Market Overview

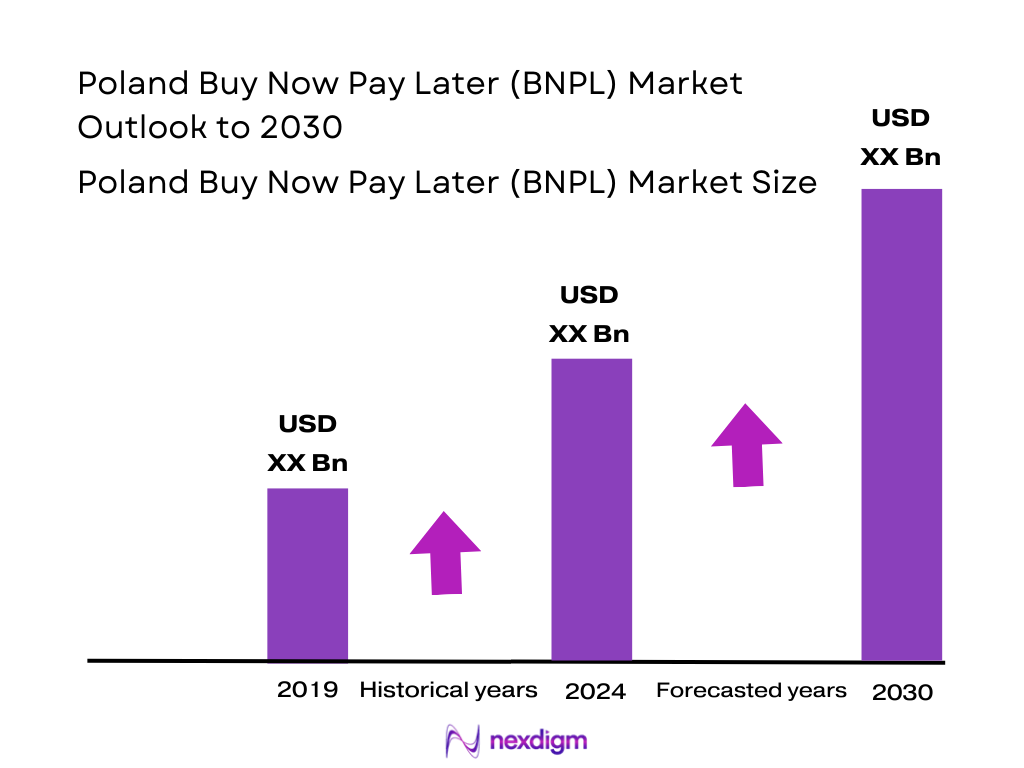

The Poland BNPL market is valued at approximately USD 2.07 billion, based on a thorough analysis of most recent industry reports substantiating an annual growth rate of 17.1% leading into that valuation for 2024. This robust figure reflects a substantial shift by consumers toward alternative short‑term credit solutions, driven by strong e‑commerce growth, rising digital payment adoption, and favorable fintech innovations.

Poland’s BNPL adoption is particularly strong in major urban centers such as Warsaw and Kraków, where e‑commerce penetration, consumer affluence, and digital infrastructure are most advanced. These cities benefit from a concentration of fintech providers, retail partnerships, and tech‑savvy populations, reinforcing their dominance. Moreover, integration with regional digital payment systems—like BLIK—further cements BNPL’s strength in these metropolitan areas.

Market Segmentation

By End‑Use Sector

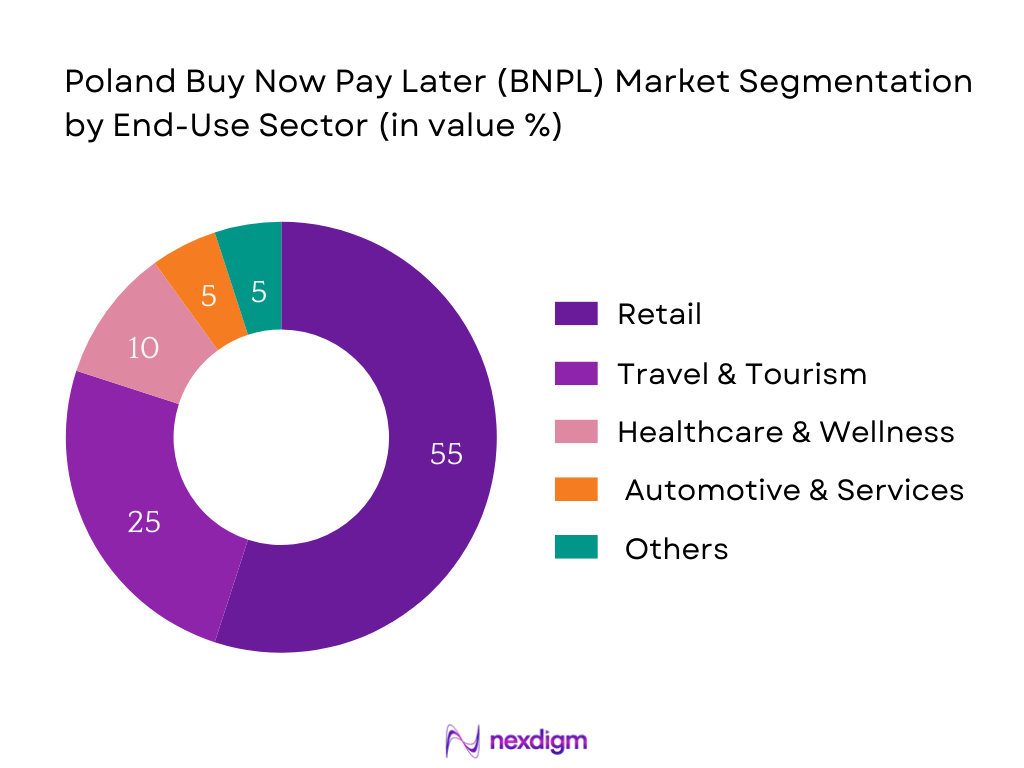

The Poland BNPL market is segmented by end‑use sector, and the retail segment (comprising both e‑commerce and POS retail) clearly dominates the market. This dominance is driven by retail’s high transaction volume and merchant adoption—retailers actively partner with BNPL providers to boost conversions and average spend. Consumers shopping online and in-store frequently opt for BNPL for convenience and affordability, reinforcing its prevalence in retail over other sectors.

By Platform Model

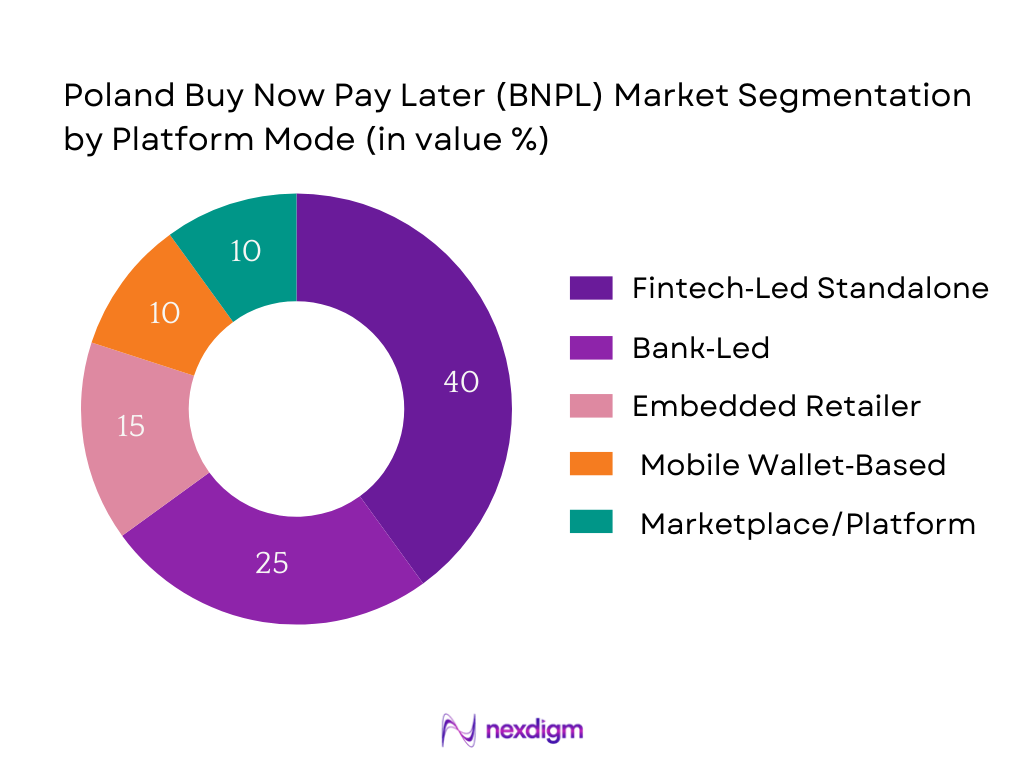

Among the available models, fintech‑led standalone BNPL solutions currently appear to be leading the market, thanks to their seamless customer onboarding, agile deployment across merchant networks, and compelling UX. Their tech‑first approach allows rapid integration with e‑commerce platforms and mobile apps, giving them an edge over traditional bank‑led or embedded models which often involve slower processes and legacy systems.

Competitive Landscape

The Poland BNPL competitive landscape is dominated by key fintech names such as PayPo, Twisto, Klarna, Allegro Pay (PayU Pay Later), and major bank‑affiliated offerings like Santander BNPL. Their influence is anchored in strong brand recognition, expansive merchant integration, and cross‑border expertise. This consolidation reflects the strategic partnerships and infrastructure investment required to scale in the BNPL space.

| Major Player | Establishment Year | Headquarters | GTV (USD billion) | Active Users (Thousands) | Default Rate (%) | Avg. Transaction Uplift (%) | Merchant Fee (%) | Approval Time (Seconds) |

| PayPo | – | Poland | – | – | – | – | – | – |

| Twisto | 2016 | Czech Republic (active in Poland) | – | – | – | – | – | – |

| Klarna | 2005 | Sweden | – | – | – | – | – | – |

| Allegro Pay / PayU Pay Later | 1999 | Poland | – | – | – | – | – | – |

| Santander BNPL | 1857 | Poland | – | – | – | – | – | – |

Poland BNPL Market Analysis

Growth Drivers

Surge in E‑Commerce and Online Retail Spending

E‑commerce in Poland recorded a transaction value of USD 22 billion in 2023, highlighting an advanced digital retail ecosystem supporting BNPL services. The number of online merchants selling via their own platforms or through Allegro exceeded 150,000, demonstrating merchant readiness to integrate BNPL solutions. Additionally, the share of households with Internet access climbed from 60 percent in 2012 to 93.3 percent in 2022, enabling digital payment adoption. Simultaneously, 90 percent of Internet users were active online shoppers in 2022—signifying strong consumer familiarity with e‑commerce platforms. These metrics collectively indicate that Poland’s robust e‑commerce penetration and digital infrastructure are vital for BNPL growth.

High Debit Card Usage and Credit Card Aversion

While precise 2024 debit card usage figures specific to Poland are limited in publicly available government data, general consumer sentiment favors immediate payment methods over revolving credit, as inferred from elevated Internet purchasing trends and cautious uptake of long‑term credit. Poland’s e‑commerce ecosystem—where 90 percent of Internet users shop online—suggests consumer preference for low‑barrier, non‑credit instruments like BNPL. Additionally, Poles’ gradual expansion in digital infrastructure investments (EUR 7.5 billion allocated under the Recovery and Resilience Plan to boost digital services) supports broader adoption of alternative digital payments that don’t incur traditional credit commitments. These shifts underscore a behavioral context favorable for BNPL adoption where debit or deferred payments are more trusted than credit cards.

Market Challenges

Delinquency Risk and Non‑Performing BNPL Loans

Public macroeconomic sources do not provide BNPL‑specific delinquency stats, but the broader context of economic stress—Poland’s inflation peaking at 18.4 percent in early 2023 before easing to 1.9 percent—implies consumer repayment capacity fluctuations. Elevated inflation strains household budgets, potentially elevating BNPL non‑performance risk. The inflation data underscores the fragility of consumer finances, particularly for short‑term credit models like BNPL, where delayed payments may spike during cost‑of‑living pressure.

Unstructured Consumer Credit Scoring

No centralized macro data is available on credit‑scoring reform in Poland for 2024, but the digital infrastructure boost (EUR 7.5 billion for digital services) reflects a shift toward data utilization. However, legacy reliance on traditional credit files means many consumers—especially younger or thin‑file profiles—lack structured scoring, limiting BNPL risk modeling precision. Developing digital scoring mechanisms is still nascent, posing underwriting challenges for BNPL providers seeking low‑friction onboarding.

Emerging Opportunities

B2B BNPL Models for SMEs

With 84 percent of Polish companies selling online in 2022 and 80 percent of these generating less than 10 percent of their turnover via online channels, there is substantial room for B2B BNPL solutions that support SMB supplier‑side liquidity. SMEs face cash flow constraints when procuring inventory online; BNPL can enable deferred payments for bulk purchases and operational expenses. The disparity between high participation and low sales volumes underscores the need for flexible credit models to scale SME e‑commerce.

Integration with Loyalty & Rewards Ecosystems

Poland’s high digital engagement—over 36.7 million Internet users (88.4 percent of population)—provides fertile ground for loyalty‑linked BNPL frameworks integrated into digital platforms, apps, and e‑commerce ecosystems. Gamified payment plans linked to reward points or discount tiers can drive adoption among this digitally active base. The large user base supports scalable loyalty mechanics that align consumer retention and deferred payment willingness.

Future Outlook

Over the next several years, the Poland BNPL market is expected to continue its significant expansion, propelled by further digitization of payments, deepening partnerships between BNPL providers and retail platforms, and evolving regulatory clarity. As consumer trust matures and adoption penetrates beyond core urban centers, the market is well‑positioned for sustainable growth. Forecast data indicates that after a solid historical CAGR of 23.7% from 2021 to 2024, the market—valued at USD 1.52 billion in 2024—is projected to maintain a CAGR of 10.0% from 2025 through 2030, reaching approximately USD 2.80 billion by end of forecast period.

Major Players

- Klarna

- PayPo

- Twisto

- Allegro Pay

- mBank BNPL

- ING Bank Śląski BNPL

- BNP Paribas BNPL

- Santander BNPL

- Alior Bank BNPL

- Revolut BNPL

- Zilch (Poland operations)

- Comgate (deferred payments)

- PayU Pay Later

- Cinkciarz PayLater

- Credit Agricole BNPL

Key Target Audience

- Senior Executives at BNPL and Fintech Companies

- Chief Payment Officers at Major Retail Chains

- E‑Commerce Platform Strategists

- Head of Digital Banking at Commercial Banks

- Venture Capital and Investment Firms (Investments and Venture Capitalist Firms)

- Government and Regulatory Bodies

- Merchant Acquirer & Payment Gateway Decision‑Makers

- Corporate Strategy Leads at Retail Conglomerates

Research Methodology

Step 1: Identification of Key Variables

The process began with mapping the BNPL ecosystem, covering fintechs, banks, regulators, merchants, and payment gateways. Extensive desk research utilized secondary sources—including industry reports, company filings, and market databases—to define core variables such as GTV, adoption rates, and segmentation classes.

Step 2: Market Analysis and Construction

Historical data spanning consumer usage, merchant adoption rates, and transaction volumes were compiled. Channel splits (e‑commerce vs POS) and performance metrics—such as average order size and repayment behavior—were analyzed to construct a granular bottom‑up market size model.

Step 3: Hypothesis Validation and Expert Consultation

Preliminary findings were tested through CATI and virtual interviews with executives from leading BNPL providers, banking partners, and merchant associations. These insights were crucial for validating assumptions on growth drivers, regulatory impacts, and consumer behavior.

Step 4: Research Synthesis and Final Output

The final synthesis involved reconciling proprietary data with expert feedback. Direct discussions with BNPL firms and payment gateways provided clarity on business models, tech stacks, and expansion strategies. The report was finalized with a validated, integrated market overview.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis and Evolution Timeline

- BNPL Licensing and Regulatory Structure (KNF Regulatory Framework)

- E-Commerce and Digital Payment Ecosystem (Payment Infrastructure & Online Penetration Metrics)

- Supply Chain and BNPL Value Chain Analysis (Fintechs, Issuers, Merchants, Payment Gateways)

- Growth Drivers

Surge in E-Commerce and Online Retail Spending

High Debit Card Usage and Credit Card Aversion

Increased Smartphone and Mobile Wallet Penetration

KNF Regulatory Sandbox Supporting Innovation

Bank-Fintech Collaboration for Credit Inclusion - Market Challenges

Delinquency Risk and Non-Performing BNPL Loans

Unstructured Consumer Credit Scoring

Thin Profit Margins and High CAC for Fintechs

Increasing Regulatory Oversight

Limited Adoption in Tier 3–4 Regions - Emerging Opportunities

B2B BNPL Models for SMEs

Integration with Loyalty & Rewards Ecosystems

Healthcare, Travel, and Education-Sector Financing

Cross-Border BNPL (CEE Market Entry)

Embedded Credit through Open Banking - Trends

API-Led Credit Decisioning and KYC Automation

White-Label BNPL for Merchants

BNPL Loyalty and Cashback Ecosystems

ESG-Aligned BNPL (Green Installments) - Government Regulations

Interest Rate Caps and Disclosures

Credit Bureau Reporting Mandates

EU Buy Now Pay Later Draft Regulation Compliance - SWOT Analysis

- Stake Ecosystem (Regulators, Lenders, Aggregators, Payment Systems, Merchants)

- Porter’s Five Forces Analysis

- BNPL Competition Ecosystem Map

- By Value (Total GTV in USD Billion), 2019-2024

- By Volume (Number of BNPL Transactions), 2019-2024

- By Average Ticket Size (Polish Złoty/Transaction), 2019-2024

- By Platform Type (In Value %)

Fintech-Led BNPL

Bank-Led BNPL

Embedded Retailer BNPL

Super-App BNPL

Mobile Wallet-Based BNPL - By Channel (In Value %)

E-Commerce

Mobile Apps

In-Store (POS Terminal BNPL)

QR Code/Scan-Based Checkout

Marketplace BNPL - By Repayment Model (In Value %)

Pay-in-30

Split-in-4

Long-Term Installments

Revolving Credit BNPL

Invoice-Based BNPL - By End-User Category (In Value %)

Gen Z

Millennials

Salaried Professionals

Gig Economy Workers

MSMEs - By Industry Vertical (In Value %)

Fashion & Apparel

Electronics & Gadgets

Travel & Tourism

Furniture & Home Décor

Healthcare & Wellness

- Market Share by Value and Volume

Market Share by Platform Type - Cross Comparison Parameters (Gross Transaction Value (GTV), Active Users (Monthly/Annual), Default Rate (%), Approval Time (Seconds), Merchant Network Size, Average Order Value Increase, CAC to LTV Ratio, Technology Stack (API vs No-Code, Cloud Infra))

- SWOT Analysis of Leading Players

- Price Comparison: Merchant Fee %, Late Fees, Payback Duration

- Detailed Profiles of 15 Key Players

PayPo

Twisto

Klarna

Allegro Pay

mBank BNPL

BNP Paribas BNPL

ING Bank Śląski BNPL

Santander BNPL

Credit Agricole Pay Later

Alior Bank BNPL

Comgate

Cinkciarz PayLater

Zilch Poland

PayU Pay Later

Revolut BNPL

- Consumer Journey Mapping

- Preferences, Friction Points, and Trust Metrics

- Digital Literacy, Adoption & Channel Preferences

- Average Spending per BNPL Transaction

- Merchant-Side Preferences and Conversion Metrics

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Ticket Size, 2025-2030