Market Overview

The Philippines tire valve stems market is fundamentally tied to the national parc of two-wheelers and passenger vehicles, the replacement cycle of tyres and tubes, and the throughput of vulcanizing shops, tyre retailers, and fleet depots. In practice, demand is driven by routine tyre maintenance and puncture repair events, rim and tyre upgrades especially tubeless conversions in motorcycles, and the growing installed base of TPMS-capable vehicles that increases the use of service kits and valve replacements during tyre changes. Data gap: A standalone Philippines market value for valves for pneumatic tyres and inner-tubes and valve stems is covered in specialist trade-intelligence products, but the publicly accessible previews do not disclose the numeric market value.

Demand concentration is typically highest where tyre replacement density, logistics intensity, and vehicle utilization are highest, which puts the largest pull in the Philippines’ major urban and industrial corridors including Metro Manila and surrounding growth areas, key port-linked regions, and major provincial hubs with dense motorcycle usage and intercity travel. On the supply side, the Philippines market is heavily influenced by importing ecosystems, where China and regional manufacturing bases commonly dominate availability because valve stems are high-volume, low-to-mid ticket consumables with strong price ladders and broad SKU proliferation including snap-in, clamp-in, TR series variants, and TPMS service kits. Data gap: country-level supplier splits for the specific tyre-valve product line require disaggregated customs and trade data.

Market Segmentation

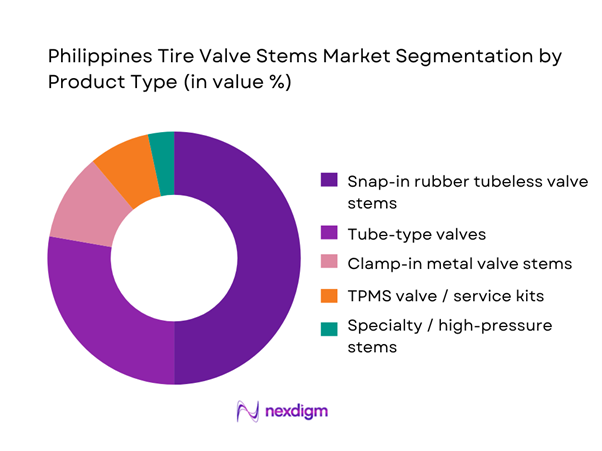

By Product Type

In the Philippines, snap-in rubber tubeless valve stems typically dominate unit consumption because they match the country’s high-frequency replacement behavior in mainstream passenger vehicles and the broad base of motorcycles transitioning to tubeless setups. They are low-cost, widely compatible with standard rims, and are often replaced proactively during tyre changes or as part of puncture repair packages at vulcanizing shops. Their dominance is reinforced by distribution reality: these SKUs are widely stocked by wholesalers and retailers, appear in multi-pack formats, and have strong substitution flexibility across common rim-hole standards. In contrast, clamp-in metal stems are more common in premium rims and selected fitments, while TPMS kits rise with newer vehicles but remain more specialized by sensor system and service procedure. This creates a volume-heavy center in snap-in stems.

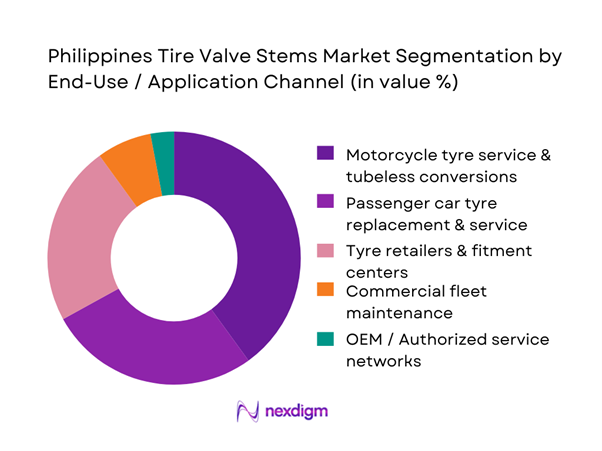

By End-Use / Application Channel

For the Philippines, motorcycle tyre service and repair ecosystems often represent the densest touchpoint layer for valve-related consumption because of the sheer frequency of tyre interventions in two-wheeler usage including punctures, pressure-loss complaints, rim and tyre replacements, and inner-tube handling that all pull valve demand into everyday workshop routines. Vulcanizing shops and neighborhood tyre points operate at high transaction volumes and favor fast-moving SKUs with consistent turnover. The application channel becomes dominant not only due to vehicle population dynamics but also because valve replacements are frequently bundled into service tickets such as valve core and cap replacement, stem replacement when cracking or leaking is detected, or during tube swaps. Passenger cars are meaningful, especially in urban centers and ride-hailing, but the intensity of small-ticket maintenance transactions in the two-wheeler repair economy typically sustains higher unit movement for valve components.

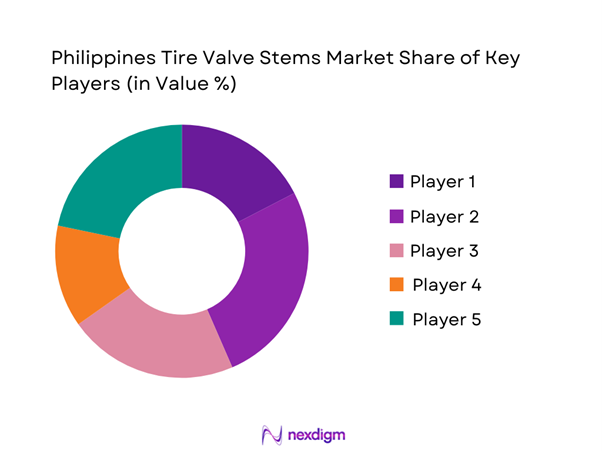

Competitive Landscape

The Philippines tire valve stems market is typically fragmented at the brand level with many interchangeable SKUs but concentrated at the channel-control level where importers, wholesalers, and large tyre distributors determine what moves. Competition is shaped by price ladders from economy to premium, perceived leak resistance, rubber quality, corrosion performance for metal stems, SKU availability, and the ability to supply fast-moving TR series stems and service parts consistently.

| Company | Established | Headquarters | Core Valve Portfolio | TPMS Service Kit Coverage | Quality Positioning | Key Differentiator | Typical Route-to-Market in PH | After-Sales / Claims Handling |

| Schrader (Sensata) | 1844 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Dill Air Controls | 1909 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Hamaton | 1999 | UK | ~ | ~ | ~ | ~ | ~ | ~ |

| Alligator (Alligator Ventilfabrik) | 1920 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| Haltec | 1970s | USA | ~ | ~ | ~ | ~ | ~ | ~ |

Philippines Tire Valve Stems Market Analysis

Growth Drivers

Two-wheeler replacement cadence and tubeless conversion

Philippines mobility is structurally two-wheeler heavy, which creates a high-frequency replacement touchpoint for tire-valve stems through routine tire changes, puncture repairs, and rim and valve swaps during service. The Philippines’ total economy expanded from USD ~ to USD ~, and then USD ~, supporting higher utilization of personal mobility and delivery ecosystems that run on motorcycles and scooters. At the same time, the registered motorcycle parc moved from ~ to ~ units, which keeps replacement and conversion demand active in urban corridors where tubeless setups are increasingly standard in newer rim and tire packages. For tire shops, valve stems become a must-replace consumable during tubeless tire mounting, and the dominance of motorcycle-centric service lanes raises the volume of small-ticket parts per service day, especially where riders prioritize uptime over long diagnostic cycles.

Fleet uptime focus and preventive maintenance

Commercial road fleets including light commercial units, vans, pickups, multi-axle trucks, and last-mile delivery vehicles treat valve stems as low-cost failure points that can cause downtime, roadside incidents, and repeat workshop visits. Macro tailwinds matter because fleet movement scales with broader economic throughput as Philippines GDP increased from USD ~ to USD ~, which typically correlates with higher goods movement intensity and higher vehicle utilization hours on congested arterials. In parallel, the total registered road motor vehicle parc rose from ~ to ~ units, enlarging the addressable base for periodic tire service, wheel balancing, and valve replacement. In practice, fleet managers and transport operators push preventive checks such as valve core tightening, rubber snap-in stem replacement during tire rotation, and leak checks because a slow leak can cascade into tire damage and schedule slippage. This shifts demand from purely reactive puncture repair replacements toward planned valve-stem changeouts during service intervals, particularly for high-mileage city fleets operating in Metro Manila, Cebu, and Davao logistics loops.

Challenges

Counterfeit and low-grade imports

Counterfeit and low-grade valve stems compress workshop trust and create a high comeback burden as leaks from porous rubber, weak cores, and inconsistent dimensions lead to repeat repairs and reputational damage. This is amplified in the Philippines because the addressable base is large and still expanding with ~ registered road vehicles and ~ motorcycles, so even a small rate of failure translates into high absolute workshop incidents. When supply chains route through fragmented wholesale markets and informal procurement, workshops often choose based on availability rather than traceability, making it harder to control quality. The macro environment with GDP at USD ~ supports high vehicle activity, which in turn accelerates wear cycles and increases the frequency of minor consumable purchases where counterfeits thrive because transaction values are small and inspection is rare. For professional workshops, the operational impact is tangible with more leak rechecks, more wheel-off events, and more customer time lost, pushing some operators to shift toward known brands and distributor-backed SKUs while leaving a large long-tail market vulnerable to inconsistent quality.

Fitment mismatch and rim hole sizing issues

Valve stems are not one-size-fits-all as rim hole diameters, rim thickness, stem length, and seat geometry vary across motorcycles, passenger cars, and commercial vehicles, and mismatch causes slow leaks, stem pull-through, or installation damage. The challenge scales with parc diversity as the Philippines’ registered base increased from ~ to ~ vehicles while the motorcycle parc reached ~, implying a broad mix of rims and service contexts including aftermarket wheels, refurbished rims, imported used rims, and mixed-brand tire replacements. In high-throughput environments such as roadside vulcanizing and neighborhood tire shops, fitment checks can be skipped, especially when procurement is fragmented and SKU depth is limited. This increases rework rates because incorrect stems can pass initial inflation but fail under heat, vibration, or higher pressures. The macro context with GDP at USD ~ supports greater mobility intensity and longer daily trip volumes in urban areas, which elevates the consequences of minor fitment errors. Operationally, the market needs more fitment discipline, better SKU mapping by vehicle class, and stronger distributor guidance so workshops stock correct stem families instead of relying on generic substitutes.

Opportunities

Premiumization into high-pressure and metal clamp-in stems

A growing vehicle parc of ~ units and a large motorcycle base of ~ units expands the installed base that can shift from generic snap-in stems to higher-grade options, especially in use cases where pressure stability and durability matter such as higher-load service, frequent highway use, fleet operations, and corrosion-prone environments. The economy’s scale with GDP at USD ~ supports greater willingness among fleets and premium consumers to prioritize fewer comebacks and higher uptime. The key is that failures of low-grade stems are operationally expensive, driving repeat visits, customer dissatisfaction, and risk events. Premiumization therefore becomes an execution opportunity for organized tire chains, dealer workshops, and top independents that standardize clamp-in stems for specific wheel types, stock corrosion-resistant cores and caps, and bundle quality stem replacement into every tire mounting job. This opportunity builds on current conditions because the parc is already large and still expanding and workshop modernization is already pushing toward standardized consumables.

TPMS service kit upselling

TPMS complexity turns valve stems from a commodity into a service kit motion involving stems, grommets, washers, cores, caps, and correct torque practices. With the registered vehicle base at ~ units, the absolute number of tire-service events involving newer vehicles is large enough for workshops to build a repeatable attachment model by selling the correct TPMS-compatible stem and seal components during every tire replacement or balancing job that touches a TPMS wheel. Economic scale with GDP at USD ~ supports higher vehicle utilization and stronger expectations of reliability, which makes customers more receptive to do-it-right-once maintenance bundles, especially fleets and premium private owners. The opportunity is about capturing value from current pain points including repeat leaks, sensor seal degradation, and rework caused by reusing old grommets or installing incorrect stems. Distributors can accelerate this by packaging vehicle-class kits, improving SKU availability, and enabling basic TPMS handling training for the independent channel.

Future Outlook

Over the next five years, the Philippines tire valve stems market is expected to grow on the back of sustained tyre replacement volumes as vehicle usage remains high, ongoing tubeless penetration in motorcycles and passenger vehicles, rising service sophistication in fitment centers, and gradual expansion of TPMS-related service kits as the circulating parc modernizes. Competitive advantage will increasingly depend on SKU availability, consistent rubber compound quality, corrosion performance, and supply reliability rather than branding alone, especially for high-velocity snap-in valve stems and service parts.

Major Players

- Schrader

- Dill Air Controls

- Hamaton

- Alligator Ventilfabrik

- Haltec

- Pacific Industrial

- TRW and legacy TR valve ecosystem

- Baolong

- Steelmate

- BH SENS

- Orange Electronic

- Autel

- Wonder

- Gaither Tool

Key Target Audience

- Tyre manufacturers and tyre importers and distributors

- National tyre retail and fitment chains

- Vulcanizing shop supply wholesalers

- Fleet operators and fleet maintenance procurement heads

- Automotive aftermarket parts distributors

- E-commerce automotive category leaders

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

We construct a Philippines tyre-service ecosystem map covering importers, wholesalers, tyre retailers, vulcanizing shops, fleet depots, and OE and dealer service. We define key variables such as valve type mix, service ticket attachment rate, TPMS service-kit penetration, and channel mark-up ladders, supported by structured desk research and database scanning.

Step 2: Market Analysis and Construction

We compile historical trade and industry indicators relevant to tyre valves where available and triangulate them with on-ground channel throughput logic including tyre replacement frequency, service-bundling norms, and workshop consumption patterns. We build a bottom-up model using workshop counts, average daily jobs, and per-job valve attachment logic while keeping all assumptions auditable and stress-tested.

Step 3: Hypothesis Validation and Expert Consultation

We validate hypotheses through CATI interviews with tyre retailers, vulcanizing shop owners, importer and distributor product managers, and fleet maintenance heads. The goal is to confirm real-world SKU velocity, failure and leak drivers, preferred specifications, and replacement triggers across passenger and two-wheeler channels.

Step 4: Research Synthesis and Final Output

We reconcile top-down indicators with bottom-up channel models, then run consistency checks on price ladders, unit economics, and channel shares. Final outputs include segmentation shares, competitive cross-comparisons, and strategy recommendations with a transparent audit trail for every data input.

- Executive Summary

- Research Methodology (Market definitions and assumptions, Abbreviations, Demand triangulation using vehicle parc tire replacement cycle and service-bay throughput, Supply triangulation using import mapping distributor sell-in and retail and e-commerce checks, Primary interviews across tire shops dealers fleets and importers, Channel audits across Luzon Visayas and Mindanao, Validation using standards tolerances and failure-mode checks, Limitations and boundary conditions)

- Definition and scope

- Market genesis and evolution of valve technologies

- Philippines vehicle ecosystem linkages

- Supply chain and value chain analysis

- Installed base and service ecology mapping

- Growth Drivers

Two-wheeler replacement cadence and tubeless conversion

Fleet uptime focus and preventive maintenance

TPMS penetration in newer vehicle models

Balancing and service-bay modernization - Challenges

Counterfeit and low-grade imports

Fitment mismatch and rim hole sizing issues

Corrosion failures in coastal cities

Fragmented tire shop procurement

Limited TPMS service capability - Opportunities

Premiumization into high-pressure and metal clamp-in stems

TPMS service kit upselling

Fleet contracts with quality assurance and traceability

Anti-counterfeit packaging and labelling

Training-led distributor programs - Trends

Increasing TPMS-relevant valve demand

Shift to service kits over whole-stem replacement

Online procurement by small tire shops

Corrosion-resistant SKUs for coastal provinces - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- By Volume, 2019–2024

- By Average Selling Price, 2019–2024

- Service Revenue Mix, 2019–2024

- By Fleet Type (in Value %)

Two-wheelers and motorcycles

Tricycles and three-wheelers

Passenger cars and sedans

SUVs and CUVs

Light commercial vehicles - By Application (in Value %)

OE and assembly replacement

Dealership service replacement

Independent tire shops and vulcanizing shops

Fleet maintenance programs

Roadside and emergency replacement - By Technology Architecture (in Value %)

Snap-in rubber valve stems

High-pressure rubber valve stems

Clamp-in metal valve stems

TPMS-integrated valve stems

Valve stem repair and service kits - By Connectivity Type (in Value %)

Non-connected conventional valve stems

TPMS-compatible valve stems

TPMS sensor service kits with valves - By End-Use Industry (in Value %)

Private vehicle owners

Commercial logistics and delivery fleets

Public transport operators

Construction and industrial operators

Agriculture and off-highway users - By Region (in Value %)

National Capital Region

CALABARZON

Central Luzon

Central Visayas

Davao Region

- Competitive intensity map

- Cross Comparison Parameters (SKU coverage by TR codes and high-pressure stems, TPMS compatibility depth and service-kit breadth, pressure and speed rating assurance and test documentation, corrosion resistance and coating strategy for coastal exposure, traceability and anti-counterfeit packaging and batch control, local availability lead-time and regional stocking model, technical training and installation SOPs including torque specs, channel reach across Luzon Visayas Mindanao and e-commerce execution)

- Detailed Profiles of Major Companies

Schrader Sensata

Pacific Industrial

Huf Hülsbeck and Fürst

Alligator

Dill Air Controls

Haltec

Rema Tip Top

Continental

Autel

Dorman Products

Milton Industries

Slime

Michelin

TRJ

- Procurement triggers

- Service workflow

- Decision hierarchy

- Replacement thresholds

- By Value, 2025–2030

- By Volume, 2025–2030

- By Average Selling Price, 2025–2030

- Service Revenue Mix, 2025–2030