Market Overview

The Philippines tailgates market is currently valued at USD ~ million, driven by the growing popularity of pickup trucks and SUVs, which are the primary vehicle types using tailgate systems. The market is bolstered by increasing consumer demand for utility vehicles and the expanding logistics sector, which increasingly requires tailgates for loading and unloading operations. Additionally, the rise in e-commerce and delivery services has led to a surge in demand for tailgates, especially in the aftermarket segment. The adoption of advanced tailgate technologies, such as power tailgates, further accelerates market growth. Increased infrastructure development and expanding urbanization also contribute to the demand for more robust and reliable tailgate systems.

Metro Manila, Cebu, and Davao are the dominant regions for the Philippines tailgates market. Metro Manila, being the capital and economic hub, sees the highest concentration of vehicles, particularly pickups and SUVs. The demand for tailgates in this region is largely driven by both individual consumers and the logistics industry, including last-mile delivery. Cebu and Davao, being central hubs for trade and commerce, also witness a high demand for tailgates due to the increasing commercial vehicle fleet, especially in sectors like construction, agriculture, and retail distribution.

Market Segmentation

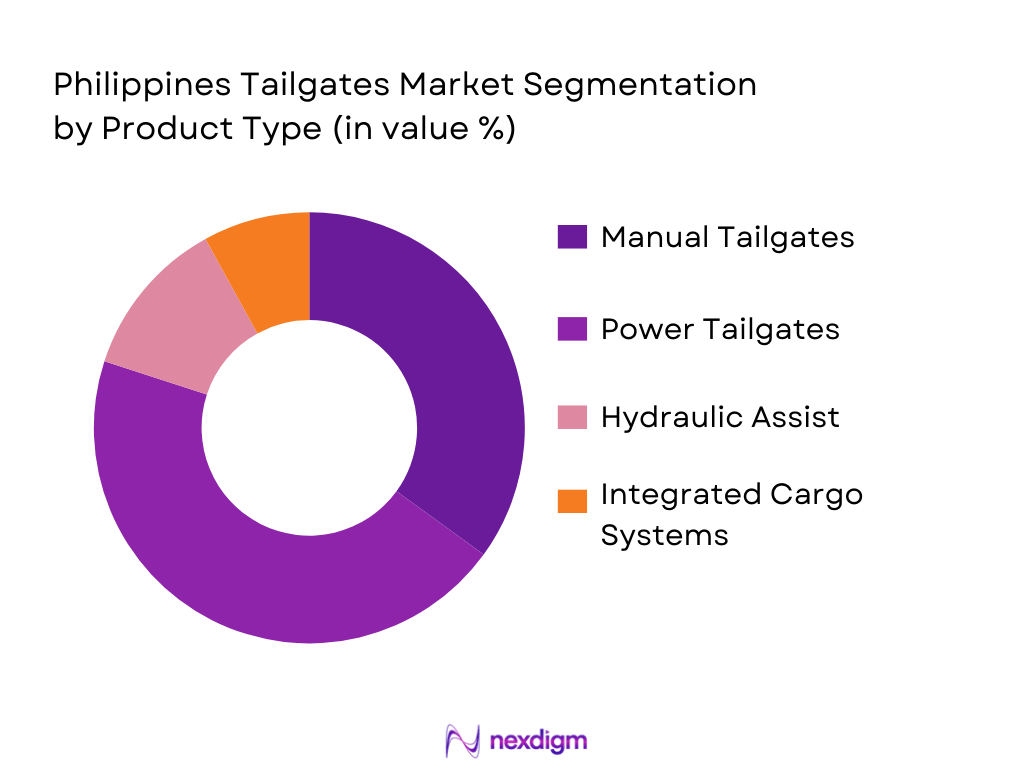

By Product Type

The Philippines tailgate market is segmented by product type into manual tailgates, power tailgates, hydraulic assist tailgates, and integrated cargo management tailgates. Among these, power tailgates dominate the market. Their growing popularity can be attributed to their convenience and ease of use, especially for consumers and fleet owners who require frequent and effortless loading and unloading. Brands like Toyota and Ford have pushed the demand for these advanced tailgates in their higher-end models. With the increasing adoption of electric vehicles (EVs) and smarter systems, power tailgates are expected to maintain their dominance.

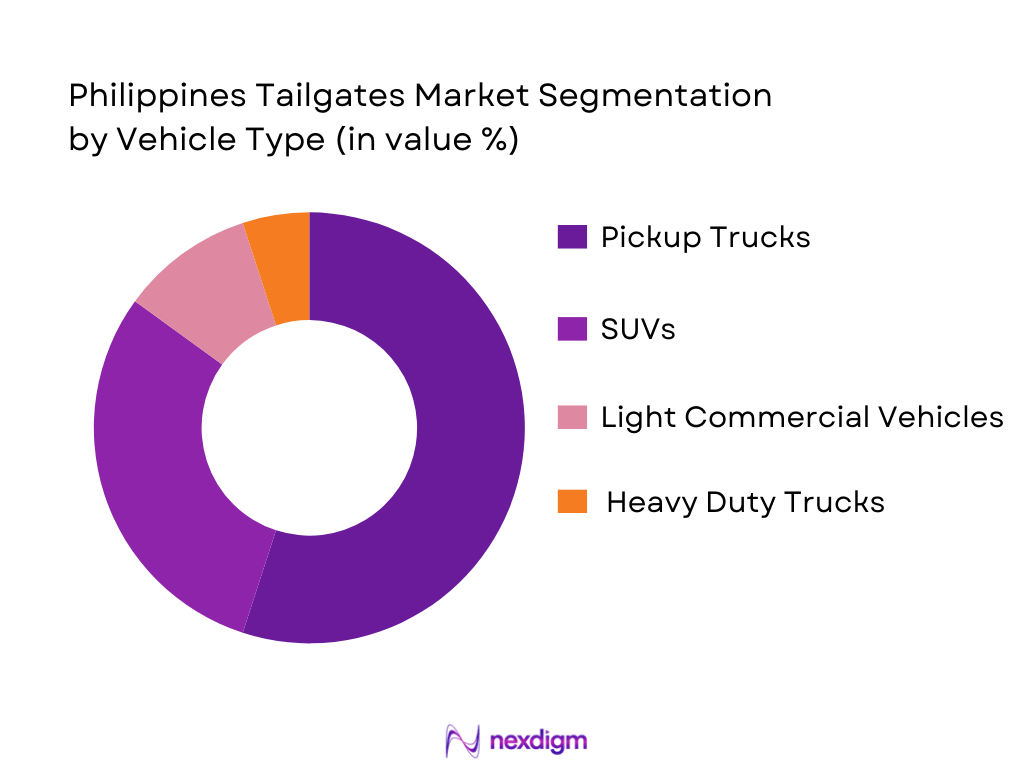

By Vehicle Type

The market is also segmented by vehicle type, which includes pickup trucks, SUVs, light commercial vehicles, and heavy-duty trucks. Pickup trucks are the dominant segment in the Philippines, primarily due to their utility and versatility, making them ideal for both personal use and business fleets. The increasing sales of pickup trucks from manufacturers like Toyota, Mitsubishi, and Isuzu have solidified the segment’s dominance. The rise of outdoor recreational activities and the growing need for cargo space are contributing factors. SUVs also hold a significant share, particularly in urban areas, as their larger tailgate systems are suitable for both personal and family use.

Competitive Landscape

The Philippines tailgates market is highly competitive, with both local and international players dominating the space. Global companies like Toyota, Ford, and Isuzu lead the OEM tailgate market, leveraging their established presence in the automotive sector and their ability to incorporate advanced technologies. Local manufacturers and distributors are also increasingly competing in the aftermarket segment, offering a wide range of tailgates at different price points. The competitive dynamics in the market also include significant participation from companies offering custom tailgates, catering to niche markets, particularly in the construction and agriculture sectors.

| Company | Establishment Year | Headquarters | Product Type | Market Focus | R&D Investments | Distribution Channels |

| Toyota Motor Philippines | 1988 | Manila, Philippines | ~ | ~ | ~ | ~ |

| Ford Philippines | 1997 | Parañaque, Philippines | ~ | ~ | ~ | ~ |

| Isuzu Philippines | 1995 | Quezon City, Philippines | ~ | ~ | ~ | |

| Mitsubishi Motors Philippines | 1963 | Manila, Philippines | ~ | ~ | ~ | ~ |

| Hino Motors Philippines | 1975 | Makati, Philippines | ~ | ~ | ~ | ~ |

Philippines Tailgates Market Analysis

Growth Drivers

Urbanization

Urbanization in the Philippines is a key driver for the tailgates market, as increasing urban populations generate higher demand for mobility, transportation, and logistical services that rely on vehicles requiring tailgate systems. The urban population accounts for approximately ~ % of the total population in 2025, showing a consistent rise from ~% in 2024 and ~ % in 2024, according to World Bank urbanization data. This concentration of population in cities like Metro Manila, where economic activities, commerce, and delivery services are centered, inherently increases vehicle utilization, particularly pickups and commercial vans that require robust tailgates for frequent loading and unloading. As urban households and businesses expand their transport requirements, the need for reliable tailgate solutions is reinforced.

Industrialization

Industrialization enhances the tailgates market through increased commercial activity and manufacturing output, where vehicles with tailgate systems are critical for logistics and supply chain operations. The Philippines has seen steady industrial contributions reflected in manufacturing value added, which continues to be a significant portion of the economy’s industrial output. As per World Bank indicators, the manufacturing sector’s value added remains a key contributor, with recent trends showing resilience amid global disruptions, indicating robust industrial engagement. This industrial momentum supports demand for trucks, light commercial vehicles, and specialized utility vehicles that rely on tailgates for effective operations. Furthermore, government emphasis on revitalizing industry and expanding domestic supplier bases as outlined in national development frameworks strengthens the link between industrial growth and demand for automotive components like tailgates.

Restraints

High Initial Costs

High initial costs constraint the Philippines tailgates market by limiting adoption, especially among small and medium enterprises (SMEs) and cost‑sensitive end users. Tailgates, particularly advanced variants like power tailgates and integrated cargo management systems, require substantial upfront investment in vehicle upgrades or OEM purchases. In an economy where consumer spending is influenced by disposable income levels, the Philippines’ GDP per capita is approximately USD ~ in 2025, as reported by the World Bank, which reflects moderate household spending power. Many logistics operators and individual buyers may postpone or opt out of purchasing premium tailgate systems due to the high entry price compared to baseline vehicle features, affecting overall market penetration.

Technical Challenges

Technical challenges present a significant restraint on the tailgates market, as advanced tailgate systems often demand specialized installation, maintenance, and parts replacement capabilities that are limited within the Philippines’ automotive service ecosystem. The country’s manufacturing and industrial sectors, while growing, are still developing their capacity for sophisticated automotive component production and repair. This limitation can result in higher dependency on imported components, longer lead times, and variable service quality across regions. Additionally, integration of technologically advanced tailgate systems with vehicle electronics requires skilled technicians and diagnostic tools, which are not evenly distributed, especially outside major urban centers, hindering broader adoption despite demand potential.

Opportunities

Technological Advancements

Technological advancements in automotive systems present a pivotal opportunity for the Philippines tailgates market, particularly in the development and deployment of power‑assisted and smart tailgate systems. With the global automotive industry increasingly integrating automation and connectivity features, dealers and manufacturers in the Philippines can leverage innovations such as remote actuation, sensor integration, and enhanced load management systems to attract value‑seeking customers. The industrial landscape in the country, focused on modernizing production capabilities and adopting new technologies, provides a foundation for this transition. Investments in automotive electronics and aftermarket service technologies also enable suppliers and installers to expand offerings that satisfy evolving consumer expectations for convenience and enhanced functionality in pickup trucks and commercial vehicles. These technological improvements align with broader industrial transformation efforts, presenting tailgate manufacturers and system integrators with the means to capture new demand segments within both OEM and aftermarket channels.

International Collaborations

International collaborations constitute a promising opportunity for the Philippines tailgates market as partnerships with global automotive component manufacturers can enhance technology transfer, supply chain resilience, and manufacturing capabilities. The Philippine government’s drive to attract foreign direct investment, supported by reforms aimed at improving the business environment, positions the country as a favorable partner for international firms seeking ASEAN market access. Such collaborations can facilitate joint ventures, licensing agreements, and localized assembly of advanced tailgate systems, reducing reliance on fully imported units and lowering operational costs. Additionally, integration with global automotive parts networks can improve quality standards and provide domestic players with exposure to best practices in production, testing, and after‑sales support, ultimately strengthening the market’s competitive landscape and offering greater choice to Filipino vehicle owners.

Future Outlook

Over the next five years, the Philippines tailgate market is expected to experience significant growth, driven by the increasing demand for pickup trucks, SUVs, and commercial vehicles. Additionally, as urbanization increases and e-commerce continues to thrive, the need for efficient and robust tailgate systems will surge. The introduction of more advanced tailgate technologies, such as electric power assist and automated systems, is also anticipated to drive the market forward. The growing preference for user-friendly features among consumers, particularly in urban areas, and government initiatives supporting infrastructure and the logistics industry will further bolster market expansion.

Major Players

- Toyota Motor Philippines

- Ford Philippines

- Isuzu Philippines

- Mitsubishi Motors Philippines

- Hino Motors Philippines

- Nissan Philippines

- Hyundai Motor Philippines

- Subaru Philippines

- Mazda Philippines

- Fuso Philippines

- Tata Motors Philippines

- Honda Cars Philippines

- Piaggio Vehicles Philippines

- Suzuki Philippines

- Mahindra Philippines

Key Target Audience

- Automobile Manufacturers (OEMs)

- Automotive Parts Distributors

- Logistics and Fleet Operators

- E-commerce and Delivery Service Providers

- Government and Regulatory Bodies (Department of Transportation, Land Transportation Office)

- Fleet Management Companies

- Vehicle Aftermarket Retailers

- Investments and Venture Capitalist Firms

Research Methodology

Step 1: Identification of Key Variables

The research begins by identifying key market variables through desk research, involving the collection of data from secondary sources, including industry reports, government publications, and existing databases. The focus is on identifying critical drivers, challenges, and trends that influence tailgate adoption in the Philippines market.

Step 2: Market Analysis and Construction

This phase involves analyzing historical data and conducting market size assessments, evaluating tailgate product demand across different segments (OEM, aftermarket). The analysis also includes examining consumer purchasing patterns and the geographical spread of tailgate usage.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated by consulting with key industry experts, including manufacturers, fleet operators, and logistics service providers. These consultations provide insights into market dynamics and help in refining the data for a more accurate representation of the market.

Step 4: Research Synthesis and Final Output

The final phase integrates all collected data, synthesizing insights from both top-down (industry reports, government data) and bottom-up (interviews, field surveys) approaches. The result is a comprehensive and validated market forecast, which is further verified through feedback from industry stakeholders.

- Executive Summary

- Research Methodology (Market Framework & Assumptions, Key Definitions [OEM vs Aftermarket Tailgates, Power Tailgates, Manual Tailgates], Abbreviations, Data Triangulation Approach, Primary & Secondary Research Coverage, ASEAN & Philippines Market Sourcing, Limitations)

- Philippines Tailgate Ecosystem

- Product & System Definitions

- ASEAN Automotive Tailgate Market Benchmarking (Country Comparisons)

- Philippines Automotive Industry & Pickup/SUV Vehicle Mix

- Tailgate Load, Cycle & Duty Expectations (Payload, Usage Intensity)

- Supply Chain & Value Chain

- Market Growth Drivers

Rising Pickup & SUV Demand (Local Sales Trends)

OEM Push for Power Tailgates & Smart Modules

Aftermarket Customization Trends

Logistics & Fleet Retrofit Incentives

- Market Challenges

Import Dependence for Power Actuation Components

Cost Sensitivity among SMEs

Distribution & Quality Standardization Barriers

- Opportunities

Smart Tailgate Integration (Remote Sensors, Connectivity)

Lightweight Material Adoption

ASEAN Supply Chain Optimization

- Market Trends

Increased Aftermarket Digital Sales (Online Tailgate Parts)

Fleet Electrification & Tailgate Module Compatibility

- Regulatory Landscape

Automotive Standards (DOTr, LTO Safety Requirements)

Import Duties on Aftermarket Components

- Price, Cost & Value Chain Analysis

- Price Band Analysis by Segment

- Import Cost vs Local Manufacturing Cost

- Logistics Cost Influence (Freight, Warehousing)

- Dealer & Retailer Margin Structures

- By Value, 2019-2025

- By Volume, 2019-2025

- By Average Price of Platforms/Services, 2019-2025

- By Tailgate Type (In Value %)

Manual Tailgates

Power/Actuated Tailgates

Hybrid Assisted Tailgates

Integrated Cargo Management Tailgates

Specialty/Commercial Tailgates (Dump Trucks, Vans) - By Vehicle Type (In Value %)

Pickup Trucks (Ford Ranger, Toyota Hilux, Isuzu D‑Max)

SUVs

Light Commercial Vehicles

Heavy Trucks

Electric & Hybrid Body Configurations - By End‑Use (In Value %)

Original Equipment Manufacturers (OEM Assembly)

Aftermarket Replacement

Fleet Upgrades (Logistics, Construction, Agricultural Fleets)

Custom & Performance Segments - By Distribution Channel (In Value %)

OEM Supply Chain (Dealer RO)

Independent Aftermarket Retailers

Online e‑commerce Platforms (Parts & Tailgate Components)

Direct Fleet Contracts

- Market Share (Value & Volume) — Leading OEM Parts & Aftermarket Vendors

- Cross Comparison Parameters (Product Portfolio Breadth, ASP, Warranty Terms, Material Innovation, Aftermarket Distribution, Local Assembly Capacity, Modular Compatibility, Digital Sales Penetration)

- SWOT Analysis — Top Market Competitors

- Market Positioning (Premium vs Value Segments)

- Detailed Company Profiles

Autogate Systems Philippines (Tailgate Fabricator)

Aftermarket Tailgate Retailers (Carousell Sellers Aggregated)

OEM Suppliers (Ford Philippines Tailgate Division)

Toyota Motor Philippines (Body Parts Division)

Isuzu Philippines (Aftermarket & OEM)

Mitsubishi Motors Philippines

Hino Motors Philippines

Nissan Philippines (Commercial Line)

Hyundai Motor Philippines

Mahindra (Commercials Imports)

Accessory Distributors (Top Tailgate Part Suppliers)

Aftermarket Chain Retailers (National Parts Retailers)

E‑Commerce Parts Platforms (Segment Level)

Local Custom Tailgate Workshops (Key Clusters)

ASEAN Component Exporters (Material/Actuator OEMs)

- Fleet Owners (Logistics/Construction) Needs & Procurement Cycles

- Individual Consumers (Pickup/SUV Owners) Preferences

- Dealer Adoption & Upsell Practices

- Service & Installation Network Mapping

- Decision Criteria

- Future Market Size by Value, 2026-2030

- Future Market Size by Volume, 2026-2030

- Average Frame Cost Outlook, 2026-2030