Market Overview

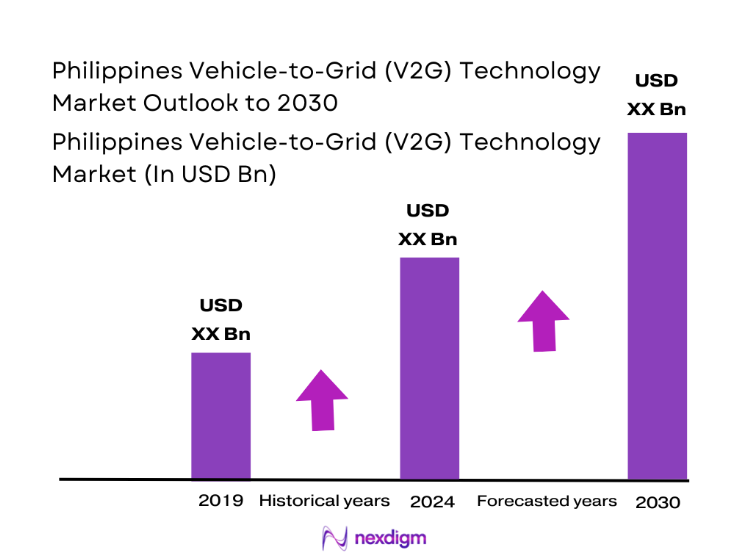

The Philippines Vehicle-to-Grid Technology Market is valued at USD ~, reflecting its early but structurally important position within the country’s evolving energy and mobility ecosystem. The market is anchored in the rapid buildout of electric vehicle charging infrastructure, smart grid investments, and growing demand for flexible power resources that can stabilize supply and demand imbalances. As utilities face rising peak loads and renewable energy penetration, bidirectional charging solutions are becoming strategically relevant for grid resilience, ancillary services, and distributed energy management.

Within the Philippines, metropolitan regions such as the National Capital Region, Calabarzon, and Central Visayas dominate early V2G readiness due to higher electric vehicle density, stronger utility digitalization, and greater commercial fleet electrification. These regions benefit from advanced distribution networks and higher energy demand concentration, making V2G applications commercially viable sooner. At the technology and solution level, global innovation leaders continue to shape local adoption pathways by setting hardware standards, software platforms, and grid integration models that local utilities and mobility operators increasingly reference when designing pilot programs and future-scale deployments.

Market Segmentation

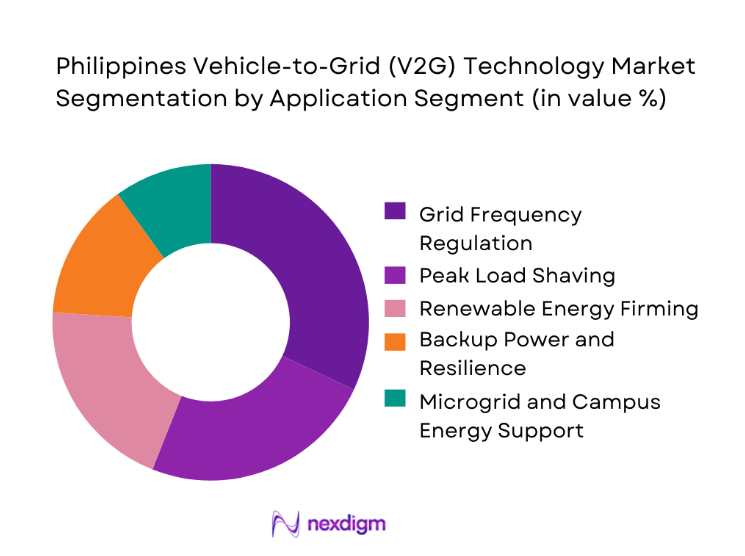

By Application Segment

The Philippines Vehicle-to-Grid Technology Market is segmented by application into grid frequency regulation, peak load shaving, renewable energy firming, backup power and resilience, and microgrid and campus energy support. Among these, grid frequency regulation dominates due to the growing need for fast-response energy balancing solutions as renewable generation expands across the country. Intermittent solar and wind resources place pressure on utilities to maintain stable voltage and frequency levels, and V2G-enabled electric vehicles offer a distributed, responsive asset base that can inject or absorb power in near real time. Utilities view this use case as the most immediate operational value of V2G, since it directly supports grid reliability without requiring large centralized storage investments. Commercial and public fleets parked for extended hours provide predictable availability windows, strengthening the practicality of this segment and reinforcing its leadership position in the market.

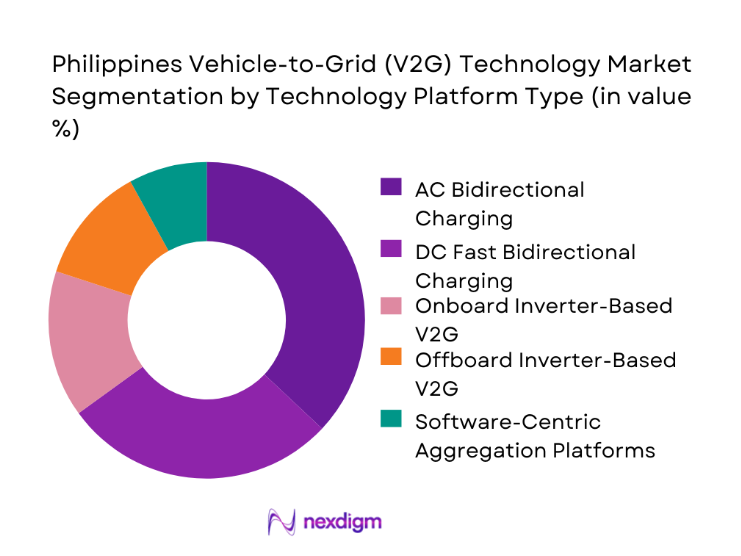

By Technology Platform Type

The market is segmented into AC bidirectional charging, DC fast bidirectional charging, onboard inverter-based V2G, offboard inverter-based V2G, and software-centric aggregation platforms. AC bidirectional charging currently dominates as it aligns well with existing residential and workplace charging infrastructure, offering a lower-cost and easier entry point for early V2G adoption. This technology integrates smoothly with standard charging equipment upgrades rather than full system replacements, making it attractive to utilities, fleet operators, and property developers seeking incremental deployment strategies. In the Philippine context, where charging networks are still scaling, the flexibility and affordability of AC-based solutions enable faster market penetration. Their compatibility with a wide range of electric vehicle models also supports broader user participation, reinforcing this segment’s leadership as the foundational layer of the V2G ecosystem.

Competitive Landscape

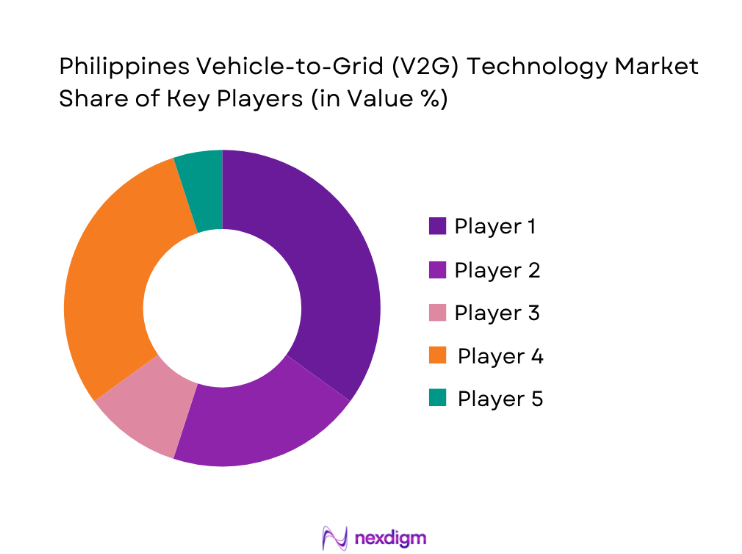

The Philippines Vehicle-to-Grid Technology market is dominated by a few major players, including Nissan Motor Corporation and global or regional brands like ABB, Schneider Electric, and Nuvve. This consolidation highlights the significant influence of these key companies.

| Company | Est. Year | Headquarters | V2G Tech Deployment | Grid Partnership Footprint | EV Fleet Integration | Software & Analytics | Charging Hardware Capability | Service & Support Network |

| Nissan | 1933 | Japan | ~ | ~ | ~ | ~ | ~ | ~ |

| ABB | 1988 | Switzerland | ~ | ~ | ~ | ~ | ~ | ~ |

| Schneider Electric | 1836 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| Nuvve | 2010 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Enel X | 2008 | Italy | ~ | ~ | ~ | ~ | ~ | ~ |

Philippines Vehicle-to-Grid (V2G) Technology Market Analysis

Growth Drivers

Grid modernization and smart infrastructure expansion

The expansion of smart grid technologies across the Philippines is creating a strong foundation for the adoption of Vehicle-to-Grid solutions. Utilities are investing in advanced metering, distribution automation, and digital control systems to improve power quality and reduce outages. These upgrades enable the two-way energy flows required for V2G operations, transforming electric vehicles into active grid assets rather than passive loads. As digital infrastructure matures, utilities gain the operational confidence to integrate distributed energy resources at scale. This shift accelerates demand for V2G platforms that can coordinate thousands of vehicles simultaneously, positioning the technology as a strategic component of long-term grid resilience and operational efficiency.

Rising electric vehicle adoption

The accelerating uptake of electric vehicles across personal, commercial, and public transport segments is expanding the addressable base for V2G participation. As more vehicles with bidirectional charging capability enter the market, the cumulative storage potential grows significantly. This expanding fleet base enhances the economic logic of V2G by lowering per-unit infrastructure costs and increasing aggregated energy capacity available to utilities. In the Philippines, fleet electrification programs in logistics, ride-hailing, and public transport create concentrated nodes of V2G readiness. These clusters allow early commercial models to emerge, demonstrating financial viability and encouraging broader adoption across the mobility ecosystem.

Challenges

Regulatory uncertainty and interconnection standards

One of the most significant barriers to V2G deployment in the Philippines is the lack of clearly defined regulatory frameworks governing bidirectional power flow between vehicles and the grid. Utilities and technology providers face ambiguity around interconnection rules, metering requirements, and compensation mechanisms for energy exported from vehicles. Without standardized protocols, project developers encounter delays in approvals and higher compliance costs. This uncertainty slows pilot-to-scale transitions and discourages private investment in supporting infrastructure. Clear regulatory direction is essential to unlock confidence among stakeholders and establish consistent operational practices across utilities and service providers.

High upfront infrastructure cost

The capital intensity associated with bidirectional chargers, grid upgrades, and advanced energy management systems presents another major hurdle. Compared to conventional charging stations, V2G-enabled infrastructure requires more sophisticated hardware and software integration, raising installation and maintenance costs. For fleet operators and property developers, the return on investment is not immediately apparent without established revenue models for grid services. This cost barrier limits early adoption to well-funded pilots rather than mass-market deployment. Overcoming this challenge will depend on policy incentives, utility cost-sharing frameworks, and innovative financing models that reduce financial exposure for early adopters.

Opportunities

Commercial fleet electrification

Commercial fleets represent one of the most promising growth avenues for the Philippines V2G market. Delivery vehicles, corporate transport fleets, and public service vehicles operate on predictable schedules and return to centralized depots, making them ideal candidates for aggregated energy services. These fleets can provide utilities with reliable, dispatchable storage capacity during peak demand periods while generating new revenue streams for fleet owners. As fleet electrification accelerates, V2G can be embedded as a standard feature of fleet energy management strategies, positioning the segment as a primary commercial driver of market expansion.

Microgrid and island grid resilience solutions

The Philippines’ geography, characterized by numerous islands and remote communities, creates unique opportunities for V2G in microgrid and off-grid environments. Electric vehicles integrated into local energy systems can enhance resilience by supplying backup power during outages and supporting renewable-heavy microgrids. This application is particularly relevant for disaster-prone areas where grid disruptions are frequent. By enabling localized energy security, V2G becomes not just a grid optimization tool but a resilience strategy that aligns with national priorities on disaster preparedness and energy access, opening new public and private sector investment pathways.

Future Outlook

The Philippines Vehicle-to-Grid Technology Market is positioned to evolve from pilot-driven experimentation to structured commercialization as electric mobility, renewable energy, and smart grid initiatives converge. Over the coming years, coordinated efforts between utilities, mobility providers, and technology firms will shape standardized frameworks that enable scalable deployment. As regulatory clarity improves and infrastructure costs decline, V2G is expected to transition into a core component of the country’s distributed energy strategy, supporting grid reliability, energy security, and the broader shift toward a more digital and decentralized power system.

Major Players

- Nissan Motor Corporation

- ABB Ltd.

- Schneider Electric SE

- Nuvve Corporation

- Enel X

- Siemens AG

- BYD Co. Ltd.

- Delta Electronics Inc.

- Hyundai Motor Company

- Mitsubishi Motors Corporation

- Honda Motor Co. Ltd.

- Tesla Inc.

- ChargePoint

- EVBox Group

Key Target Audience

- Electric utilities and distribution companies

- EV manufacturers and automotive OEMs

- Charging infrastructure developers and operators

- Commercial fleet and logistics operators

- Renewable energy project developers

- Investments and venture capitalist firms

- Government and regulatory bodies

- Smart city and urban infrastructure authorities

Research Methodology

Step 1: Identification of Key Variables

The research begins with mapping the complete ecosystem of the Philippines Vehicle-to-Grid Technology Market, identifying utilities, mobility providers, regulators, and technology vendors. Secondary research across policy documents, industry publications, and proprietary databases establishes the foundational variables that influence market dynamics. These variables form the basis for market sizing and segmentation logic.

Step 2: Market Analysis and Construction

Historical data on electric vehicle adoption, charging infrastructure deployment, and grid modernization initiatives are compiled to construct the market framework. This phase focuses on understanding demand patterns, infrastructure readiness, and revenue generation pathways. Quantitative insights are synthesized with sector-level trends to build a coherent market structure.

Step 3: Hypothesis Validation and Expert Consultation

Preliminary findings are validated through structured consultations with industry stakeholders including utility planners, fleet managers, and technology providers. These expert discussions refine assumptions related to adoption timelines, commercial models, and regulatory impact. Feedback from practitioners ensures the market narrative reflects operational realities.

Step 4: Research Synthesis and Final Output

The final phase integrates all quantitative and qualitative inputs into a unified analytical framework. Cross-validation of data sources ensures consistency and credibility. The result is a comprehensive, client-ready report that presents a balanced, actionable view of the Philippines Vehicle-to-Grid Technology Market.

- Executive Summary

- Research Methodology (Market definitions and scope boundaries, terminology and abbreviations, V2G and bidirectional charging taxonomy, market sizing logic by enabled vehicles chargers and dispatched capacity, revenue attribution across hardware software aggregation and services, primary interview program with utilities OEMs charging operators and aggregators, data triangulation and validation approach, assumptions limitations and data gaps)

- Definition and Scope

- Market Genesis and Readiness of Bidirectional Charging in the Philippines

- Grid Reliability Context and Flexibility Needs in Key Load Centers

- V2G Value Stack Across Vehicle Charger Aggregator and Market Operator

- Interconnection and Export Rules for Distributed Energy Resources

- Utility Program Landscape and Fleet Led Deployment Models

- Growth Drivers

Grid reliability concerns driving interest in flexible capacity

Fleet electrification growth in buses delivery and corporate transport

Rising electricity prices and demand charge exposure for C and I sites

Renewable integration needs and daytime solar variability

Expansion of campus and industrial estate energy management programs - Challenges

Limited bidirectional capable vehicle availability and model constraints

Interconnection approvals and export metering complexity

Battery warranty concerns and cycle life impact perception

Operational complexity for fleet dispatch and charging schedules

Cybersecurity and data governance requirements for grid connected assets - Opportunities

Depot led V2G for e bus fleets and high utilization operators

Bundled charger software and revenue share contracting models

Integration with onsite solar storage and building energy management

Resilience programs for critical facilities and disaster response sites

Standardized interoperability frameworks for chargers vehicles and aggregators - Trends

Shift from pilots to fleet anchored deployments

Growth of virtual power plant models using aggregated EV fleets

Increasing role of microgrids in industrial estates and campuses

Standardization push for communications and metering workflows

Commercialization of bidirectional charging portfolios by charger OEMs - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- By Enabled Vehicle Base, 2019–2024

- By Bidirectional Charger Installed Base, 2019–2024

- By Dispatchable Capacity and Events Delivered, 2019–2024

- By Fleet Type (in Value %)

Electric bus fleets and public transport operators

Commercial delivery and logistics fleets

Municipal and government fleets

Workplace and campus fleets

Light duty consumer EVs - By Application (in Value %)

Peak shaving and demand response

Backup power and site resilience

Renewable smoothing and curtailment reduction

Microgrid participation and critical facility support

Capacity support for constrained feeders - By Technology Architecture (in Value %)

AC bidirectional charging systems

DC bidirectional charging systems

Depot scale bidirectional charging hubs

Onboard inverter enabled bidirectional platforms

Offboard inverter enabled bidirectional platforms - By Connectivity Type (in Value %)

Utility managed V2G programs

Aggregator managed V2G platforms

Charger operator managed V2G services

OEM managed energy services and app ecosystems

Microgrid controller integrated dispatch platforms - By End-Use Industry (in Value %)

Electric utilities and distribution operators

Charging infrastructure developers and operators

Fleet operators and depot managers

Commercial and industrial site hosts

Microgrid and energy service companies - By Region (in Value %)

NCR

CALABARZON

Central Luzon

Visayas

Mindanao

- Competitive ecosystem structure across aggregators charger OEMs utilities and fleet operators

- Positioning driven by dispatch performance interoperability and program readiness

- Partnership models across OEMs fleets utilities and energy service providers

- Cross Comparison Parameters (bidirectional charger efficiency, export power rating and duty cycle, interoperability and standards compliance readiness, aggregation platform dispatch latency, metering and settlement capability, cybersecurity posture and device management, program revenue capture and contract flexibility, warranty alignment and battery impact controls)

- SWOT analysis of major players

- Pricing and commercial model benchmarking

- Detailed Profiles of Major Companies

Nuvve

Fermata Energy

The Mobility House

Autogrid

EnergyHub

ABB

Siemens

Schneider Electric

Eaton

ChargePoint

Wallbox

Enel X

Powerledger

ACEN

MERALCO

- Fleet participation drivers and operational constraints

- Utility program design priorities and performance requirements

- Aggregator contracting models and settlement readiness

- Site host economics for resilience and bill reduction

- Risk factors across warranty liability and uptime expectations

- By Value, 2025–2030

- By Enabled Vehicle Base, 2025–2030

- By Bidirectional Charger Installed Base, 2025–2030

- By Dispatchable Capacity and Events Delivered, 2025–2030