro Manila drives the demand for advanced risk management and stress testing tools. Furthermore, Cebu and Davao have emerged as secondary hubs due to the rising number of technology-driven startups and increasing demand for cloud-based solutions across the IT and finance sectors. The Philippines’ overall market dominance in the region is driven by its rapidly expanding digital infrastructure and growing regulatory compliance needs in sectors like banking, telecom, and healthcare.

Market Segmentation

By Product Type

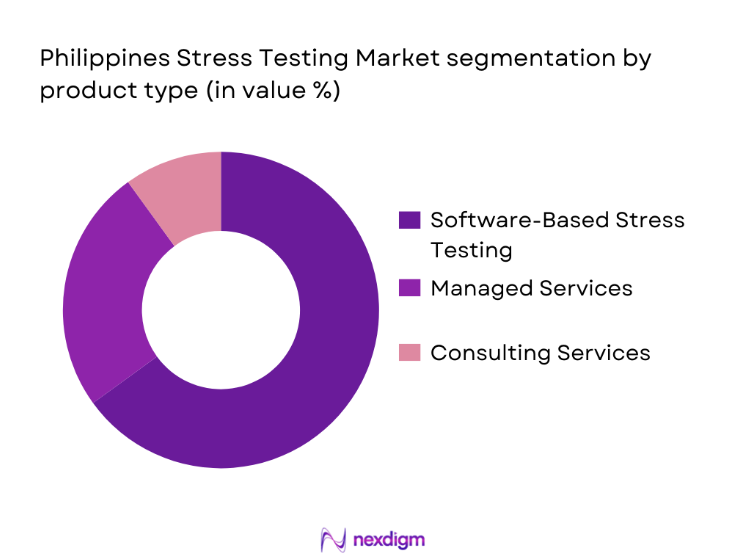

The Philippines Stress Testing market is segmented by product type into software-based stress testing tools, managed services, and consulting services. Software-based stress testing tools dominate the market, with a major share in 2024. The increasing automation of stress tests, especially in the banking and insurance sectors, contributes to this dominance. These tools are highly favored for their efficiency in assessing financial models under various risk scenarios. The growing complexity of financial products and stringent regulations around capital adequacy require robust stress testing solutions that can handle large datasets and real-time analytics.

By End-User Sector

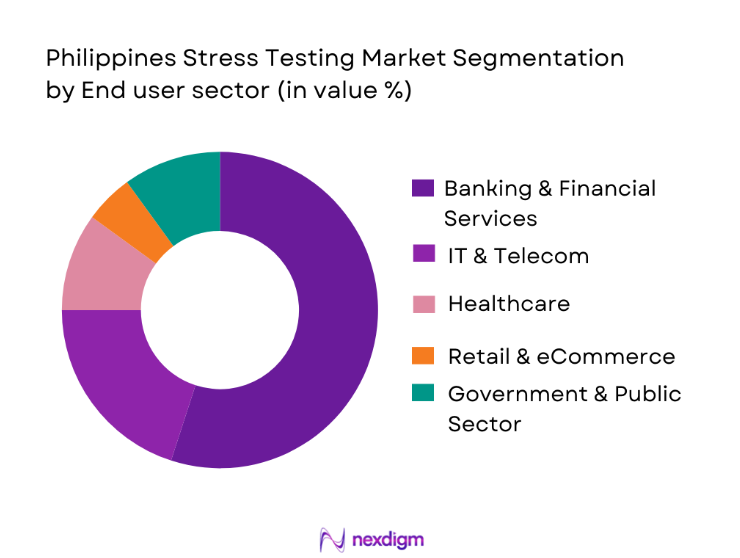

In terms of end-user sector, banking and financial services (BFSI) lead the market due to the stringent regulatory framework imposed by the Bangko Sentral ng Pilipinas (BSP) and other financial regulatory bodies. Banks are increasingly required to conduct stress tests on their portfolios to comply with risk management regulations, ensuring they have sufficient capital buffers in place. The banking sector’s reliance on stress testing tools for risk mitigation, particularly in credit, market, and liquidity risks, contributes to its dominance in this segment.

Competitive Landscape

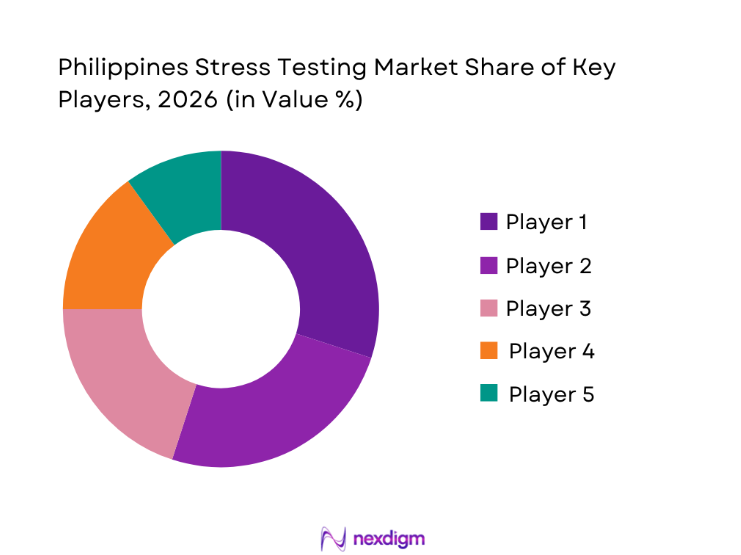

The Philippines Stress Testing market is highly competitive, with both global and local players vying for dominance. Global companies like IBM, Oracle, and SAP lead the market by offering comprehensive risk management solutions that integrate with financial systems. Local players such as I-Cubed, Inc. and FinTech innovators are also gaining traction, leveraging their understanding of the Philippine market’s unique regulatory and technological landscape. The competition is characterized by continuous advancements in AI-powered stress testing tools and services, especially in the banking and healthcare sectors.

| Company | Year Established | Headquarters | Key Product Offering | Market Position | Global Presence | Technology Focus |

| IBM | 1911 | New York, USA | ~ | ~ | ~ | ~ |

| Oracle | 1977 | California, USA | ~ | ~ | ~ | ~ |

| SAP | 1972 | Germany | ~ | ~ | ~ | ~ |

| I-Cubed, Inc. | 2003 | Manila, Philippines | ~ | ~ | ~ | ~ |

| FinTech Innovations | 2010 | Manila, Philippines | ~ | ~ | ~ | ~ |

Philippines Stress Testing Market Analysis

Growth Drivers

Digital Transformation & Cloud Adoption

The Philippines continues to undergo significant digital transformation, driven by the increasing adoption of cloud computing services across industries. The Philippines’ cloud computing market is expected to grow rapidly, with enterprises transitioning to cloud infrastructure for cost savings, scalability, and better resource management. According to the World Bank, digital adoption in the Philippines is accelerating as part of the government’s Digital Transformation Roadmap, with public and private sector investments growing by over ~ in 2025. As a result, sectors such as banking, healthcare, and telecom are increasingly deploying cloud-based stress testing tools to ensure business continuity in the digital age. Moreover, ~ of large enterprises in the Philippines had migrated at least one key business function to the cloud in 2025, reflecting the crucial role of cloud technologies in supporting resilience testing across industries.

Regulatory Stress Test Compliance

Regulatory requirements around stress testing have been a key growth driver in the Philippines market, particularly within the banking and financial services sector. The Bangko Sentral ng Pilipinas (BSP) has mandated that financial institutions conduct rigorous stress tests to assess their ability to withstand financial shocks. This regulatory push comes as the country works to align with international standards, including those set by the Basel Committee. As of 2025, the BSP has enforced more stringent capital adequacy requirements for banks, with all domestic banks required to conduct stress tests on capital buffers to align with global risk mitigation standards. Additionally, the Philippine insurance industry, regulated by the Insurance Commission, has mandated similar stress testing practices for solvency risk assessments. These regulatory frameworks are ensuring a sustained demand for stress testing solutions.

Market Challenges

Data Quality & Systemic Risk Modeling Maturity Gaps

One of the significant challenges faced by the Philippines market is the lack of high-quality, reliable data necessary for effective stress testing, especially in financial risk modeling. Despite the growing adoption of digital tools in the banking sector, institutions often face difficulties in collecting and integrating real-time, accurate data from diverse sources such as SMEs, non-financial enterprises, and unbanked populations. This challenge limits the effectiveness of stress tests, particularly in systemic risk modeling. Only ~ of local financial institutions have fully integrated risk management data systems, indicating a maturity gap. In 2023, a significant portion of financial institutions continued to rely on traditional, siloed data management systems, which hindered accurate scenario modeling.

High Implementation Costs

The cost of implementing advanced stress testing tools remains a barrier for smaller firms in the Philippines, particularly in the banking and insurance sectors. In 2025, the average cost for deploying a comprehensive enterprise-grade stress testing solution was reported at around USD ~ per year, according to the Securities and Exchange Commission of the Philippines. While large financial institutions and telecom companies have the resources to absorb these costs, smaller players in the market, such as regional banks and SMEs, face challenges in adopting such tools. This has led to a slower uptake of advanced stress testing solutions among smaller organizations. Additionally, ongoing operational costs, such as system maintenance and updates, add to the financial strain.

Opportunities

Climate Risk Stress Testing Integration

Given the Philippines’ high vulnerability to climate-related disasters, there is a growing opportunity for integrating climate risk scenarios into stress testing frameworks. In 2023, the Philippines was ranked as the 5th most disaster-prone country globally, according to the Global Climate Risk Index. This has prompted organizations, especially in the financial sector, to increasingly consider climate risks as part of their broader risk management strategies. Financial institutions are now incorporating climate scenarios into their stress tests to better understand the potential impacts of natural disasters on their portfolios. These developments are creating new market opportunities for stress testing solutions that focus on environmental factors.

AI/ML in Stress Scenario Forecast Engines

The use of Artificial Intelligence (AI) and Machine Learning (ML) in stress testing solutions is set to revolutionize the Philippines market. AI and ML can enable the development of advanced scenario forecasting models that simulate a broader range of stress events, including financial, cyber, and operational disruptions. In 2023, the Philippines’ AI adoption rate in business applications was estimated at 25%, with sectors such as banking, telecom, and government leading the way in AI-driven solutions. AI/ML applications are enhancing the accuracy of stress tests, improving risk assessments, and offering predictive analytics capabilities. The growing interest in these technologies presents a significant opportunity for market expansion.

Future Outlook

Over the next five years, the Philippines Stress Testing market is expected to witness significant growth, driven by continuous advancements in technology, regulatory changes, and the increasing demand for operational resilience in both the public and private sectors. As regulatory requirements become more stringent, particularly in the BFSI and healthcare sectors, companies will increasingly adopt cloud-based and AI-powered stress testing solutions to comply with these regulations. Additionally, the rising frequency of cyber-attacks and operational risks in various sectors will continue to spur the adoption of advanced risk management tools.

Major Players

- IBM

- Oracle

- SAP

- I-Cubed, Inc.

- FinTech Innovations

- Accenture

- Capgemini

- Wipro

- Infosys

- TCS

- Deloitte

- KPMG

- PwC

- Microsoft

- SAS Institute

Key Target Audience

- Investments and Venture Capitalist Firms

- Government Agencies

- Financial Institutions

- Telecommunication Companies

- Healthcare Providers

- IT Service Providers

- Regulatory Bodies

- Large Enterprises in Retail and E-commerce

Research Methodology

Step 1: Identification of Key Variables

This phase involves defining the scope of stress testing within the Philippines market and identifying key market players, technologies, and regulatory drivers. We use a combination of desk research, interviews with industry experts, and secondary data from government agencies and market leaders to construct a comprehensive understanding of market dynamics.

Step 2: Market Analysis and Construction

In this phase, we analyze historical market data, trends in the BFSI and IT sectors, and other relevant sectors. A bottom-up approach is used to estimate the market size based on data gathered from industry players, regulators, and other sources. This is supplemented by revenue generation analysis and the evaluation of existing stress testing platforms.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses regarding market growth, sectoral adoption, and technological advancements are validated through interviews with key stakeholders, including regulatory bodies, financial institutions, and technology providers. Expert consultations ensure the robustness of the initial data and refine the understanding of market trends.

Step 4: Research Synthesis and Final Output

The final phase synthesizes all gathered data and insights into a comprehensive market report. This includes direct engagement with major market players for product insights, sales data, and operational challenges. The final analysis is cross-checked with third-party sources and market intelligence reports to ensure accuracy and validity.

- Executive Summary

- Research Methodology (Definitions & Assumptions, Philippines BSP Stress Testing Practices Benchmark, Market Sizing & Estimation Methodology, Primary vs Secondary Data Integration, Macro Scenario Modeling Techniques, Data Quality & Limitations, Competitive Intelligence Protocols)

- Market Genesis & Adoption History

- Early adopters in Banking, BFSI & Enterprise IT

- Regulatory Milestones & Compliance Drivers

- BSP Circulars & Stress Test Mandates

- IFRS‑9 data requirements for stress models

- Growth Drivers

Digital transformation & cloud adoption

Regulatory stress test compliance

Rising cyber & operational risk exposures

Increasing enterprise demand for resilience analytics - Market Challenges

Data quality & systemic risk modeling maturity gaps

High implementation costs

Skills & talent shortage in stress analytics - Future Opportunities

Climate risk stress testing integration

AI/ML in stress scenario forecast engines

SME & regional branch adoption - Trends

Integration of AI/ML in Stress Testing Tools

Growth of Cloud-Based Stress Testing Solutions

Focus on Real-Time Stress Testing for Operational Continuity

Increasing Customization in Stress Testing Models - Regulatory & Policy Landscape

- SWOT Analysis

- Porter’s Five Forces

- By Value ,2019-2025

- By Adoption Rate ,2019-2025

- By Deployment Category ,2019-2025

- Channel Revenue Mix , 2019-2025

- By End‑User (In value %)

Banking & Financial InstitutionsIT & Telecom

Healthcare Systems

Retail & eCommerce Platforms

Government & Public Sector Risk Assessment - By Stress Test Solution Type (In value %)

Software Stress Testing Tools

Cloud‑based Stress Testing Services

Managed Stress Testing Services (Consulting + Testing)

AI/ML‑Enabled Stress Simulation Platforms

Custom Scenario Modeling Engines - By Deployment Mode (In value %)

Cloud‑Native

Hybrid

On‑Premise

Edge & IoT - By Pricing Model (In value %)

Perpetual License

SaaS/Subscription

Pay‑Per‑Use Stress Cycles - By Geography (In value %)

Metro Manila

Cebu & Visayas

Davao & Mindanao

Emerging Provincial Hubs

- Market Share of Major Players

- Cross‑Comparison Parameters (Company Overview, Stress Testing Technology Stack, Regulatory Compliance Certification, End‑User Footprint in Philippines, Revenue by Solution Type, Segment‑wise Implementation Experience, Partnership & Channel Ecosystem, R&D & Innovation Intensity, Customer Retention Index, Integration Capabilities, Training & Support Footprint, Scenario Library Depth, Performance Benchmark Scores, Time‑to‑Deploy Metrics)

- SWOT Analysis of Key Players

- Pricing Analysis of Major Players

- Detailed Profiles of Market Players

Accenture plc

Capgemini SE

IBM Corporation

Oracle Corporation

Microsoft Corporation

Infosys Ltd.

Wipro Ltd.

Tata Consultancy Services Ltd.

Capita plc

Cigniti Technologies Ltd.

SmartBear Software Inc.

RadView Software Ltd.

BlazeMeter (by Broadcom)

LoadRunner (Micro Focus)

Tricentis GmbH

- Stress Testing Use Patterns by Sector

- Enterprise Budget Allocations for Stress Tools

- Procurement Decision Criteria

- Pain Points (Scalability, Scenario Accuracy, Reporting Dashboards)

- IT/Finance Team Roles in Adoption

- By Value, 2026-2030

- By Volume ,2026-2030

- By Average Price, 2026-2030