Market Overview

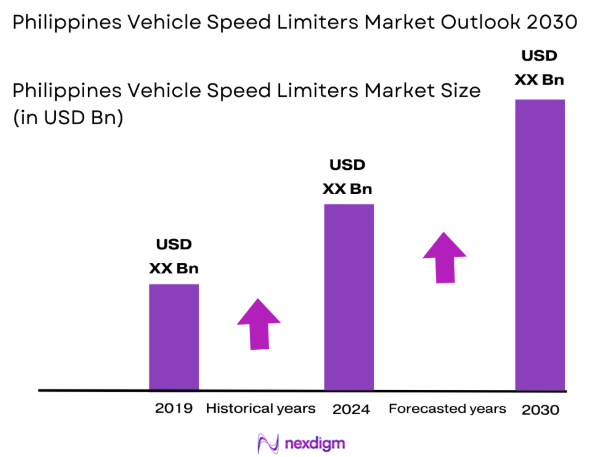

The Philippines Vehicle Speed Limiters market has seen significant growth in recent years, driven primarily by stringent government regulations and a growing focus on road safety. In 2024, the market is valued at approximately USD ~. This growth is primarily fueled by the enforcement of the Road Speed Limiter Act of 2016 (RA 10916), which mandates the installation of speed limiters on public utility vehicles (PUVs) and heavy trucks to mitigate road accidents. Additionally, growing public awareness of road safety and vehicle compliance has encouraged the adoption of these devices. As the government intensifies compliance measures, demand for these speed-limiting devices is expected to increase significantly.

The Philippines’ vehicle speed limiter market is highly influenced by major urban centers such as Metro Manila, Cebu, and Davao. These regions dominate due to their higher concentration of fleet operators and public utility vehicles that require compliance with safety regulations. Metro Manila, being the capital and the largest economic hub, has the highest demand for speed limiters, especially among buses, jeepneys, and delivery trucks. The government’s regulatory efforts, paired with the region’s extensive road networks, have contributed to the early adoption of speed limiters in these areas. Cebu and Davao, as rapidly growing cities, are following suit due to increasing traffic congestion and a rise in commercial vehicle fleets.

Market Segmentation

By Device Technology

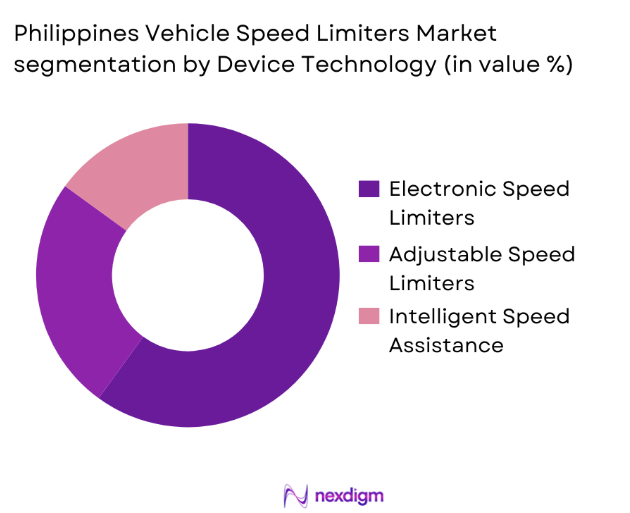

The Philippines Vehicle Speed Limiters market is segmented by device technology into electronic speed limiters, adjustable speed limiters, and intelligent speed assistance systems. Among these, electronic speed limiters dominate the market share, particularly in compliance-driven sectors like public utility vehicles (PUVs) and cargo trucks. Electronic speed limiters are preferred for their cost-effectiveness, ease of installation, and reliability in limiting speed within set parameters. These devices are typically fixed and operate through the vehicle’s ECU, ensuring that the vehicle’s speed does not exceed the predetermined limit. Their widespread adoption is a direct result of regulatory mandates, as these systems are the most straightforward and universally accepted by regulators.

By Vehicle Type

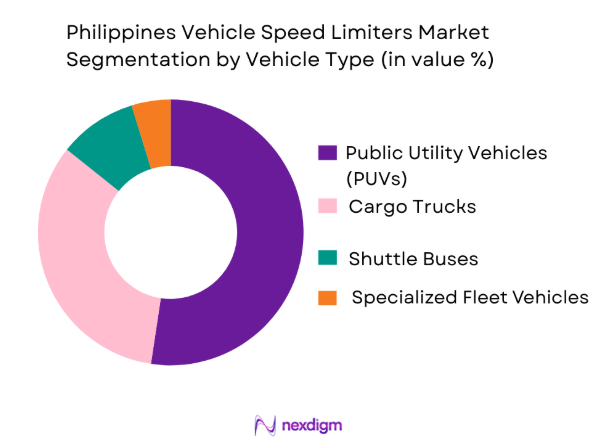

The market is also segmented by vehicle type, including public utility vehicles (PUVs), cargo trucks, shuttle buses, and specialized fleet vehicles. Public utility vehicles (PUVs) hold the dominant market share within this segment. The government’s enforcement of the Road Speed Limiter Act has significantly impacted this segment, as PUVs such as buses, jeepneys, and taxis are now required to comply with speed limitation regulations. These vehicles are commonly used in urban areas, where high traffic density necessitates speed control measures for safety. As more PUV operators prioritize compliance to avoid penalties, the demand for speed limiters within this category remains robust.

Competitive Landscape

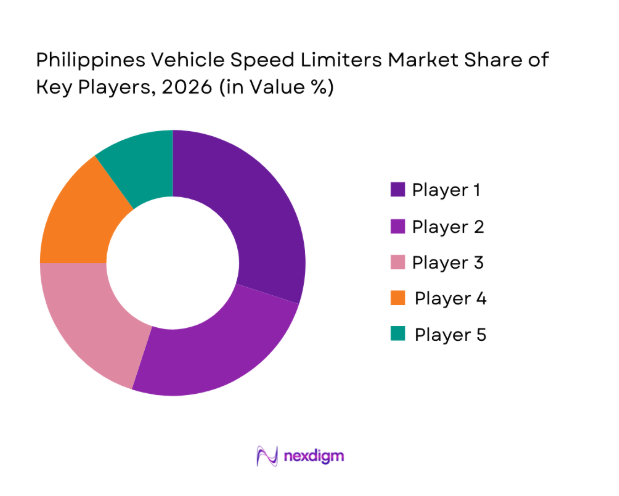

The Philippines Vehicle Speed Limiters market is dominated by a mix of global and local players. Some of the key companies include Safemax, Bosch, Continental, and Resolute Dynamics. These companies provide a wide range of speed limiter solutions that meet government standards, offering both retrofitting options and OEM-based solutions.

The market has seen a consolidation of major players due to the government’s strong regulations that favor certified devices. These major players have robust distribution networks, technical expertise in compliance, and long-standing relationships with fleet operators and public transportation companies. Their market dominance highlights the significant influence of regulatory requirements and the need for reliable, cost-effective speed limiter solutions.

| Company Name | Establishment Year | Headquarters | Product Portfolio | Technology Type | Pricing Strategy | Distribution Channels |

| Safemax Speed Limiter Devices | 2009 | Manila, Philippines | ~

|

~ | ~ | ~

|

| Bosch Automotive | 1886 | Gerlingen, Germany | ~

|

~

|

~

|

~

|

| Continental AG | 1871 | Hanover, Germany | ~

|

~

|

~

|

~

|

| Resolute Dynamics | 2010 | Makati, Philippines | ~

|

~

|

~

|

~

|

| Valeo Automotive | 1923 | Paris, France | ~

|

~

|

~

|

~

|

Philippines Vehicle Speed Limiters Market Analysis

Growth Drivers

Regulatory Mandates and Road Safety Concerns

The primary growth driver for the Philippines Vehicle Speed Limiters market is the ongoing enforcement of the Road Speed Limiter Act (RA 10916), which mandates the installation of speed limiters on public utility vehicles (PUVs) and cargo trucks to reduce road accidents. In 2023, the Philippines saw a 6% increase in traffic-related accidents, contributing to the urgency of safety measures. Furthermore, the Department of Transportation (DOTr) has been progressively increasing compliance checks, with over 10,000 vehicles fitted with speed limiters in 2022, driving market demand. These safety regulations push adoption across commercial fleets to meet the government’s mandates.

Road Safety Regulations and Government Mandates

A further growth driver for the Philippines Vehicle Speed Limiters market is the increased emphasis on road safety by the government and local authorities. In 2022, the Department of Transportation (DOTr) reported that ~ traffic-related fatalities occurred in the Philippines. As a result, there is a significant push to enforce stricter regulations for road safety. With commercial vehicle fleets being a key contributor to these accidents, the government has mandated speed limiter installations for public utility vehicles and trucks, thus fueling demand in the market. The increasing number of traffic safety awareness campaigns also further drives adoption across various sectors.

Market Challenges

Regional Disparities in Compliance Enforcement

Another challenge is the uneven enforcement of speed limiter mandates across regions. While urban centers like Metro Manila and Cebu have seen higher compliance rates, rural areas still face significant gaps in regulation enforcement. According to the Land Transportation Office (LTO), as of 2023, only ~ of commercial vehicles in major cities have adopted speed limiters, while in less urbanized regions, adoption is much slower due to weaker regulatory enforcement and the lack of infrastructure for installations. This regional disparity creates difficulties in achieving nationwide compliance, slowing the overall market growth.

High Upfront Costs and Installation Barriers

A key challenge in the market is the high upfront cost of installing speed limiters, especially for small fleet operators. The lack of financial incentives for fleet upgrades exacerbates this barrier. According to the Philippine Statistics Authority, the average cost of vehicle maintenance increased by ~ in 2022, leading to financial strain on operators. Additionally, regulatory compliance is often hindered by a limited installer network, particularly in rural regions. Furthermore, there is resistance from vehicle owners due to perceived high costs, and operational disruptions during installation, affecting the market’s wider adoption across all vehicle types.

Trends

Shift Toward Intelligent Speed Assistance Systems

There is a noticeable trend toward integrating Intelligent Speed Assistance systems alongside traditional speed limiters. These systems offer real-time monitoring, adjusting the vehicle’s speed based on road conditions and regulatory limits. In 2022, over ~ of newly registered commercial vehicles included ISA systems, reflecting a shift towards more advanced safety technologies. Additionally, fleet management systems are being incorporated with speed limiters, enabling fleet operators to monitor real-time speed and improve vehicle safety. This integration of technology indicates a growing preference for advanced solutions to not only meet regulatory requirements but enhance fleet efficiency.

Integration of Speed Limiters with Telematics and Fleet Management Systems

Another key trend is the gradual shift towards integrating speed limiter technologies with telematics and fleet management systems. In 2023, the Philippines saw an increase in the number of fleet operators adopting these integrated solutions, with over ~ of large fleet operators using telematics to monitor vehicle performance, including speed. This integration enables fleet managers to track real-time data, such as vehicle speed, location, and driving behavior, making it easier to enforce compliance and improve fleet safety. The use of telematics is also expected to grow as fleets become more digitalized, further influencing speed limiter technology trends.

Opportunities

Growing Retrofit Market for Fleet Compliance

An immediate opportunity lies in the retrofitting market, where existing fleets are being upgraded to comply with the Road Speed Limiter Act. In 2022, more than ~ public utility vehicles were retrofitted with speed limiters to meet compliance requirements, showing a clear demand for retrofitting services. Furthermore, as the number of commercial fleets continues to grow, especially in urban areas like Metro Manila, fleet operators are increasingly looking for solutions that integrate safety and operational efficiency. This demand creates a substantial opportunity for aftermarket retrofitting services and telematics integration for enhanced fleet management.

Government Incentives for Fleet Modernization

Another significant opportunity lies in the government’s potential subsidies or incentives for fleet operators to install speed limiters in line with environmental and safety initiatives. As of 2022, the Philippine government has been exploring ways to incentivize fleet modernization under the Public Utility Vehicle Modernization Program (PUVMP), which could include financial assistance for installing speed limiters. With over ~ public utility vehicles in the country, such initiatives present a substantial opportunity for companies offering speed limiter technologies to tap into a growing market. These incentives would facilitate quicker adoption and offer a new growth avenue for service providers.

Future Outlook

The Philippines Vehicle Speed Limiters market is expected to grow significantly over the next 5 years, driven by government support, continuous enforcement of road safety regulations, and an increasing focus on fleet safety. As more vehicles are required to install speed limiters for compliance with the Road Speed Limiter Act, the market is projected to see steady growth, particularly in the public utility and logistics sectors. Furthermore, advancements in intelligent speed assistance systems are expected to complement existing speed limiter technologies, driving additional adoption among fleet operators aiming to integrate more advanced safety features into their vehicles.

Major Players

- Safemax Speed Limiter Devices

- Bosch Automotive

- Continental AG

- Resolute Dynamics

- Valeo Automotive

- Autokontrol

- DENSO Corporation

- Magneti Marelli

- Teletrac Navman

- Trimble

- Trackimo

- Siemens Automotive

- Hella Gutmann Solutions

- Mobileye / Intel

- Valeo Automotive

Key Target Audience

- Fleet Operators

- Vehicle Manufacturers

- Vehicle Retrofit Service Providers

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Public Utility Vehicle Operators

- Insurance Companies

- Automotive Aftermarket Retailers

Research Methodology

Step 1: Identification of Key Variables

This phase involves creating a comprehensive map of stakeholders within the Philippines Vehicle Speed Limiter market, using a combination of secondary and proprietary research. The goal is to identify and define the major drivers, trends, and challenges impacting the market. This step will also define key data points such as regulatory frameworks, vehicle fleet composition, and speed limiter adoption rates.

Step 2: Market Analysis and Construction

Historical data will be collected, including vehicle adoption rates, speed limiter market

penetration, and the financial aspects of speed limiter technologies. Additionally, a review of market demand and the geographic concentration of vehicle fleets will be conducted to estimate the total addressable market.

Step 3: Hypothesis Validation and Expert Consultation

In this phase, market hypotheses will be validated through expert consultations, including discussions with OEM manufacturers, fleet operators, and government bodies responsible for vehicle compliance. These consultations will provide operational insights to refine the market data.

Step 4: Research Synthesis and Final Output

The final output will be a comprehensive market report, validated through interactions with industry experts and stakeholders. This will ensure that all data points, including market size, growth drivers, and technology adoption rates, are accurate and comprehensive.

- Executive Summary

- Research Methodology (Data Sources and Methodology, Market Definitions and Assumptions, Primary and Secondary Research Approaches, Market Sizing Approach, Data Triangulation and Validation)

- Definition and Scope

- Market Dynamics

- Historical Overview

- Timeline

- Growth Drivers

Regulatory Mandates and Road Safety Concerns

Road Safety Regulations and Government Mandates - Market Challenges

Regional Disparities in Compliance Enforcement

High Upfront Costs and Installation Barriers - Trends

Shift Toward Intelligent Speed Assistance (ISA) Systems

Integration of Speed Limiters with Telematics and Fleet Management Systems - Opportunities

Growing Retrofit Market for Fleet Compliance

Government Incentives for Fleet Modernization - Government Regulations

- SWOT Analysis

- Porter’s 5 Forces

- By Value, 2019-25

- By Volume 2019-25

- By Average Price 2019-25

- By Device Technology (by value %)

Electronic Speed Limiters (SLD)

Intelligent Speed Assistance (ISA) Systems

Adjustable Speed Limitation Devices (ASLD) - By Vehicle Type (by value %)

Public Utility Vehicles (PUVs)

Cargo Trucks & Haulers

Shuttle Buses & Vans

Specialized Vehicles (Logistics, Construction, etc.) - By Sales Channel (by value %)

OEM Fitment

Aftermarket Retrofitting

Direct Sales via Distributor Networks

By Geography

Luzon, Visayas, Mindanao

Key Urban Centers: Metro Manila, Cebu, Davao - By Application (by value %)

Fleet Compliance

Regulatory Mandates

Fleet Safety Programs

Insurance Risk Mitigation

- Market Share of Major Players

- Cross Comparison Parameters (Product Offerings, Distribution Networks & Installer Coverage, Technological Advancements, Market Positioning)

- SWOT Analysis of Key Players

- Pricing Analysis of Major Players

- Detailed Profile of Major Players

Autokontrol (Speed Limiter Distributor)

Safemax Speed Limiter Devices

Resolute Dynamics (Telematics and Compliance Solutions)

Bosch Automotive Systems

Continental AG (Speed Limiters and ISA Solutions)

Valeo (ADAS and Speed Limiting Solutions)

Mobileye / Intel (Intelligent Speed Assistance Systems)

DENSO Corporation (OEM Solutions for Speed Limiting)

Magneti Marelli (Speed Limiter Integration for Fleets)

Teletrac Navman (Fleet Management Integration)

Trimble (Telematics Solutions with Speed Control)

Trackimo (GPS-Linked Speed Limiting Devices)

Siemens Automotive (Speed Limiter Technologies)

Hella Gutmann Solutions (Speed Limiter Systems)

Valeo Automotive (Telematics and Safety Systems)

- Regulatory Compliance Requirements

- Fleet Management Needs

- Cost vs Benefit Analysis

- Insurance Implications

- Decision-Making Factors

- By Value 2026-2030

- By Volume 2026-2030

- By Average Price 2026-2030