Market Overview

Philippines Wheel Alignment Systems Market is valued at USD ~ million, reflecting its role as a core enabler of vehicle safety, tire lifecycle optimization, and suspension integrity across the country’s expanding automotive parc. Structural demand is driven by sustained growth in registered vehicles, extended vehicle ownership cycles, and uneven road conditions that accelerate alignment drift. Wheel alignment systems function as repeat-use workshop assets rather than one-time installations, anchoring their demand to service frequency rather than new vehicle sales alone. Preventive maintenance adoption among private vehicle owners and commercial fleets has increased alignment checks during tire replacement, suspension repair, and periodic servicing. Additionally, rising fuel efficiency awareness and safety compliance requirements are reinforcing alignment as a non-negotiable service line, making equipment uptime and accuracy critical for workshop profitability and customer retention.

Demand concentration is highest in Metro Manila due to vehicle density, traffic intensity, and the presence of dealership-led and organized multi-brand service networks. Luzon corridors surrounding industrial and logistics hubs follow, supported by commercial fleet activity, while Visayas and Mindanao show steady penetration through regional service chains. Global equipment manufacturers dominate system technology and calibration software, influencing local adoption standards through authorized distributors. Domestic players mainly participate as integrators, installers, and service partners rather than core technology developers. Global vendors shape accuracy benchmarks, upgrade cycles, and training protocols, while local distributors influence pricing structures, financing access, and aftermarket reach, together defining the competitive structure of the market.

Market Segmentation

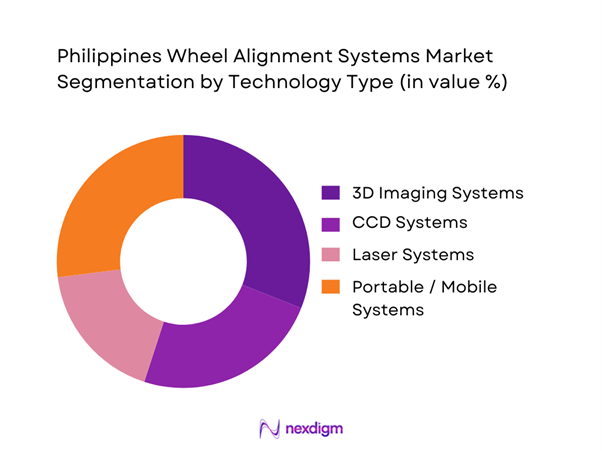

By Technology Type

3D imaging alignment systems dominate the Philippines wheel alignment systems market due to their superior accuracy, faster service turnaround, and compatibility with modern vehicle architectures. As vehicle suspensions become more complex and customer expectations shift toward measurable precision, workshops increasingly prioritize 3D systems over manual or laser-based alternatives. These systems enable real-time measurements, digital reporting, and reduced dependency on highly specialized technician judgment, which is particularly important in markets facing skill constraints. 3D platforms also support integration with wheel balancing and diagnostic workflows, allowing workshops to upsell bundled services and improve bay productivity. Dealership service centers and high-volume independent workshops are the primary adopters, as they require consistency across multiple vehicle models. Over time, declining relative complexity of installation and improved distributor support have further strengthened the position of 3D systems within the local market.

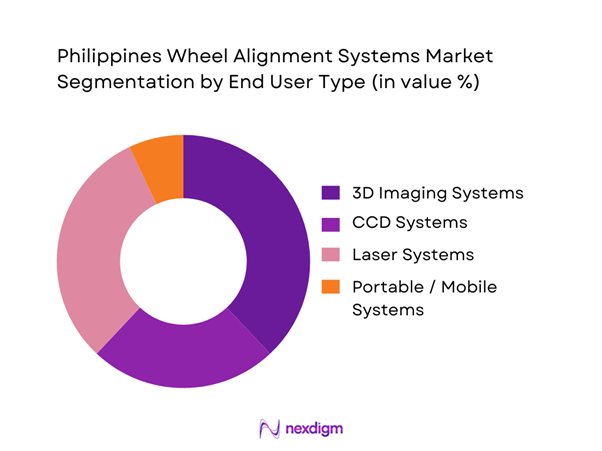

By End User Type

Private vehicle owners represent the largest share of end-user demand, driven by the country’s large base of personal vehicles and rising awareness of preventive maintenance benefits. Alignment services are typically consumed during tire replacement, suspension repair, or periodic servicing, making this segment structurally resilient. While commercial fleets demonstrate higher service frequency, the sheer volume of private vehicles sustains consistent workshop utilization. Consumer preference for smoother ride quality and tire cost optimization further reinforces demand. Independent multi-brand workshops capture a significant portion of this segment by offering competitively priced alignment services compared to dealerships. As urban traffic congestion and road surface variability increase wear rates, private owners increasingly view alignment as a necessary maintenance activity rather than an optional service, strengthening long-term demand fundamentals.

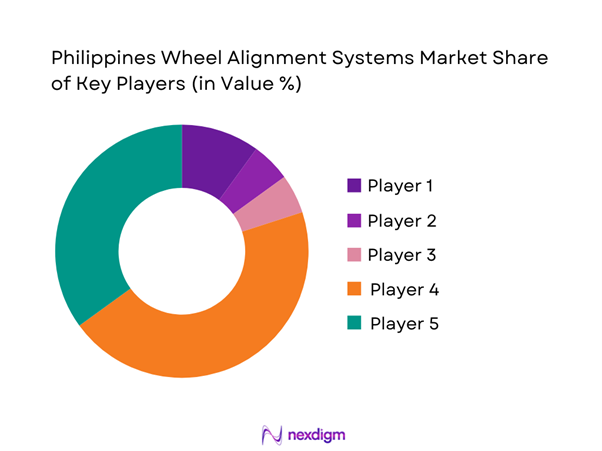

Competitive Landscape

The Philippines Wheel Alignment Systems market is dominated by a few major players, including Hunter Engineering Company and global or regional brands like Bosch Automotive Service Solutions, Snap-on Equipment, and Launch Tech. This consolidation highlights the significant influence of these key companies.

| Company | Establishment Year | Headquarters | Product Breadth (Alignment Range) | Typical Buyer Type | After-Sales Model Strength | Software/Database Updates | Training Enablement | ADAS / Alignment Integration Readiness |

| Hunter Engineering | 1946 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Snap-on / John Bean / Hofmann | 1920 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Bosch Automotive Service Solutions | 1886 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| Launch Tech | 1992 | China | ~ | ~ | ~ | ~ | ~ | ~ |

| Ravaglioli (Vehicle Service Group ecosystem) | 1958 | Italy | ~ | ~ | ~ | ~ | ~ | ~ |

Philippines Wheel Alignment Systems Market Analysis

Growth Drivers

Rising Vehicle Parc and Extended Ownership Cycles

Sustained growth in the national vehicle parc combined with longer vehicle retention periods is increasing cumulative suspension wear across passenger and commercial vehicles. As vehicles age, misalignment becomes more frequent due to bushing degradation, shock absorber wear, and road impact stress. This directly elevates alignment service frequency, particularly outside warranty periods when owners shift from dealerships to independent workshops. For service providers, higher vehicle age translates into predictable, repeat demand, justifying investment in alignment systems with higher throughput and consistency. The structural outcome is a shift from reactive alignment checks to routine preventive service inclusion, strengthening long-term utilization rates of installed systems.

Expansion of Organized Automotive Service Infrastructure

The steady expansion of dealership service networks and organized multi-brand workshop chains is accelerating equipment standardization across the country. These operators prioritize service repeatability, digital reporting, and technician-independent accuracy, which favors advanced alignment systems over manual alternatives. As organized players expand beyond Metro Manila into secondary cities, they carry uniform service protocols that mandate alignment capability. This not only increases system installations but also raises the baseline technology expectation across the broader workshop ecosystem, indirectly pressuring smaller players to upgrade.

Challenges

High Capital Intensity for Advanced Alignment Systems

Modern 3D and imaging-based alignment systems require significant upfront investment, including calibration infrastructure and periodic software updates. For small independent workshops operating on thin margins, this capital intensity delays adoption despite clear service demand. Financing constraints and uncertain payback periods outside high-traffic urban locations further compound the issue. As a result, market penetration remains uneven across regions, limiting total addressable demand for high-end systems.

Technician Skill Gaps and Utilization Inefficiencies

Effective deployment of alignment systems depends on technician competency in setup, interpretation, and corrective procedures. Skill gaps lead to underutilization, inaccurate readings, and longer service times, reducing return on investment. Inconsistent training availability across regions restricts operational efficiency, particularly for independent workshops, creating a bottleneck that slows technology diffusion even where equipment demand exists.

Opportunities

Upgrade Cycle Toward 3D and Digitally Integrated Systems

A significant opportunity lies in replacement and upgrade cycles as workshops move from manual, laser, or CCD platforms to 3D systems. Digital alignment reporting, faster bay turnaround, and integration with wheel balancing and diagnostic tools enable service bundling and higher average ticket values. Vendors offering modular upgrades, financing, and training support can accelerate adoption among mid-tier workshops.

Fleet Maintenance Contract Expansion

Commercial fleets increasingly seek predictable maintenance outcomes and reduced downtime. Alignment system providers can capitalize by partnering with fleet service operators to deploy high-throughput systems under long-term maintenance contracts. This model shifts revenue emphasis from one-time equipment sales to recurring service alignment demand, improving market stability and visibility.

Future Outlook

The Philippines wheel alignment systems market is expected to evolve toward higher precision, digitally integrated platforms aligned with workshop productivity goals and preventive maintenance models. Technology differentiation, service support, and training ecosystems will become as critical as hardware capability. Market expansion will be driven less by first-time adoption and more by replacement cycles and upgrades to advanced systems, particularly in organized service networks and fleet-focused workshops.

Major Players

- Hunter Engineering Company

- Bosch Automotive Service Solutions

- Snap-on Equipment

- Launch Tech

- Ravaglioli

- Hofmann

- John Bean

- Beissbarth

- Corghi

- Mahle Aftermarket

- Werther International

- Bright Technology

Key Target Audience

- Automotive service equipment manufacturers

- Independent multi-brand workshop chains

- Automotive dealership groups

- Commercial fleet operators

- Logistics and delivery companies

- Tire and suspension service specialists

- Investments and venture capitalist firms

- Government and regulatory bodies (Philippines)

Research Methodology

Step 1: Identification of Key Variables

Assessment of vehicle parc characteristics, service frequency drivers, workshop density, and equipment utilization patterns specific to wheel alignment systems.

Step 2: Market Analysis and Construction

Mapping of demand across service formats, technology types, and regions, combined with revenue attribution across installation and service use cases.

Step 3: Hypothesis Validation and Expert Consultation

Validation through interviews with workshop owners, equipment distributors, and service technicians to refine adoption drivers and barriers.

Step 4: Research Synthesis and Final Output

Integration of quantitative structure and qualitative insights to produce a cohesive market narrative aligned with client decision-making needs.

- Executive Summary

- Research Methodology (Market Definitions and Inclusions/Exclusions, Abbreviations, Topic-Specific Taxonomy, Market Sizing Framework, Revenue Attribution Logic Across Use Cases or Care Settings, Primary Interview Program Design, Data Triangulation and Validation, Limitations and Data Gaps)

- Definition and Scope

- Market Genesis and Evolution

- Wheel Alignment Usage and Automotive Service Value-Chain Mapping

- Business Cycle and Demand Seasonality

- Philippines Automotive Service and Workshop Delivery Architecture

- Growth Drivers

Rising Vehicle Parc and Aging Fleet Dynamics

Expansion of Organized Automotive Service Chains

Urban Road Conditions and Alignment Wear Frequency

Commercial Fleet Utilization Intensity

Technology Upgrade in Service Workshops - Challenges

High Capital Cost of Advanced Alignment Systems

Fragmented Independent Workshop Landscape

Skill Gaps and Technician Training Constraints

Price Sensitivity in Preventive Maintenance

Infrastructure Variability Across Regions - Opportunities

Penetration of 3D and Digital Alignment Systems

Growth of Fleet Maintenance Contracts

Dealership Network Expansion Outside Metro Areas

Integration with Diagnostic and ADAS Calibration

Aftermarket Service Formalization - Trends

Shift Toward 3D Imaging Alignment Platforms

Bundling Alignment with Tire and Suspension Services

Workshop Digitization and Data Logging

Mobile Alignment for Fleet Operators

OEM-Recommended Preventive Alignment Intervals - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- By Installed Base, 2019–2024

- By Average System Price, 2019–2024

- By Alignment Type (in Value %)

Camber Alignment

Caster Alignment

Toe Alignment

Four-Wheel Alignment

Thrust Angle Alignment - By Vehicle Type (in Value %)

Passenger Cars

Light Commercial Vehicles

Medium Commercial Vehicles

Heavy Commercial Vehicles

Two-Wheelers - By Technology / Product Type (in Value %)

Manual Alignment Systems

CCD Alignment Systems

3D Imaging Alignment Systems

Laser Alignment Systems

Mobile Alignment Systems - By Deployment / Distribution Model (in Value %)

OEM-Authorized Workshops

Independent Multi-Brand Workshops

Dealership Service Centers

Fleet and Commercial Service Centers - By End-Use Industry / Customer Type (in Value %)

Private Vehicle Owners

Commercial Fleet Operators

Public Transport Operators

Automotive Dealerships

Logistics and Delivery Companies - By Region (in Value %)

Metro Manila

Luzon (Excluding Metro Manila)

Visayas

Mindanao

- Competition ecosystem overview

- Cross Comparison Parameters (installation footprint, alignment accuracy tolerance, calibration frequency, software upgrade cycle, service turnaround time, technician training support, aftermarket compatibility, lifecycle operating cost)

SWOT analysis of major players - Pricing and commercial model benchmarking

- Detailed Profiles of Major Companies

Hunter Engineering Company

Bosch Automotive Service Solutions

Snap-on Equipment

Launch Tech

Ravaglioli

Hofmann

John Bean

Beissbarth

Corghi

Mahle Aftermarket

Werther International

Bright Technology

AutoChek Systems

Sun Auto

Sice

- Buyer personas and decision-making units

- Procurement and contracting workflows

- KPIs used for evaluation

- Pain points and adoption barriers

- By Value, 2025–2030

- By Installed Base, 2025–2030

- By Average System Price, 2025–2030