Market Overview

The Philippines Telehealth Platforms market is valued at USD ~ million, driven primarily by the country’s growing digital health adoption. Key factors fueling this growth include a rise in smartphone penetration, an increase in healthcare access through digital platforms, and the government’s push for universal health coverage. The increasing prevalence of chronic diseases like diabetes and hypertension also bolsters demand for remote health services, as more patients opt for telemedicine consultations to avoid the inconvenience of in-person visits. Furthermore, regulatory developments such as the Telemedicine Law and enhanced digital infrastructure are aiding the market’s expansion.

Manila, Cebu, and Davao are the leading regions dominating the Philippines’ telehealth market. The concentration of healthcare facilities and high internet penetration in Manila makes it the focal point of telemedicine adoption, with patients and healthcare providers increasingly utilizing digital platforms. Additionally, Cebu and Davao’s growing healthcare infrastructure, paired with rising urbanization and access to mobile broadband, make them important hubs for telehealth services. These regions have seen a higher uptake due to government initiatives that promote telemedicine integration within the healthcare system.

Market Segmentation

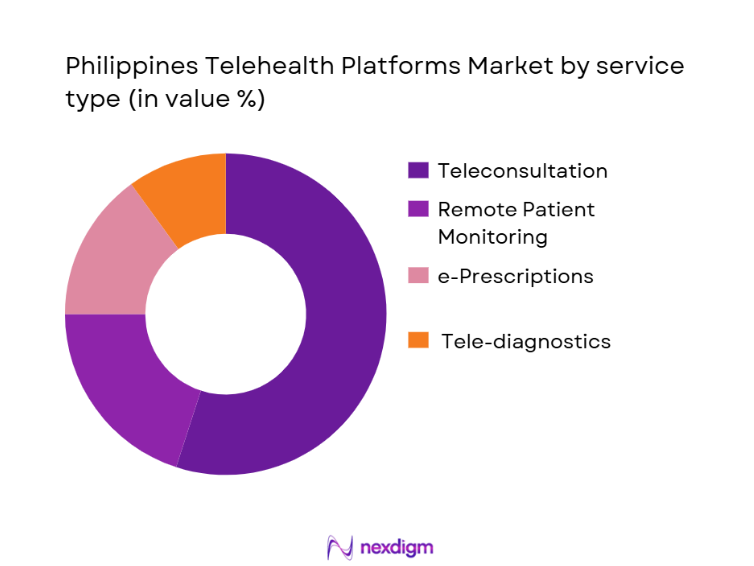

By Service Type

The Philippines Telehealth market is segmented into Teleconsultation, Remote Patient Monitoring (RPM), e-Prescriptions, and Tele-Diagnostics. Among these, Teleconsultation dominates the market. The convenience of receiving medical advice without needing to visit a healthcare facility is a driving factor. The significant demand for accessible healthcare, especially in rural and underserved areas, makes teleconsultation the most sought-after service. Patients are opting for consultations for general health issues, mental health counseling, and follow-up care. Furthermore, government initiatives to facilitate teleconsultation adoption in the public health sector have spurred the growth of this sub-segment.

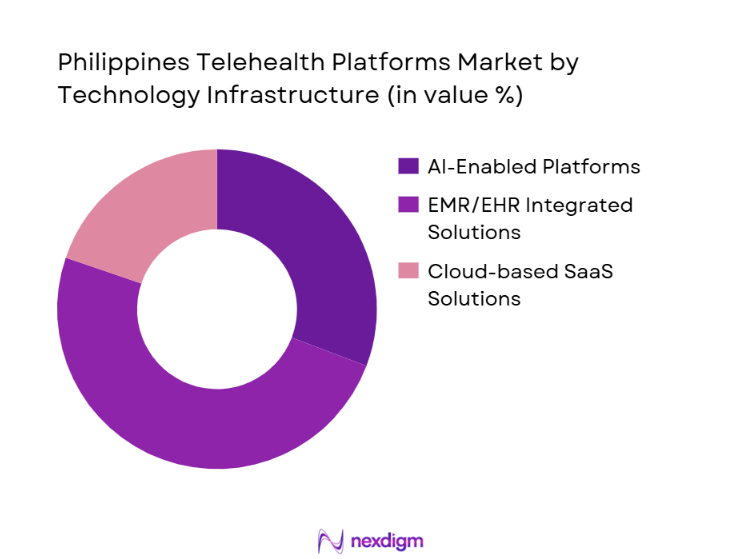

By Technology Infrastructure

The technology infrastructure for telehealth in the Philippines includes AI-enabled platforms, EMR/HER integrated solutions, and cloud-based SaaS systems. Among these, AI-enabled platforms are gaining the largest share due to their ability to provide more accurate diagnostics and enhance patient care. These platforms use machine learning and predictive analytics to help doctors diagnose conditions remotely, improving both the speed and accuracy of consultations. This technology is also helping healthcare providers offer personalized treatment plans, driving its dominance in the market.

Competitive Landscape

The Philippines Telehealth market is highly competitive, with several key players vying for market share. Key local players include KonsultaMD and MyHealth Clinic, while global brands like Medgate and Docquity are also making significant strides. The competitive dynamics are shaped by factors such as pricing models, the integration of advanced technologies like AI and tele-diagnostics, and customer retention strategies. These companies are enhancing their market positioning by expanding their healthcare networks, offering mobile apps, and collaborating with hospitals and insurance providers to reach a larger pool of patients.

| Company | Establishment Year | Headquarters | Technology Type | Platform Type | Patient Base | Geographic Coverage | Partnerships |

| KonsultaMD | 2016 | Manila | AI-enabled, Teleconsultation | Web, Mobile | 500,000+ | Nationwide | Hospitals, Pharmacies |

| MyHealth Clinic | 2012 | Makati | EHR Integration | Web, Mobile | 300,000+ | Metro Manila, Cebu | Clinics, Hospitals |

| Medgate | 2017 | Manila | Teleconsultation, RPM | Web, Mobile | 250,000+ | Nationwide | Hospitals |

| Docquity | 2014 | Manila | EHR Integration | Web, Mobile | 150,000+ | Metro Manila, Davao | Healthcare Providers |

| HealthNow | 2015 | Manila | AI-enabled, Teleconsultation | Mobile | 100,000+ | Metro Manila | Clinics |

Philippines Telehealth Platforms Market Analysis

Growth Drivers

Government Support and Policy Initiatives

The Philippine government’s push for Universal Health Care (UHC) and digital health integration has significantly facilitated the adoption of telehealth platforms. The inclusion of telemedicine under PhilHealth’s benefits has expanded access to healthcare services, particularly for underserved populations in rural areas. This support from the government has led to increased trust and demand for telehealth services.

Rising Healthcare Access and Smartphone Penetration

With the increasing penetration of smartphones and mobile internet, more Filipinos are turning to digital solutions for their healthcare needs. The growing use of mobile phones has made teleconsultation and remote health services more accessible, especially in geographically isolated areas. This trend is pushing telehealth platforms to scale and innovate their service offerings to reach a larger patient base.

Market Challenges

Limited Internet Connectivity in Rural Areas

One of the primary challenges hindering the widespread adoption of telehealth services in the Philippines is inconsistent and limited internet connectivity in rural areas. While urban centers like Manila experience robust internet access, rural regions face significant challenges, including slow speeds and limited network coverage. This disparity restricts telehealth services’ ability to reach all populations equally.

Digital Literacy and Trust Barriers

Another challenge is the varying levels of digital literacy among the population. Many patients, particularly older adults or those in rural areas, may lack the skills to navigate telehealth platforms effectively. Additionally, there is a general lack of trust in online medical consultations, as some individuals still prefer traditional face-to-face interactions with healthcare providers, which slows the market’s adoption.

Opportunities

Integration of AI and Remote Patient Monitoring (RPM)

Telehealth platforms in the Philippines have a significant opportunity to integrate advanced technologies like artificial intelligence (AI) for diagnostic support and remote patient monitoring (RPM). The use of AI-driven platforms can enhance the accuracy of diagnoses, while RPM tools can enable healthcare providers to monitor chronic conditions more effectively, creating a more personalized healthcare experience.

Corporate Healthcare Programs and B2B Collaborations

There is a growing opportunity to expand telehealth services through corporate healthcare programs. Businesses, especially those in the BPO sector, are increasingly offering telehealth benefits to employees. Collaborations with companies to provide corporate telemedicine solutions can open new revenue streams for telehealth platforms, allowing them to cater to a wider audience and establish strong relationships with large employers and insurers.

Future Outlook

Over the next five years, the Philippines Telehealth Platforms market is expected to grow significantly. This growth is driven by the continued rise in internet and mobile broadband penetration, government support for telemedicine, and the increasing demand for healthcare services in underserved areas. Teleconsultation and AI-driven diagnostic platforms will see a significant increase in adoption, transforming the healthcare landscape. Additionally, remote patient monitoring technologies will become more integrated into mainstream healthcare offerings, especially for chronic disease management.

Major Players in the Market

- KonsultaMD

- MyHealth Clinic

- Medgate

- Docquity

- HealthNow

- AIDE

- SeeYouDoc

- PhilHealth Telehealth Initiatives

- Medifi

- eConsult

- WellMed

- CareSpan

- Lifetrack Medical Systems

- Qure.ai (Philippine Operations)

- TeleClinic Networks

Key Target Audience

- Investments and Venture Capitalist Firms

- Healthcare Providers

- Government and Regulatory Bodies (Department of Health, PhilHealth)

- Insurance Providers

- Digital Health Solution Developers

- Telecommunication Companies

- Corporate Healthcare Programs (e.g., BPO, Manufacturing)

- Large Hospitals and Healthcare Networks

Research Methodology

Step 1: Identification of Key Variables

In the initial phase, a comprehensive ecosystem map of stakeholders will be constructed, identifying the variables that drive the telehealth market in the Philippines. Key data sources will include industry reports, regulatory publications, and interviews with platform providers and healthcare institutions.

Step 2: Market Analysis and Construction

Historical data and current market penetration will be analyzed to forecast the growth trajectory. This includes assessing the volume of teleconsultations, RPM adoption rates, and technology implementation in hospitals and healthcare networks across the Philippines.

Step 3: Hypothesis Validation and Expert Consultation

Consultations with industry experts and market leaders will be conducted to validate hypotheses about the market’s dynamics, such as the increasing preference for teleconsultation and AI integration. This will be done via phone interviews and online surveys.

Step 4: Research Synthesis and Final Output

The final research will integrate insights gained from primary research with secondary data. This will help refine market forecasts, adjust assumptions, and provide a holistic analysis of the market dynamics for the Philippines Telehealth Platforms.

- Executive Summary

- Research Methodology (Definitions and Telehealth Scope, Data Sources, Assumptions and Market, Modelling Framework, Market Size Estimation, CAGR and Sensitivity Analyses, Limitation Metrics)

- Telehealth Definition and Service Boundaries

- Market Genesis and Evolution

- Telehealth Ecosystem Mapping

- Value Chain Analysis, Regulatory and Policy Framework

- Growth Drivers

Rising Smartphone Penetration & Mobile Broadband Reach

Chronic Disease Burden and Demand for Continuity of Care

Health Systems Digitalization and Provider Demand

Patient Behaviour Trends in Rural & Urban Contexts - Market Challenges

Digital Literacy Disparities

Internet Connectivity Constraints in Rural Areas

Regulatory Ambiguity - Strategic Opportunities

5G/Consultation Latency Reduction

Enterprise Telehealth Integration

Insurance Reimbursement Models

|Hybrid TeleClinic Networks - Market Trends and Innovations

AI/MLEnabled Triage and Patient Routing

Remote Monitoring Wearables Integration

MultiDiscipline Virtual Care Coordination - Regulatory and Policy Landscape

UHC Digital Health Mandates

Telehealth Practice Standards

Patient Data Protection - Ecosystem Analysis

Health System & Telecommunication Partnership Dynamics

Provider Adoption Lifecycle

Patient Engagement and Retention Funnels

- By Market Value 2019-2025

- By Number of Active Users/Registered Patients 2019-2025

- By Teleconsultation Volume 2019-2025

- Platform Revenue by Monetization Model 2019-2025

- By Service Type (In Value %)

Teleconsultation

Remote Patient Monitoring

Virtual Follow-ups & Chronic Care Management

ePrescription & Pharmacy Integration

TeleDiagnostics - By Delivery Mode (In Value %)

WebBased Portals

Mobile App Platforms

Enterprise/Clinic Integrated Portals

CloudHosted SaaS Solutions - By End User (In Value %)

Individual Patients

Clinics & Hospitals

Corporate Health Programs

Insurance/Payers

Government/Public Health Initiatives - By Technology Infrastructure (In Value %)

AIEnabled Diagnostic Support

EMR/ EHR Integrated Platforms

Interoperable Platforms

StandAlone Systems - By Specialty Focus (In Value %)

Primary Care

Mental Health & Psychiatry

Chronic Diseases

Women’s Health

Pediatrics & Geriatric Care

- Market Share – Platform Usage & Revenue

- Cross Comparison Parameters (Company Overview, Platform Technology Stack, Teleconsultation Volume & Growth, Customer Acquisition Cost & Retention, ARPU, Provider Network Strength, Chronic Care Module Capabilities, Interoperability & EHR Integration, Pricing Strategy Analysis, Innovation Radar, Strategic Moves)

- Company Profiles – Major Philippines Telehealth Platforms

KonsultaMD

MyHealth Clinic

Medgate Philippines

HealthNow

AIDE

SeeYouDoc

PhilHealth Telehealth Initiatives

Docquity

Medifi

eConsult

WellMed

CareSpan

Qure.ai

Lifetrack Medical Systems Telehealth Modules

TeleClinic Networks

- Patient Utilization Behavior and Demand Elasticity

- Provider Platform Adoption and Workflow Integration

- Enterprise & Payer Integration Preferences

- Barriers to Adoption

- Decision Making and Procurement Dynamics

- Value Forecast 2026-2030

- User Base & Adoption Forecast 2026-2030

- Service Revenue Mix Projections 2026-2030

- Technology Penetration Outlook 2026-2030