Market Overview

The Philippines telemedicine market is valued at USD ~ million, supported by rising healthcare demand and the economics of shifting low-acuity care away from facility settings. At the system level, the country’s total health spending increased from PHP ~ trillion to PHP ~ trillion, while per-capita health spending rose from PHP ~ to PHP ~, expanding the addressable pool for digitally-enabled care pathways such as teleconsults, e-prescriptions, triage, and chronic follow-ups.

Telehealth service delivery is most concentrated in Metro Manila (NCR) and adjacent growth corridors in CALABARZON and Central Luzon, where private hospital networks, corporate payers, and digital-health operators cluster—accelerating provider onboarding, referral loops, and HMO/employer program execution. This concentration is reinforced by higher healthcare purchasing power and denser utilization: overall health spending moved from PHP ~ trillion to PHP ~ trillion, and per-capita health spending moved from PHP ~ to PHP ~, which improves affordability for subscription consults, employer benefits, and bundled virtual-first primary care.

Market Segmentation

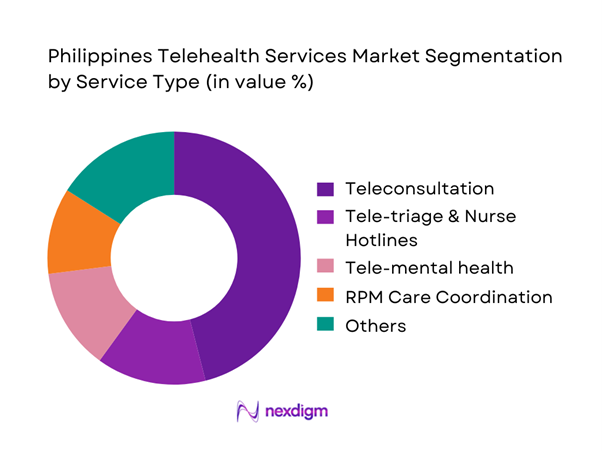

By Service Type

The Philippines telehealth services market is segmented by service type into teleconsultation (primary care & specialty), tele-triage & nurse hotlines, remote patient monitoring coordination (care teams + device-linked follow-ups), tele-mental health, tele-dermatology, and tele-radiology enablement. Teleconsultation dominates because it is the simplest “front door” to care: it requires minimal hardware beyond smartphones, aligns with out-of-pocket spending realities, and reduces time-to-treatment for common acute issues and chronic refills. It is also the easiest to bundle into employer and HMO benefits, creating predictable utilization. Finally, hospitals use teleconsults to extend reach beyond facility catchments and to protect premium clinic capacity for higher-acuity visits, improving overall care throughput.

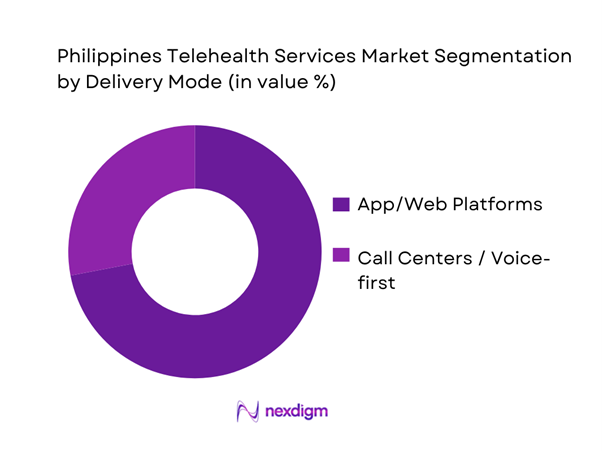

By Delivery Mode

The market is segmented by delivery mode into app/web platforms (video/voice/chat) and call-center/voice-first models. App/web platforms dominate because they support richer clinical workflows (identity verification, structured intake, e-prescriptions, EMR notes, payment, and asynchronous chat), enabling better clinician productivity and patient experience compared with voice-only. App-first models also allow scalable “care journeys” (e.g., chronic disease follow-ups, mental health programs, preventive packages) rather than one-off consults. As health spending expands and corporate health benefits mature, app platforms become the operating layer for utilization management—triage, routing, documentation, and analytics—making them structurally advantaged versus call-center-only delivery.

Competitive Landscape

The Philippines telehealth services market is led by a small set of platforms backed by large healthcare groups, insurers, and corporate ecosystems, alongside specialist operators focused on home care and chronic programs. Consolidation pressure is driven by acquisition economics (clinician supply, brand trust, and enterprise contracting) and by the need to integrate e-pharmacy, diagnostics, and clinic/hospital referrals into one care journey. The market also reflects a structured competitive environment with player positioning and strategy benchmarking in the country’s telemedicine ecosystem.

| Company | Est. Year | HQ | Ownership / Backer | Core Offer | Care Modalities | Enterprise/Payer Signal | Provider Network Model | Ecosystem Integrations | Differentiator (PH context) |

| KonsultaMD | 2016 | Philippines | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| mWell | 2020 | Philippines | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| SeeYouDoc | 2017 | Philippines | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| HealthNow | 2019 | Philippines | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| AIDE | 2015 | Philippines | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

Philippines Telehealth Services Market Dynamics and Performance Analysis

Growth Drivers

Connectivity-Led Access

Philippines telehealth demand is structurally tied to how quickly basic connectivity reaches households, LGUs, and primary care points—because “consult + follow-up + eRx” becomes viable only when patients can reliably enter a video/voice queue and receive digital care instructions. The macro base is large: the Philippines’ economy is measured at USD ~ (GDP, current US$) and a large, dispersed population increases the value of “remote-first” access models over travel-led access. Connectivity build-out is tangible in infrastructure counts: installed telecom towers rose to ~ (installed) which expands last-mile coverage and reduces dead zones that break consultations. Public digital access programs also directly support telehealth touchpoints in public service delivery: DICT–UNDP activated ~ new Wi-Fi access points placed across ~ public health facilities, ~ geographically isolated/disadvantaged areas, and ~ indigenous peoples communities—locations where telemedicine can reduce referral delays and “no-show” care gaps. On the healthcare spend side (a proxy for addressable care utilization), the PSA-reported PHP ~ per-capita health spending versus PHP ~ previously indicates a larger base of health interactions that telehealth platforms can triage, schedule, and route efficiently, especially for primary care and follow-up consults that do not always require facility-based visits.

HMO Teleconsult Bundling

HMO-embedded teleconsult is scaling because it converts telehealth from an “out-of-pocket trial” into a repeatable benefit workflow (membership eligibility → triage → accredited provider routing → eRx/diagnostics referral → claims/benefit filing). Two macro signals support bundling intensity: first, the economy’s large formal and informal workforce base sustains payer-led purchasing of outpatient access; second, total system health spending is large enough that payers can justify digital-first diversion for low-acuity cases. On the payer infrastructure side, national coverage mechanics matter: PhilHealth’s database indicates ~ beneficiaries (members + qualified dependents) under Direct Contributors alone, which is a large base for hybrid models where teleconsult becomes an entry point before facility care. Health spending per person is also rising in peso terms (PHP ~ per capita vs PHP ~ previously), which typically increases utilization frequency and the value of gatekeeping/triage layers—precisely where bundled teleconsult sits (symptom capture, first-contact decisioning, follow-up). Bundling is further enabled by digital infrastructure expansion into public health sites (where HMOs often coordinate with hospitals/clinics for downstream services): the DICT–UNDP program’s ~ access points across public health facilities and underserved areas strengthens the “insured patient can actually connect” requirement for plan utilization.

Challenges

Provider Capacity

Provider capacity is a binding constraint in Philippine telehealth because demand can scale faster than clinician hours, especially during seasonal illness peaks and post-disaster periods. While connectivity and payer bundling expand demand, clinical time remains finite—so queue times, clinician burnout, and uneven specialty coverage can suppress repeat usage. The scale of healthcare utilization is visible in national spending: per-capita health spending rose to PHP ~ from PHP ~, implying more encounters that could flow into telehealth channels and stretch clinician capacity if rostering does not scale. On the supply pipeline, PRC exam outcomes show ~ examinees and ~ passers in a physicians licensure exam release—new supply exists, but distribution and practice patterns (urban clustering, migration, facility preference) can still limit telehealth staffing depth across time blocks.

Macroeconomic scale (USD ~ GDP) and population size create large absolute volumes of consult demand; when telehealth lowers access friction, “latent demand” surfaces quickly (symptom checks, follow-ups, prescription renewals). Connectivity expansion (telecom towers reaching ~) is a double-edged sword: it enables more patients to connect but also increases peak concurrency needs on provider rosters. Public Wi-Fi deployments (e.g., ~ access points in health facilities and underserved areas) similarly expand reach, making capacity planning more complex because demand becomes less geographically predictable.

Quality Standardization

Quality standardization is challenging in Philippine telehealth because service delivery spans diverse provider types (hospital-based physicians, independent clinicians, platform-employed doctors, and sometimes multi-disciplinary teams) and must remain consistent across languages, regions, and care pathways. Variation in clinical documentation, triage thresholds, and follow-up discipline can create uneven outcomes and reputational risk. National healthcare utilization is rising in peso terms—PHP ~ per-capita spending versus PHP ~ previously—so a larger volume of encounters increases the number of “quality moments” (correct diagnosis, correct escalation, correct documentation) that must be standardized. Standardization is also affected by the distributed connectivity environment: with ~ telecom towers installed, patients can access telehealth from widely varying network conditions and device capabilities, which can degrade clinical assessment quality (video clarity, dropped calls) and push platforms to create protocol-based minimum data standards (photo requirements, symptom checklists).

Opportunities

Hospital Virtual Front Doors

Hospitals can use telehealth as a “virtual front door” that triages demand before it floods emergency rooms and outpatient departments—routing low-acuity cases to self-care guidance, scheduled clinic slots, diagnostics, or escalation pathways. This is especially relevant when national healthcare utilization is rising: per-capita health spending increased to PHP ~ from PHP ~, meaning more total patient interactions that hospitals must absorb or redirect. Connectivity expansion makes a hospital-operated virtual front door feasible at scale: installed telecom towers reached ~, improving the reach of hospital-led digital entry points beyond immediate catchment areas. Public facility connectivity investments create direct operational landing zones for hospital systems and referral networks: the DICT–UNDP activation of ~ Wi-Fi access points across ~ public health facilities and ~ underserved community locations (GIDA + IP communities) supports telemedicine initiation and referral coordination from the primary level into hospital systems.

Payer infrastructure can reinforce the front-door model because eligibility verification and benefit-linked care pathways are already large-scale: PhilHealth’s database shows large beneficiary counts (e.g., ~ Direct Contributor beneficiaries), which supports standardized intake and documentation workflows when hospitals align tele-triage with covered services.

Province-first Networks

Province-first telehealth networks are an opportunity because they are designed around the Philippines’ real constraint: uneven local clinical supply plus travel friction across islands. The scalable model is not “one national queue only,” but “provincial primary-care access points + referral routing to metro specialists,” supported by connectivity and payer relationships. The macro base is large and geographically distributed (population at national scale), which increases the value of remote access as a structural service, not a pandemic-only behavior. Connectivity programs are directly enabling province-first models: DICT–UNDP’s ~ Wi-Fi access points, placed across ~ public health facilities, ~ GIDAs, and ~ IP communities, create provincial “nodes” where telemedicine can be initiated reliably—especially when personal mobile data is insufficient or unstable. National telecom infrastructure scale (installed towers at ~) improves the feasibility of province-wide operations that rely on a mix of home connectivity, barangay/LGU sites, and facility hotspots.

Future Outlook

The Philippines telehealth services market is expected to expand as healthcare financing grows, provider networks push virtual-first access points, and platforms deepen integration with diagnostics, e-pharmacy, and care pathways for chronic disease and mental health. National spending momentum—total health expenditure rising from PHP ~ trillion to PHP ~ trillion—supports broader adoption of subscription consults and employer-funded access. At the category level, the market’s anchor valuation of USD ~ million creates runway for enterprise-driven scaling and multi-service platform consolidation.

Major Players

- KonsultaMD

- mWell

- SeeYouDoc

- HealthNow

- AIDE

- Medgate Philippines

- SeriousMD

- MyPocketDoctor

- Teladoc Health

- Philips Healthcare

- Medtronic

- GE Healthcare

- Siemens Healthineers

- Babylon Health

Key Target Audience

- Investments and venture capitalist firms

- Hospitals and integrated private health systems

- Health Maintenance Organizations and private insurers

- Large employers and BPO/IT parks

- Pharmacy chains and e-pharmacy operators

- Diagnostics and imaging networks

- Government and regulatory bodies

- Telecommunications operators and device ecosystem partners

Research Methodology

Step 1: Identification of Key Variables

We map the Philippines telehealth ecosystem across platforms, provider groups, payers, pharmacies, diagnostics, and regulators, then define variables such as consult volume drivers, clinician supply constraints, channel mix, reimbursement readiness, and unit economics of care journeys.

Step 2: Market Analysis and Construction

We compile historical indicators (health spending, provider footprint, smartphone-led care access, enterprise benefits penetration) and translate them into a market model anchored to published market sizing, with service-line contribution logic and delivery-mode splits.

Step 3: Hypothesis Validation and Expert Consultation

We validate assumptions through structured interviews with executives across telehealth platforms, hospital digital leads, payer product owners, and clinician network managers—focusing on utilization mix, retention, CAC drivers, and clinical workflow integration.

Step 4: Research Synthesis and Final Output

We triangulate published sources with stakeholder inputs and observed platform design patterns (triage→consult→prescription→diagnostics→follow-up), producing scenario-based outlooks, competitive benchmarking, and investment white-space mapping.

- Executive Summary

- Research Methodology (Market Definitions and Scope Boundaries, Assumptions and Exclusions, Abbreviations, Data Triangulation Framework, Primary Interview Program, Expert Validation Approach, Market Sizing Logic, Forecasting Model Architecture, Pricing and Utilization Modeling Approach, Limitations and Confidence Scoring)

- Definition and Scope

- Market Genesis and Evolution

- Telehealth Adoption Phases and Inflection Points

- Telehealth Business Cycle and Seasonality

- Telehealth Ecosystem Map

- Growth Drivers

Connectivity-Led Access

HMO Teleconsult Bundling

Employer Preventive Care Programs

eRx Convenience

Specialist Reach Expansion - Challenges

Provider Capacity

Quality Standardization

Fraud and Identity Controls

Prescription Misuse Risks

Connectivity Reliability - Opportunities

Hospital Virtual Front Doors

Province-first Networks

Chronic Care Programs

Mental Health Integration

Diagnostics and Pharmacy Attach - Trends

Super-app Health Ecosystems

Embedded Telehealth in HMOs

Omni-channel Care Journeys

Home-care Add-ons

Corporate Benefit Deepening - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- By Utilization, 2019–2024

- By Realized Pricing, 2019–2024

- By Application (in Value %)

Teleconsultation

Tele-triage

Teleprescription and eMedical Certificate

Chronic Care Remote Check-ins

Behavioral Teletherapy

Tele-dermatology - By Technology Architecture (in Value %)

Video

Voice

Chat

Asynchronous Store-and-Forward

Hybrid Virtual-to-Clinic Referral - By End-Use Industry (in Value %)

Primary Care

Internal Medicine

Pediatrics

OB-GYN

Dermatology

Psychiatry and Psychology - By Connectivity Type (in Value %)

Out-of-Pocket

Subscription

HMO-Covered

Employer-Sponsored

Government or Program-Supported - By Region (in Value %)

NCR

Luzon non-NCR

Visayas

Mindanao

Urban Areas

Rural Areas

- Competitive Positioning Matrix

- Cross Comparison Parameters (Physician Network Depth and Specialty Mix, Average Wait-Time SLA and Peak-Hour Coverage, HMO and Employer Benefit Integration Capability, eRx and eMedical Certificate Workflow Robustness, Diagnostics and ePharmacy Attachment Partnerships, Payments Coverage, Data Privacy and Hosting Compliance Controls, Geographic Reach Beyond NCR and Referral Closure Strength)

- Company SWOT Snapshots

- Go-to-Market and Partnership Benchmarking

- Detailed Profiles of Major Companies

KonsultaMD

Medgate Philippines

Doctor Anywhere Philippines

mWell

NowServing

SeeYouDoc

HealthNow

AIDE

Maxicare

MediCard

PhilCare

Avega

Cocolife Healthcare

Makati Medical Center

The Medical City

- B2C Consumer Journey

- HMO Member Journey

- Corporate and Employer Journey

- Provider Journey

- Pain Point Analysis

- By Value, 2025–2030

- By Utilization, 2025–2030

- By Realized Pricing, 2025–2030