Market Overview

The Philippines Tamper-Evident Pharmaceutical Packaging market is valued at USD ~ million, based on a five-year historical analysis of pharmaceutical production volumes, import flows, and packaging consumption. Growth is driven by an expanding domestic pharmaceutical industry, which recorded medicine imports worth USD ~ billion and local drug manufacturing output exceeding USD ~ billion, according to UN Comtrade and PSA data. Increasing regulatory scrutiny, rising counterfeit incidence across ASEAN, and e-pharmacy penetration have accelerated industry adoption of tamper-evident (TE) labels, closures, and secondary packaging systems across OTC, Rx, and biologic segments.

Metro Manila dominates TE pharmaceutical packaging demand due to its clustering of major drug manufacturers, repacking units, and distribution hubs handling more than 60 percent of national pharmaceutical logistics throughput. Cebu and Davao follow as regional consolidation points for hospital networks and retail pharmacy chains. Internationally, high TE-compliant imports originate primarily from Singapore, India, and the United States, where stringent regulatory frameworks require pre-integrated TE features. These countries control major pharma export pipelines into the Philippines, influencing the TE format mix and compliance requirements adopted locally.

Market Segmentation

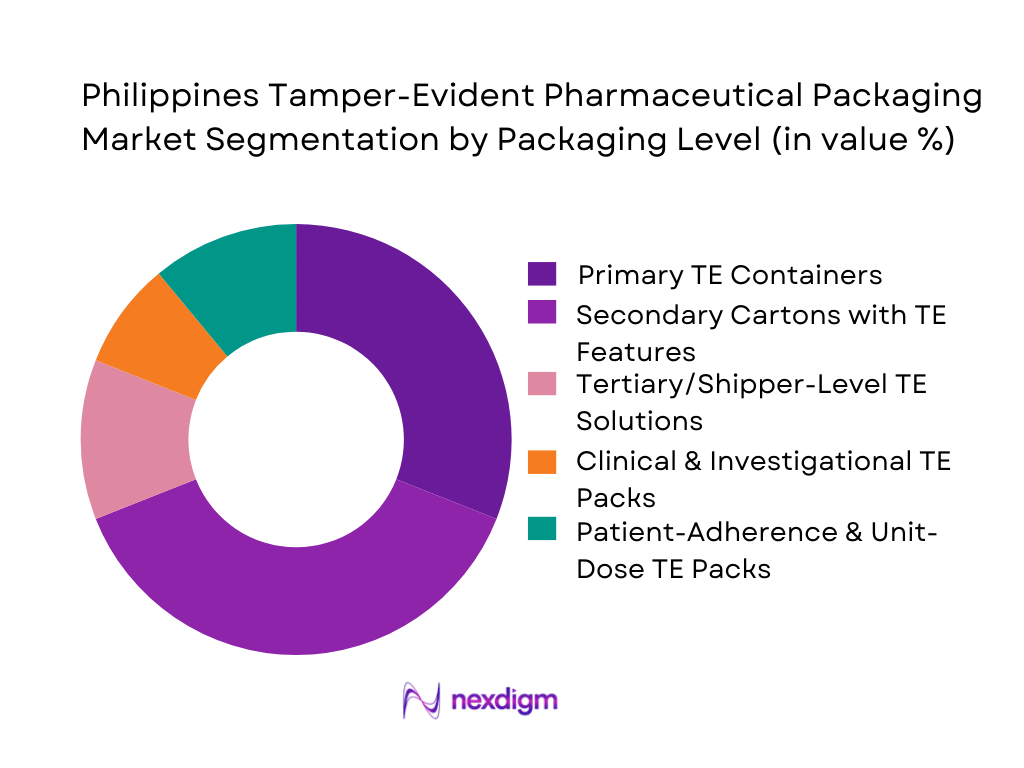

By Packaging Level

The segmentation of the Philippines tamper-evident pharmaceutical packaging market by packaging level shows secondary folding cartons with tamper-evident features holding the dominant market share. This leadership is attributed to the widespread use of folding cartons in both branded generics and OTC products, which represent the largest share of domestic drug consumption. The increasing retail-market orientation and the requirement for visible evidence of tampering during distribution enhance the dominance of TE-equipped cartons. High adoption among multinational pharma affiliates and controlled-temperature logistics operations further reinforces their position as the market’s leading TE format.

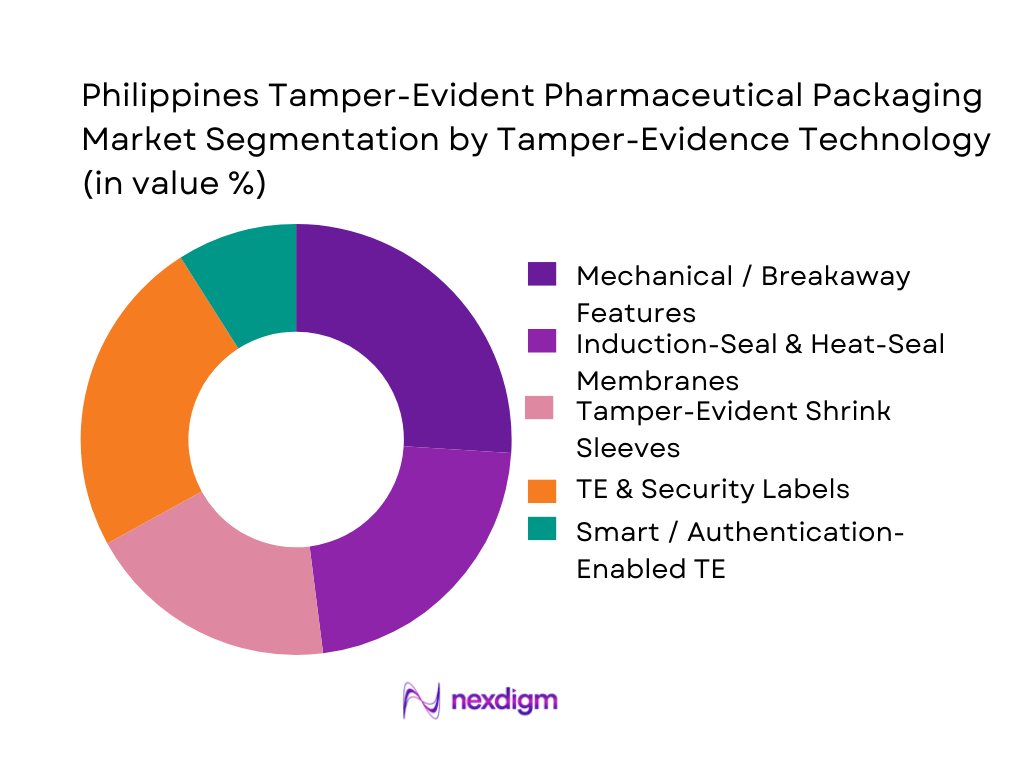

By Tamper-Evidence Technology

Among tamper-evident technologies, tamper-evident and security labels dominate due to their universal compatibility with bottles, cartons, vials, and pouches. Local manufacturing presence for label converting, coupled with lower capital requirements compared to induction sealing or shrink-sleeve applicators, supports their market strength. Additionally, rising counterfeit and diversion concerns in the ASEAN pharmaceutical trade have encouraged the adoption of void labels, frangible seals, and serialized QR-enabled TE stickers. These solutions offer low-cost integration, manual or automated application flexibility, and rapid scale-up, making them the preferred TE technology across both generic and multinational pharmaceutical operations.

Competitive Landscape

The Philippines tamper-evident pharmaceutical packaging market is shaped by a mix of multinational converters, local component manufacturers, and specialized security-label providers. Competition is driven by regulatory compliance capabilities, printing/serialization infrastructure, and supply reliability. Multinationals dominate high-spec TE cartons and flexible materials, whereas local firms lead in rigid plastics, closures, and TE labels. Increasing demand for authentication features and serialized packaging has also intensified collaboration between packaging players and digital security firms, creating a hybrid competition model combining physical TE with digital verification.

| Company | Establishment Year | Headquarters | TE Capability Breadth | Pharma Client Base | Security / Serialization Capability | Local Manufacturing Presence | Product Range Diversity | Key Philippines Advantage |

| Amcor Flexibles Philippines | 1860 | Switzerland | ~ | ~ | ~ | ~ | ~ | ~ |

| San Miguel Yamamura Packaging | 1997 | Philippines | ~ | ~ | ~ | ~ | ~ | ~ |

| Bestpak Packaging Solutions | 1990s | Philippines | ~ | ~ | ~ | ~ | ~ | ~ |

| Netpak Philippines | 1980s | Philippines | ~ | ~ | ~ | ~ | ~ | ~ |

| Packtica Philippines | 2000s | Malaysia | ~ | ~ | ~ | ~ | ~ | ~ |

Philippines Tamper-Evident Pharmaceutical Packaging Market Analysis

Growth Drivers

Pharma Manufacturing and CDMO Capacity Expansion

The Philippines is scaling local pharma output, creating a larger installed base of blistering, bottling and cartoning lines that can be upgraded with tamper-evident (TE) features. A national roadmap for the pharmaceutical industry targets significantly higher local production of essential medicines to reduce import dependence, with government planners highlighting the country’s population of 115,843,670 people as of 2024 and rising health demand as key justification. As more manufacturers and CDMOs invest in compliant fill-finish and packaging assets, every new solid-dose or sterile line becomes a candidate for TE closures, seals and serialized secondary packs.

Rising Healthcare Expenditure and Medicine Consumption

Expanding health budgets and treatment volumes directly lift demand for secure packs that protect products in high-throughput hospital, retail and e-pharmacy channels. Total health expenditure reached ₱ ~ trillion in 2022, according to the Philippine Congress’ research office, reflecting robust funding for medicines, vaccines and logistics. Health-care spending per person increased from US$ ~ in 2022 to US$ ~ in 2023 on World Bank estimates, signalling higher per-capita therapy uptake and more packs in circulation that need TE closures, perforated cartons, seals and shrink sleeves to safeguard integrity.

Challenges

TE Feature Cost and Line Conversion Economics

Upgrading cartoners, blister lines and bottle-filling equipment to add perforations, security seals or serialized coding competes with other capital needs in a cost-sensitive health system. Total health expenditure of ₱ ~ trillion in 2022 must cover hospitals, human resources and primary care in addition to medicines, limiting room for abrupt packaging cost increases. With GDP per capita at US$ ~ in 2024, manufacturers serving the domestic market balance TE investments against patients’ out-of-pocket constraints, making payback periods for new TE applicators, inspection cameras and shippers a central concern in project decisions.

SME Manufacturer Readiness and Technical Capability Gaps

Tamper-evident technologies demand capabilities in packaging design, validation, documentation and line qualification that many smaller firms still lack. Philippine statistics show 1,105,143 business establishments in 2022, of which 99.59% were micro, small and medium enterprises and only 4,541 were large companies, underscoring a base dominated by resource-constrained players. While a subset of larger pharma manufacturers can invest in serialized carton lines and security labels, many SMEs supplying generics or contract packs must still build competencies in artwork control, packaging quality assurance and regulatory audit readiness for TE features.

Opportunities

Migration from Non-TE to Fully TE-Compliant Portfolios

The combination of frequent counterfeit-medicine advisories and growing immunization/therapy volumes creates a strong case for systematic migration from partial or non-TE packs to fully TE-compliant portfolios. In 2022, the National Immunization Program recorded 1,337,743 fully immunized children nationwide, a cohort that depends on vaccine and pediatric packs maintaining integrity from factory to barangay health stations. With 181,645,251 COVID-19 doses administered and multiple counterfeit incidents prompting specific FDA warnings, pharma manufacturers and brand owners have tangible incentives to adopt TE cartons, breakable closures, seals and serialized identifiers across their full product range.

Smart and Connected TE Packaging

High internet and smartphone penetration create favourable conditions for QR-coded, app-linked and cloud-connected TE solutions that allow patients and pharmacists to authenticate packs in real time. World Bank data indicate that 84% of Filipinos used the internet in 2023, against a total population of 115,843,670 in 2024, implying tens of millions of digitally connected patients and caregivers. Improvements in mobile-network quality, including a 32% increase in mobile internet speeds between January 2023 and July 2024, further support deployment of authentication apps, serial-number look-up portals and scan-based recall/trace solutions embedded into TE labels and cartons.

Future Outlook

Over the next several years, the Philippines tamper-evident pharmaceutical packaging market is expected to experience sustained expansion, driven by larger domestic pharmaceutical output, growth in e-pharmacy and home-delivery services, and increased vigilance surrounding counterfeit prevention across Southeast Asia. Regulatory expectations around serialization and secure packaging for exports to the US, EU, and Singapore will encourage wider adoption of high-integrity TE components. The shift toward biologics, vaccines, and sensitive formulations will further stimulate demand for TE vials, seals, and smart packaging solutions.

Major Companies

- Amcor Flexibles Philippines

- San Miguel Yamamura Packaging Corporation

- Bestpak Packaging Solutions

- Netpak Philippines

- Robicel Trading

- GL Otometz Corporation

- Plastic Container Packaging Corporation

- APO International Marketing

- Merfel Plastic Products

- Versa Group Philippines

- SwissPac

- Packtica Philippines

- Unisto Security Seals

- MM Group Healthcare Packaging

- Euro-Med Laboratories Packaging Operations

Key Target Audience

- Pharmaceutical Manufacturing Companies

- Contract Development & Manufacturing Organizations

- Contract Packaging Organizations

- Packaging Material Manufacturers & Converters

- Pharmaceutical Distributors & Logistics Firms

- E-Pharmacy & Digital Health Dispensing Platforms

- Government & Regulatory Bodies

- Investment & Venture Capital Firms

Research Methodology

Step 1: Identification of Key Variables

The initial stage involved mapping the entire Philippines pharmaceutical packaging ecosystem, including material suppliers, converters, pharma manufacturers, distributors, and regulatory bodies. Extensive secondary research using PSA, WHO, World Bank, IMF, Statista, and UN Comtrade databases helped identify key variables such as TE adoption rate, packaging material usage, counterfeit incidents, and regulatory requirements. These variables formed the foundation of the market scope and data model.

Step 2: Market Analysis and Construction

Historical data on pharmaceutical production, import flows, packaging consumption, security-label printing capacity, and pharma retail expansion were analyzed. Ratios such as packaging units per drug formulation, TE penetration per product category, and pharma manufacturing throughput were used to estimate market revenue. Quality metrics, including supply-chain integrity violations and regulatory recall statistics, ensured accuracy and realism in market size development.

Step 3: Hypothesis Validation and Expert Consultation

Industry hypotheses were tested through structured interviews with packaging suppliers, regulatory experts, plant heads, and supply-chain managers from leading pharma companies. CATI interviews gathered insights related to cost pressures, TE technology preferences, scalability challenges, and line-integration constraints. The operational and financial insights validated assumptions regarding TE adoption trends and demand growth drivers.

Step 4: Research Synthesis and Final Output

Data synthesized from top-down (import/manufacturing) and bottom-up (SKU-level packaging units) approaches was cross-verified with insights from packaging converters and pharma procurement teams. Validation inputs from equipment manufacturers specializing in induction sealing, shrink-sleeve applicators, and TE-label automation further refined the final market figures. This multi-layer approach ensured that the Philippines tamper-evident pharmaceutical packaging market analysis is both robust and fully substantiated.

- Executive Summary

- Research Methodology (Research Design and Scope, Market Definitions, Nomenclature and Assumptions, Data Sources, Triangulation and Validation, Market Sizing and Forecasting Approach, Sampling Frame and Stakeholder Interview Coverage, Bottom-Up and Top-Down Reconciliation, Study Limitations and Sensitivity Tests)

- Definition and Scope

- Market Genesis and Evolution of Tamper-Evident Requirements

- Role of TE Packaging in Philippines Pharma Supply Chain Integrity

- Business Cycle: From Resin, Cartonboard and Inks to TE-Finished Pack

- Supply Chain and Value Chain Structure

- Growth Drivers

Pharma Manufacturing and CDMO Capacity Expansion

Rising Healthcare Expenditure and Medicine Consumption

Counterfeit, Diversion and Parallel Trade Risk

Regulatory Upgrades and ASEAN/Global Export Requirements

E-Pharmacy, Mail-Order and Home-Delivery Growth - Challenges

TE Feature Cost and Line Conversion Economics

SME Manufacturer Readiness and Technical Capability Gaps

Import Dependence on Specialized Materials and Components

Fragmented Supply Chain for Security Features

Regulatory Interpretation, Documentation and Audit Complexity - Opportunities

Migration from Non-TE to Fully TE-Compliant Portfolios

Smart and Connected TE Packaging

Cold-Chain and Vaccine TE Solutions

Localization of Key TE Components

Sustainability-Focused TE Innovations - Trends

Shift Toward CR-TE and Senior-Friendly Designs

Late-Stage Customization and On-Demand TE Features

Serialization, Aggregation and Digital Identity Integration

Vendor-Consolidation and Preferred-Partner Models

Increased Use of Data-Carrier TE Labels - Government and Regulatory Framework

- Philippines FDA and DOH Requirements for TE Packaging

- SWOT Analysis

- Stakeholder Ecosystem Mapping

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Realization per Unit, 2019-2024

- By Packaging Level (in Value %)

Primary Tamper-Evident Containers

Secondary Folding Cartons with TE Features

Tertiary and Shipper-Level TE Solutions

Clinical-Trial and Investigational Medicinal Product Packs

Patient-Adherence and Unit-Dose Packs - By Component / Format Type (in Value %)

Blister Packs and Wallet Cards

Bottles, Jars and Vials with TE Closures

Flexible Sachets, Stickpacks and Pouches

Folding Cartons and Sleeves

Labels, Seals and Overwraps - By Tamper-Evidence Technology (in Value %)

Mechanical and Breakaway Features

Induction-Seal and Heat-Seal Technologies

Shrink-Sleeve and Overwrap Systems

Tamper-Evident and Security Labels

Smart and Authentication-Enabled TE - By End-Use Product and Therapy Class (in Value %)

Prescription Solid-Oral Generics

Branded and Specialty Rx

Vaccines and Biologics

OTC, Consumer Health and Nutraceuticals

Hospital, Institutional and Government Programs - By Customer Type (in Value %)

Local Ethical and Generic Manufacturers

Multinational Pharma Affiliates

Contract Development and Manufacturing / Contract Packaging Organizations Government Procurement Agencies and Public Health Programs

Distributors, E-Pharmacies and Parallel Trade Actors - By Region within the Philippines (in Value %)

Mega Manila / NCR and Immediate Growth Corridors

Luzon (Outside NCR) Manufacturing Corridors

Visayas (Cebu and Surrounding Islands) Pharma and Distribution Hubs

Mindanao Pharma, Distribution and Government Supply Nodes

Export-Linked Ecozones and Logistics Gateways

- Market Share of Major Players by Value and Volume

Market Share by Packaging Level and Component Type

Market Share by Customer Type and Therapy Focus - Cross Comparison Parameters (Regulatory and Quality Compliance Footprint, Tamper-Evident Feature Portfolio Breadth, Serialization, Track-and-Trace and Data-Carrier Capabilities, Local Manufacturing and Supply-Chain Footprint, Dosage-Form and Therapy-Class Coverage, Innovation and Sustainability Initiatives, Service Model, Technical Support and Line-Integration Expertise, Commercial Model and Strategic Partnerships)

- SWOT Analysis of Major Players

- Pricing and Cost-Structure Analysis for Major Players

- Detailed Profiles of Major Companies

Amcor Flexibles Philippines Corp.

San Miguel Yamamura Packaging Corporation

Bestpak Packaging Solutions, Inc.

Netpak Phils., Inc.

Robicel Trading

Euro-Med Laboratories Philippines Inc.

GL Otometz Corporation

Plastic Container Packaging Corporation

APO International Marketing Corporation

Merfel Plastic Products

Versa Group Philippines Corporation

SwissPac

Packtica Philippines

Unisto Security Seals Philippines

- Demand Patterns by Therapy Area and Dosage Form

- Procurement Models and Budget Allocation for TE Features

- TE Requirements by Channel

- End-User Needs, Preferences and Pain Points

- Decision-Making Unit and Influencer Mapping

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Realization per Unit, 2025-2030