Market Overview

The Philippines Telemonitoring Services Market is valued at USD ~ million. The market has reached this scale due to structural pressures within the country’s healthcare system, including a rising chronic disease burden, uneven physician distribution, and capacity constraints in tertiary hospitals. Telemonitoring services address persistent gaps between demand for continuous care and limited physical healthcare infrastructure by enabling remote tracking, early intervention, and clinician oversight beyond hospital walls. Demand is further reinforced by the growing cost burden of preventable admissions, longer lengths of stay, and post-discharge complications, pushing providers and payers to adopt remote monitoring as a cost-optimization and care-continuity tool. Employers and insurers are increasingly viewing telemonitoring as a mechanism to manage long-term health risks while maintaining workforce productivity. These structural drivers position telemonitoring as a core service layer rather than a discretionary digital add-on within the Philippine healthcare ecosystem.

Within the Philippines, demand is concentrated in the National Capital Region due to the high density of tertiary hospitals, private healthcare groups, insurers, and digitally enabled patient populations. CALABARZON and Central Luzon follow as extensions of Metro Manila’s care networks, driven by suburban population growth and hospital chain expansion. Cebu and Davao serve as regional hubs in the Visayas and Mindanao, respectively, due to their role as referral centers and growing private hospital investments. Domestic digital health firms dominate service delivery through localized platforms, physician networks, and payer partnerships, while global vendors exert influence through medical devices, cloud infrastructure, analytics engines, and interoperability standards. This blend allows local providers to adapt services to Philippine care realities while leveraging globally proven technologies for scalability, security, and clinical reliability.

Market Segmentation

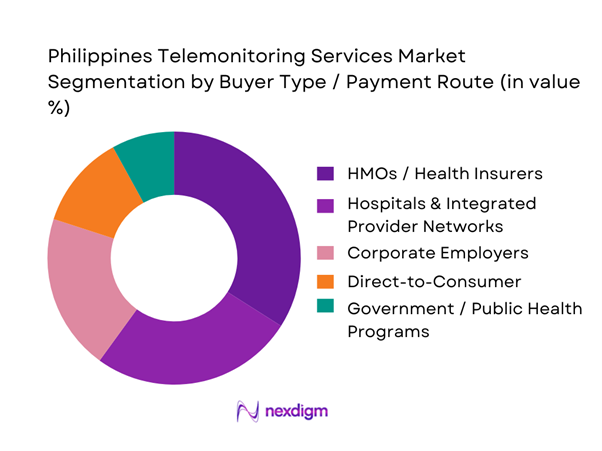

By Buyer Type / Payment Route

HMOs aggregate lives, manage utilization, and can standardize telemonitoring as a benefit rider for chronic disease members (hypertension, diabetes, heart failure), making enrollment economics more predictable than pure D2C acquisition. They also influence provider behavior through accredited networks and pre-authorization pathways, which helps integrate telemonitoring escalation into facility care. Additionally, telemedicine practice guidance and Philippine telehealth frameworks acknowledge remote patient monitoring as part of telemedicine modalities, enabling HMOs to position RPM-based services within compliant telehealth delivery models rather than ad-hoc wellness offerings.

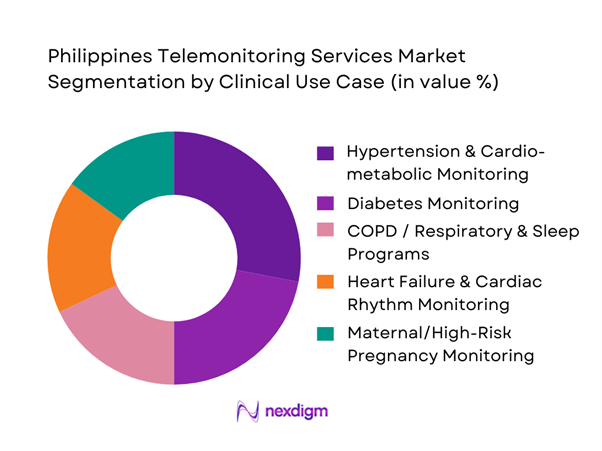

By Clinical Use Case

Chronic disease management dominates the Philippines telemonitoring services market due to the sustained and recurring nature of care required for non-communicable diseases such as diabetes, hypertension, and cardiac conditions. These patient populations require continuous tracking of vital parameters, medication adherence support, and timely clinical intervention, making them structurally aligned with remote monitoring models. Hospitals and insurers prioritize chronic disease telemonitoring because it supports long-term cost control, reduces preventable admissions, and improves continuity of care outside acute settings. From a service-provider perspective, chronic care programs generate predictable, subscription-based revenues and allow platform scalability across large patient cohorts. Patients and caregivers also perceive higher value due to reduced travel requirements and improved access to specialists, particularly in underserved regions.

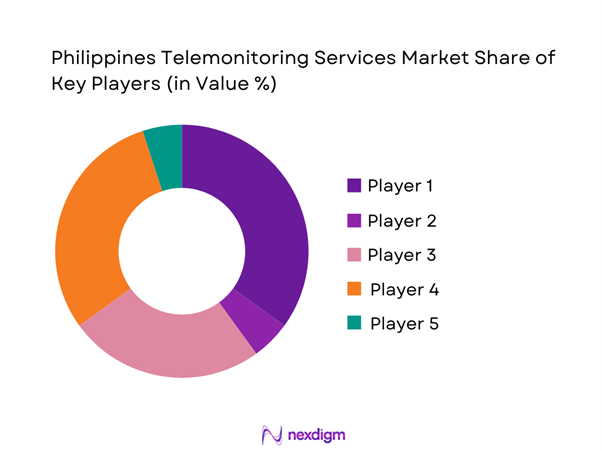

Competitive Landscape

The Philippines Telemonitoring Services market is dominated by a few major players, including KonsultaMD and global or regional brands like mWell PH, Medifi, and AIDE Telehealth. This consolidation highlights the significant influence of these key companies.

| Company | Est. Year | HQ (PH / Global) | Telemonitoring Offering Type | Core Clinical Focus | Care Team Coverage Model | Device Strategy | Interoperability Posture | Primary Buyer Motion |

| KonsultaMD (AC Health) | 2016 | Philippines | ~ | ~ | ~ | ~ | ~ | ~ |

| mWell PH | 2020 | Philippines | ~ | ~ | ~ | ~ | ~ | ~ |

| HealthNow | 2021 | Philippines | ~ | ~ | ~ | ~ | ~ | ~ |

| Philips | 1891 | Netherlands | ~ | ~ | ~ | ~ | ~ | ~ |

| Medtronic | 1949 | Ireland/US | ~ | ~ | ~ | ~ | ~ | ~ |

Philippines Telemonitoring Services Market Analysis

Growth Drivers

Chronic disease burden management

The Philippines telemonitoring services market is strongly driven by the growing burden of chronic and lifestyle-related conditions that require continuous monitoring rather than episodic clinical visits. A large and aging patient base with diabetes, hypertension, cardiac conditions, and respiratory disorders creates sustained demand for longitudinal care models. Telemonitoring enables early detection of deterioration, timely clinical intervention, and improved medication adherence, reducing avoidable hospitalizations. For providers, this translates into better clinical outcomes with lower operational strain, while for payers and employers it supports long-term cost control and productivity preservation. The structural nature of chronic disease prevalence ensures recurring service demand, making telemonitoring integral to care pathways rather than a one-time digital engagement tool.

Hospital capacity optimization and continuity-of-care pressure

Hospitals in the Philippines face persistent pressure to optimize bed utilization, manage overcrowding, and reduce readmission risk, particularly in urban tertiary centers. Telemonitoring allows hospitals to safely transition suitable patients into home settings while retaining clinical oversight through remote vital tracking and alerts. This directly improves discharge efficiency, shortens inpatient stays, and enables better allocation of scarce clinical resources. Over time, hospitals recognize telemonitoring as a strategic operational lever rather than a purely clinical add-on. As these programs mature, they become embedded into discharge planning, specialty clinics, and post-acute care workflows, reinforcing institutional demand and accelerating market adoption.

Challenges

Clinical workflow integration and physician adoption resistance

One of the most significant challenges in the Philippines telemonitoring services market is resistance to workflow change among clinicians and care teams. Telemonitoring introduces continuous data streams that require new protocols, alert management processes, and accountability structures. Without seamless integration into existing clinical routines, physicians may perceive monitoring platforms as increasing cognitive and administrative burden rather than improving efficiency. This resistance slows onboarding, limits utilization depth, and reduces realized value from deployed systems. For providers, overcoming this challenge requires investment in training, workflow redesign, and clinical governance models, all of which extend implementation timelines and increase short-term operational complexity.

Connectivity reliability and patient adherence constraints

Telemonitoring effectiveness depends heavily on stable connectivity, device reliability, and consistent patient engagement, all of which vary significantly across the Philippines. Outside major urban centers, intermittent internet access and power stability can disrupt data transmission and clinical confidence. On the patient side, varying levels of digital literacy and adherence affect data quality and continuity. These constraints create uneven service performance and limit scalability, particularly for nationwide programs. Providers must invest in device redundancy, patient education, and support infrastructure, increasing delivery costs and slowing expansion into underserved regions.

Opportunities

Expansion of hospital-at-home and post-acute care models

Telemonitoring creates a significant opportunity to expand hospital-at-home and structured post-acute care programs across the Philippines. By enabling continuous remote oversight, providers can safely manage selected acute and recovery-phase patients outside hospital walls. This model supports capacity expansion without proportional infrastructure investment and aligns with provider goals to improve patient experience. As hospitals seek differentiated service offerings and resilience against capacity shocks, telemonitoring becomes central to these alternative care models. Service providers that design clinically robust, easy-to-integrate monitoring solutions are well positioned to capture long-term institutional contracts.

Insurance-led and employer-sponsored remote monitoring programs

Health insurers and large employers represent a growing opportunity segment as they seek tools to manage long-term health risk and claims volatility. Telemonitoring supports proactive disease management, early intervention, and improved member engagement. For insurers, this creates pathways to outcome-linked care programs, while employers benefit from reduced absenteeism and improved workforce health. These buyers favor scalable, analytics-driven solutions with predictable commercial structures, opening opportunities for providers to move beyond episodic service delivery into recurring, contract-based revenue models.

Future Outlook

The Philippines telemonitoring services market is expected to evolve toward deeper clinical integration, broader multi-condition monitoring, and closer alignment with payer and hospital reimbursement models. As digital health infrastructure matures and stakeholders gain operational experience, telemonitoring will shift from pilot initiatives to standardized components of care delivery, supporting sustainable market expansion without reliance on short-term experimentation.

Major Players

- KonsultaMD

- mWell PH

- Medifi

- AIDE Telehealth

- SeeYouDoc

- HealthNow

- SeriousMD

- MyPocketDoctor

- Avega Telehealth

- Intellicare Telemonitoring

- Maxicare Telehealth

- PhilCare Remote Services

Key Target Audience

- Hospitals and healthcare provider networks

- Health insurance companies

- Home healthcare service providers

- Corporate employers

- Digital health platform developers

- Medical device suppliers

- Government and regulatory bodies (Philippines)

- Investments and venture capitalist firms

Research Methodology

Step 1: Identification of Key Variables

The study identifies service scope, care settings, customer types, technology models, and revenue mechanisms relevant to telemonitoring services in the Philippines.

Step 2: Market Analysis and Construction

Demand drivers, supply structures, and service workflows are analyzed to construct a coherent view of market operations and value creation.

Step 3: Hypothesis Validation and Expert Consultation

Insights are validated through structured consultations with healthcare administrators, clinicians, technology providers, and policy stakeholders.

Step 4: Research Synthesis and Final Output

Findings are synthesized into an integrated market narrative supported by segmentation, competitive analysis, and forward-looking insights.

- Executive Summary

- Research Methodology (Market Definitions and Inclusions/Exclusions, Abbreviations, Topic-Specific Taxonomy, Market Sizing Framework, Revenue Attribution Logic Across Use Cases or Care Settings, Primary Interview Program Design, Data Triangulation and Validation, Limitations and Data Gaps)

- Definition and Scope

- Market Genesis and Evolution

- Telemonitoring Care-Continuum Mapping

- Business Cycle and Demand Seasonality

- Philippines Healthcare Service Delivery Architecture

- Growth Drivers

Chronic disease burden management

Hospital capacity optimization pressure

Urban–rural healthcare access gaps

Digital health infrastructure expansion

Payer and employer cost containment needs - Challenges

Clinical workflow integration resistance

Connectivity and device reliability issues

Patient adherence and digital literacy gaps

Data privacy and cybersecurity concerns

Fragmented reimbursement frameworks - Opportunities

Hospital-at-home program expansion

Insurance-led remote care models

Public-sector digital health initiatives

AI-enabled predictive monitoring

Regional telemonitoring hubs for provincial care - Trends

Hybrid care delivery normalization

Device-agnostic monitoring platforms

Integration with electronic medical records

Shift toward outcome-linked contracts

Expansion of multi-condition monitoring bundles - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- By Service Revenue Mix, 2019–2024

- By Utilization Volume, 2019–2024

- By Average Commercial Rate , 2019–2024

- By Clinical Application (in Value %)

Chronic disease management

Post-acute care monitoring

Maternal and neonatal monitoring

Geriatric and elderly care monitoring

Cardiac and vital signs monitoring

Respiratory condition monitoring - By Care Setting (in Value %)

Hospital-led telemonitoring programs

Home-based patient monitoring

Primary care and outpatient clinics

Employer-sponsored health programs

Insurance-led remote monitoring programs - By Technology / Platform Type (in Value %)

Wearable sensor-based monitoring

Connected medical devices

Mobile app-based monitoring platforms

Cloud-based monitoring dashboards

AI-enabled analytics platforms - By Deployment / Delivery Model (in Value %)

Subscription-based service models

Managed service contracts

Pay-per-use or episodic monitoring - By End-Use Customer Type (in Value %)

Public hospitals

Private hospitals

Specialty clinics

Home healthcare providers

Health insurance providers

Corporate employers - By Region (in Value %)

National Capital Region

CALABARZON

Central Luzon

Central Visayas

Davao Region

Rest of Philippines

- Competition ecosystem overview

- Cross Comparison Parameters (service portfolio breadth, clinical condition coverage, device integration capability, analytics sophistication, data security compliance, scalability across regions, pricing flexibility, local clinical partnerships)

- SWOT analysis of major players

- Pricing and commercial model benchmarking

- Detailed Profiles of Major Companies

KonsultaMD

mWell PH

Medifi

AIDE Telehealth

SeriousMD

HealthNow

KHealth Philippines

MyPocketDoctor

Avega Telehealth

Telehealth PH

Wellness Whisperer

Intellicare Telemonitoring

Maxicare Telehealth

SeeYouDoc

PhilCare Remote Services

- Buyer personas and decision-making units

- Procurement and contracting workflows

- KPIs used for evaluation

- Pain points and adoption barriers

- By Value, 2025–2030

- By Service Revenue Mix, 2025–2030

- By Utilization Volume, 2025–2030

- By Average Commercial Rate, 2025–2030