Market Overview

The Vehicle Occupant Detection Systems Market in the Philippines is projected to see substantial growth, reaching a market size of USD ~ million by 2024. This growth is primarily driven by the increasing government emphasis on road safety, stringent vehicular safety regulations, and the rising demand for advanced driver-assistance systems. As a growing market within Southeast Asia, the Philippines has experienced a rise in car ownership and public transport modernization, which are expected to further fuel demand for occupant detection systems. Government-led initiatives and collaborations with automotive manufacturers to promote safer driving technologies and systems are boosting the penetration of occupant detection systems, contributing to market growth.

Metro Manila is the dominant region in the Philippines for Vehicle Occupant Detection Systems due to its high population density and concentrated automotive activity. As the capital and largest city, Metro Manila houses a significant portion of the country’s automotive sales, including both passenger vehicles and public utility vehicles (PUVs). Additionally, key industrial hubs such as Cebu and Davao are also playing an important role in the market due to their growing transportation infrastructure and increasing consumer demand for vehicle safety technologies. These regions lead the adoption of advanced automotive systems like occupant detection due to both government regulations and a demand for safer public and private transportation solutions.

Market Segmentation

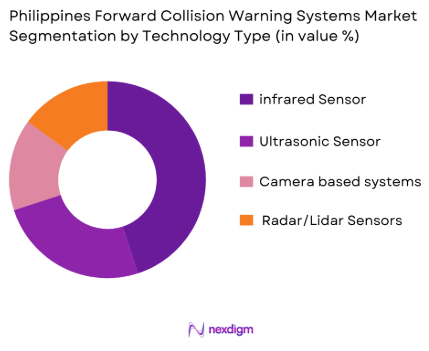

By Technology Type

The Vehicle Occupant Detection Systems Market in the Philippines is segmented into various technologies, including infrared sensors, ultrasonic sensors, camera-based systems, and radar/lidar-based systems. Among these, infrared sensor-based systems dominate the market. This is because of their effectiveness in detecting both the presence and position of occupants in various conditions, including low visibility environments. Infrared sensors are increasingly integrated into vehicles as part of advanced driver-assistance systems (ADAS), making them critical for both safety and comfort. These systems have witnessed significant adoption in mid- to high-end passenger vehicles due to their ability to detect even minor occupant movements, enhancing safety in the event of sudden braking or a crash.

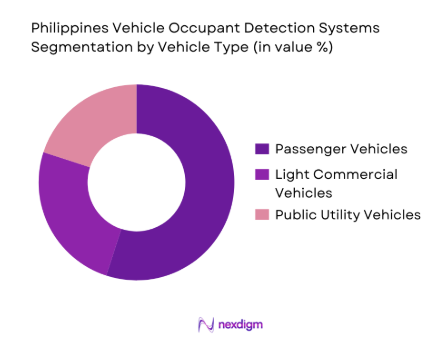

By Vehicle Type

Vehicle types in the Philippines, particularly passenger vehicles, light commercial vehicles, and public utility vehicles (PUVs), drive the segmentation of the Vehicle Occupant Detection Systems Market. The passenger vehicle segment holds the largest market share, primarily due to the growing preference for safer, feature-rich cars among Filipino consumers. Consumer awareness regarding safety and the integration of occupant detection as part of standard safety features in new vehicle models is propelling the demand. With an increasing middle-class population and a rise in new car sales, more consumers are opting for advanced safety features, including occupant detection systems.

Competitive Landscape

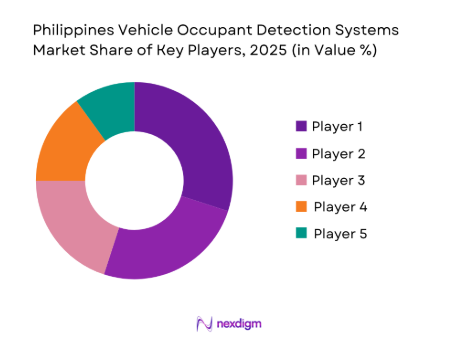

The Philippines Vehicle Occupant Detection Systems Market is competitive, with both global and local players making substantial investments to expand their presence. The market is dominated by a few leading players such as Continental AG, Denso Corporation, and Robert Bosch, which offer cutting-edge occupant detection technology to OEMs and Tier 1 suppliers. The competitive advantage in this market is largely based on technological innovation, strategic partnerships with automakers, and compliance with local safety standards.

The market’s key players are increasingly focusing on sensor fusion, which combines data from multiple sensors to provide more accurate occupant detection, especially in public transport systems. This focus on system reliability, advanced sensors, and software integration is expected to foster the growth of major players in the market.

Table: Major Players in the Philippines Vehicle Occupant Detection Systems Market

| Company | Establishment Year | Headquarters | Technology Focus | Regional Market Presence | Product Portfolio Depth | Strategic Partnerships |

| Continental AG | 1871 | Germany | Infrared Sensors | ~ | ~ | ~ |

| Denso Corporation | 1949 | Japan | Ultrasonic Sensors | ~ | ~ | ~ |

| Robert Bosch GmbH | 1886 | Germany | Camera-based Systems | ~ | ~ | ~ |

| Valeo SA | 1923 | France | Radar/Lidar Sensors | ~ | ~ | ~ |

| Lear Corporation | 1917 | USA | Hybrid Systems | ~ | ~ | ~ |

Philippines Vehicle Occupant Detection Systems Market Dynamics

Growth Drivers

Government Road Safety Mandates & Compliance Benchmarking

The Philippine government has been progressively strengthening road safety measures. In 2023, the Land Transportation Office (LTO) reported over 500,000 road accidents in the country, prompting increased government regulation to ensure vehicle safety. The introduction of the PUV Modernization Program, which includes mandatory safety feature upgrades for public utility vehicles (PUVs), encourages the adoption of advanced safety systems, such as occupant detection. Additionally, the government has adopted a stricter stance on safety compliance, ensuring that vehicles meet international standards for occupant protection, further driving market demand for occupant detection systems.

Rising Consumer Safety Awareness & Insurance Incentives

Rising consumer awareness regarding road safety and the benefits of advanced vehicle safety technologies is pushing the demand for occupant detection systems in the Philippines. A 2023 report from the Philippine Statistics Authority highlighted a 15% increase in private vehicle registrations, which reflects greater consumer interest in vehicles equipped with enhanced safety features. Additionally, insurance companies are offering incentives to consumers who opt for safer vehicles, further boosting the adoption of occupant detection technologies. The government’s focus on safety, paired with these incentives, is accelerating the shift toward advanced safety systems.

Market Challenges

High Sensor System ASP vs Price-Sensitive Market

While the demand for advanced occupant detection systems is growing, the high average selling price (ASP) of these sensors remains a significant challenge. The Philippine market, especially in rural areas, is price-sensitive, with many consumers and businesses prioritizing affordability over advanced technology. According to the Philippine Statistics Authority, nearly 80% of households in the country have an annual income below USD 6,000, which makes the adoption of higher-end safety technologies challenging. As a result, manufacturers must balance technological advancements with pricing strategies that cater to a broader range of consumers to stimulate market growth.

Infrastructure & Calibration Support Gaps

The Philippines faces significant infrastructure gaps in terms of service centers and calibration facilities for advanced vehicle technologies. In 2023, the Department of Transportation reported that fewer than 30% of the country’s regions have adequate calibration facilities for ADAS and related systems. This creates a challenge for vehicle owners, particularly in remote areas, where access to qualified calibration services for occupant detection sensors is limited. As the demand for these systems grows, ensuring that infrastructure can support proper installation and calibration will be crucial for market expansion.

Opportunities

Public Transport Fleet Modernization Procurement

The Philippine government’s push to modernize the public transport fleet presents a significant market opportunity for occupant detection systems. As part of the PUV Modernization Program, the government plans to replace thousands of old jeepneys with new, safer vehicles. In 2023, over 3,000 modernized vehicles were introduced to the public transport system. This large-scale transformation creates a substantial demand for safety features, including occupant detection systems. The government’s investment in safer vehicles will drive the adoption of these technologies across both private and public transport sectors in the coming years.

AI and Machine-Learning Occupant Detection Enhancement

With advancements in AI and machine learning, the capabilities of occupant detection systems are expected to improve significantly. In 2024, several automotive manufacturers in the Philippines have begun to incorporate AI-driven systems into their vehicles, enhancing the accuracy of occupant detection by analyzing various factors such as seat occupancy, weight distribution, and passenger posture. These systems are expected to reduce false detections and improve safety during vehicle crashes. The integration of AI technologies into these systems is a promising area of growth for the market, as it offers more reliable and intelligent safety solutions for modern vehicles.

Future Outlook

Over the next five years, the Vehicle Occupant Detection Systems Market in the Philippines is expected to experience steady growth driven by increasing government safety regulations, rising consumer demand for safer vehicles, and advancements in vehicle safety technologies. With an emphasis on enhancing road safety in public transportation and private vehicles, the market is expected to benefit from innovations in sensor technologies and system integration. The government’s push for modernizing public transport, including the PUV Modernization Program, will also contribute significantly to the expansion of occupant detection systems.

Major Players

- Continental AG

- Denso Corporation

- Robert Bosch GmbH

- Valeo SA

- Lear Corporation

- Autoliv Inc.

- Magna International

- ZF Friedrichshafen AG

- Hyundai Mobis

- Aptiv

- Delphi Technologies

- Panasonic Corporation

- Harman International

- Texas Instruments

- ON Semiconductor

Key Target Audience

- Automotive Manufacturers (OEMs)

- Public Transportation Authorities

- Vehicle Safety Technology Suppliers

- Aftermarket Vehicle Accessory Retailers

- Investment and Venture Capitalist Firms

- Automotive Component Distributors

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves identifying key market variables by conducting extensive secondary research, including the examination of industry reports, government regulations, and OEM strategies. This will help build a comprehensive understanding of the key factors affecting the Vehicle Occupant Detection Systems Market in the Philippines.

Step 2: Market Analysis and Construction

This phase includes historical analysis and forecasting market demand based on adoption trends of occupant detection systems across various vehicle types, technologies, and geographic regions. We will leverage primary data gathered through interviews with industry stakeholders, market leaders, and automotive companies.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses on the future growth of the market will be validated through consultations with automotive technology experts and key industry players. These consultations will provide insights into product development strategies, emerging market trends, and anticipated regulatory changes.

Step 4: Research Synthesis and Final Output

Final data synthesis will involve analysing and verifying the findings from expert consultations, secondary research, and market surveys. This process ensures the accuracy of the projected market size, segmentation, and outlook for the Philippines Vehicle Occupant Detection Systems Market.

- Executive Summary

- Research Methodology (Key revenue & volume takeaways Philippines market positioning relative to APAC Growth levers & priority strategic imperatives risk and mitigation summary for investors and OEMs)

- Market Definition and Scope

- Historical Genesis & Adoption Timeline

- Philippines Road Safety Policy & Vehicle Safety Regulation Landscape

- ASEAN NCAP & Local Safety Mandates Impact

- Passenger Vehicle Fleet Structure & Modernisation Programs

- Growth Drivers

Government road safety mandates & compliance benchmarking

Rising consumer safety awareness & insurance incentives

Increasing integration with ADAS & in‑cab intelligence platforms - Market Challenges

High sensor system ASP vs price‑sensitive market

Infrastructure & calibration support gaps

Aftermarket quality & counterfeit sensor risks - Opportunities

Public transport fleet modernisation procurement

AI and machine‑learning occupant detection enhancement

Insurance telematics + occupant data services - Technology and Adoption Trends

Sensor fusion & multi‑modal detection

Biometric & radar‑based occupant analytics

Integration with occupant classification & airbag control systems

- By Market Value, 2019-2025

- By Unit Shipments, 2019-2025

- By System ASP, 2019-2025

- By Technology Type (In Value %)

Infrared sensor

Ultrasonic sensor

Camera‑based

Radar/Lidar sensor

Hybrid fusion - By Detection Feature (In Value %)

Occupant presence

Weight classification

Position estimation

Child/Rear occupant alert

Driver seat occupancy

- By Installation Type (In Value %)

Built‑in OEM

Aftermarket retrofit - By Vehicle Segment (In Value %)

Heavy trucks/buses

PUVs - By Distribution Channel (In Value %)

OEM direct fitment

Tier‑1 supplier contracts

Aftermarket retail

PTA/transport authority procurements

- Market Share Analysis

- Competitor SWOT

- Porter’s Five Forces

- Company Profiles

Continental AG

Denso Corporation

ZF Friedrichshafen AG

Robert Bosch GmbH

Texas Instruments Incorporated

Valeo SA

Harman International / Caaresys

Lear Corporation

Autoliv Inc.

Novelic

Fortran Traffic Systems Ltd.

NEC Corporation of America

Conduent Inc.

Indra Sistemas

TransCore

- OEM Demand by Vehicle Class

- Aftermarket Consumer Purchasing Insights

- Fleet Customer Requirements

- Procurement & Budgeting Patterns

- User Pain Points & Decision Criteria

- By Value, 2026–2030

- By System Volume, 2026–2030

- By Feature Penetration, 202-2030