Market Overview

The Philippines Teleconsultation Services Market is valued at USD ~, which represents the overall value of teleconsultation services delivered across digital channels in the Philippines, reflecting the structural role of virtual care in alleviating outpatient congestion, physician access gaps, and time-cost inefficiencies in healthcare delivery. The market’s demand logic is anchored in urban outpatient overflow, uneven geographic distribution of clinicians, and increasing acceptance of remote consultations for low-acuity, follow-up, and mental health use cases. Teleconsultation has evolved from an access substitute into an integrated front door for care navigation, triage, and continuity, supporting both private and public healthcare objectives. Its importance is reinforced by the country’s mobile-first digital behavior and the need for scalable care delivery without proportional physical infrastructure expansion.

Within the Philippines, demand concentration is highest in the National Capital Region due to dense hospital networks, higher private healthcare spending, and employer-led telehealth adoption, followed by urban clusters across Luzon, Visayas, and Mindanao where specialist availability remains uneven. Urban dominance is driven by smartphone penetration, private insurance usage, and corporate health programs. Technology influence is shaped by external platform architectures, clinical workflow standards, and data security frameworks developed in advanced digital health ecosystems, which are localized to meet Philippine regulatory, language, and care delivery realities. These external influences define platform design, physician engagement models, and enterprise integration practices within the country.

Market Segmentation

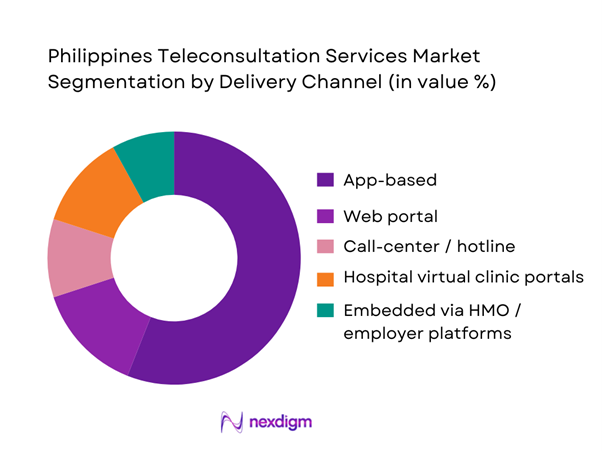

By Delivery Channel

App-first delivery leads because it compresses the full care journey—booking, queueing, video consult, e-prescription storage, and follow-up—into a single interface and supports “super-app” bundling. Leading platforms highlight short wait times, 24/7 coverage, and integrated add-ons (medicine delivery, lab coordination, mental health consults), which increases conversion from consultation to fulfilment. Embedded distribution also boosts app usage when HMOs route covered members into partner apps, effectively lowering out-of-pocket friction and driving repeat consultations.

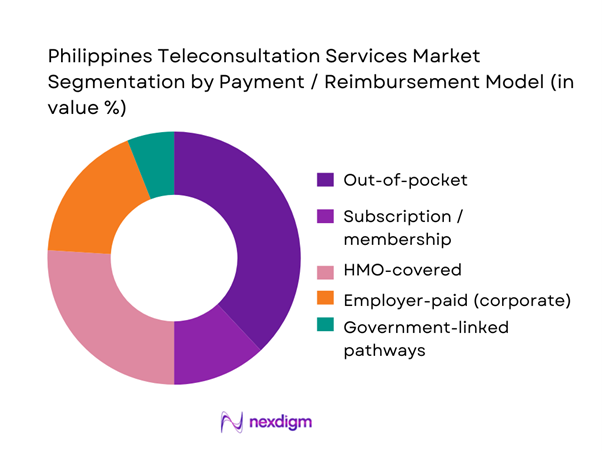

By Payment / Reimbursement Model

HMO-covered and employer-paid access (combined dominance, with HMO slightly ahead). Coverage-linked usage grows faster because it reduces price sensitivity and encourages early consults rather than delayed care. HMOs and large employers increasingly position teleconsult as a first line of care for non-emergent symptoms, triaging cases and directing members to in-person care only when needed. This model improves provider utilization and reduces avoidable ER visits. Additionally, insurer partnerships (including app-powered videoconsult offers) strengthen member acquisition and retention, turning teleconsult into a sticky benefit rather than a one-off transaction.

Competitive Landscape

The Philippines Teleconsultation Services market is dominated by a few major players, including KonsultaMD and global or regional brands like Doctor Anywhere Philippines, Whitecoat Philippines, and mWell PH. This consolidation highlights the significant influence of these key companies.

| Company | Est. Year | HQ (PH) | Primary Model | 24/7 Availability | Core Specialties Depth | eRx Support | Labs/Diagnostics Integration | Pharmacy Delivery / Ordering | Key Channel Strength |

| KonsultaMD | Philippines | ~ | ~ | ~ | ~ | ~ | ~ | ~ | |

| mWell | Philippines | ~ | ~ | ~ | ~ | ~ | ~ | ~ | |

| Medgate Philippines | Philippines | ~ | ~ | ~ | ~ | ~ | ~ | ~ | |

| Doctor Anywhere PH | Philippines | ~ | ~ | ~ | ~ | ~ | ~ | ~ | |

| NowServing (SeriousMD) | Philippines | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

USA Teleconsultation Services Market Analysis

Growth Drivers

Rising outpatient load in urban centers

The sustained rise in outpatient consultations across major urban centers in the Philippines has placed mounting pressure on hospital outpatient departments and private clinics, creating a structurally favorable environment for teleconsultation adoption. High patient footfall in metropolitan areas leads to long waiting times, overcrowded facilities, and clinician fatigue, particularly for low-acuity and repeat visits. Teleconsultation services increasingly absorb non-emergency consultations, prescription renewals, post-treatment follow-ups, and initial triage, allowing physical facilities to prioritize complex and procedural care. This shift enables healthcare providers to optimize clinician time allocation and improve patient throughput without corresponding investments in additional real estate, consultation rooms, or front-desk staff. As urban populations continue to grow and healthcare-seeking behavior intensifies, teleconsultation functions as a critical demand-smoothing mechanism that supports operational efficiency, patient satisfaction, and system resilience within urban healthcare ecosystems.

Physician availability imbalance

The uneven geographic distribution of physicians across the Philippines remains a persistent structural challenge, directly supporting teleconsultation market growth. Specialist physicians are heavily concentrated in metropolitan areas, while secondary cities and rural regions experience limited access to qualified clinicians. Teleconsultation platforms bridge this imbalance by enabling remote delivery of consultations, follow-ups, and second opinions without requiring physician relocation or physical infrastructure expansion. Hospitals, insurers, and government-backed health programs increasingly rely on teleconsultation to extend specialist reach while maintaining centralized clinical governance and standardized care protocols. This imbalance also influences platform design, prioritizing scheduling efficiency, referral pathways, and multi-specialty access. As healthcare equity and access remain policy and operational priorities, physician availability gaps continue to act as a sustained driver for teleconsultation adoption across both private and public healthcare delivery models.

Challenges

Clinical appropriateness limitations

Clinical appropriateness remains a fundamental constraint in the Philippines teleconsultation services market, limiting the scope of conditions that can be effectively managed through virtual channels. Consultations requiring physical examination, diagnostic testing, imaging, or procedural intervention cannot be fully addressed through teleconsultation alone. This necessitates robust triage systems, clear clinical protocols, and seamless referral pathways to in-person care, which are inconsistently implemented across providers. Inadequate triage increases the risk of misdiagnosis, delayed treatment, or patient dissatisfaction, undermining confidence in virtual care models. Certain specialties remain cautious in adopting teleconsultation due to medico-legal exposure and perceived quality limitations. As a result, providers must balance accessibility with clinical rigor, investing in governance frameworks and clinician training to ensure teleconsultation is used appropriately and safely within defined care boundaries.

Data privacy and consent complexity

Ensuring secure handling of patient data presents a significant operational challenge for teleconsultation providers in the Philippines. Digital consultations require the collection, storage, and transmission of sensitive health information across multiple systems, devices, and stakeholders. Variability in provider cybersecurity maturity and patient digital literacy complicates informed consent processes and increases exposure to data misuse or breaches. Compliance with national data protection requirements adds administrative overhead, particularly for smaller platforms with limited compliance infrastructure. Patients may also express hesitation regarding data security, affecting adoption and repeat usage. Providers must therefore invest in secure platform architecture, standardized consent workflows, and continuous monitoring mechanisms. These requirements elevate operating costs and complexity, creating barriers to entry and scale while reinforcing trust and credibility as critical competitive differentiators in the teleconsultation market.

Opportunities

Chronic care virtual management

Teleconsultation offers a significant opportunity to enhance chronic disease management across the Philippines by enabling consistent, low-burden patient engagement over extended periods. Conditions such as diabetes, hypertension, and respiratory disorders require regular monitoring, medication adjustments, and lifestyle counseling rather than frequent physical examinations. Virtual follow-ups allow clinicians to maintain continuity of care while reducing unnecessary hospital visits and patient travel time. Teleconsultation platforms can support medication adherence, symptom tracking, and patient education, improving long-term outcomes and reducing acute exacerbations. For providers and payers, chronic care virtualization lowers downstream hospitalization risk and supports predictable care delivery models. As chronic disease prevalence continues to rise, teleconsultation is well-positioned to become an integral component of population health strategies focused on stability, efficiency, and patient-centered care.

Employer-led virtual primary care

Employer-sponsored teleconsultation represents a scalable growth avenue as organizations increasingly prioritize workforce health, productivity, and cost control. Virtual primary care services reduce employee downtime associated with clinic visits, enable early intervention for common health issues, and provide discreet access to mental health support. Employers favor bundled teleconsultation offerings that include primary care, wellness guidance, referral coordination, and utilization reporting. These contracts provide platforms with stable revenue streams and higher user engagement compared to purely consumer-driven models. Integration with corporate benefits systems and analytics dashboards further strengthens platform value propositions. As employers seek measurable health outcomes and absenteeism reduction, teleconsultation providers that tailor solutions to enterprise needs can expand adoption while embedding virtual care into routine employee health management frameworks.

Future Outlook

The Philippines teleconsultation services market is expected to transition from episodic virtual visits toward integrated hybrid care models, where teleconsultation functions as a coordinated entry point into broader healthcare delivery. Strategic focus will shift toward deeper clinical integration, payer alignment, and chronic care enablement, reinforcing teleconsultation as a structural component of the national healthcare system rather than a supplemental service.

Major Players

- KonsultaMD

- Doctor Anywhere Philippines

- Whitecoat Philippines

- mWell PH

- SeriousMD

- KHealth

- MyPocketDoctor

- Medifi

- SeeYouDoc

- AIDE App

- HealthNow

- CURA Healthcare

- Telemed PH

- MedGrocer Telehealth

Key Target Audience

- Hospitals and clinic networks

- Health insurance providers

- Corporate employers

- Digital health platform operators

- Pharmaceutical companies

- Healthcare IT vendors

- Investments and venture capitalist firms

- Government and regulatory bodies of the Philippines

Research Methodology

Step 1: Identification of Key Variables

Key variables included service types, care settings, platform models, end-user segments, and regulatory constraints shaping teleconsultation adoption and monetization.

Step 2: Market Analysis and Construction

The market framework was constructed by mapping service delivery models to care use cases, revenue attribution logic, and active usage patterns across the Philippines.

Step 3: Hypothesis Validation and Expert Consultation

Insights were validated through structured discussions with clinicians, platform operators, healthcare administrators, and policy stakeholders active in teleconsultation delivery.

Step 4: Research Synthesis and Final Output

Findings were synthesized into a cohesive market narrative, ensuring internal consistency, exclusion clarity, and alignment with client decision-making requirements.

- Executive Summary

- Research Methodology (Market Definitions and Inclusions/Exclusions, Abbreviations, Topic-Specific Taxonomy, Market Sizing Framework, Revenue Attribution Logic Across Use Cases or Care Settings, Primary Interview Program Design, Data Triangulation and Validation, Limitations and Data Gaps)

- Definition and Scope

- Market Genesis and Evolution

- Teleconsultation Usage and Care-Continuum Mapping

- Business Cycle and Demand Seasonality

- Philippines Healthcare Service Delivery Architecture

- Growth Drivers

Rising outpatient load in urban centers

Physician availability imbalance

Digital health policy support

Mobile-first patient behavior

Cost and time efficiency pressures - Challenges

Clinical appropriateness limitations

Fragmented provider adoption

Data privacy and consent complexity

Reimbursement ambiguity

Digital literacy gaps - Opportunities

Chronic care virtual management

Rural access expansion

Employer-led virtual primary care

Insurance-integrated teleconsultation

AI-supported clinical triage - Trends

Hybrid care models

Platform consolidation

Clinical workflow integration

Asynchronous care adoption

Localized language interfaces - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- By Consultation Volume, 2019–2024

- By Average Consultation Ticket, 2019–2024

- By Monetization Mix, 2019–2024

- By Consultation Type (in Value %)

Primary care consultations

Specialist consultations

Mental health consultations

Chronic disease follow-ups

Post-acute care consultations

Second-opinion consultations - By Care Setting (in Value %)

Standalone teleconsultation platforms

Hospital-integrated teleconsultation

Employer-sponsored telehealth

Insurance-linked virtual care

Government-supported teleconsultation - By Platform Type (in Value %)

Video-based consultation

Audio-only consultation

Chat-based consultation

AI-assisted triage platforms

Integrated EHR-enabled platforms - By Delivery Model (in Value %)

Direct-to-consumer

B2B enterprise contracts

Payer-mediated access

Public health programs - By End-Use Customer Type (in Value %)

Individual patients

Hospitals and clinics

Corporate employers

Insurance providers

Government health agencies

NGOs and foundations - By Region (in Value %)

National Capital Region

Luzon (excluding NCR)

Visayas

Mindanao

- Competition ecosystem overview

- Cross Comparison Parameters (physician network depth, specialty coverage breadth, average consult turnaround time, platform uptime reliability, clinical governance protocols, data privacy compliance readiness, payer integration capability, enterprise onboarding speed)

- SWOT analysis of major players

- Pricing and commercial model benchmarking

- Detailed Profiles of Major Companies

KonsultaMD

KHealth

SeriousMD

MyPocketDoctor

Medifi

SeeYouDoc

AIDE App

HealthNow

mWell PH

Doctor Anywhere Philippines

CURA Healthcare

Telemed PH

CloudMD Philippines

MedGrocer Telehealth

Whitecoat Philippines

- Buyer personas and decision-making units

- Procurement and contracting workflows

- KPIs used for evaluation

- Pain points and adoption barriers

- By Value, 2025–2030

- By Consultation Volume, 2025–2030

- By Average Consultation Ticket, 2025–2030

- By Monetization Mix, 2025–2030