Market Overview

The Philippines wheel covers market is best tracked through the broader road wheels and wheel accessories value pool, because retail “wheel cover / hubcap” sell-through is largely embedded inside OEM accessory programs and aftermarket wheel-and-tire retail. In the latest year, the Philippines road wheel market was valued at USD ~ million (market value/consumption). In the prior year, the Philippines imported USD ~ million of HS ~ (road wheels and parts/accessories), showing a sizable imported accessory inflow that supports aftermarket replenishment and replacement demand.

Demand is concentrated in the Philippines’ largest vehicle-owning and vehicle-trading hubs, led by Metro Manila (NCR) and adjacent provinces in CALABARZON due to the densest clusters of dealerships, fleet operators, used-car resellers, tire-and-wheel shops, and e-commerce fulfillment nodes. Secondary demand hubs include Cebu (Visayas distribution anchor) and Davao (Mindanao anchor) because these cities combine high vehicle utilization, strong parts retail presence, and inter-island logistics roles. New vehicle throughput also sustains accessory attach: consolidated reporting shows ~ vehicles were sold in the latest year versus ~ units in the prior year, expanding the addressable base for OEM hubcaps and replacement wheel covers.

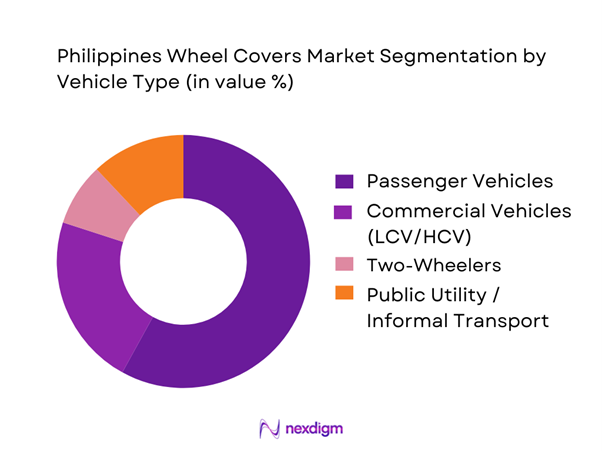

Philippines Wheel Covers Market Segmentation

By Vehicle Type

The Philippines wheel covers market is segmented by vehicle type into passenger vehicles, commercial vehicles, two-wheelers, and public utility and informal transport (e.g., UV/MPV shuttle conversions, tricycle supply chain). In the latest year, passenger vehicles dominate wheel-cover demand because hubcaps are most commonly bundled with steel-wheel trims on entry/mid trims, and replacement is frequent due to curb damage, theft risk, and cosmetic refresh cycles in the used-car channel. Passenger vehicles also benefit from the country’s expanding annual new-vehicle volume and the dense concentration of PV service bays and accessory shops in Metro Manila–centric corridors.

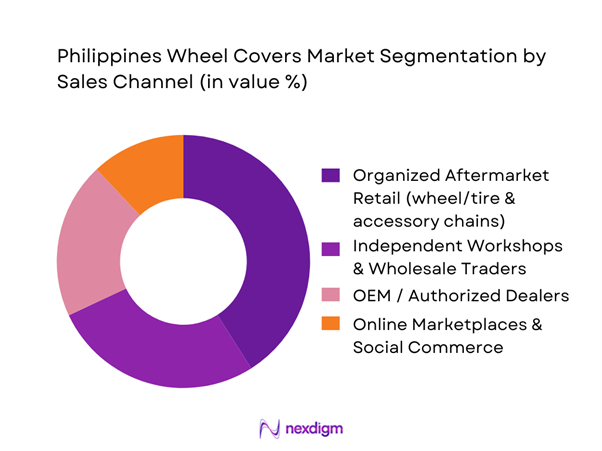

By Sales Channel

The Philippines wheel covers market is segmented by sales channel into OEM/authorized dealers, organized aftermarket retail, independent workshops & wholesale traders, and online marketplaces. In the latest year, organized aftermarket retail dominates because wheel covers are a high-velocity add-on sold alongside tires, basic servicing, and cosmetic accessories—typically positioned as a fast “visual upgrade” with immediate fitment. Organized channels also win on SKU availability (sizes, lug patterns, styles), installation convenience, and bundling with wheel alignment/balancing visits, which increases attach. At the same time, online marketplaces are growing, but fitment errors and returns keep offline conversion strong for this category.

Competitive Landscape

The Philippines wheel covers market is moderately fragmented: OEMs influence demand through genuine accessory catalogs and bundled trims, while the aftermarket is shaped by organized accessory retailers, wheel-and-tire specialists, and import-led distributors. Consolidation is visible at the “point of fitment” (large urban shop networks), but product sourcing remains diversified, with heavy reliance on imports for road wheels and accessories.

| Company | Est. Year | HQ | Market Role in PH Wheel Covers | Primary Route-to-Market | Strength in Fitment Network | Typical Customer | SKU Breadth (sizes/styles) | Price Positioning | After-sales/Returns Handling |

| Toyota Motor Philippines | 1988 | Philippines | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Mitsubishi Motors Philippines | 2002 | Philippines | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Honda Cars Philippines | 1992 | Philippines | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Blade Auto Center | 1997 | Philippines | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Concorde / Tire & wheel retailers (organized) | 1970s | Philippines | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

Philippines Wheel Covers Market Analysis

Growth Drivers

Vehicle Parc Expansion

The wheel covers market expands in line with the number of vehicles being added to the national fleet and concentrated urban use-cycles. The Philippines’ economic base supports continued motorization: nominal GDP is reported at USD ~ and GDP per capita at USD ~, increasing from USD ~ and USD ~ respectively, which directly correlates with higher household and MSME mobility spending (fleet operations, deliveries, commuting). At the same time, the country’s total population is recorded at ~, rising from ~, which sustains demand for daily mobility and used-car circulation. On the “new additions” side, vehicle assemblers reported sales of ~ units (from ~ units)—a large annual intake of vehicles that typically enter the road with OEM hubcaps or trims and subsequently shift to replacement/upgrade cycles via dealerships, tire shops, car-care stores, and e-commerce. In the Philippines, wheel covers sit at the intersection of (a) new vehicle deliveries (OEM-fitted covers), (b) used vehicle refurbishment (appearance restoration), and (c) city-heavy driving that increases cosmetic wear from curbs and tight parking.

Cost-Sensitive Aesthetics

Wheel covers are a high-visibility, low-complexity exterior accessory that fits the Philippines’ practical “look-good-without-heavy-mods” consumer behavior—especially in commuter corridors where appearance affects perceived upkeep and resale readiness. The macro context shows why this “cost-sensitive aesthetics” category persists: GDP per capita is recorded at USD ~ (up from USD ~), and nominal GDP is USD ~ (up from USD ~), supporting incremental spending on vehicle appearance even when buyers avoid big-ticket customization. Crucially, the scale of annual vehicle intake is large—~ units were sold by vehicle assemblers (from ~ units)—creating a broad base of owners who want quick aesthetic refreshes across sedans, AUV/MPV fleets, and work vehicles. In practice, wheel covers address common “visual pain points” in Philippine cities: scuffed rims, mismatched wheels on used vehicles, and worn hubcaps on high-mileage fleet cars. Because wheel covers are easy to install, they also suit the fragmented aftermarket where independent shops and online sellers dominate. The same economic backdrop—rising output and a growing population (~ from ~)—keeps competition intense among retailers, pushing buyers toward appearance upgrades that are simple, widely available, and repeatable without technical skill.

Challenges

Low Product Differentiation

Wheel covers face structurally low differentiation because functional performance differences are limited and many designs converge on similar visual patterns, fitment sizes, and clip/retention mechanisms. This becomes a stronger constraint in a large, price-sensitive vehicle market where volumes are high and buyers compare visually similar products across sellers. In the Philippines, the scale of the vehicle base is evidenced by ~ units sold by vehicle assemblers (from ~ units), which creates a broad aftermarket but also encourages a “fast follower” dynamic—popular designs are copied quickly, compressing brand distinctiveness. The macro context supports intense competition: nominal GDP is USD ~ (from USD ~) and population is ~ (from ~), supporting many small retailers and online sellers entering the category. In such an environment, product listing photos and “fits ~–~ inch” style claims become the primary basis of choice, which is easy to replicate. Low differentiation also reduces willingness to pay for branded covers unless buyers see clear benefits such as stronger retention, better finish durability, or consistent availability. For distributors, the challenge is margin sustainability: when products are perceived as interchangeable, channel conflict rises between tire shops, accessory stalls, and e-commerce sellers competing on speed and availability. This is why differentiation often has to be engineered through packaging integrity, fitment assurance, and anti-counterfeit measures rather than design alone.

Price Competition from Imports

Import-driven price pressure is a persistent challenge in wheel-related accessories because the Philippines sources substantial volumes of vehicle parts and accessories through international supply chains, enabling a wide range of low-priced SKUs to enter both formal and informal channels. Trade data for HS ~ (road wheels and parts/accessories) shows Philippines imports from major exporters in a recent year, including USD ~ from China, USD ~ from Japan, USD ~ from Thailand, and USD ~ from South Korea—figures that indicate the scale and diversity of imported wheel-component supply into the country. These import flows intensify “race-to-the-bottom” pricing in highly substitutable categories such as wheel covers, especially when designs are easy to copy and fitment can be marketed broadly. The macro backdrop further supports an import-competitive retail landscape: nominal GDP is USD ~ (from USD ~) and vehicle sales reached ~ units (from ~ units), expanding the addressable base for imported accessories sold through distributors, marketplaces, and stall retail. For local traders and assemblers, the core challenge is not only unit price but also the speed at which imported sellers can refresh designs and flood channels. For brands, the fight often becomes one of reliability (retention clips, finish quality), availability across common sizes, and claims that survive daily Philippine road conditions.

Opportunities

Design Customization

Design customization is a growth opportunity because it converts wheel covers from a “repair replacement” item into a personalization product that can command better channel placement and repeat purchases (seasonal looks, fleet branding aesthetics, model-themed styling). The Philippines offers a strong demand base for this: vehicle assemblers reported ~ units sold (from ~ units), and LTFRB activity around ride-hailing supply includes ~ TNVS slots—both signals of large cohorts of vehicles that care about exterior presentation (private owners and commercial operators). Macro capacity is also improving: nominal GDP is USD ~ (from USD ~) and GDP per capita USD ~ (from USD ~), supporting incremental spend on appearance-driven add-ons. The customization angle can be executed without “future claims” by focusing on current channel realities: online marketplaces allow rapid SKU proliferation, while physical tire/accessory shops can offer “fit-and-style” bundles. Customization also helps brands fight low differentiation: unique spoke patterns, matte/metallic finishes, two-tone trims, and model-specific fitment claims provide clearer reasons to choose a branded SKU. Finally, customization can be tied to anti-counterfeit cues (distinctive molding marks, QR verification), which matters in a market where counterfeit seizures reached PHP ~ billion and PHP ~ billion in adjacent years—showing why trusted branding and verification can become part of the value proposition.

SUV-Focused Styling

SUV-focused styling is an opportunity because Philippine demand is heavily urban and utility-driven, and many buyers prefer an “SUV look” even on crossovers and MPVs—making wheel aesthetics an easy way to deliver perceived ruggedness without structural modifications. The opportunity is supported by the scale of new vehicle inflow: vehicle assemblers reported ~ units sold (from ~ units), and sales growth tends to concentrate in practical body styles used for family transport and fleet services—segments where wheel-cover styling has high visual impact (larger diameters, aggressive spoke designs, dark finishes). Ride-hailing expansion also reinforces this: LTFRB opened ~ TNVS slots, and TNVS operators often favor vehicle types that look premium while remaining practical for passenger comfort, creating demand for durable, “premium-look” wheel covers that survive high utilization. Macro indicators suggest continued purchasing power and mobility demand: nominal GDP is USD ~ (from USD ~) and population is ~ (from ~), sustaining vehicle use density. The key is to frame “SUV styling” as a present-day channel play: stock availability of popular sizes, compatibility with common wheel diameters, stronger retention for rough road use, and easy replacement availability in NCR and other high-traffic metros where incident volume is high (e.g., MMDA crash records).

Future Outlook

Over the next five years, the Philippines wheel covers market is expected to expand on the back of a larger vehicle parc, steady new vehicle sales throughput, and continued consumer preference for cost-effective cosmetic upgrades (especially for used vehicles). Replacement demand will remain the anchor (loss/damage/theft), while OEM-driven volumes will track entry and mid-trim sales. Import dependence in road wheels and accessories is likely to persist, keeping price/availability sensitive to logistics and FX.

Major Players

- Toyota Motor Philippines

- Mitsubishi Motors Philippines

- Honda Cars Philippines

- Nissan Philippines

- Suzuki Philippines

- Hyundai Motor Philippines

- Kia Philippines

- Isuzu Philippines

- Ford Philippines

- MG Philippines

- Geely Philippines

- BYD Philippines

- Chery Auto Philippines

- Blade Auto Center

Key Target Audience

- Automotive OEMs & Authorized Dealer Groups

- Wheel & Tire Retail Chains

- Aftermarket Accessory Chains & Category Buyers

- Importers, Distributors & Wholesale Traders

- Fleet Owners & Fleet Management Firms

- E-commerce Marketplaces & Large Online Sellers

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

Research Methodology

Step 1: Identification of Key Variables

We map the wheel covers ecosystem across OEM accessories, aftermarket retail, importers, and fitment workshops. Desk research is used to define variables such as vehicle parc expansion, accessory attach behavior, import dependence, SKU fitment complexity, and price ladder structure.

Step 2: Market Analysis and Construction

We compile historical demand indicators (new vehicle sales throughput, road wheel & accessory trade flows, and retail channel density) and build an “apparent consumption” view anchored to the most measurable value pools (wheels & accessories).

Step 3: Hypothesis Validation and Expert Consultation

We validate sizing logic via CATI discussions with accessory category managers, wheel-and-tire retailers, distributors, and service managers to confirm attach rates, fast-moving SKUs, typical replacement triggers, and channel margins.

Step 4: Research Synthesis and Final Output

We triangulate findings using bottom-up channel checks (store/online assortment mapping, fitment patterns) and top-down anchors (published market values and trade datasets), then finalize segment shares, competitive positioning, and growth scenarios.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Engineering Framework, Bottom-Up and Top-Down Validation, Demand-Side and Supply-Side Triangulation, Dealer and Installer Interviews, Importer and Distributor Insights, Limitations and Assumptions)

- Definition and Scope

- Market Genesis and Evolution of Wheel Covers in the Philippines

- Timeline of OEM Adoption and Aftermarket Penetration

- Automotive Business Cycle Linkage

- Supply Chain and Value Chain Analysis

- Growth Drivers

Vehicle Parc Expansion

Cost-Sensitive Aesthetics

Ride-Hailing Vehicle Demand

Replacement Frequency

OEM Cost Optimization - Challenges

Low Product Differentiation

Price Competition from Imports

Counterfeit Products

Low Brand Loyalty - Opportunities

Design Customization

SUV-Focused Styling

Online Aftermarket Expansion

Fleet Customization - Trends

Shift Toward Alloy-Look Covers

Matte and Sporty Finishes

Lightweight Designs - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- By Volume, 2019–2024

- By Average Selling Price, 2019–2024

- By Fleet Type (in Value %)

Passenger Cars

Hatchbacks

Sedans

MPVs

SUVs - By Application (in Value %)

13-inch

14-inch

15-inch

16-inch

Above 16-inch - By Technology Architecture (in Value %)

ABS Plastic

Polypropylene

Composite Blends - By Connectivity Type (in Value %)

OEM Fitment

Authorized Dealerships

Independent Aftermarket

Online Auto Platforms - By End-Use Industry (in Value %)

First-Time Car Owners

Fleet Operators

Ride-Hailing Vehicles

Used Car Owners - By Region (in Value %)

NCR

Luzon Ex-NCR

Visayas

Mindanao

- Market Share Analysis by Value and Volume

- Cross Comparison Parameters (Price Band Positioning, Rim Size Coverage, Vehicle Compatibility Breadth, Design Portfolio Depth, Import Dependency, Channel Reach, OEM Relationships, Brand Recognition)

- SWOT Analysis of Major Players

- Pricing Analysis by Key SKUs and Rim Sizes

- Detailed Profiles of Major Companies

Toyota Genuine Accessories Philippines

Honda Cars Philippines Accessories Division

Suzuki Genuine Parts Philippines

Mitsubishi Motors Philippines Accessories

Nissan Philippines Genuine Accessories

Autobacs Philippines

Blade Auto Center

Concorde Auto Accessories

Gold Wheels Accessories Trading

RideTech Auto Accessories

Speedlab Philippines

Wheelcat Automotive Accessories

JDM Select Philippines

Auto Plus Philippines

- Demand and Usage Patterns

- Purchase Drivers and Budget Sensitivity

- Replacement and Upgrade Behavior

- Decision-Making Criteria

- Pain Points and Unmet Needs

- By Value, 2025–2030

- By Volume, 2025–2030

- By Average Selling Price, 2025–2030