Market Overview

The Philippines vehicle cybersecurity market is valued at approximately USD ~ million in 2024, driven by the increasing integration of connected and autonomous vehicle technologies. As the number of connected vehicles on Philippine roads grows, so does the demand for robust cybersecurity measures to protect against cyberattacks. The Philippine government is introducing policies focused on improving vehicle safety, alongside a growing automotive industry, which together contribute to the expansion of this market. In 2024, connected vehicle sales are projected to reach ~ units, with a forecasted ~% growth in connected car penetration.

Metro Manila is the dominant market for vehicle cybersecurity solutions in the Philippines due to its concentration of connected vehicles, the presence of international automakers, and a higher adoption rate of technology in urban areas. The region’s dense traffic and rapid urbanization necessitate enhanced cybersecurity measures for vehicles with advanced telematics and in‑vehicle infotainment systems. Cebu and Davao are also emerging as important centers for the market due to increasing vehicle sales, particularly in fleet management and shared mobility services, which depend heavily on cybersecurity for their connected platforms.

Market Segmentation

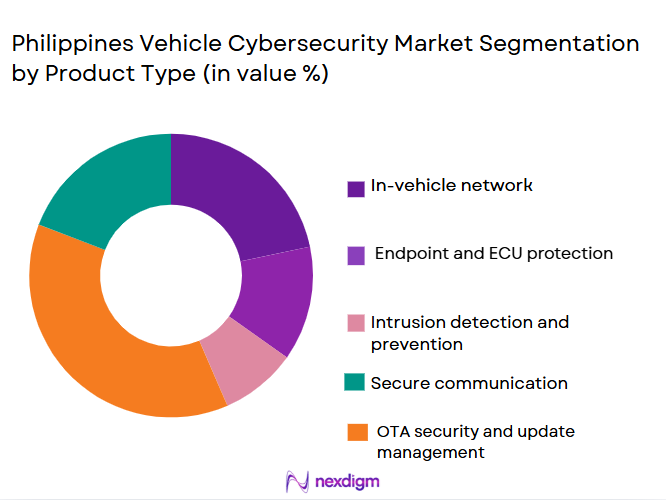

By Product Type

The vehicle cybersecurity market in the Philippines is segmented by offering into hardware, software, and services. Software solutions dominate the market, particularly for in‑vehicle networks, intrusion detection, and over‑the‑air updates. As vehicles become more connected, the need for software solutions that can provide real-time monitoring and security updates is growing rapidly. This trend is further driven by the increasing use of Advanced Driver Assistance Systems (ADAS) and the demand for security solutions for cloud‑based services.

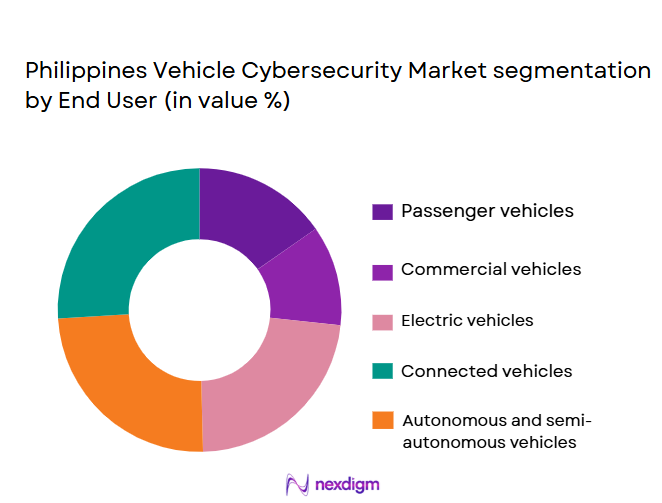

By End User

The vehicle cybersecurity market is segmented by vehicle type into passenger cars, light commercial vehicles (LCVs), heavy commercial vehicles (HCVs), and electric vehicles (EVs). Passenger cars account for the largest market share, driven by the increasing number of connected cars with telematics, infotainment, and autonomous driving systems. These vehicles require robust cybersecurity systems to ensure the protection of in‑vehicle data and communication systems from external threats. As EV adoption grows, the market for cybersecurity solutions tailored to these vehicles is expected to rise due to their reliance on connected technology.

Competitive Landscape

The Philippines vehicle cybersecurity market is characterized by a mix of global and regional players providing solutions to protect connected vehicles. Major players like Aptiv, Harman International, and BlackBerry QNX have established themselves as dominant players due to their extensive portfolios and partnerships with original equipment manufacturers (OEMs). Regional startups are also making strides by offering niche cybersecurity solutions that cater to the specific needs of local fleet operators and car-sharing services, further intensifying competition.

| Company | Establishment Year | Headquarters | Cybersecurity Solutions | Vehicle Types Covered | Partnerships | Digital Integration |

| Aptiv | 1994 | USA | ~ | ~ | ~ | ~ |

| Harman International | 1980 | USA | ~ | ~ | ~ | ~ |

| BlackBerry QNX | 1984 | Canada | ~ | ~ | ~ | ~ |

| Continental AG | 1871 | Germany | ~ | ~ | ~ | ~ |

| NXP Semiconductors | 1953 | Netherlands | ~ | ~ | ~ | ~ |

Philippines Air Quality Monitoring System Market Analysis

Growth Drivers

Urbanization

Indonesia’s extensive urbanization significantly drives the demand for air quality monitoring systems as dense city populations produce high pollution levels. In 2024, approximately ~ percent of Indonesia’s population lived in urban areas, equating to around ~ million urban residents requiring environmental oversight. Jakarta’s metropolitan area alone houses over ~ million people, and similarly large urban centers such as Bandung and Surabaya intensify air pollution from vehicles, construction, and energy use, necessitating comprehensive monitoring systems to inform policy and protect public health.

Industrialization

Industrialization in Indonesia contributes to elevated emissions that bolster demand for air quality monitoring systems. As the industrial sector remains a major component of economic activity, facilities producing steel, cement, chemicals, and power release significant airborne pollutants, increasing the need for real‑time monitoring of particulates and gases. Transport emissions also add pressure; Indonesia’s transport sector produced 149,538 thousand tones of CO₂ in 2023, a major source of urban air pollution, reinforcing the requirement for expanded monitoring networks.

Challenges

Air quality monitoring systems

Air quality monitoring systems require technical expertise for calibration, data integration, and long‑term maintenance, posing challenges across Indonesia’s archipelago. Reliable pollutant measurement depends on stable power and telecommunications infrastructure, which are inconsistent in some regions, impairing data quality.

Diverse sensor technologies

Additionally, integrating diverse sensor technologies — from fixed stations to low‑cost IoT sensors — into unified platforms demands sophisticated software and analytical tools that local agencies may lack, slowing the pace of system upgrades.

Opportunities

Technological Advancements

Technological advancements offer opportunities for more scalable and cost‑effective air quality monitoring in Indonesia. Emerging IoT‑based sensor arrays provide continuous pollutant tracking and can be deployed across urban and peri‑urban regions at lower cost than traditional fixed stations. These systems deliver real‑time data streams and can integrate with mobile and cloud platforms, enhancing the granularity and usability of air quality insights. Adoption of advanced analytics and remote calibration tools further extends monitoring reach without proportional increases in manpower.

International Collaborations

International collaborations present opportunities to strengthen Indonesia’s monitoring capabilities through knowledge exchange, technical support, and shared frameworks. Partnerships with multilateral agencies and regional networks can facilitate access to advanced sensor technologies, training programs, and data management standards. Such cooperation improves local capacity in environmental data governance and aligns Indonesian monitoring practices with global best practices, enhancing both data accuracy and policy effectiveness.

Future Outlook

Over the next five years, the Philippines vehicle cybersecurity market is expected to experience significant growth driven by the proliferation of connected and autonomous vehicles. The government is likely to introduce more stringent regulations for vehicle safety and cybersecurity, aligning with international standards like ISO/SAE ~. The growing adoption of electric vehicles (EVs) and advanced technologies such as over‑the‑air (OTA) software updates and in‑vehicle infotainment systems will further fuel demand for cybersecurity solutions. Moreover, the need for robust data protection measures will increase as vehicles become more connected to cloud networks and autonomous driving technologies.

Major Players

- Aptiv

- Harman International

- BlackBerry QNX

- Continental AG

- NXP Semiconductors

- Upstream Security

- Karamba Security

- Bosch Automotive Cybersecurity

- DENSO Corporation

- McAfee (Intel)

- Trend Micro

- Cisco Systems

- Palo Alto Networks

- Symantec (Broadcom)

- ZF Friedrichshafen AG

Key Target Audience

- Vehicle OEMs

- Tier 1 Automotive Suppliers

- Fleet Management Companies

- Insurance Providers

- Investments and Venture Capitalist Firms

- Telematics Solution Providers

- Government and Regulatory Bodies

- Automotive Cybersecurity Solution Providers

Research Methodology

Step 1: Identification of Key Variables

The research process begins with the identification of critical market variables such as regulatory frameworks, vehicle connectivity trends, and cybersecurity standards for vehicles. Secondary data from trusted industry reports, academic papers, and government publications is analyzed to develop a deep understanding of the market landscape.

Step 2: Market Analysis and Construction

In this phase, historical data related to vehicle cybersecurity adoption, connected car trends, and market drivers is collected. The research focuses on identifying penetration rates of connected vehicles, regional adoption differences, and shifts in consumer behavior regarding vehicle data security.

Step 3: Hypothesis Validation and Expert Consultation

The market hypotheses are validated through interviews with industry experts, OEMs, tier 1 suppliers, and cybersecurity professionals. These expert insights help in refining the analysis, ensuring the accuracy and relevance of the research findings.

Step 4: Research Synthesis and Final Output

The final output synthesizes data from primary research and secondary sources to create a comprehensive report. This phase includes engaging with key market players to validate the findings, ensuring that the data reflects current trends and accurately represents the market’s trajectory.

- Executive Summary

- Research Methodology

Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising adoption of connected and software-defined vehicles

Increasing awareness of vehicle cyber threats and data breaches

Government focus on road safety and digital infrastructure - Market Challenges

Limited local expertise in automotive cybersecurity

Cost sensitivity among mass-market vehicle segments

Lack of unified cybersecurity standards and regulations - Market Opportunities

Expansion of cybersecurity solutions for electric and connected vehicles

Growth of managed security services for vehicle fleets

Partnerships between OEMs and cybersecurity technology providers - Trends

Integration of AI-based threat detection systems

Shift toward cloud-managed vehicle security platforms

Growing focus on lifecycle cybersecurity management

- By Market Value 2019–2024

- By Installed Units 2019–2024

- By Average System Price 2019–2024

- By System Complexity Tier 2019–2024

- By System Type (In Value%)

In-vehicle network security systems

Endpoint and ECU protection solutions

Intrusion detection and prevention systems

Secure communication and encryption systems

OTA security and update management systems - By Platform Type (In Value%)

Passenger vehicles

Commercial vehicles

Electric vehicles

Connected vehicles

Autonomous and semi-autonomous vehicles - By Fitment Type (In Value%)

OEM-integrated cybersecurity systems

Aftermarket cybersecurity solutions

Embedded hardware-based security modules

Cloud-based vehicle security platforms

Hybrid on-vehicle and cloud security systems - By EndUser Segment (In Value%)

Automotive OEMs

Fleet operators and logistics providers

Public transportation operators

Ride-hailing and mobility service providers

Government and defense vehicle fleets - By Procurement Channel (In Value%)

Direct OEM supply agreements

Software licensing and subscription models

System integrator partnerships

Fleet-level bulk procurement contracts

Government and public sector tenders

- Market Share Analysis

- Cross Comparison Parameters

[Threat detection capability, Integration complexity, Scalability, Compliance readiness, Cost structure] - SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Bosch

Continental

Harman International

Aptiv

Denso

NXP Semiconductors

BlackBerry QNX

GuardKnox

Upstream Security

Argus Cyber Security

Karamba Security

C2A Security

VicOne

Cisco Systems

Trend Micro

- OEMs prioritize secure-by-design vehicle architectures

- Fleet operators focus on minimizing downtime and cyber risks

- Mobility service providers demand scalable security solutions

- Government fleets emphasize compliance and data protection

- Forecast Market Value 2025–2030

- Forecast Installed Units 2025–2030

- Price Forecast by System Tier 2025–2030

- Future Demand by Platform 2025–2030