Market Overview

The automotive cybersecurity market is valued at USD ~ billion in the prior year and USD ~ billion in the latest year, based on widely cited global automotive cybersecurity benchmarks. This expansion is driven by the rapid increase in connected-vehicle functions (telematics, infotainment-cloud pairing, remote diagnostics, OTA enablement) and by regulation-driven cybersecurity-by-design programs across OEMs and Tier-1s. Hardware demand rises when OEMs harden ECUs using secure elements/HSM-capable MCUs and secure gateways.

Within the Philippines, adoption intensity is anchored in Metro Manila and adjacent industrial corridors because these areas concentrate OEM/dealer service networks, commercial fleets, and telematics integrators—making secure retrofit gateways, hardened TCUs, and hardware-backed identity more deployable at scale. On the supply side, Japan, South Korea, and China shape the country’s cybersecurity hardware content because they dominate the Philippines’ imported vehicle base and OEM platform standards, and their Tier-1 supply chains decide whether secure gateways/HSM-ready compute ships by default.

Market Segmentation

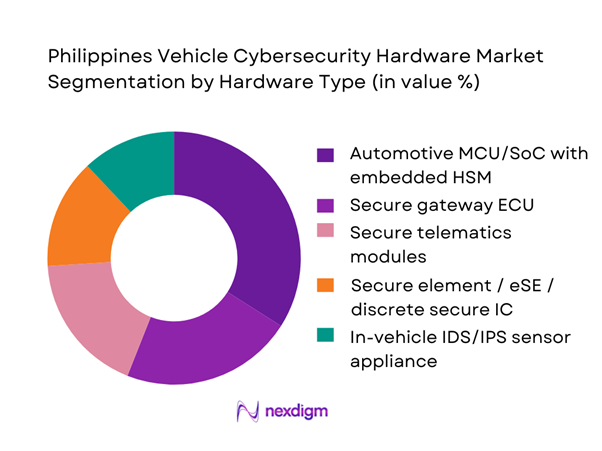

By Hardware Type

The Philippines Vehicle Cybersecurity Hardware Market is segmented by hardware type into secure elements/eSE, automotive MCUs/SoCs with embedded HSM, secure gateway ECUs (CAN/CAN-FD ↔ Ethernet), in-vehicle IDS/IPS sensor appliances, and secure telematics modules (TCU security add-ons). Recently, automotive MCUs/SoCs with embedded HSM dominate because OEM and Tier-1 design choices increasingly embed cryptography, secure boot, and key storage into the primary compute silicon rather than adding multiple discrete security chips. This reduces BOM complexity, improves latency for secure communications, and supports compliance-aligned development flows (security-by-design). In the Philippines, the dominance is reinforced by importer-led vehicle platform carryover: models already designed for multi-market compliance ship with HSM-capable controllers, while fleets and integrators typically retrofit at the edge (TCU/gateway) only when mandated by risk exposure.

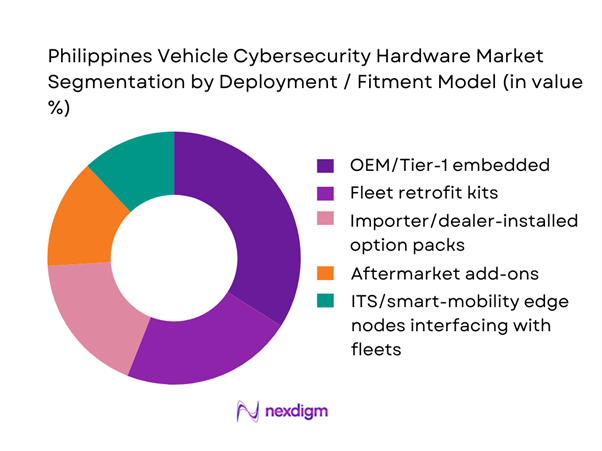

By Deployment / Fitment Model

The Philippines Vehicle Cybersecurity Hardware Market is segmented by deployment model into OEM/Tier-1 embedded (factory fit), importer/dealer-installed option packs, fleet retrofit kits, and aftermarket add-ons, plus ITS/smart-mobility edge nodes interfacing with fleets. Recently, OEM/Tier-1 embedded dominates because cybersecurity hardware is most cost-effective and defensible when it is designed into ECUs and gateways at platform level—where secure boot chains, key injection, and hardware-backed identity are integrated into manufacturing and homologation processes. In the Philippines, importer economics also favor factory-fit security: dealers prefer solutions that do not create post-sale calibration liability, and fleet operators prefer warranty-safe configurations for high-uptime assets. Retrofits still grow, but are concentrated in fleets with higher cyber exposure (telematics-heavy operations, cashless in-vehicle workflows, or safety-critical routing) and where integrators can provide provisioning and RMA support.

Competitive Landscape

The Philippines Vehicle Cybersecurity Hardware Market is characterized by platform-led consolidation: silicon vendors (secure MCU/SoC and secure element providers) influence the core hardware root-of-trust, while Tier-1s (gateways/domain controllers/TCUs) determine how security is integrated into vehicle architectures delivered into the country via import channels. Competition is therefore decided by reference designs, automotive qualification depth, provisioning toolchains, and local channel capability (inventory + RMA + engineering support).

| Company | Est. Year | Headquarters | Primary PH Route-to-Market | Core Cybersecurity Hardware Focus | Vehicle Network Coverage | Hardware Root-of-Trust Approach | Provisioning Model | Automotive Qualification Depth | After-sales Enablement |

| NXP Semiconductors | 2006 | Netherlands | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Infineon Technologies | 1999 | Germany | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| STMicroelectronics | 1987 | Switzerland | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Bosch (incl. ETAS ecosystem) | 1886 | Germany | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Continental | 1871 | Germany | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

Philippines Vehicle Cybersecurity Hardware Market Analysis

Growth Drivers

Connected vehicle penetration

The baseline driver for in-vehicle cybersecurity hardware is the Philippines’ rapidly expanding “connected surface area” across drivers, passengers, and vehicles—because every additional connected endpoint increases exposure for IVI/telematics/ECU networks and pushes OEMs, importers, and fleets toward hardened gateways, secure elements, and authenticated in-vehicle communications. The Philippines’ population is ~ and GDP is USD ~ billion, which supports continued scaling of the digital economy and connected mobility services across Metro Manila and other high-traffic corridors. Internet adoption is also structurally high: ~ (internet users, percent of population) is the latest reading, which translates to a very large online base when applied to a population above ~—meaning more app-based navigation, ride-hailing, e-commerce logistics, and remote fleet operations that depend on connected vehicles. On the automotive side, new-vehicle throughput is large and still expanding: total new motor vehicle sales of ~ units followed by ~ units, widening the installed base of newer, more electronically complex vehicles that are more likely to feature networked infotainment, telematics, advanced gateways, and software-defined functions that require hardware-rooted trust.

Telematics device deployment across fleets

Fleet digitalization increases demand for cybersecurity hardware because commercial operations rely on always-on telematics and back-office integration—turning the vehicle gateway/TCU into a high-value attack path that must be protected with secure boot, hardware security modules/secure elements, tamper resistance, and credential lifecycle controls. The Philippines’ macro backdrop supports this digitization: GDP per capita is USD ~ and consumer price inflation is ~ (annual, percent), which together signal a large consumption economy where logistics and mobility services compete heavily on utilization, routing efficiency, and uptime—conditions that encourage fleets to instrument vehicles with connected trackers and telemetry. On the demand side, commercial vehicle movement is consistently the larger slice of monthly sales: in a peak month, total sales reached ~ units with ~ units commercial vehicles versus ~ units passenger vehicles—an operating reality that naturally expands the addressable base for fleet-grade telematics and, by extension, vehicle cybersecurity hardware protecting TCUs/gateways and in-vehicle networks. Even early-year momentum is strong: total sales in the first two months reached ~ units, reinforcing that fleets and SME operators are continuously adding vehicles that increasingly plug into dispatch, tracking, and digital payment workflows. As telematics becomes embedded into route compliance, driver behavior programs, and preventive maintenance, hardware security becomes mandatory—not optional—because a compromised TCU or gateway can create operational disruption (vehicle immobilization, falsified telemetry, or ransomware-style lockouts), regulatory exposure, and safety risk.

Challenges

Cost sensitivity and ASP constraints

A key constraint for cybersecurity hardware adoption is affordability pressure across fleet buyers and consumers, because hardware-rooted security adds BOM and integration workload that must be justified against operating margins, financing costs, and total cost-of-ownership targets. The Philippines’ GDP per capita is USD ~, which anchors the reality that many vehicle purchases are cost-managed and that aftermarket “security add-ons” compete with essential spend (maintenance, tires, fuel, insurance). Inflation is ~ (annual, percent) in the latest snapshot, which, even when moderate, can tighten procurement thresholds and slow the willingness to pay for invisible security features. At the same time, the market is adding vehicles at high volumes—~ units of new vehicle sales in the latest full year—so even small per-vehicle security cost increments translate into large absolute procurement decisions for OEM import programs and large fleets. This creates a “value proof” challenge: cybersecurity hardware must be positioned not as an optional accessory but as a risk-control mechanism that prevents downtime, liability, and data compromise. Without credible incident-driven ROI framing, cost sensitivity can push buyers toward minimum compliance, partial protection (software-only), or postponing gateway/TCU hardening until after a security event.

Limited local automotive-grade supply chain

The Philippines’ vehicle market is large in sales throughput, but local availability of automotive-grade cybersecurity hardware (secure elements, HSM-enabled gateways, certified cryptographic components) can be constrained by reliance on imported platforms, qualification requirements, and limited local depth in AEC-Q/automotive-grade electronics ecosystems. This becomes challenging when the installed base expands quickly—~ units then ~ units of new sales in successive periods—because local service networks and parts channels must scale secure replacements (genuine gateway modules, authenticated diagnostic interfaces, secure key injection services) without relying on informal grey supply. On the macro side, foreign direct investment net inflows are ~ (percent of GDP, latest snapshot), which matters because scaling a local, quality-controlled automotive electronics supply chain typically requires sustained investment into testing, compliance, and secure manufacturing/provisioning processes. As the market absorbs more connected vehicles, supply constraints surface in long lead times for genuine parts, limited local availability of security-certified modules, and fragmentation between OEM channels and aftermarket sourcing—each of which slows cybersecurity hardware penetration beyond factory-fit solutions.

Opportunities

Secure gateway retrofits for fleets

Fleet retrofits represent a near-term growth lever because the Philippines has a large and expanding base of commercially used vehicles and digitally managed operations, creating immediate demand for retrofit-grade secure gateways, hardware security modules/secure elements, and hardened telematics interfaces. Commercial vehicle sales are consistently heavy—one high-volume month shows ~ commercial units versus ~ passenger units—indicating a steady stream of vehicles entering duty cycles where telematics and remote operations are economically valuable. Early-year sales also show scale: ~ units in the first two months in one reported period, reinforcing that fleet and SME operators are continuously adding vehicles. These operating conditions reward security hardware that reduces operational risk: secure gateways that segment in-vehicle networks, authenticate diagnostic sessions, and protect cryptographic keys can prevent telemetry manipulation, unauthorized immobilization, and data leakage that disrupts dispatch and compliance. The macro base supports rapid diffusion of retrofit programs: GDP is USD ~ billion, and mobile cellular subscriptions are ~, providing the connectivity conditions that make secured telematics and secured OTA-like maintenance workflows practical for fleets.

OEM security content expansion

An important opportunity is deeper OEM “security content” shipped by default into vehicles delivered to the Philippines—more secure elements, HSM-enabled gateways, and hardware-assisted intrusion detection—because global regulatory and engineering baselines are converging and OEMs increasingly standardize platforms across regions. Cybersecurity regulation frameworks set expectations around cybersecurity management and technical controls that cascade into vehicle architectures worldwide, including markets supplied primarily through global platforms and imports. Locally, the vehicle market’s sustained scale—~ units followed by ~ units annual new sales—means OEM content decisions translate into large hardware volumes even without local market-share dominance numbers. The national risk environment supports stronger OEM defaults: ~ incidents handled in a seven-month period signals persistent threats across the same digital infrastructure vehicles rely on (telecom, cloud, identity). With a population of ~ and high internet use (latest value ~ as percent of population), OEMs have commercial incentives to protect connected services (apps, remote features, infotainment accounts) using hardware-rooted trust that reduces fraud and account takeover risks that damage brand trust and aftersales revenue.

Future Outlook

Over the next five to six years, the Philippines Vehicle Cybersecurity Hardware Market is expected to accelerate as vehicles transition to software-defined architectures, higher telematics penetration, and broader OTA readiness. Fleet operators will push for hardware-backed identity, anti-tamper controls, and secure remote access to reduce downtime and cyber incidents. Meanwhile, global compliance pull from UN R155 / ISO-aligned cybersecurity engineering will increasingly influence the baseline security content of imported models, raising demand for secure gateways, HSM-enabled compute, and secure provisioning toolchains.

Major Players

- NXP Semiconductors

- Infineon Technologies

- STMicroelectronics

- Renesas Electronics

- Texas Instruments

- Microchip Technology

- Qualcomm Technologies

- NVIDIA

- Bosch

- Continental

- Aptiv

- DENSO

- HARMAN

- Thales

Key Target Audience

- Automotive OEM regional offices and importer/distributor groups

- Commercial fleet operators and fleet management heads

- Telematics and IVMS solution integrators

- Automotive electronics distributors / authorized semiconductor distributors

- Insurance providers and underwriting teams for connected fleets

- Payments/fintech + mobility platform operators

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

We construct an ecosystem map covering OEM/importer channels, Tier-1 electronics pathways, semiconductor distribution, fleets, and integrators in the Philippines. Desk research is used to define hardware categories (secure elements, HSM-enabled compute, secure gateways, IDS appliances) and the variables that drive adoption.

Step 2: Market Analysis and Construction

We compile historical adoption signals across connected features, telematics penetration in fleets, and ECU architecture trends. This phase links “security hardware content” to vehicle categories and deployment models (factory-fit vs retrofit) to structure demand pools.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through CATI-style interviews with distributors, fleet integrators, and automotive electronics stakeholders. These discussions validate procurement behavior, provisioning constraints, certification requirements, and service/RMA realities.

Step 4: Research Synthesis and Final Output

Findings are synthesized using triangulation across channel checks, OEM platform intelligence, and integrator deployment patterns. The output is stress-tested for internal consistency across fitment models, hardware function mapping, and buyer decision flows.

- Executive Summary

- Research Methodology (market definitions and scope boundaries, hardware-only inclusion and exclusion logic, Philippines vehicle parc linkage approach, OEM–importer–aftermarket triangulation, bill of materials mapping and secure-component attribution, distributor and channel validation, expert interview framework, regulatory and standards assessment, assumptions and limitations)

- Definition and Scope

- Market Genesis

- Ecosystem Timeline

- Vehicle Technology Stack Evolution

- Supply Chain and Value Chain Mapping

- Growth Drivers

Connected vehicle penetration

Telematics device deployment across fleets

OTA enablement requirements

Increasing ECU and gateway complexity

Rising cybersecurity incident exposure - Challenges

Cost sensitivity and ASP constraints

Limited local automotive-grade supply chain

Calibration and service capability gaps

Counterfeit and grey-market risks

Secure provisioning skill shortages - Opportunities

Secure gateway retrofits for fleets

OEM security content expansion

EV cybersecurity hardware integration

ITS and fleet convergence opportunities

Hardware-backed provisioning services - Trends

Zonal gateway architectures

Migration toward automotive Ethernet

Hardware-backed identity adoption

Secure diagnostics access control

Post-quantum readiness indicators - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- By Volume, 2019–2024

- By Average Selling Price and Security Content, 2019–2024

- By Fleet Type (in Value %)

Passenger Vehicles

Commercial Vehicles

Buses and Public Utility Fleets

Two and Three Wheelers with Connectivity Kits

Electric and Hybrid Vehicles - By Application (in Value %)

Secure Boot and Runtime Integrity

Cryptographic Acceleration

Key Management and Secure Provisioning

Network Segmentation and Firewalling

Intrusion Detection and Prevention - By Technology Architecture (in Value %)

Discrete Secure Elements and eSE

Automotive MCU or SoC with Embedded HSM

Trusted Platform Modules

Secure Gateway ECUs

Dedicated In-Vehicle IDS Hardware - By Connectivity Type (in Value %)

CAN and CAN-FD

LIN

Automotive Ethernet

Cellular Telematics Connectivity

Wi-Fi Bluetooth and V2X Interfaces - By End-Use Industry (in Value %)

OEM and Vehicle Importers

Fleet Operators and Logistics Providers

Public Transportation Authorities

Ride-Hailing and Mobility Platforms

Smart City and ITS Operators - By Region (in Value %)

National Capital Region

CALABARZON

Central Luzon

Visayas

Mindanao

- Competitive Benchmarking Framework

- Cross Comparison Parameters (automotive-grade qualification and safety alignment, hardware root-of-trust strength, cryptographic acceleration throughput and latency, secure boot and OTA verification depth, in-vehicle network coverage, integration footprint and toolchain support, provisioning model and anti-cloning controls, Philippines channel capability)

- Market Share Assessment

- SWOT Analysis of Key Players

- Pricing and BOM Positioning

- Company Profiles

NXP Semiconductors

Infineon Technologies

STMicroelectronics

Renesas Electronics

Texas Instruments

Microchip Technology

Qualcomm Technologies

NVIDIA

Bosch

Continental

Aptiv

DENSO

HARMAN

Thales

- OEM and importer decision frameworks

- Fleet operator adoption dynamics

- Public mobility procurement models

- Vendor selection and validation process

- Buyer pain point assessment

- By Value, 2025–2030

- By Volume, 2025–2030

- By Average Selling Price and Security Content, 2025–2030