Market Overview

The Philippines Tire Balancing Equipment Market is valued at USD ~ million. The market scale is directly linked to the size and utilization intensity of the national vehicle parc, routine tire replacement cycles, and the expanding footprint of professional automotive service facilities. Tire balancing equipment is a non-discretionary workshop asset, embedded in periodic maintenance rather than optional upgrades, which creates structurally stable demand even during economic slowdowns. Growth is reinforced by rising vehicle ownership in urban corridors, increased mileage per vehicle driven by logistics and commuting, and growing consumer sensitivity toward ride comfort, vibration, and uneven tire wear. The shift from informal roadside repair models to semi-organized and organized workshops has further strengthened demand for reliable, repeatable balancing solutions. Equipment purchases are primarily replacement- and capacity-driven rather than speculative, giving the market a predictable, service-linked demand profile with long equipment operating lifecycles.

Metro Manila dominates demand due to the country’s highest vehicle density, concentration of dealership networks, large-format tire retailers, and fleet operators serving ride-hailing and last-mile logistics. Secondary demand clusters are emerging in CALABARZON, Central Luzon, Cebu, and Davao, supported by industrial activity, port-led logistics flows, and rising private vehicle ownership. These regions dominate because of higher workshop throughput and faster adoption of standardized service processes. Global equipment manufacturers influence the market through technology benchmarks in accuracy, automation, and cycle time, while domestic distributors control channel access, installation, training, and after-sales service. Local players rarely manufacture equipment but play a decisive role in vendor selection, financing, and brand penetration through long-standing workshop relationships.

Market Segmentation

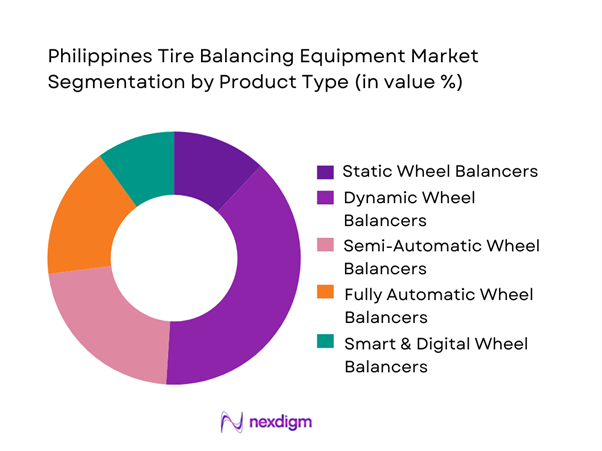

By Product Type

The Philippines tire balancing equipment market is segmented by product type into static wheel balancers, dynamic wheel balancers, semi-automatic wheel balancers, fully automatic wheel balancers, and smart/digital wheel balancers. Among these, dynamic wheel balancers hold the dominant market share, accounting for ~% of total market value. Their dominance is driven by their compatibility with passenger vehicles and light commercial vehicles, which form the bulk of the national vehicle parc. Dynamic balancers offer faster throughput, acceptable accuracy for most workshops, and relatively lower capital expenditure compared to fully automatic systems, making them the preferred choice for independent tire shops and mid-sized service centers.

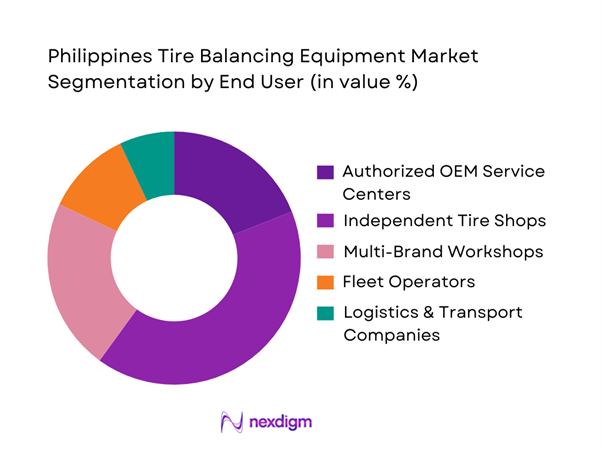

By end user,

The market is segmented into authorized OEM service centers, independent tire shops, multi-brand automotive workshops, fleet maintenance operators, and logistics & transport companies. Independent tire shops dominate the market with a ~% share, driven by their high volume of wheel servicing, aggressive equipment replacement cycles, and preference for cost-efficient balancing solutions. These workshops form the backbone of the Philippine automotive aftermarket, especially outside dealership networks, and increasingly invest in semi-automatic and digital balancers to improve service turnaround and customer retention.

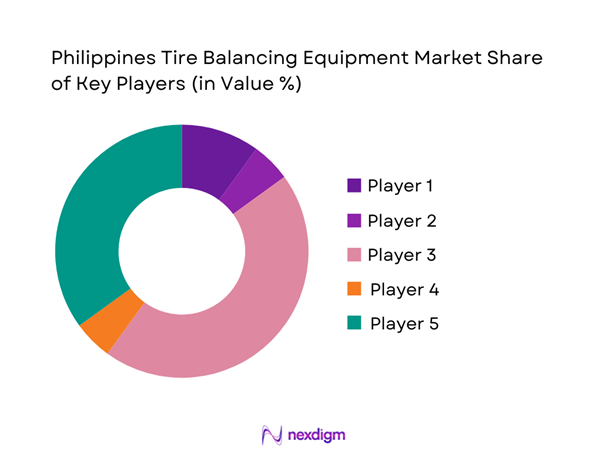

Competitive Landscape

The Philippines tire balancing equipment market is dominated by a few major players, including Bosch Automotive Service Solutions and global or regional brands like Hunter Engineering, Snap-on Equipment, and Hofmann Megaplan. This consolidation highlights the significant influence of these key companies.

| Company | Established | Headquarters | Product Range | Automation Level | Service Network | Price Positioning | EV Compatibility |

| Hunter Engineering | 1946 | USA | ~ | ~ | ~ | ~ | ~ |

| Hofmann Megaplan | 1931 | Germany | ~ | ~ | ~ | ~ | ~ |

| Corghi | 1954 | Italy | ~ | ~ | ~ | ~ | ~ |

| Launch Tech | 1992 | China | ~ | ~ | ~ | ~ | ~ |

| Bosch Automotive | 1886 | Germany | ~ | ~ | ~ | ~ | ~ |

Philippines Tire Balancing Equipment Market Analysis

Growth Drivers

Expansion of the National Vehicle Parc and Usage Intensity

The expanding vehicle population and rising vehicle utilization levels form the core structural driver for tire balancing equipment demand in the Philippines. Increased daily commuting distances, ride-hailing penetration, and inter-city logistics activity accelerate tire wear and imbalance frequency. As vehicles accumulate mileage faster, balancing shifts from an occasional service to a routine maintenance requirement. This effect is particularly pronounced in urban centers where road congestion, uneven surfaces, and frequent braking amplify imbalance issues. Workshops are therefore compelled to increase service capacity and reduce turnaround time, encouraging investments in automated and faster-balancing systems. The demand impact is cumulative rather than cyclical, as every incremental vehicle added to the parc generates recurring balancing demand across its operating life. This creates a steady equipment replacement and upgrade cycle tied directly to vehicle activity rather than discretionary spending.

Professionalization of Automotive Workshops

The Philippine automotive service ecosystem is undergoing steady professionalization, driven by customer expectations, competitive pressure, and fleet servicing requirements. Workshops increasingly operate under standardized service menus, fixed turnaround targets, and quality assurance protocols, all of which require reliable balancing accuracy and repeatability. Manual and low-precision equipment struggles to meet these expectations at scale, pushing workshops toward semi-automatic and automatic balancers. Professionalization also raises the importance of technician productivity, as higher labor costs and staffing constraints necessitate faster service cycles per bay. Equipment investment becomes a strategic decision linked to throughput, customer retention, and brand positioning rather than a purely technical upgrade. This shift structurally favors higher-value equipment segments and supports sustained market growth beyond simple vehicle parc expansion.

Challenge

Capital Cost Sensitivity Among Independent Workshops

A large portion of Philippine workshops remain small, independently operated businesses with limited access to financing. High upfront equipment costs create adoption barriers, particularly for fully automatic or digitally advanced balancers. Many workshops extend the operational life of aging equipment well beyond optimal replacement cycles, accepting lower accuracy and slower service speeds to avoid capital expenditure. This cost sensitivity slows technology penetration outside major urban centers and creates uneven service quality across regions. The challenge is amplified by import dependence, which exposes equipment pricing to currency fluctuations and logistics costs. As a result, market growth is partially constrained by delayed purchasing decisions, even when service demand fundamentals are strong.

Dependence on Imported Equipment and After-Sales Support

The Philippine tire balancing equipment market relies almost entirely on imported systems, making supply chains vulnerable to shipping delays, inventory gaps, and parts availability issues. Workshops place significant weight on local service support, calibration capability, and spare parts availability when selecting equipment. Inconsistent after-sales support can deter adoption of advanced systems, even when technical performance is superior. Smaller distributors may lack nationwide service coverage, limiting their ability to scale beyond core regions. This dependence increases total cost of ownership uncertainty for buyers and can slow replacement cycles if workshops fear extended downtime due to maintenance or component failure.

Opportunity

Replacement of Aging Installed Base

A substantial portion of installed balancing equipment in the Philippines consists of older manual or early-generation digital systems. As service volumes increase and customer tolerance for vibration-related issues declines, these systems become operational bottlenecks. Replacement demand represents a significant opportunity, particularly for compact, semi-automatic, and mid-range automatic balancers that balance performance with affordability. Workshops upgrading equipment can immediately improve throughput, reduce rework, and enhance customer satisfaction without expanding physical space. Vendors that position solutions around lifecycle cost, durability, and service support rather than just upfront price are well positioned to capture this replacement-driven growth.

Fleet and Organized Service Network Expansion

Fleet operators, tire retail chains, and multi-branch service networks are expanding steadily across the Philippines. These buyers prioritize consistency, uptime, and predictable maintenance outcomes across locations, making them strong adopters of standardized balancing platforms. Fleet servicing requires higher-duty equipment capable of sustained daily usage, faster cycles, and minimal calibration drift. As organized players expand regionally, they create scalable demand for uniform equipment specifications and centralized service contracts. This shift opens opportunities for vendors to bundle equipment sales with training, preventive maintenance, and long-term service agreements, increasing revenue stability and deepening customer lock-in.

Future Outlook

The Philippines tire balancing equipment market is expected to evolve toward higher automation, improved accuracy standards, and deeper integration with alignment and diagnostic systems. Market growth will be driven by workshop consolidation, fleet servicing demand, and gradual technology upgrades beyond major urban centers, reinforcing the strategic role of balancing equipment in the automotive service ecosystem.

Major Players

- Bosch Automotive Service Solutions

- Hunter Engineering

- Snap-on Equipment

- Hofmann Megaplan

- CEMB

- Ravaglioli

- Corghi

- Launch Tech

- Teco Automotive Equipment

- Sicam

- Bright Technology

- Manatec Electronics

- Autel Intelligent Technology

Key Target Audience

- Automotive equipment manufacturers

- Authorized automotive dealerships

- Independent vehicle repair workshops

- Tire retail and service chains

- Fleet management companies

- Logistics and transport operators

- Investments and venture capitalist firms

- Government and regulatory bodies (Philippines)

Research Methodology

Step 1: Identification of Key Variables

Demand drivers, equipment categories, service models, and end-user profiles were identified through structured industry mapping.

Step 2: Market Analysis and Construction

Historical trends, installed base behavior, and procurement patterns were analyzed to construct market structure.

Step 3: Hypothesis Validation and Expert Consultation

Insights were validated through interviews with distributors, workshop operators, and equipment specialists.

Step 4: Research Synthesis and Final Output

Findings were triangulated and consolidated into a coherent, client-ready market narrative.

- Executive Summary

- Research Methodology (Market Definitions and Inclusions/Exclusions, Abbreviations, Topic-Specific Taxonomy, Market Sizing Framework, Revenue Attribution Logic Across Use Cases or Care Settings, Primary Interview Program Design, Data Triangulation and Validation, Limitations and Data Gaps)

- Definition and Scope

- Market Genesis and Evolution

- Tire Balancing Equipment Usage and Automotive Service Value-Chain Mapping

- Business Cycle and Demand Seasonality

- Philippines Automotive Service Delivery Architecture

- Growth Drivers

Expansion of the Vehicle Parc Installed Base

Rising Professionalization of Automotive Workshops

Growth of Organized Tire Retail Chains

Urban Congestion and Accelerated Tire Wear

Increasing Focus on Vehicle Safety and Ride Quality - Challenges

High Capital Cost Sensitivity Among Small Workshops

Uneven Adoption of Advanced Digital Equipment

Dependence on Imported Equipment Supply

Skill Gaps in Equipment Calibration and Maintenance

Fragmentation of the Independent Service Market - Opportunities

Penetration of Semi-Automatic and Compact Balancers

Aftermarket Equipment Replacement Cycles

Fleet and Mobility Service Provider Demand

Training-Linked Equipment Sales Models

Regional Workshop Modernization Beyond Metro Areas - Trends

Shift from Manual to Digital Balancing

Integration of Alignment and Balancing Systems

Compact Equipment for Space-Constrained Workshops

Service Bundling by Tire Retail Chains

Growing Preference for Faster Balancing Cycles - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- By Unit Shipments, 2019–2024

- By Installed Base, 2019–2024

- By Average Selling Price, 2019–2024

- By Equipment Type (in Value %)

Static Wheel Balancers

Dynamic Wheel Balancers

Manual Tire Balancers

Semi-Automatic Tire Balancers

Automatic Tire Balancers - By Vehicle Type (in Value %)

Passenger Vehicles

Light Commercial Vehicles

Heavy Commercial Vehicles

Two Wheelers

Three Wheelers - By Technology Type (in Value %)

Bubble Balancing Systems

Computerized Digital Balancers

Laser-Guided Balancing Systems

Road Force Measurement Systems

Portable Balancing Units - By Distribution Model (in Value %)

Direct OEM Sales

Authorized Distributors

Independent Equipment Dealers

Online and E-commerce Channels - By End-Use Customer Type (in Value %)

Authorized Automotive Dealerships

Independent Repair Workshops

Tire Retail Chains

Fleet Maintenance Operators

Vehicle Inspection Centers - By Region (in Value %)

Metro Manila

Luzon (excluding Metro Manila)

Visayas

Mindanao

- Competition ecosystem overview

- Cross Comparison Parameters (equipment accuracy tolerance, balancing cycle time, wheel size compatibility, calibration frequency, power requirements, footprint size, after-sales service coverage, training support, price durability)

- SWOT analysis of major players

- Pricing and commercial model benchmarking

- Detailed Profiles of Major Companies

Bosch Automotive Service Solutions

Hunter Engineering

Snap-on Equipment

Hofmann Megaplan

CEMB

Ravaglioli

Corghi

Launch Tech

Teco Automotive Equipment

Sicam

Bright Technology

Manatec Electronics

Autel Intelligent Technology

John Bean

Techno Vector

- Buyer personas and decision-making units

- Procurement and contracting workflows

- KPIs used for evaluation

- Pain points and adoption barriers

- By Value, 2025–2030

- By Unit Shipments, 2025–2030

- By Installed Base, 2025–2030

- By Average Selling Price, 2025–2030