Market Overview

The Philippines Vehicle Black Box Systems Market is valued at USD ~ million, driven by increasing vehicle sales, rising demand for road safety, and governmental regulatory requirements. The market plays an important role in enhancing vehicle security and accident documentation, providing value to both consumers and businesses. The surge in telematics adoption and AI integration into vehicle technologies further bolsters the market’s growth, while advances in data recording and fleet management applications contribute to broader market appeal. Additionally, the ongoing demand for consumer protection and data privacy compliance supports the sector’s stability and long-term prospects.

Metro Manila is the dominant region, accounting for a large portion of the market due to its high vehicle population and robust regulatory policies on vehicle safety. The demand in urban centers is influenced by factors such as the rise of e-commerce and ride-sharing services, with black box systems becoming an essential tool for insurance verification and dispute resolution. Cities like Cebu and Davao are also showing increasing adoption rates, driven by expanding transportation networks and governmental support for road safety initiatives. Global suppliers influence technology and product innovation in the market, including advancements in AI and cloud-based services.

Market Segmentation

By Product Type

The Philippines Vehicle Black Box Systems Market is segmented by product type into Dash Cameras, Fleet Management Systems, Advanced Driver Assistance Systems (ADAS), Event Data Recorders (EDRs), and Integrated Systems. Among these, dash cameras hold the largest share of the market. Dash cameras’ dominance is attributed to the increasing number of personal vehicle owners who are looking for solutions to document road incidents and protect against fraud. Additionally, their widespread availability and ease of installation across both OEM and aftermarket segments have made them a go-to product for vehicle owners.

By Application

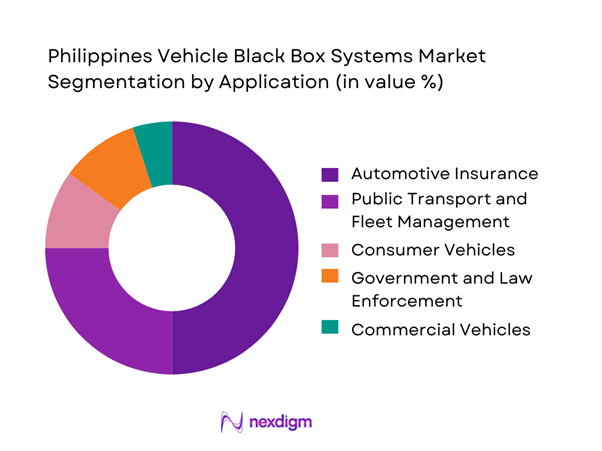

The Philippines Vehicle Black Box Systems Market is segmented by application into Automotive Insurance, Public Transport and Fleet Management, Consumer Vehicles, Government and Law Enforcement, and Commercial Vehicles. Automotive insurance applications dominate the market. Insurance companies are increasingly mandating black box systems to help verify claims, prevent fraud, and promote safer driving behaviors. The rising need for insurers to manage risks efficiently in the growing vehicle market is a major factor in the dominance of this segment.

Competitive Landscape

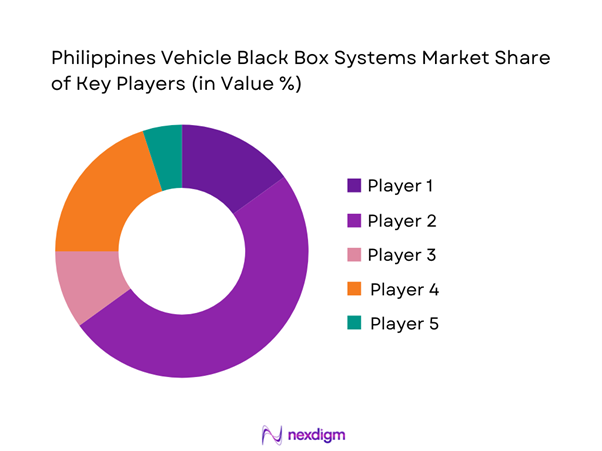

The Philippines Vehicle Black Box Systems market is dominated by a few major players, including BlackVue and global or regional brands like Garmin, Thinkware, and Nexar. This consolidation highlights the significant influence of these key companies. These firms lead the market in technological advancements and brand recognition, while smaller players continue to innovate and cater to niche segments within the market.

| Company | Establishment Year | Headquarters | Revenue | Market Share | Product Type | Technological Innovation | Distribution Channels |

| BlackVue | 2008 | South Korea | ~ | ~ | ~ | ~ | ~ |

| Garmin | 1989 | United States | ~ | ~ | ~ | ~ | ~ |

| Thinkware | 1997 | South Korea | ~ | ~ | ~ | ~ | ~ |

| Viofo | 2014 | China | ~ | ~ | ~ | ~ | ~ |

| Nexar | 2015 | United States | ~ | ~ | ~ | ~ | ~ |

Philippines Vehicle Black Box Systems Market Analysis

Growth Drivers

Increasing Vehicle Sales

The increasing number of vehicles on the road is one of the primary drivers for the adoption of vehicle black box systems in the Philippines. As more people purchase cars and businesses expand their fleets, the need for safety and security solutions becomes more prominent. Vehicle owners and fleet operators are more likely to seek technologies that enhance safety, minimize accidents, and protect against theft. This growing vehicle population directly correlates with higher demand for black box systems that offer features such as accident recording, real-time tracking, and enhanced vehicle security.

Rising Focus on Road Safety and Security

With the rise in traffic accidents and road safety concerns, there is a growing focus on enhancing vehicle security. The increasing awareness of the importance of accident documentation and driver protection encourages more vehicle owners and companies to install black box systems. Governments, insurers, and the public are increasingly prioritizing road safety, which pushes the demand for advanced safety technologies. As safety regulations become stricter, the adoption of vehicle black boxes, which help in both accident investigation and fraud prevention, is becoming an essential part of vehicle ownership.

Market Challenges

High Initial Investment Costs

One of the major barriers to the widespread adoption of vehicle black box systems is the high upfront cost associated with purchasing and installing these systems. While the long-term benefits, such as insurance savings and enhanced vehicle security, can offset the initial expense, many consumers and fleet owners may hesitate due to the price. The cost factor becomes particularly significant for businesses with large fleets, as they must invest in multiple units, installation, and ongoing maintenance. This can hinder the market’s growth, especially in cost-sensitive regions.

Data Privacy and Security Concerns

As vehicle black box systems collect and transmit sensitive data, privacy and security concerns become critical challenges. The data recorded by these devices often includes driver behavior, GPS coordinates, and event-related information, which can be vulnerable to hacking or misuse. Many consumers are wary about the potential for their data to be accessed without their consent. Similarly, businesses and government agencies face the challenge of ensuring that these systems comply with privacy laws and regulations. Addressing data security concerns is crucial for widespread adoption and consumer trust.

Opportunities

Growing Demand for Smart Vehicle Technologies

As smart technologies continue to gain traction in the automotive sector, there is a growing demand for vehicle black box systems equipped with advanced features such as real-time data analysis, AI-powered monitoring, and cloud integration. These technologies enhance the functionality of black box systems by providing more detailed insights into vehicle performance, safety, and driver behavior. The increasing popularity of connected and autonomous vehicles opens up new opportunities for black box system manufacturers to innovate and cater to the evolving needs of tech-savvy consumers and businesses.

Expansion of the Commercial Fleet Sector

The expansion of the commercial fleet sector presents a significant opportunity for the vehicle black box systems market. Companies operating large fleets of vehicles, such as delivery services, logistics providers, and ride-sharing platforms, increasingly seek solutions to improve operational efficiency, monitor driver behavior, and ensure the safety of both their vehicles and drivers. Black box systems help fleet operators reduce operational costs, enhance route planning, and improve overall safety. As the commercial fleet sector continues to grow, the demand for vehicle black box systems is expected to rise, offering substantial growth potential for market players.

Future Outlook

The Philippines Vehicle Black Box Systems Market is expected to continue its growth trajectory, driven by ongoing advancements in technology, including AI and cloud-based solutions. The increasing penetration of telematics and fleet management solutions, combined with regulatory mandates, will further fuel the adoption of black box systems across various sectors. As consumer awareness of safety and fraud prevention increases, the demand for these systems is expected to grow across both personal and commercial vehicle segments.

Major Players

- BlackVue

- Garmin

- Thinkware

- Nexar

- Viofo

- Mobius

- Papago

- Xiaomi

- Yi Technology

- DJI

- Street Guardian

- DOD

- Rexing

- Kenwood

- Aukey

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (e.g., Philippine Land Transportation Office)

- Automotive Manufacturers

- Fleet Management Companies

- Insurance Companies

- Commercial Vehicle Operators

- Ride-sharing Platforms (e.g., Grab)

- Telecommunication and Telematics Providers

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying all the key market drivers, trends, challenges, and regional dynamics influencing the Vehicle Black Box Systems Market in the Philippines. This step utilizes a combination of secondary research, including industry reports and government publications, to gather an in-depth understanding of the market landscape.

Step 2: Market Analysis and Construction

Historical data is analyzed to examine how market trends have evolved, focusing on demand for various types of black box systems. This includes a detailed review of the automotive, insurance, and fleet management sectors, as well as technological advancements.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses regarding consumer preferences, industry developments, and technological innovation are validated through interviews with key stakeholders such as manufacturers, fleet managers, and insurance companies. These consultations provide valuable operational insights.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing the gathered data into a coherent report, with the market insights, forecasts, and strategic recommendations based on the findings from both primary and secondary research.

- Executive Summary

- Research Methodology (Market Definitions and Inclusions/Exclusions, Abbreviations, Topic-Specific Taxonomy, Market Sizing Framework, Revenue Attribution Logic Across Use Cases or Care Settings, Primary Interview Program Design, Data Triangulation and Validation, Limitations and Data Gaps)

- Definition and Scope

- Market Genesis and Evolution

- Usage / Value-Chain / Care-Continuum Mapping

- Business Cycle and Demand Seasonality

- Philippines Industry / Service / Delivery Architecture

- Growth Drivers

Increasing Vehicle Sales

Rising Focus on Road Safety and Security

Government Regulations and Mandates - Market Challenges

High Initial Investment Costs

Data Privacy and Security Concerns - Opportunities

Growing Demand for Smart Vehicle Technologies

Expansion of the Commercial Fleet Sector - Trends

Advancements in AI and Machine Learning

Integration of Autonomous Vehicle Technologies - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- By Volume, 2019–2024

- By Average Price, 2019–2024

- By Product Type, (In Value %)

Dash Cameras

Fleet Management Systems

Advanced Driver Assistance Systems (ADAS)

Event Data Recorders (EDRs)

Integrated Systems - By Application, (In Value %)

Automotive Insurance

Public Transport and Fleet Management

Consumer Vehicles

Government and Law Enforcement

Commercial Vehicles - By Distribution Channel, (In Value %)

OEM (Original Equipment Manufacturers)

Aftermarket

Direct Sales

Online Retail

Dealerships - By Region, (In Value %)

Luzon

Visayas

Mindanao - By Technology, (In Value %)

GPS and Navigation Systems

Audio and Video Recording

Real-Time Data Analysis

Telematics Integration

Cloud-Based Systems

- Competition ecosystem overview

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Organizational Structure, Revenues, Number of Dealers and Distributors, Margins, Production Plants, Capacity, Unique Value Offering, and Others)

- SWOT analysis of major players

- Pricing and commercial model benchmarking

- Detailed Profiles of Major Companies

BlackVue

Garmin

Thinkware

Nexar

Viofo

Mobius

Papago

Xiaomi

Yi Technology

DJI

Street Guardian

DOD

Rexing

Kenwood

- Buyer personas and decision-making units

- Procurement and contracting workflows

- KPIs used for evaluation

- Pain points and adoption barriers

- By Value, 2025–2030

- By Volume, 2025–2030

- By Average Price, 2025–2030