Market Overview

The Philippines vehicle subscription platforms market was valued at USD ~ million in the most recent year. Growth is being propelled by “bundled usership” economics (single monthly fee covering registration/insurance/maintenance), and by pain points that make ownership less attractive in dense metros—especially congestion and parking scarcity. Demand is reinforced by the wider auto ecosystem’s momentum: new vehicle sales increased from ~ units in the prior year to ~ units in the most recent year, expanding the addressable pool for subscription-ready customers and corporate fleets.

The market is anchored in Metro Manila (Makati–BGC–Ortigas corridor), Cebu, and Davao because these hubs concentrate corporate head offices, BPO operations, airports, and high-frequency business travel—use cases where fixed-cost mobility is valued. Metro Manila’s congestion and time-loss economics also incentivize flexible mobility models: widely cited official/JICA-based estimates put congestion costs at PHP ~ billion per day, strengthening the rationale for pay-as-you-use “usership” solutions for both individuals and employers.

Market Segmentation

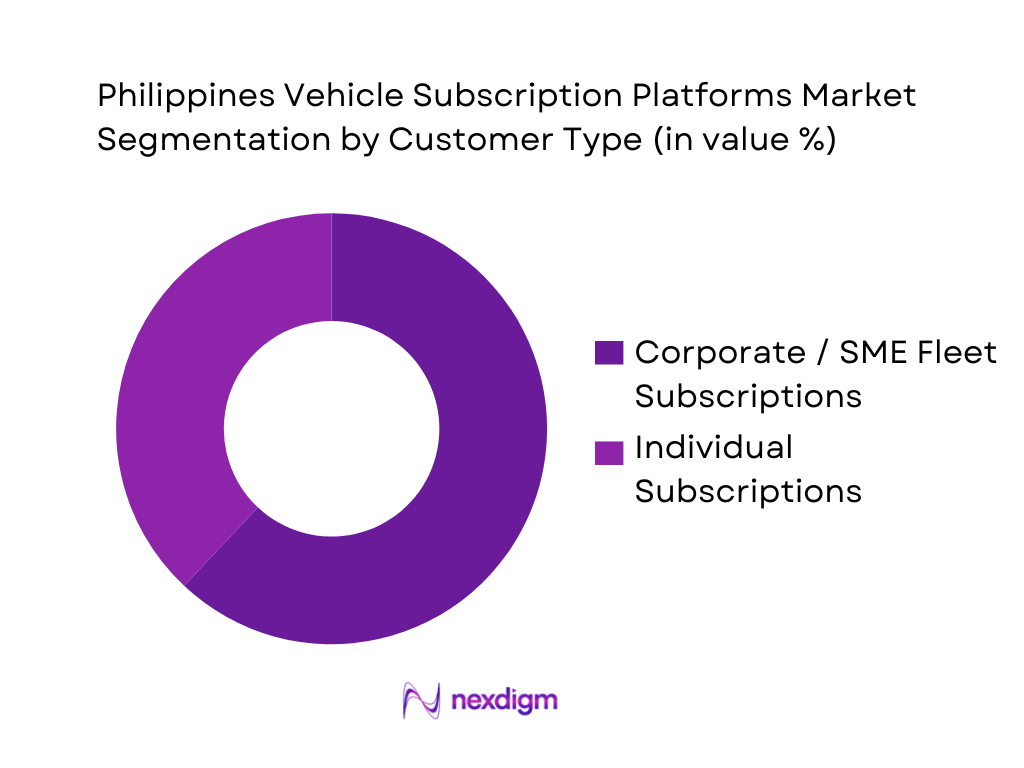

By Customer Type

The market is segmented by customer type into corporate/SME fleet subscriptions and individual subscriptions. Corporate/SME fleets dominate because subscriptions simplify fleet budgeting (single recurring fee), reduce admin load, and enable faster fleet scaling for seasonal demand. This is particularly relevant for BPOs, field sales teams, logistics coordinators, and project-based staffing where vehicle need fluctuates. Corporate customers also prefer structured mileage packages, replacement vehicle support, and centralized billing—features explicitly baked into major offers such as Toyota’s full-service lease/subscription positioning.

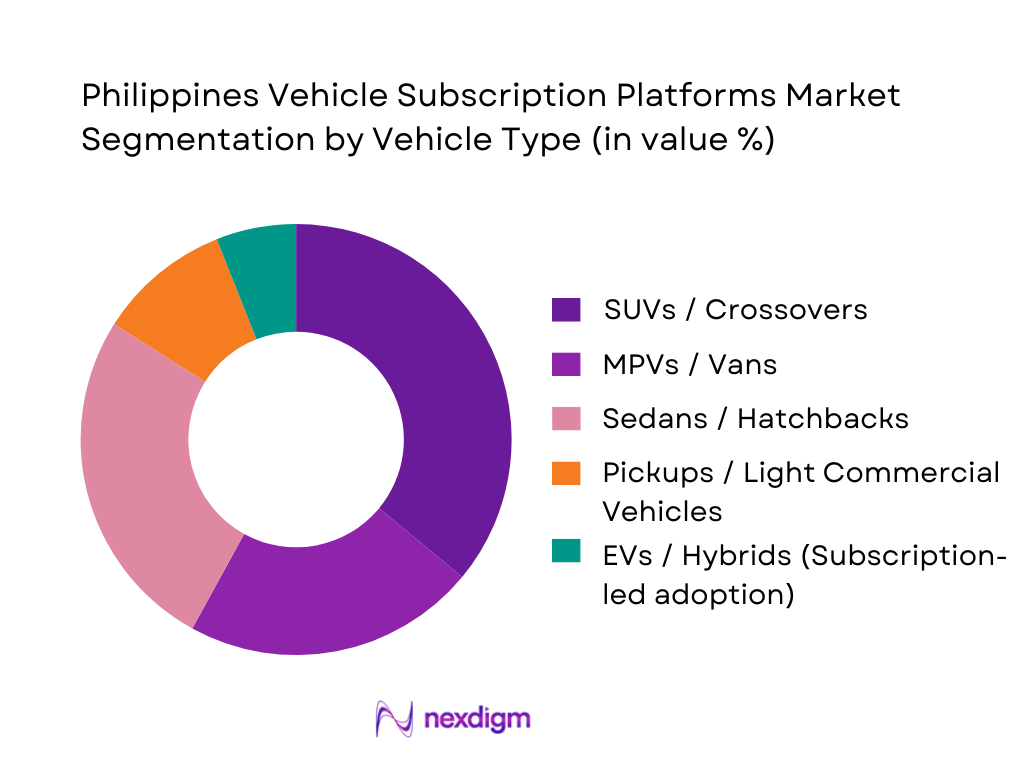

By Vehicle Type

The market is segmented by vehicle type into SUVs/crossovers, MPVs/vans, sedans/hatchbacks, pickups/LCVs, and EVs/hybrids. SUVs/crossovers dominate due to road-condition practicality, higher ground clearance, and suitability for mixed urban–out-of-town driving common in Luzon corridors and provincial business travel. They also align with corporate “duty of care” preferences (perceived safety, capacity for equipment, and multi-passenger use). Meanwhile, MPVs/vans hold strong traction in airport-heavy and group mobility use cases. EV/hybrid subscriptions remain smaller but are supported by policy tailwinds (including continued EV tariff support), and by the ability to “trial” electrification without long-term commitment—an important adoption bridge for fleets.

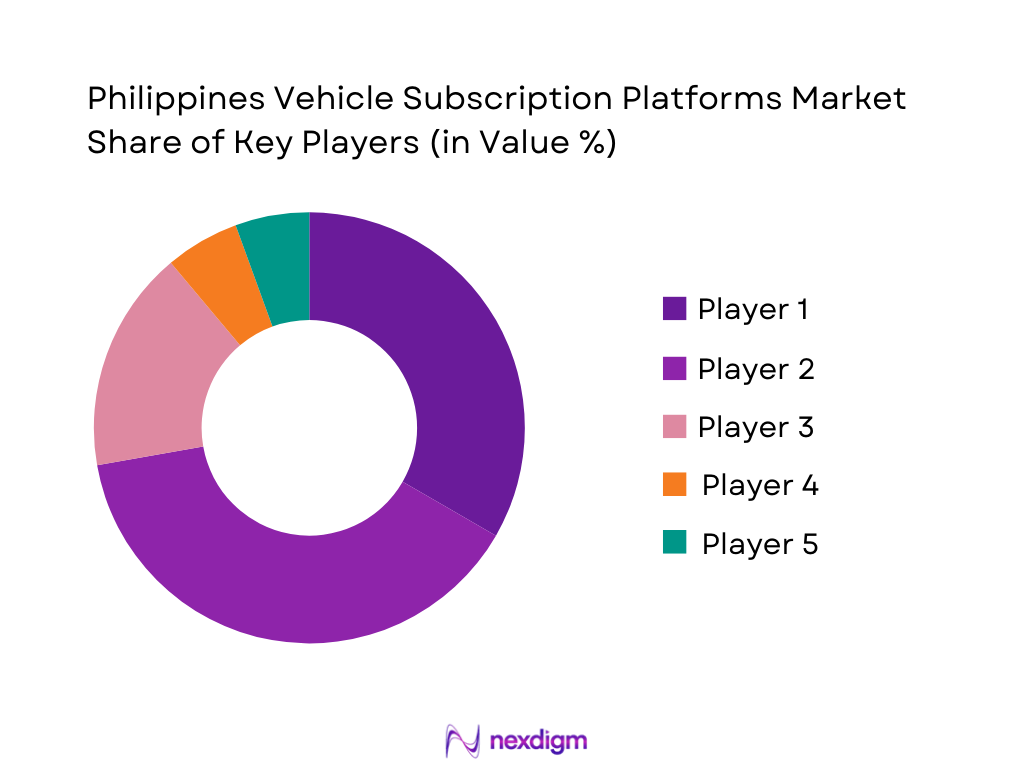

Competitive Landscape

The Philippines vehicle subscription platforms market is led by OEM-backed and fleet-operator models, with Toyota’s KINTO One positioned as a full-package usership/leasing offer available to individuals and businesses. Competition also comes from long-term rental and flexible fleet solutions (including monthly models), plus app-led subscription/rental hybrids that emphasize digital onboarding and rapid access.

| Company / Platform | Established | Headquarters | Platform Type | Typical Tenure Options | Mileage / Usage Packaging | Inclusions Bundle Depth | Booking & Fulfilment | Primary Target |

| Toyota Mobility Solutions Philippines – KINTO One | — | Philippines | ~ | ~ | ~ | ~ | ~ | ~ |

| Europcar Philippines – DuoFlex (monthly model) | — | Global / Philippines presence | ~ | ~ | ~ | ~ | ~ | ~ |

| invygo (app-led rental/subscription) | — | UAE (app available in Philippines) | ~ | ~ | ~ | ~ | ~ | ~ |

| Long-term fleet and corporate rental aggregators (multi-operator) | — | Philippines | ~ | ~ | ~ | ~ | ~ | ~ |

| Dealer-aligned flexible leasing programs (non-Toyota ecosystem) | — | Philippines | ~ | ~ | ~ | ~ | ~ | ~ |

Philippines Vehicle Subscription Platforms Market Dynamics and Ecosystem Analysis

Growth Drivers

Urban congestion and convenience premium

Metro Manila’s congestion is a structural “time tax” that increases the appeal of subscription-based vehicles that bundle access, service coordination, and faster availability versus traditional ownership and ad-hoc rentals. Japan International Cooperation Agency (JICA) and Philippine transport stakeholders cite Metro Manila congestion-linked transport costs estimated at PHP ~ billion per day (survey-based estimate), underscoring how predictable access and reduced downtime become valuable in daily mobility decisions. At the same time, demand-side fundamentals remain strong: the Philippines’ economy recorded a GDP of USD ~ billion (current US$), which supports urban consumption and mobility intensity, while new-vehicle throughput indicates continued motorization pressure. Consolidated industry reporting shows ~ vehicles sold in the country in the latest full-year release, reflecting the scale of household and SME vehicle demand that “spills over” into alternatives like subscriptions when congestion and parking friction rise.

Rising total cost of vehicle ownership

Even without using pricing or cost figures, macro indicators show persistent pressure on the household transport basket—fuel sensitivity, maintenance scheduling, and insurance participation—pushing consumers and SMEs to consider “vehicle-as-a-service” models that reduce administrative burden and smooth usage decisions. The Philippines received USD ~ billion in cash remittances coursed through banks, a large and stable inflow that supports vehicle-related consumption for many households, but it also amplifies expectations for predictable mobility in worker households with irregular cash-flow timing. In parallel, the payments and mobility ecosystem is scaling quickly: InstaPay processed ~ million transactions in October with a total value of PHP ~ billion, signaling that consumers are increasingly comfortable with recurring, app-based payments—an enabling behavior for subscription billing, damage deposits, and automated renewals. Against this backdrop, the economy’s scale (USD ~ billion GDP) supports ongoing vehicle demand, while the automotive market’s volume (~ units sold) demonstrates that ownership remains aspirational—yet rising friction around ownership administration (renewals, downtime coordination, claims, documentation) makes bundled subscription propositions more compelling for time-constrained professionals and SMEs.

Challenges

High upfront fleet capital requirements

Fleet-led subscription models face a structural constraint: they must secure and manage a sufficiently large, refreshed vehicle pool to meet demand peaks and minimize downtime, which is challenging in a market with strong baseline vehicle demand and rapid throughput. Consolidated automotive reporting recorded ~ vehicles sold in the latest full-year result, illustrating how many units are absorbed by retail and institutional buyers—tightening the availability of vehicles for subscription fleet build-out and forcing operators to compete for supply allocation. The macro backdrop matters: a USD ~ billion economy supports sustained consumption and business expansion, which increases the number of entities seeking vehicles for private use, SME operations, and corporate mobility. This scale can strain procurement planning for subscription platforms that need consistent OEM allocation, predictable delivery schedules, and standardized trims to simplify maintenance and resale cycles. The challenge intensifies when platforms aim to diversify vehicle categories (sedans, MPVs, small SUVs, light commercial vehicles) to match varied customer journeys.

Insurance and damage claim disputes

Insurance is a core dependency for vehicle subscriptions because platform trust depends on clear claims handling, coverage transparency, and predictable repair workflows—yet disputes can arise from documentation gaps, incident attribution, and repair authorization complexity. The scale of the formal motor insurance ecosystem is large and growing: the Insurance Commission’s industry release reported Net Premiums Written of PHP ~ billion, and it explicitly identifies the Motor Car line as the major contributor, with Motor Car net premiums increasing from PHP ~ billion to PHP ~ billion in the same reporting comparison. This large premium base indicates substantial motor risk volume flowing through the system, which also implies a high absolute number of claims and claim interactions. For subscription platforms, disputes can occur at the interface between customer agreements (wear-and-tear clauses, deductible responsibility), insurer documentation requirements, and repair network timelines. Where platforms operate across multiple cities, inconsistencies in repair capacity and documentation quality can produce friction in claims closure, vehicle turnaround time, and customer satisfaction—directly affecting fleet utilization.

Opportunities

Electric vehicle subscription bundles

EV bundling is an opportunity because it combines a policy tailwind with a market need for risk-managed adoption (battery anxiety, charging planning, service coordination) without requiring customers to commit to long-term ownership. The Philippines’ policy direction is clearly supportive: the government extended a ~ import tariff policy on electric vehicles and parts and widened coverage to include hybrids and light electric mobility categories, strengthening the near-term availability of EV models in the local market and expanding the addressable vehicle set for subscription bundles. This matters because the subscription model can package EV access with charging solutions, maintenance coordination, and usage-based fleet planning—reducing friction in the customer journey. Macro conditions are supportive: a USD ~ billion economy and remittance-backed household liquidity (bank-coursed cash remittances of USD ~ billion) create a foundation for higher-value mobility products when risk and complexity are managed by the service provider. For corporate customers, EV bundles can be positioned around sustainability reporting, fleet modernization, and predictable operational uptime—while for consumer users, EV subscriptions can act as a “trial channel” that normalizes EV driving behavior before purchase.

Partnerships with OEMs and dealerships

OEM and dealership partnerships are a high-leverage route to scale because they improve vehicle sourcing reliability, standardize aftersales support, and strengthen consumer trust via recognizable brands. This is particularly relevant in the Philippines given the market’s unit volume: ~ vehicles were sold in the latest consolidated reporting, signaling a large and active OEM-dealer ecosystem where partnerships can unlock consistent fleet allocation, priority servicing lanes, and structured remarketing pathways when vehicles rotate out of subscription fleets. OEM-linked subscription offerings already exist locally—Toyota Mobility Solutions Philippines markets a full-service leasing/subscription package positioned for both individuals and business owners—demonstrating that brand-backed models can help educate customers and reduce adoption friction. In addition, the formal risk ecosystem is sizable: the non-life insurance industry reported PHP ~ billion in net premiums written, with Motor Car as a major line, which supports bundled, insured subscription propositions when platforms integrate insurer workflows and dealership repair networks.

Future Outlook

Over the next several years, the Philippines vehicle subscription platforms market is expected to expand as urban congestion, high upfront ownership costs, and corporate fleet outsourcing preferences strengthen demand for bundled mobility. OEM-led “usership” will likely deepen penetration among SMEs and professionals, while flexible monthly models will attract project-based corporate demand. Policy signals that support electrification can also accelerate EV/hybrid trials through subscriptions, reducing adoption risk for fleets and high-mileage users.

Major Players

- Toyota Mobility Solutions Philippines

- Toyota Financial Services Philippines

- Europcar Philippines

- invygo

- Avis

- Hertz Philippines

- Budget Rent a Car Philippines

- Thrifty Car Rental Philippines

- Diamond Rent-a-Car Philippines

- Saferide Car Rental

- TransWealth Fleet & Parking Management

- VPI Cars

- AutoDeal ecosystem partners

- CARSOME Philippines

Key Target Audience

- Head of Corporate Fleet / Transport & Mobility

- Head of Procurement

- Head of Admin & Facilities

- Head of HR & Total Rewards

- Head of Sales Operations

- Head of Logistics & Distribution

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

We map the Philippines subscription mobility ecosystem covering OEM captives, rental operators, leasing firms, insurers, and digital platforms. We compile variables such as tenure design, mileage packaging, bundled services, underwriting rules, and fleet utilization levers using secondary research and structured platform feature benchmarking.

Step 2: Market Analysis and Construction

We build a bottom-up view using active offer scans (models available, tenure menus, mileage caps, inclusions) and triangulate against sector indicators such as new vehicle sales volumes and urban mobility constraints. We structure revenue logic around subscriber cohorts, average monthly fee bands, and utilization cycles.

Step 3: Hypothesis Validation and Expert Consultation

We validate adoption drivers and operating metrics through CATI-style expert consultations with fleet managers, leasing operators, and dealership-aligned mobility teams. Inputs focus on churn drivers, corporate procurement decision flows, underwriting constraints, and vehicle remarketing practices.

Step 4: Research Synthesis and Final Output

We synthesize findings into segment forecasts, competitive positioning, and go-to-market white spaces. Results are cross-validated against published market sizing from credible market research sources and anchored with policy/industry indicators relevant to the Philippines mobility environment.

- Executive Summary

- Research Methodology (Market definitions & platform taxonomy, assumptions & exclusions, abbreviations, market sizing approach, triangulation: fleet operators–OEMs–leasing firms–insurers, primary interviews: platform operators, dealerships, corporate mobility buyers, consumer panel checks, pricing capture by tenure/mileage/vehicle class, limitations & validation protocol)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Urban congestion and convenience premium

Rising total cost of vehicle ownership

Growth of corporate fleet outsourcing

Digitalization of auto finance and payments

Increasing acceptance of vehicle-as-a-service - Challenges

High upfront fleet capital requirements

Insurance and damage claim disputes

Consumer trust and fraud risks

Utilization volatility and churn - Opportunities

Electric vehicle subscription bundles

Partnerships with OEMs and dealerships

Corporate mobility programs

Tourism and short-term expatriate demand - Trends

Flexible tenure and swap-based plans

Bundled insurance and maintenance models

Telematics-driven pricing and risk management - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- By Value, 2019–2024

- By Fleet Units on Subscription, 2019–2024

- By Average Monthly Subscription Fee, 2019–2024

- By Platform Take-Rate / Margin Structure, 2019–2024

- By Fleet Type (in Value %)

Passenger cars

SUVs/MPVs

Vans

Pickups

Premium/luxury vehicles

Electric and hybrid vehicles - By Application (in Value %)

Personal commuting

Family mobility

Business travel

Field sales and service

Tourism and airport usage

Temporary replacement vehicles - By Technology Architecture (in Value %)

OEM-captive platforms

Independent digital-first platforms

Fleet-operator-led platforms

Dealer-led subscription models

Aggregator or marketplace platforms - By Connectivity Type (in Value %)

Telematics-enabled subscriptions

Mileage-verified subscriptions

Non-telematics subscriptions - By End-Use Industry (in Value %)

Retail consumers

Corporate fleets

MSMEs

Gig economy and ride-hailing partners

Government and NGOs - By Region (in Value %)

National Capital Region

Luzon corridors

Visayas hubs

Mindanao hubs

Tourism-driven clusters

- Market Share of Major Players

- Cross Comparison Parameters (fleet size and active subscribed units, average tenure and swap frequency, mileage policy and telematics enforcement, deposit and credit underwriting approach, insurance and claims inclusions, maintenance and roadside SLA coverage, delivery and pickup speed with city coverage, pricing transparency and cancellation structure)

- SWOT Analysis of Major Players

- Pricing Benchmarking by Vehicle Class and Tenure

- Detailed Profiles of Major Companies

Toyota Mobility Solutions Philippines

Toyota Financial Services Philippines

BPI Tokyo Century Rental Corporation

Diamond Rent-a-Car Philippines

ORIX Metro Leasing and Finance Corporation

Avis Philippines

Budget Philippines

Hertz Philippines

Europcar Philippines

Honda Leasing Partners

DOON PH

Mobii

GT Rentals PH

Diamond IGB Inc.

- Persona-wise demand assessment

- Decision-making journey

- Willingness-to-pay triggers

- Renewal and switching behavior

- By Value, 2025–2030

- By Fleet Units on Subscription, 2025–2030

- By Average Monthly Subscription Fee, 2025–2030

- By Platform Take-Rate / Margin Structure, 2025–2030