Market Overview

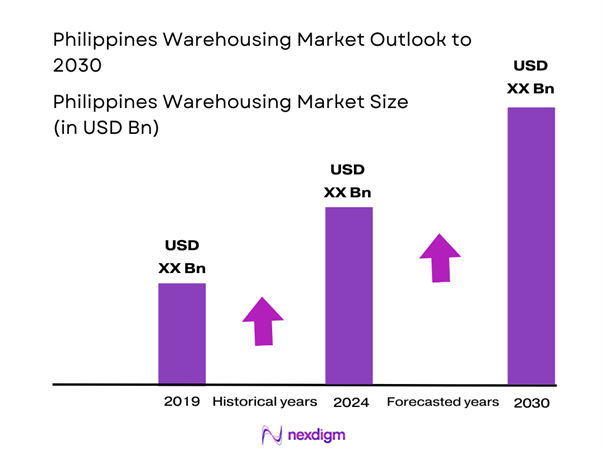

The Philippines warehousing market is valued at approximately USD 3.2 billion in 2024 with an approximated compound annual growth rate (CAGR) of 5.7% from 2024-2030, supported by the rapid growth of the e-commerce sector coupled with infrastructural improvements across the archipelago. The market has seen a surge due to heightened demand for storage solutions as businesses expand their operations to cater to a growing online consumer base. Reliable data indicate that the market is on track to reach USD 4.5 billion, as logistics services evolve to meet dynamic consumer needs, particularly in urban areas where demand for warehousing infrastructure is substantial.

The National Capital Region (NCR), particularly Metro Manila, along with Calabarzon and Central Luzon, dominate the Philippine warehousing market due to their strategic geographic locations and advanced infrastructure. Metro Manila serves as the country’s commercial and economic hub, making it a prime spot for distribution centers. The proximity to international ports, improved road networks, and rising urbanization rates contribute to these regions’ appeal as they enable businesses to streamline their supply chains effectively.

The urban population in the Philippines is growing rapidly with projections estimating that over 55% of the total population will be urban by end of 2025. The Philippine Statistics Authority indicated that the country’s population is expected to reach approximately 115 million in 2025. This urbanization trend correlates with an increase in demand for warehousing due to the concentration of consumer markets and industrial activities in urban centers.

Market Segmentation

By Warehousing Type

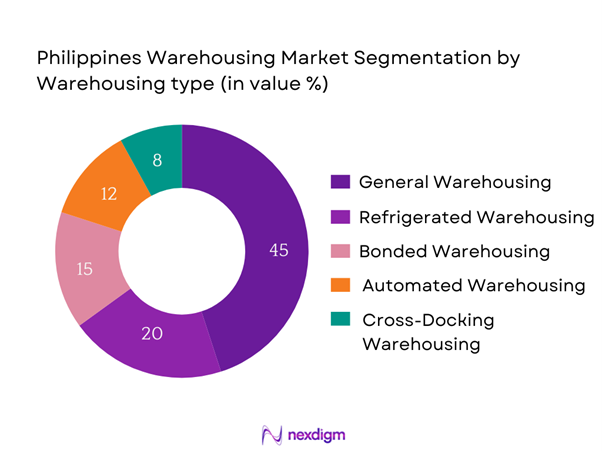

The Philippine warehousing market is segmented by warehousing type into general warehousing, refrigerated warehousing, bonded warehousing, automated warehousing, and cross-docking warehousing. Among these, general warehousing holds a dominant market share due to its versatility in accommodating various goods from different sectors, including retail and manufacturing. General warehousing provides businesses with the necessary flexibility to adapt to changing demands, allowing significant cost savings in long-term operations. Additionally, increased activity in e-commerce and logistics enables facilities designed for general warehousing to be utilized more efficiently, further solidifying its leading position in the market.

By End-User Industry

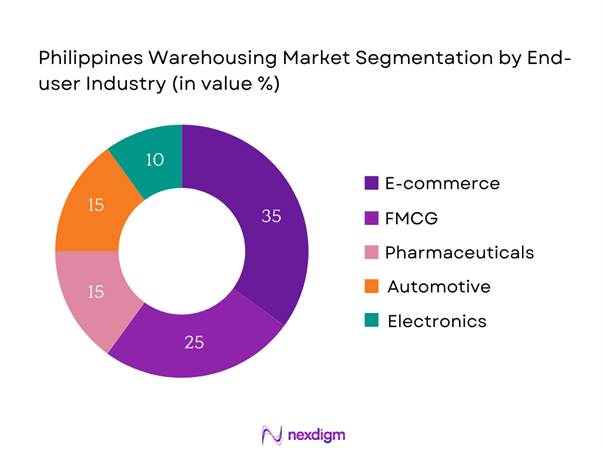

The market is also segmented by end-user industry, which includes e-commerce, FMCG (Fast-Moving Consumer Goods), pharmaceuticals, automotive, and electronics. The e-commerce segment reflects a significant share as it thrives on the need for efficient and timely deliveries, which necessitates increased warehousing capacity. As more consumers turn to online shopping, e-commerce companies are investing heavily in warehousing solutions to ensure they can meet consumer expectations for quick order fulfillment. This segment’s explosive growth is driven by technological advancements and changing consumer behavior, fostering a robust logistics and warehousing environment.

Competitive Landscape

The Philippines warehousing market is dominated by several key players, including local firms and international corporations that have established a strong presence in the region. Companies like JLL, Ayala Land Logistics, and Robinsons Land Corporation exemplify competitiveness through strategic investments and innovative warehousing solutions. This consolidation highlights the significant influence of these major companies, which are adept at responding to the needs of a rapidly evolving market landscape.

| Company Name | Establishment Year | Headquarters | Market Share (%) | Warehousing Type | Major Clients | Unique Offerings |

| JLL | 1783 | Chicago, USA | – | – | – | – |

| Ayala Land Logistics | 1996 | Makati, Philippines | – | – | – | – |

| Robinsons Land Corporation | 1980 | Pasig City, Philippines | – | – | – | – |

| Prologis | 1983 | San Francisco, USA | – | – | – | – |

| Storeco | 1997 | Quezon City, Philippines | – | – | – | – |

Philippines Warehousing Market Analysis

Growth Drivers

Expansion of E-commerce Sector

The Philippines’ e-commerce sector is experiencing rapid growth, with an estimated revenue of USD 24 billion in 2022 and projected to reach USD 32.7 billion by end of 2025. This growth is driving demand for warehousing solutions that cater to online retailers looking for efficient logistics. There were approximately 60 million internet users in the country in 2022, contributing to an increased online shopping behavior where over 80% of consumers prefer digital channels. The rise in e-commerce has necessitated a more extensive warehousing infrastructure to support faster fulfillment and logistics operations.

Growth in Foreign Direct Investments

Foreign direct investment (FDI) in the Philippines reached approximately USD 11.3 billion in 2022, a significant portion of which is directed toward infrastructure and logistics sectors, including warehousing. The Philippine government aims to attract further foreign investments through initiatives, such as reducing the corporate income tax rate to 25% and enhancing ease of doing business. Investment in logistics has increased by about 12% annually, reflecting foreign interest in tapping into the growing consumer market and established logistics networks to support business operations.

Market Challenges

Infrastructure Limitations

Despite the growing demand for warehousing solutions, the Philippines faces significant infrastructure limitations that impact the logistics sector. The World Economic Forum’s Global Competitiveness Report noted that only 73% of roads in the Philippines were paved as of 2022, leading to inefficiencies in supply chain operations. Moreover, the country ranked 91st out of 141 nations in terms of overall infrastructure quality, which significantly affects transportation and logistics efficiency. Addressing these challenges through investments is essential for enhancing warehousing capabilities and operations across the archipelago, especially given its geographic layout.

Regulatory and Compliance Hurdles

The warehousing industry in the Philippines contends with complex regulatory and compliance frameworks that create challenges for operations. According to the World Bank’s Ease of Doing Business Index, the Philippines ranks 95th out of 190 economies for business regulations affecting logistics and warehousing. Businesses face lengthy processes for securing permits and licenses, which can result in delays. Additionally, compliance with various environmental and safety regulations adds an extra layer of complexity to warehouse operations. Streamlining these processes is essential for firms to operate efficiently within the market.

Opportunities

Technology Integration and Automation

The increasing integration of technology within the warehousing sector presents substantial growth opportunities. In 2022, over 30% of logistics companies in the Philippines had begun implementing automated systems, such as warehouse management systems (WMS) and robotics. The adoption of these technologies is expected to improve efficiency, and reduce operational costs, while enhancing inventory management accuracy. With the logistics technology market expected to grow by USD 14.82 billion globally from 2022 to 2025, the Philippines stands to benefit significantly from incorporating modern systems in warehousing to streamline operations and boost productivity

Sustainability Initiatives in Logistics

Sustainability has become a critical focus within the logistics and warehousing industry, with a growing emphasis on eco-friendly practices. According to the Philippine Department of Transportation, 40% of logistics players have initiated sustainability initiatives in their supply chains as of 2022, including the adoption of energy-efficient technologies and reduced carbon footprints. The push for sustainable warehousing solutions is further driven by consumer preference shifts toward environmentally responsible products and services.

Future Outlook

Over the next five years, the Philippines warehousing market is expected to show significant growth, driven by the continuous expansion of the e-commerce sector, improvements in logistics and infrastructure, and increasing consumer demand for timely deliveries. Technological advancements, such as automation and AI, are anticipated to further enhance operational efficiency in warehousing, while government initiatives to boost logistics capabilities will support sustained growth. As companies invest more into logistics, the market’s competitive landscape will become even more dynamic, ultimately benefiting customers with improved service delivery and cost efficiency.

Major Players

- JLL (Jones Lang LaSalle)

- Ayala Land Logistics

- Robinsons Land Corporation

- Prologis

- Storeco

- GMR (GMR Infrastructure)

- DHL Supply Chain Philippines

- 2Go Group, Inc.

- CEVA Logistics

- San Miguel Properties

- XPO Logistics

- Q Logistics

- Nex Logistics

- Brown Company

- Megaworld Corporation

Key Target Audience

- E-commerce companies

- Retail organizations

- FMCG manufacturers

- Pharmaceutical companies

- Automotive manufacturers

- Electronics manufacturers

- Investments and venture capitalist firms

- Government and regulatory bodies (Department of Trade and Industry, Bureau of Customs)

Research Methodology

Step 1: Identification of Key Variables

The research begins with constructing an ecosystem map of the warehousing market in the Philippines. This involves identifying the major stakeholders, including logistics service providers, warehousing companies, and end-users. Comprehensive desk research is utilized, drawing from secondary data and proprietary databases to compile a clear picture of the market dynamics.

Step 2: Market Analysis and Construction

Historical data related to the warehousing market is compiled and analyzed during this phase. This includes examining the demand for warehousing, market penetration rates, and the activities of key service providers within the industry. An assessment of service quality statistics is conducted to ensure accurate estimations of market revenue and growth potential.

Step 3: Hypothesis Validation and Expert Consultation

In order to refine market hypotheses, computer-assisted telephone interviews (CATI) are conducted with industry experts. This takes into account feedback from a diverse range of companies in the warehousing sector, providing valuable operational and financial insights to strengthen the overall analysis of the market.

Step 4: Research Synthesis and Final Output

The final phase focuses on engaging with key players in the warehousing market to acquire significant insights regarding industry-specific factors, sales performances, product offerings, and consumer preferences. This engagement serves as a verification mechanism, ensuring that the data collected reflects a comprehensive analysis of the warehousing market landscape.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Expansion of E-commerce Sector

Growth in Foreign Direct Investments

Urbanization and Population Growth - Market Challenges

Infrastructure Limitations

Regulatory and Compliance Hurdles - Opportunities

Technology Integration and Automation

Sustainability Initiatives in Logistics - Trends

Rise of Smart Warehousing

Adoption of AI and IoT in Logistics - Government Regulation

Policies Affecting Warehousing operations

Tax Incentives for Logistics Sector - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Warehousing Type (In Value %)

General Warehousing

– Dry Goods Storage

– Bulk Commodity Storage

– Multi-Client Shared Warehousing

Refrigerated Warehousing

– Chilled Storage (2°C to 8°C)

– Frozen Storage (-18°C and below)

– Pharma-Grade Cold Rooms

Bonded Warehousing

– Import/Export Bonded Goods Storage

– Customs-Approved Duty-Free Facilities

Automated Warehousing

– AS/RS (Automated Storage and Retrieval Systems)

– Conveyor-Based Storage Systems

– Robotic Picking & Packing Systems

Cross-Docking Warehousing

– Inbound Consolidation Points

– Outbound Sorting and Forwarding

– Minimal Storage Turnaround Hubs - By End-User Industry (In Value %)

E-commerce

– Fulfillment Centers for Online Marketplaces

– Reverse Logistics Warehouses

– High Turnover Sorting Facilities

FMCG

– Dry Goods for Food & Beverages

– Hygiene & Personal Care Items

– High-Speed Pick-Pack Zones

Pharmaceuticals

– Temperature-Controlled Drug Storage

– Medical Device Warehousing

– Regulatory-Compliant Storage

Automotive

– Spare Parts Warehousing

– Tyre & Battery Storage

– Aftermarket Parts Distribution

Electronics

– Climate-Controlled Warehouses

– Anti-Static Equipment Storage

– High-Security Storage Units - By Region (In Value %)

National Capital Region (NCR)

Calabarzon

Central Luzon

Visayas

Mindanao - By Facility Size (In Value %)

Small (< 20,000 sq. ft)

– Urban Mini-Warehouses

– SME and Last-Mile Storage

Medium (20,000–100,000 sq. ft)

– Regional Distribution Centers

– Mid-Scale Fulfillment Warehouses

Large (> 100,000 sq. ft)

– National Hubs

– Multinational Storage and Consolidation Centers - By Service Type (In Value %)

Third-Party Logistics (3PL)

– Contract-Based Storage & Fulfillment

– Vendor-Managed Inventory Solutions

Distribution Management

– Regional Replenishment Hubs

– Cross-Border Logistics Coordination

Inventory Management

– Real-Time Inventory Tracking Systems

– SKU-Level Visibility and Forecasting Tools

Transportation Management

– Integrated Trucking & Dispatching

– Route Optimization and Delivery Scheduling

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Warehousing Type, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Revenues by Warehousing Type, Number of Touchpoints, Distribution Channels, Number of Dealers and Distributors, Margins, Production Plant, Capacity, Unique Value Offering, and others)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

JLL (Jones Lang LaSalle)

Colliers International

GMR (GMR Infrastructure)

Prologis

Storeco

Robinsons Land Corporation

Ayala Land Logistics

XPO Logistics

A. Brown Company

S&R Membership Shopping

San Miguel Properties

Megaworld Corporation

2Go Group, Inc.

DHL Supply Chain Philippines

CEVA Logistics

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030