Market Overview

The Philippines tire recycling market is valued at USD ~ billion and the global tire recycling market is valued at USD ~ billion in the latest year, with growth driven by end-of-life tire volumes, sustainability mandates, and downstream demand for TDF, crumb rubber, and recovered carbon black.

In the Philippines, dominance concentrates in Mega Manila–Central Luzon and Cebu / Northern Mindanao / Davao because these corridors combine the highest tire “generation density” (vehicle parc + replacement cycles) with the most bankable offtake route—cement kiln co-processing (TDF / whole tires)—and the strongest logistics. A key indicator of feedstock pressure is that CAMPI-TMA new-vehicle sales rose from ~ units in the prior year to ~ units in the latest year, intensifying replacement-tire volumes over time. On the processing side, Geocycle operates multiple co-processing facilities across La Union, Bulacan, Misamis Oriental, and Davao, enabling national collection reach and steady kiln offtake.

Market Segmentation

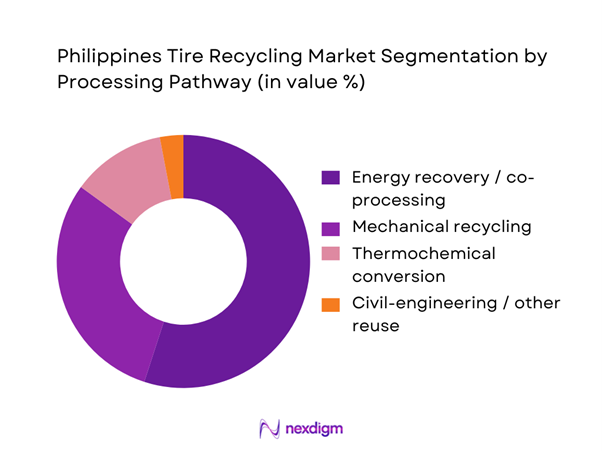

By Processing Pathway

Energy recovery via cement kiln co-processing tends to dominate because it solves the two hardest constraints in the Philippines at once: reliable, continuous offtake at industrial scale and tolerance for heterogeneous feedstock quality versus tight-spec crumb and rubber applications. The country’s archipelagic logistics make long-haul reverse supply chains expensive; co-processing works with hub-and-spoke collection into large cement corridors and provides a “sink” for difficult fractions such as mixed sizes and contaminated tires that would otherwise accumulate. Geocycle’s multi-site footprint across Luzon, Visayas linkage points, and Mindanao supports this model by enabling intake near major waste-generation centers and routing into kilns. In practical procurement, co-processing also aligns with corporate sustainability targets and waste compliance requirements, making it easier for large generators such as fleets, LGUs, ports, and industrial parks to sign multi-year disposal contracts.

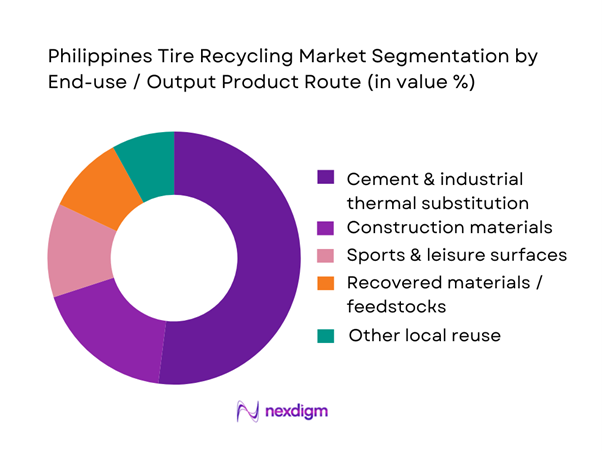

By End-use / Output Product Route

Cement and industrial thermal substitution typically leads because it has the clearest “business case” under Philippine operating realities. Cement kilns can consume high-calorific tire fractions as alternative fuel, displacing imported fossil fuels, while also recovering the embedded steel as mineral input, creating two value streams within one compliance pathway. Globally, co-processing is a recognized route for end-of-life materials where energy fraction and mineral fraction can be recovered in a single process, and Geocycle’s co-processing model explicitly positions tires as both energy and alternative raw material content.

For market participants, this route reduces the risk of demand volatility compared with crumb rubber applications that depend on construction cycles, procurement standards, and performance acceptance. It also simplifies contracting, as large-volume generators prefer single-exit solutions with auditable documentation that co-processing providers can supply through established industrial governance.

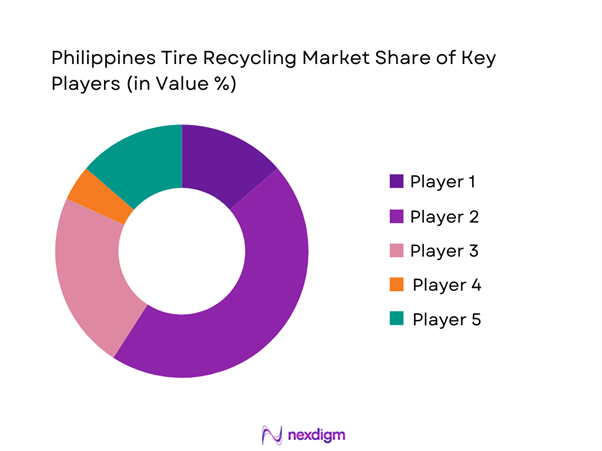

Competitive Landscape

The Philippines tire recycling ecosystem is route-consolidated: a smaller number of industrial offtakers, especially cement kiln co-processors, anchor volume absorption, while a wider layer of collectors, transporters, and niche recyclers compete on aggregation efficiency, preprocessing capability, and documentation and traceability. The most defensible positions are held by players that control multi-island intake, preprocessing such as shredding and metal separation, and bankable offtake through kiln feeding or contracted buyers.

| Company | Est. year | HQ | Primary route focus | Footprint / facilities | Feedstock acceptance model | Pre-processing capability | Offtake security | Compliance & documentation |

| Geocycle Philippines (Holcim ecosystem) | — | Philippines | ~ | ~ | ~ | ~ | ~ | ~ |

| Holcim Philippines (cement operations interface) | — | Philippines | ~ | ~ | ~ | ~ | ~ | ~ |

| Republic Cement | — | Philippines | ~ | ~ | ~ | ~ | ~ | ~ |

| CEMEX Philippines | — | Philippines | ~ | ~ | ~ | ~ | ~ | ` |

| Local crumb rubber / mechanical recyclers (cluster) | — | Philippines | ~ | ~ | ~ | ~ | ~ | ~ |

Philippines Tire Recycling Market Analysis

Growth Drivers

End-of-life tire accumulation rate

The Philippines’ end-of-life tire pipeline is structurally tied to how fast the vehicle parc expands and how intensively it is used in dense corridors. In the latest two complete years, new motor vehicle sales increased from ~ units to ~ units, and then reached ~ units, a volume trajectory that mechanically increases replacement-tire consumption and, with a lag, end-of-life tire generation across passenger vehicles, light commercial vehicles, buses, trucks, and motorcycles. This expansion is happening in a macro context where the economy is large enough to sustain rising mobility demand, with GDP at USD ~ billion in current prices, signaling the scale of road freight, commuting, and distribution activity that consumes tires. In parallel, the tire flow is reinforced by trade availability, with the Philippines importing ~ items of new pneumatic tires for cars and ~ items of new pneumatic tires for buses and trucks in the latest available year within the requested window, indicating a sizable installed base pipeline that ultimately converts into end-of-life tires. Practically, these inflows concentrate end-of-life tire generation where fleets, logistics hubs, and dense commuter travel accelerate wear, creating consistent volumes for collectors, processors, and cement kilns or pyrolysis operators once collection capture improves.

Cement alternative fuel demand

Cement is one of the most credible sink markets for tire-derived fuel and tire chips because kilns can co-process high-calorific wastes under tightly controlled combustion conditions, and because the industry operates at steady baseload. In the Philippines, the cement footprint is nationally distributed but still concentrated where demand and logistics are strongest, with plant siting patterns showing a majority of facilities in Luzon and the remainder split between Visayas and Mindanao, which matters because end-of-life tire collection economics improve when processors can aggregate near kiln clusters and major arterial corridors. On the macro side, demand is supported by the scale of domestic economic activity, with GDP at USD ~ billion in current prices, consistent with sustained construction and infrastructure activity that underpins clinker and cement offtake. Tire co-processing demand also links to fossil-fuel substitution logic, as the Philippines imports much of its fuel needs, making industrial users sensitive to import exposure and supply security. Where co-processing is permitted and properly monitored, end-of-life tires reduce dependence on coal and petcoke in the thermal mix and create an end market that can absorb mixed-quality tire feedstock that may not be optimal for higher-value crumb rubber. This is why kiln-adjacent preprocessing such as shredding, wire removal, and chip sizing is commercially important, converting heterogeneous end-of-life tires into a spec-compliant alternative fuel stream that cement plants can consume at scale, particularly around high-demand regions where construction material flows are heaviest.

Challenges

Collection inefficiencies

End-of-life tire economics fail first at collection. If tires are not aggregated cleanly, documented, and moved at scale, processing plants starve for feedstock while illegal dumping and stockpiles persist. The Philippines’ disposal infrastructure coverage gap is a practical indicator of why collection is hard, with ~ operational sanitary landfills servicing ~ LGUs, leaving a large number of LGUs outside full sanitary landfill coverage and often relying on interim disposal practices that make systematic end-of-life tire capture more difficult. Meanwhile, tire inflows remain large and geographically dispersed, with vehicle sales increasing from ~ units to ~ units and then to ~ units, expanding the end-of-life tire generation base across urban and peri-urban corridors. Trade data further indicates widespread tire availability, with imports of ~ items of bus and truck tires and ~ items of car tires in the latest year in the window, implying extensive distribution through importers, wholesalers, and retailers, each a potential collection node only if incentives and compliance align. In macro terms, the operational challenge exists inside a large, complex economy with GDP at USD ~ billion, reflecting the breadth of supply chains and the heterogeneity of actors such as small vulcanizing shops, fleet depots, dealers, and LGUs, which increases transaction costs for consistent collection.

Informal sector leakage

Informal leakage occurs when end-of-life tires are diverted into undocumented resale, backyard burning, illegal dumping, or unregistered processing, which disrupts both environmental outcomes and formal plant utilization. One marker of this risk is the persistence of limited compliant disposal coverage, with ~ operational sanitary landfills servicing ~ LGUs, meaning many areas still have weak enforcement capacity across waste streams, conditions under which special wastes like tires can leak into informal channels. At the same time, tire volumes are large and widely distributed, with imports of new tires reaching ~ items of car tires and ~ items of bus and truck tires in the latest reported year in the window, and new vehicle sales rising to ~ units after ~ units the prior year. This creates a broad network of small retail and service nodes such as vulcanizing shops and small dealers where informal flows can flourish if formal take-back has no advantage. Macro scale again matters, as GDP at USD ~ billion implies a vast number of micro-enterprises and transport operators. In such an ecosystem, cash-and-carry disposal can easily outcompete compliant hauling unless compliance is enforced and transaction friction is reduced. The commercial impact is material: informal leakage reduces feedstock availability for legal processors, increases variability in casing mix, and pushes formal operators to pay more for tires while still being blamed for environmental outcomes caused by illegal burning or dumping. This is why traceability becomes a differentiator in the Philippine end-of-life tire market as enforcement expectations tighten.

Opportunities

Pyrolysis capacity scale-up

Pyrolysis scale-up is an opportunity when three conditions align: sufficient end-of-life tire capture, credible offtake for products such as oil, gas, and recovered carbon, and compliance and monitoring that protect licenses and bankability. The Philippines has a large feedstock base potential, with new vehicle sales rising from ~ units to ~ units and then ~ units, while tire imports in the latest available year include ~ items of car tires and ~ items of bus and truck tires. These numbers imply a wide installed base of tires that eventually becomes end-of-life material. At the same time, the market has pressure signals that can support diversion, with ~ operational sanitary landfills serving ~ LGUs, underscoring why LGUs and regulators increasingly need non-landfill outlets for bulky wastes. Macro fundamentals support industrial investment capacity and energy-demand depth, with GDP at USD ~ billion suggesting the economy can support multiple mid-scale plants if feedstock and permitting are secured. The growth pathway should be framed using current facts rather than future promises, as existing tire inflows and mobility expansion already justify aggregation hubs, preprocessing yards, and staged modular pyrolysis installations starting where feedstock capture is easiest and where industrial customers can absorb outputs. The key to making this opportunity real is quality and compliance, including continuous reactors, strong emissions control, steel recovery, and product testing so outputs can enter legitimate industrial channels rather than remaining low-value or disputed fuel streams.

Long-term cement co-processing contracts

Long-term cement kiln co-processing contracts are the most bankable near-term opportunity because they monetize diversion without requiring perfect product markets for pyrolysis outputs, and because cement plants can absorb large, steady volumes if the tire chips meet specification. The Philippines’ cement footprint is broad enough to support multi-site offtake, with a nationwide plant base showing strong concentration in Luzon and meaningful capacity in Visayas and Mindanao, a geography that matches the country’s main end-of-life tire generation corridors. The feedstock base is already large, with new vehicle sales reaching ~ units after ~ units and tire imports including ~ items of bus and truck tires and ~ items of car tires in the latest available year shown. Landfill constraints strengthen the diversion case, as ~ operational sanitary landfills serving ~ LGUs indicate persistent capacity and compliance pressures that make non-landfill outlets politically and operationally valuable. Macro scale supports the contracting ecosystem, with GDP at USD ~ billion implying a large construction and logistics base that underpins cement demand and kiln utilization. The commercial unlock is to move from spot buying to contracts that specify chip size range, maximum moisture, steel handling, delivery cadence, documentation and traceability, and compliance monitoring. With these terms in place, processors can finance shredding lines and collection networks because revenue becomes predictable, creating a practical growth engine for the Philippine tire recycling value chain without requiring speculative assumptions about future policy or future market pricing.

Future Outlook

Over the next planning cycle, the Philippines tire recycling market should strengthen on three reinforcing tracks: rising end-of-life tire generation from vehicle sales and parc growth, higher enforcement pressure against open dumping and stockpiling, and expanding industrial demand for alternative fuels and circular materials. A structural tailwind is the scaling of multi-island collection systems paired with stable offtake through cement kilns and selective growth in higher-value outputs such as crumb rubber for infrastructure applications and pyrolysis outputs where offtake and permitting are secured. At the same time, winners will be those who can prove traceability, build preprocessing resilience, and lock long-term buyers for recycled outputs.

Major Players

- Geocycle Philippines

- Holcim Philippines

- Republic Cement

- CEMEX Philippines

- Eagle Cement

- Taiheiyo Cement Philippines

- Solid Cement Corporation

- LafargeHolcim ecosystem partners

- Local tire collection & aggregation operators

- Local mechanical shredding & crumb rubber recyclers

- Local mechanical shredding & crumb rubber recyclers

- Local mechanical shredding & crumb rubber recyclers

- Pyrolysis project operators

- Industrial waste logistics providers

Key Target Audience

- Cement & building materials manufacturers

- Fleet operators and transport and logistics companies

- Tire manufacturers, importers, and major distributors

- Industrial parks, SEZ locators, and large factories

- Construction contractors and asphalt producers

- Waste management operators and specialized haulers

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

We map the end-to-end end-of-life tire ecosystem including generation points, collection density, logistics lanes, preprocessing nodes, and offtake sinks. Desk research is used to define variables such as tire generation drivers, collection economics, acceptance specifications, and regulatory touchpoints that govern waste movement and treatment.

Step 2: Market Analysis and Construction

We build the market using a pathway-based framework covering co-processing, mechanical recycling, and thermochemical conversion, and validate revenue pools via service pricing structures and product monetization routes. We stress-test assumptions against the operational realities of archipelagic logistics and offtake continuity.

Step 3: Hypothesis Validation and Expert Consultation

We conduct CATIs with cement alternative fuel teams, waste operators, recyclers, and major generators to validate throughput constraints, contamination rates, contract structures, and documentation requirements. We also validate demand-side specifications for crumb rubber, construction applications, and thermochemical outputs.

Step 4: Research Synthesis and Final Output

We triangulate primary insights with credible secondary anchors including vehicle market volume signals, disclosed industrial co-processing footprints, and global tire recycling benchmarks to position the Philippines within regional maturity bands. The final model is reviewed for internal consistency across volumes, routes, and feasible processing capacities.

- Executive Summary

- Research Methodology (Market Definitions and Scope, End-of-Life Tire Assumptions, Scrap Tire Generation Logic, Recovery Rate Benchmarks, Informal vs Formal Flow Mapping, Primary Interviews with Recyclers and Cement Plants, Bottom-Up Capacity Mapping, Top-Down Waste Estimation, Data Triangulation Framework, Limitations and Validation Controls)

- Definition and Scope

- Market Genesis and Evolution

- Tire Waste Lifecycle in the Philippines

- Industry Business Cycle

- End-of-Life Tire Supply Chain and Value Chain Analysis

- Growth Drivers

End-of-life tire accumulation rate

Cement alternative fuel demand

Urban vehicle parc expansion

Landfill capacity constraints

Import substitution for industrial fuel - Challenges

Collection inefficiencies

Informal sector leakage

Limited advanced processing capacity

Regulatory enforcement gaps

Feedstock price volatility - Opportunities

Pyrolysis capacity scale-up

Long-term cement co-processing contracts

Rubberized infrastructure adoption

Export-grade recovered carbon black

ESG-linked project financing - Trends

Cement–recycler strategic partnerships

Shift from landfill disposal to co-processing

Digital traceability of scrap tire flows

Carbon credit and sustainability alignment - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- By Volume, 2019–2024

- By Processing Revenue Mix, 2019–2024

- By Technology Architecture (in Value %)

Mechanical Shredding and Crumbing

Ambient Grinding

Cryogenic Processing

Pyrolysis Processing

Direct Reuse and Retreading - By Application (in Value %)

Cement Kilns and Co-Processing (TDF)

Rubberized Asphalt and Road Materials

Molded Rubber Goods and Mats

Fuel Oil and Recovered Carbon Black

Export-Oriented Scrap and Granules - By End-Use Industry (in Value %)

Cement Manufacturing

Infrastructure and Construction

Rubber Goods Manufacturing

Energy and Industrial Fuel Users

Export and Trading Companies - By Fleet Type (in Value %)

Passenger Vehicle Tires

Commercial Truck and Bus Tires

Two-Wheeler Tires

Off-the-Road and Industrial Tires

Retread Rejects and Manufacturing Scrap - By Region (in Value %)

Luzon

National Capital Region

Visayas

Mindanao

Freeport and Industrial Zones

- Market share of key players by processing volume and technology type

- Cross Comparison Parameters (installed processing capacity, technology type, feedstock control mechanism, cement kiln tie-ups, output product mix, geographic footprint, regulatory compliance status, cost per ton processed)

- SWOT analysis of major players

- Pricing and margin benchmarking by shredded tire, TDF, pyrolysis oil, and recovered carbon black

- Detailed Company Profiles

Envirocycle Philippines

Green Antz Builders

Holcim Philippines

Republic Cement

Solid Waste Integrated Solutions Philippines

PhilEco Recycling Solutions

Power Circle Recycling

Prime Green Solutions

Crown Tire Recycling

Geocycle Philippines

Ecoloop Solutions

Evergreen Waste Management

Metro Waste Recycling

Greenway Environmental Solutions

Asia Rubber Recycling Enterprises

- Cement industry demand dynamics

- Infrastructure and construction sector utilization

- Rubber goods manufacturers’ procurement behavior

- Export buyers’ quality and compliance requirements

- Decision-making criteria and contracting models

- By Value, 2025–2030

- By Volume, 2025–2030

- By Processing Technology Mix, 2025–2030