Market Overview

The Philippines vehicle connectivity solutions market is valued at approximately USD ~, primarily driven by the increasing demand for connected car features in the region. The market’s growth is attributed to rising adoption of telematics services, enhanced vehicle safety features, and government initiatives promoting smart transportation infrastructure. With the Philippines’ strong smartphone penetration and robust growth in the automotive sector, connectivity solutions such as real-time navigation, infotainment, and remote diagnostics are becoming integral parts of the consumer experience. Additionally, the government’s focus on developing smart cities and improving traffic management systems is propelling the demand for vehicle connectivity solutions.

Metro Manila, Cebu, and Davao are the primary regions driving the vehicle connectivity solutions market in the Philippines. Metro Manila leads due to its large urban population, high vehicle density, and developed telecom infrastructure, which supports widespread adoption of connected car services. Cebu and Davao follow, with their growing automotive markets and increasing adoption of smart city initiatives, which emphasize vehicle connectivity for enhanced urban mobility. The dominance of these regions is primarily due to their superior infrastructure, urbanization rates, and government-backed smart city development projects.

Market Segmentation

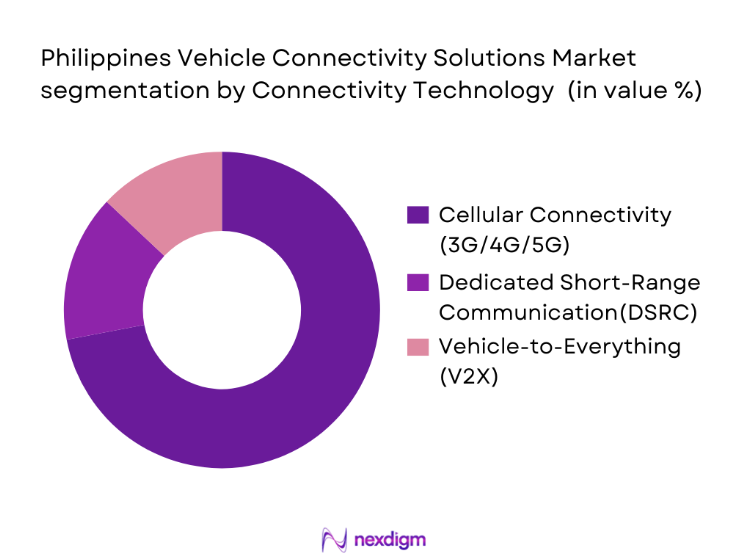

By Connectivity Technology

The Philippines vehicle connectivity market is segmented by technology into cellular connectivity (3G/4G/5G), Dedicated Short-Range Communications (DSRC), and Vehicle-to-Everything (V2X) systems. Among these, cellular connectivity dominates the market. This dominance is due to the widespread availability of 4G/5G networks in urban centers, along with the extensive coverage provided by telecom giants such as PLDT and Globe Telecom. Cellular technology enables seamless real-time data communication, making it ideal for connected vehicle applications such as telematics, navigation, and infotainment. Moreover, the growing 5G infrastructure is expected to further boost cellular connectivity in the automotive sector, supporting advanced features like autonomous driving and vehicle-to-cloud communications.

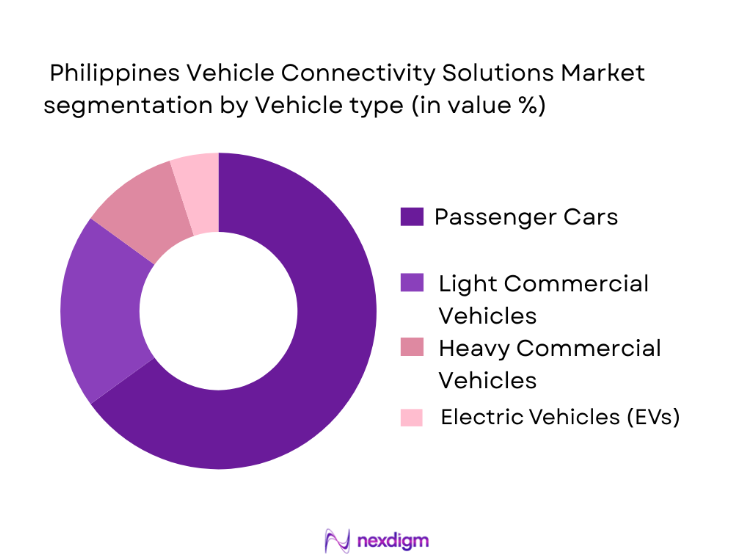

By Vehicle Type

The market is segmented into passenger cars, light commercial vehicles (LCVs), heavy commercial vehicles (HCVs), and electric vehicles (EVs). Among these, passenger cars dominate the market due to their large consumer base and the growing trend of in-car connectivity. As consumers demand more personalized and integrated driving experiences, features such as infotainment systems, advanced navigation, and vehicle diagnostics have become standard in modern passenger vehicles. The increasing availability of affordable connected car solutions and the rising adoption of electric vehicles further contribute to the dominance of this segment.

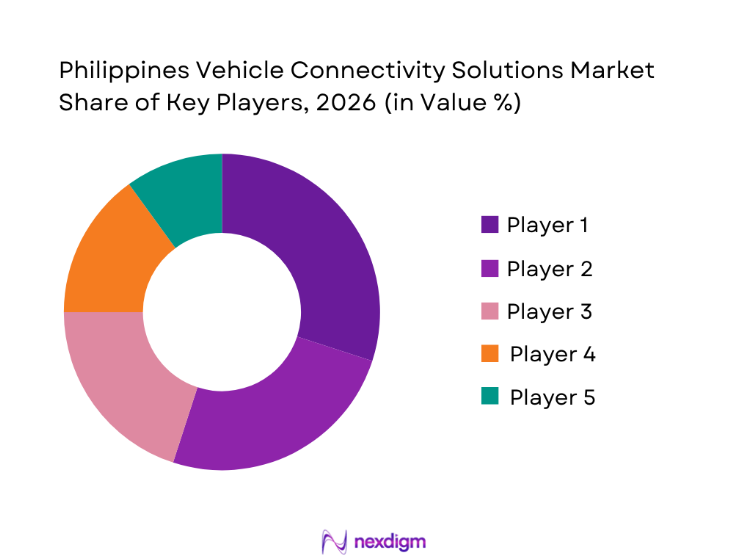

Competitive Landscape

The Philippines vehicle connectivity market is dominated by a few major players, including global telecom companies and automotive giants. Local players such as Globe Telecom and PLDT dominate the telecom aspect, offering data services and connectivity solutions for vehicles. Additionally, global automotive brands like Toyota, Mitsubishi, and Ford play a significant role in the market, integrating advanced connected technologies into their vehicles. This consolidation highlights the significant influence of these key companies in shaping the market dynamics.

| Company | Establishment Year | Headquarters | Market Segment | Technology Focus | Key Offering | Partnerships |

| Toyota Motor | 1937 | Philippines | ~ | ~ | ~ | ~ |

| Mitsubishi Motors | 1970 | Japan | ~ | ~ | ~ | ~ |

| PLDT | 1928 | Philippines | ~ | ~ | ~ | ~ |

| Globe Telecom | 1935 | Philippines | ~ | ~ | ~ | ~ |

| Ford Motors | 1903 | United States | ~ | ~ | ~ | ~ |

Philipppines Vehicle Connectivity Solutions Market Analysis

Growth Drivers

Growing Demand for Real‑Time Telematics & Fleet Efficiency

The demand for real-time telematics is driven by the increasing need for efficiency in fleet management and operational cost reduction. In the Philippines, the transportation sector is seeing a surge in telematics integration due to improvements in the logistics industry. In 2024, the Philippines’ logistics market was valued at USD ~, contributing significantly to the adoption of fleet management technologies. According to the World Bank, infrastructure improvements in the Philippines are enhancing the potential for real-time telematics, further supporting fleet efficiency. Increased fuel prices and rising vehicle maintenance costs make telematics a key tool for businesses to optimize their fleet management operations.

Smart City & Transportation Infrastructure Push

Smart city initiatives in the Philippines are boosting the adoption of connected vehicle technologies, with significant investments made in transportation infrastructure. The Philippine government’s “Build, Build, Build” program, which allocated PHP ~ for infrastructure development in 2024, has played a vital role in urban mobility. This investment is helping create the necessary conditions for vehicle connectivity, with integrated traffic management systems and smart roads. According to the Department of Transportation (DOTr), the roll-out of smart city solutions in Metro Manila and key provinces is driving the implementation of vehicle connectivity systems to improve traffic flow and safety. These developments reflect a positive trajectory for the market’s expansion.

Market Challenges

Limited Rural Connectivity Infrastructure

One of the key challenges for vehicle connectivity adoption in the Philippines is the limited rural connectivity infrastructure. Although urban areas like Metro Manila are well-served by telecom networks, rural regions still struggle with 3G and 4G connectivity. According to the National Economic and Development Authority (NEDA), as of 2024, approximately ~% of rural areas remain underserved by reliable mobile networks. This gap in connectivity affects the ability to implement connected vehicle technologies in rural areas, limiting the potential market for telematics and connected car solutions in these regions. The government’s initiatives to expand telecom infrastructure in rural areas are expected to mitigate this challenge in the long run.

Cost Barriers of OEM Built‑in Connectivity

The cost of integrating built-in connectivity into vehicles remains a significant challenge in the Philippines, particularly for local manufacturers and consumers. OEMs often bundle connectivity features into higher-end vehicle models, making them inaccessible to a large segment of the population. According to the Philippine Statistics Authority (PSA), the average vehicle price in the country increased by ~ in 2025, largely driven by rising production costs and the inclusion of advanced technologies. This trend further exacerbates the affordability issue for average consumers, particularly in a country with a GDP per capita of approximately USD ~ in 2025. These economic conditions hinder the widespread adoption of built-in connectivity solutions.

Market Opportunities

Data Monetization & Subscription Services

The opportunity for data monetization and subscription-based services is growing rapidly in the Philippines’ vehicle connectivity market. With the increasing amount of data generated by connected vehicles, including driver behavior, vehicle health, and location data, there is a significant opportunity to offer subscription-based services. According to the Philippine Statistics Authority, internet penetration in the country reached 75% in 2023, indicating a growing market for data-driven services. Car manufacturers and telecom providers are now looking at ways to monetize this data by offering premium services, such as real-time navigation updates, remote diagnostics, and insurance telematics. As more consumers adopt connected vehicles, the potential for data monetization is expected to expand, creating a lucrative market segment for service providers.

Vehicle‑to‑Everything (V2X) Ecosystem Enablement

The V2X (Vehicle-to-Everything) ecosystem is a key opportunity for the Philippines’ vehicle connectivity market. With increasing investments in smart city infrastructure and advancements in 5G technologies, the foundation for V2X applications is being laid. V2X enables vehicles to communicate with each other, as well as with infrastructure such as traffic lights and road signs, for enhanced safety and efficiency. In 2023, the Philippine Department of Transportation launched its “Intelligent Transport Systems” program to improve traffic management through smart technologies, including V2X. This development, coupled with the deployment of 5G networks, is expected to accelerate the adoption of V2X solutions, creating new revenue streams for telecom operators and automakers.

Future Outlook

Over the next five years, the Philippines vehicle connectivity market is expected to experience significant growth. This will be driven by continuous advancements in telecom infrastructure, particularly with the deployment of 5G networks, and the increasing consumer demand for enhanced in-car experiences. Government initiatives focusing on smart city development and traffic management will further stimulate the need for connected vehicle solutions. The rising adoption of electric vehicles (EVs) and connected fleet solutions will also play a key role in shaping the future of the market. As the market matures, companies are expected to invest in more advanced telematics services, AI-driven vehicle diagnostics, and autonomous driving features.

Major Players

- Toyota Motor Philippines

- Mitsubishi Motors Philippines

- Ford Motor Company

- Globe Telecom

- PLDT

- Honda Cars Philippines

- Nissan Philippines

- Hyundai Asia Resources

- Bosch Philippines

- Geotab

- Garmin

- Teletrac Navman

- HERE Technologies

- Verizon Connect

- Gurtam

Key Target Audience

- Automotive OEMs (Original Equipment Manufacturers)

- Telecom Operators

- Fleet Management Companies

- Electric Vehicle Manufacturers (e.g., Nissan, Toyota)

- Connected Car Service Providers

- Insurance Companies (Usage-Based Insurance Providers)

- Government Agencies (Department of Transportation, Local Government Units)

- Investment and Venture Capitalist Firms

Research Methodology

Step 1: Identification of Key Variables

In the first phase, an ecosystem map is constructed, identifying all major stakeholders within the Philippines vehicle connectivity market. This phase is supported by secondary research and proprietary databases to gather industry-level information, and critical market variables are defined.

Step 2: Market Analysis and Construction

Historical data is compiled to assess market penetration, market size, and service quality statistics. This phase involves evaluating key trends, revenue generation, and key performance indicators to ensure market data accuracy and reliability.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses are developed and validated through consultations with industry experts, including interviews with telematics providers, OEMs, and telecom operators. These consultations provide valuable operational and financial insights that help corroborate the findings.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with key stakeholders, including vehicle manufacturers and service providers, to acquire detailed insights into product segments, consumer preferences, and technology adoption. This ensures that the final report provides a comprehensive and accurate analysis of the Philippines vehicle connectivity market.

- Executive Summary

- Research Methodology (Definitions & Market Scope, Primary & Secondary Research Framework, Data Sources: OEM Sales, Connectivity Penetration, Fleet Deployments, Market Sizing & Forecasting Techniques, Assumptions & Limitations)

- Definition and Market Boundaries

- Connectivity Ecosystem Landscape

- Vehicle Connectivity Technology Evolution

- Connectivity Architecture & Communication Stack

- Regulatory & Policy Environment

- Growth Drivers

Growing Demand for Real‑Time Telematics & Fleet Efficiency

Smart City & Transportation Infrastructure Push

5G Rollout & High‑Speed Connectivity Adoption

Rising EV & Automated System Adoption - Market Challenges

Limited Rural Connectivity Infrastructure

Cost Barriers of OEM Built‑in Connectivity

Cybersecurity & Data Privacy Risks - Market Opportunities

Data Monetization & Subscription Services

Vehicle‑to‑Everything (V2X) Ecosystem Enablement

Telematics‑Driven Insurance (UBI) Partnerships

Platform Ecosystems (App Marketplace, APIs) - Key Market Trends

Edge Analytics & AI in Connectivity

Integrated Telematics & Infotainment Consoles

Smart Fleet & Predictive Maintenance Platforms

- Total Market Value & Installed Base (Connected Units), 2019-2025

- Connectivity Solution Revenues, 2019-2025

- OEM Embedded vs Aftermarket Connectivity Deployment, 2019-2025

- Penetration by Vehicle Type (Passenger, Commercial, EV/HEV), 2019-2025

- Connectivity Service ARPU & Subscription Trends, 2019-2025

- By Connectivity Technology (In value %)

Cellular

Dedicated Short‑Range Communications (DSRC) / ITS‑G5

V2X (V2V, V2I, V2P, V2N)

Satellite‑Assisted Connectivity - By Solution Type (In value %)

Telematics Solutions

Infotainment & Multimedia Platforms

Safety & ADAS Connectivity

Over‑the‑Air (OTA) Software & Firmware Connectivity

In‑Car Payment & Digital Wallet Integration - By End‑User Segment (In value %)

Individual Vehicle Owners

Corporate Fleets

Government & Public Sector

Ride‑Hailing & MaaS Providers

Insurance & Usage‑Based Insurance Providers - By Connectivity Deployment Model (In value %)

OEM Native Connectivity

Aftermarket Telematics Modules

Platform & API‑Driven Connectivity

Hybrid Smart Fleet Connectivity - By Vehicle Type (In value %)

Passenger Cars

Light Commercial Vehicles

Heavy Commercial Vehicles

Electric & Hybrid Vehicles

Two‑Wheelers & Specialty Mobility

- Philippines Vehicle Connectivity Solutions Market Share by Connectivity Provider & OEM

- Cross‑Comparison Parameters (Include Connectivity Coverage, Data Throughput, Standard Compliance, API Ecosystem, Telematics Feature Set, Penetration Velocity, Platform Scalability, Network Partners, Cybersecurity Certifications, Service Monetization Models, OTA Capabilities, Localization Support, Tier‑1 Integration Depth)

- Pricing analysis of major players

- SWOT Analysis of Leading Competitors

- Detailed Company Profiles

Toyota Motor Philippines (OEM Connectivity)

Mitsubishi Motors Philippines

Honda Cars Philippines

Ford Philippines

Nissan Philippines

Hyundai Asia Resources

Globe Telecom – GlobeDrive Connectivity

PLDT – Smart Tracker Connectivity

Bosch (Telematics & Connected Services)

Garmin

Gurtam (Wialon Platform Provider)

Geotab (Fleet Telematics)

Teletrac Navman (Mobility Analytics)

HERE Technologies (Mapping & Connectivity Data)

Verizon Connect (Telematics & Fleet Services)

- Passenger Vehicle Owners

- Use Case & Demand Patterns

- Drivers of Adoption

- Pain Points & Barriers

- Value Realized

- Future Market Size – Value & Units, 2026-2030

- Technology Adoption Curves , 2026-2030

- Penetration Forecast by Segment & Deployment Model, 2026-2030

- Revenue Streams Forecast , 2026-2030