Market Overview

The Philippines Vehicle Crash Test Systems market is valued at USD ~ million, driven primarily by the expansion of automotive production and increased regulatory pressure for vehicle safety compliance. This market is characterized by a growing number of vehicles on the road, which has led to a higher demand for crash testing services. The automotive industry in the Philippines has grown significantly, with key manufacturers increasingly focusing on ensuring that their vehicles meet ASEAN NCAP and other international safety standards. The market’s growth is further supported by rising consumer awareness about vehicle safety and the increasing demand for more advanced crash test methodologies, including virtual testing.

Metro Manila, Cebu, and Davao are the primary hubs for the Philippines’ vehicle crash test systems market. Metro Manila leads due to its role as the economic and industrial heart of the country, hosting the majority of OEM manufacturers and regulatory bodies. Cebu, known for its strategic location and industrial activities, also sees considerable activity in crash testing services. Davao, with its growing automotive and industrial sectors, has seen a rise in demand for crash testing services as automotive production grows, further contributing to the market’s expansion. These regions benefit from robust infrastructure, government support, and proximity to major automotive manufacturing plants.

Market Segmentation

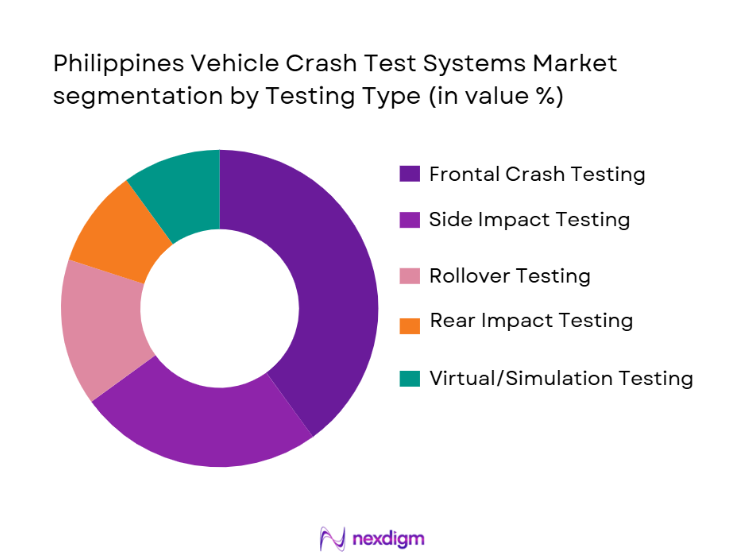

By Testing Type

The Philippines Vehicle Crash Test Systems market is segmented by testing type into Frontal Crash Testing, Side Impact Testing, Rollover Testing, Rear Impact Testing, and Virtual/Simulation Testing. Among these, Frontal Crash Testing dominates the market. This segment is largely driven by stringent global safety regulations, including ASEAN NCAP standards, which emphasize frontal crashworthiness. Given that frontal impacts are the most common in real-world accidents, OEMs are prioritizing this test type to ensure their vehicles achieve high safety ratings, thereby enhancing their market competitiveness. The widespread adoption of frontal crash testing is further boosted by advanced testing equipment, including high-speed cameras, sensors, and crash test dummies that allow for more accurate impact assessments.

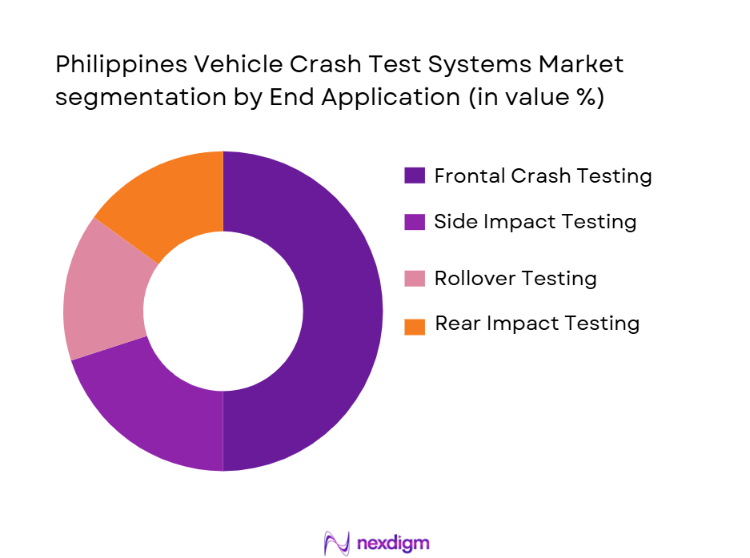

By End Application

The market is also segmented by end application, which includes Passenger Vehicles, Commercial Vehicles, Electric & Hybrid Vehicles, and Autonomous Vehicles. Among these, Passenger Vehicles hold the largest share. This dominance is driven by the high demand for vehicles in the Philippines, especially in urban areas like Metro Manila, where consumers are becoming increasingly safety-conscious. With growing awareness of vehicle safety standards and the rise in disposable incomes, consumers are prioritizing cars with high NCAP ratings, which require rigorous crash testing. Moreover, the increasing number of passenger vehicles on the road is further propelling the demand for crash testing services in this segment.

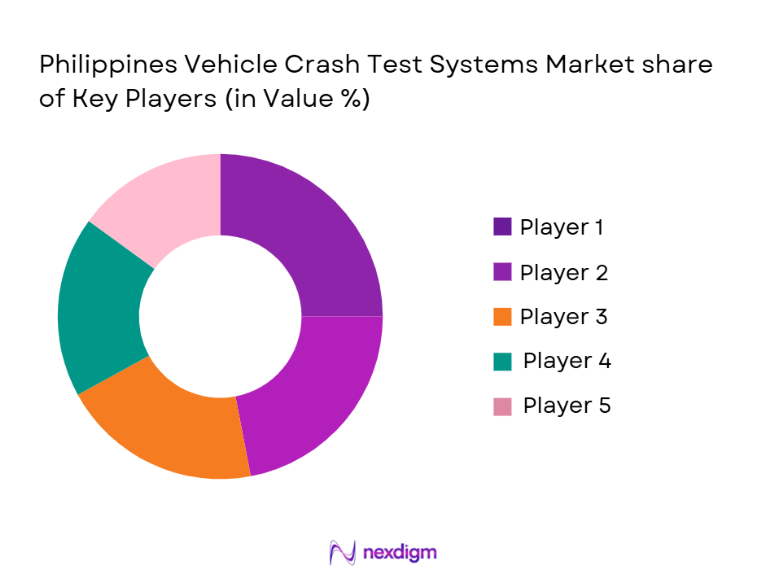

Competitive Landscape

The Philippines Vehicle Crash Test Systems market is dominated by a few major players, both local and international. These companies are key players due to their advanced testing capabilities, adherence to global safety standards, and the broad range of services offered. Applus+ IDIADA, TÜV SÜD, and DEKRA SE are some of the leading names in the market. The market is also witnessing a rise in local players offering both physical and virtual crash testing services, providing competitive pricing and customized solutions for regional manufacturers. These companies dominate through partnerships with major vehicle manufacturers, government contracts, and a focus on expanding their testing infrastructure.

| Company Name | Establishment Year | Headquarters | Testing Capabilities | Key Clients | Service Portfolio | Market Focus |

| Applus+ IDIADA | 1999 | Spain | ~ | ~ | ~ | ~ |

| TÜV SÜD | 1866 | Germany | ~ | ~ | ~ | ~ |

| DEKRA SE | 1925 | Germany | ~ | ~ | ~ | ~ |

| HORIBA MIRA Ltd. | 1946 | UK | ~ | ~ | ~ | ~ |

| Millbrook Proving Ground | 1988 | UK | ~ | ~ | ~ | ~ |

Philippines Vehicle Crash Test Systems Market Analysis

Growth Drivers

Increasing Regulatory Standards

Governments and regulatory bodies, such as ASEAN NCAP and global automotive safety standards, are mandating stricter crash test requirements, pushing automotive manufacturers to prioritize vehicle safety and invest in more comprehensive testing services.

Rising Demand for Electric and Autonomous Vehicles

As the adoption of electric vehicles (EVs) and autonomous driving technologies increases, there is a growing need for specialized crash tests to assess battery safety and autonomous system crashworthiness, further driving market demand.

Market Challenges

High Testing Costs

The capital-intensive nature of physical crash tests, including the infrastructure, equipment, and labor costs associated with these tests, poses a financial barrier for smaller players and manufacturers with limited budgets.

Limited Local Testing Infrastructure

In the Philippines, there is a lack of advanced testing facilities capable of handling the growing demand for crash tests, especially for newer vehicle types such as EVs and autonomous vehicles, leading to delays and higher testing costs.

Opportunities

Adoption of Virtual and Simulation Testing

Advancements in computer-aided engineering (CAE) and virtual crash testing solutions offer a cost-effective alternative to physical crash tests, presenting an opportunity for service providers to innovate and expand their offerings.

Expansion of EV and Hybrid Vehicle Testing

As the automotive industry shifts toward electric and hybrid vehicles, there is an opportunity for crash test providers to offer specialized testing services tailored to the unique safety requirements of these vehicles, particularly for battery safety.

Future Outlook

Over the next five years, the Philippines Vehicle Crash Test Systems market is expected to show significant growth driven by continuous advancements in vehicle safety technologies, the increasing production of electric and autonomous vehicles, and rising government regulations mandating vehicle safety compliance. The shift toward simulation and virtual testing technologies will also accelerate, providing cost-effective alternatives to traditional physical testing. With rising urbanization and automotive production in the Philippines, the demand for comprehensive crash testing services will continue to rise, ensuring the market’s sustained expansion.

Major Players

- Applus+ IDIADA

- TÜV SÜD

- DEKRA SE

- HORIBA MIRA Ltd.

- Millbrook Proving Ground

- Element Materials Technology

- Humanetics Innovative Solutions

- Calspan Corporation

- MGA Research Corporation

- Aumovio Safety Engineering GmbH

- Local Testing Laboratories in the Philippines

- Regional ASEAN NCAP Affiliated Testing Centers

- NHTSA

- SGS SA

- Global NCAP

Key Target Audience

- Automotive Manufacturers (OEMs)

- Tier-1 & Tier-2 Automotive Suppliers

- Investment and Venture Capitalist Firms

- Government & Regulatory Bodies

- Crash Test Facility Providers

- Electric Vehicle Manufacturers

- Autonomous Vehicle Developers

- Automotive Safety Technology Providers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves identifying critical variables that affect the Philippines Vehicle Crash Test Systems market. This process includes desk research and the analysis of historical industry data to understand the role of regulations, testing standards, and technological advancements.

Step 2: Market Analysis and Construction

This phase involves compiling historical data, examining market penetration rates, service provider growth, and safety testing adoption trends. We analyze these elements to build a clear picture of the market’s structure and performance.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses developed during earlier phases are validated through direct consultations with key industry players and experts, including OEMs, testing agencies, and regulatory bodies. This ensures the insights are relevant and reflective of real-time industry conditions.

Step 4: Research Synthesis and Final Output

The final phase includes the consolidation of primary and secondary data sources, including expert consultations, to validate the market sizing and segmentation. Comprehensive analyses of market trends, drivers, and challenges are incorporated into the final report, ensuring that all conclusions are evidence-based.

- Executive Summary

- Research Methodology (Market Definitions & Assumptions, Data Collection Framework, Market Sizing & Forecasting Approach, Data Normalization & Validation, Limitations & Future Outlook)

- Market Definition & Scope

- Industry Genesis & Evolution

- Diagnostic & Testing Value Chain

- Supply Chain Mapping

- Market Access & Reimbursement Landscape

- Growth Drivers

Increasing Demand for Vehicle Safety Standards

Rising Automotive Production and Crash Testing for Compliance

Growth of the Electric Vehicle (EV) Segment and Battery Safety

Government Mandates on Vehicle Safety Testing - Market Challenges

High Costs Associated with Physical Testing

Limited Local Testing Infrastructure

Regulatory Compliance Gaps in Local and Global Standards

Lack of Skilled Workforce in Advanced Testing - Market Opportunities

Virtual Testing Advancements: Simulation & CAE Solutions

Local Testing Infrastructure Development

Increased Focus on Autonomous & EV Safety Testing - Demand & Usage Trends

Growing Demand for Self-Driving Vehicle Safety Validation

Rise in EV and Hybrid Vehicle Crash Testing

Shift Towards Simulation & Digital Twins for Cost-Effective Testing - Regulatory & Compliance Framework

Philippines Regulatory Standards for Vehicle Crash Testing

Import & Quality Certification Requirements for Testing Equipment

Tariff & Duty Structures Impacting Testing Costs

International Standardization & Harmonization with Global Testing Procedures

- By Market Value 2019-2025

- By Volume of Units Tested 2019-2025

- Average Testing Price Analysis 2019-2025

- Price Sensitivity & Elasticity 2019-2025

- Market Share by Segment 2019-2025

- By Testing Type (In Value %)

Frontal Crash Testing

Side Impact Testing

Rollover Testing

Rear Impact Testing

Simulation & Virtual Testing - By End Application (In Value %)

Passenger Vehicles

Commercial Vehicles

Electric & Hybrid Vehicles

Autonomous Vehicles (ADAS) - By Service Type (In Value %)

Physical Crash Test Services

Virtual Testing & Simulation Services - By Customer Segment (In Value %)

OEM Manufacturers

Tier-1 and Tier-2 Suppliers

Government & Regulatory Bodies

Academic & Research Institutions - By Equipment & Instrumentation Type (In Value %)

Crash Test Dummies

High-Speed Cameras & Sensors

Data Acquisition Systems (DAQ)

Impact Sled Systems

Computer-Aided Engineering (CAE) Software

- Market Share Analysis

- Cross-Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths & Weaknesses, Revenue by Testing Service Type, Distribution Reach, Pricing Strategy & Price Bands, Meter Compatibility and Service Availability, After-Sales Support & Data Platform Integration)

- SWOT Overview

- Pricing Benchmarking

- Major Players

Applus+ IDIADA

DEKRA SE

TÜV SÜD

TÜV Rheinland

HORIBA MIRA Ltd.

Millbrook Proving Ground

Element Materials Technology

Humanetics Innovative Solutions

Calspan Corporation

MGA Research Corporation

Aumovio Safety Engineering GmbH

Local Testing Laboratories in the Philippines

Regional ASEAN NCAP Affiliated Testing Centers

- Adoption Patterns by Industry Segments

- Purchasing Decision Drivers

- Patient Pain Points

- Budget Allocation & Reimbursement Behavior

- Government & Regulatory Preferences

- Market Preferences in Automotive OEMs

- Market Size Projection 2026-2030

- Average Selling Price (ASP) Trend Forecast 2026-2030

- Technology & Multi-Parameter Innovation Adoption 2026-2030

- Future Regulatory & Reimbursement Impact Scenarios 2026-2030