Market Overview

The Qatar Advanced Surface Movement Guidance and Control Systems (A‑SMGCS) market is driven by the increasing need for safety and operational efficiency in airport ground operations. As Qatar’s aviation sector continues to expand, especially with the growth of Hamad International Airport as a key global hub, the demand for A‑SMGCS is poised to rise. The market is expected to reach a valuation of USD ~ million in 2024, largely driven by modernization efforts and regulatory requirements for enhanced surface movement safety and efficiency. Factors such as the adoption of next-generation technologies, including radar systems, ADS-B, and data fusion platforms, are also propelling the market forward.

Qatar, particularly Doha, is the dominant player in the A‑SMGCS market, driven by the rapid growth of Hamad International Airport, one of the largest aviation hubs in the Middle East. The nation’s ongoing infrastructure investments, supported by the 2024 FIFA World Cup and the upcoming expansion of the airport, have fostered a conducive environment for A‑SMGCS adoption. Other key players in the market include Dubai and Abu Dhabi, where advanced air traffic management technologies are in demand due to the high volume of air traffic and regional development of smart airports. These cities dominate due to their investment in cutting-edge technologies and a strategic focus on aviation safety.

Market Segmentation

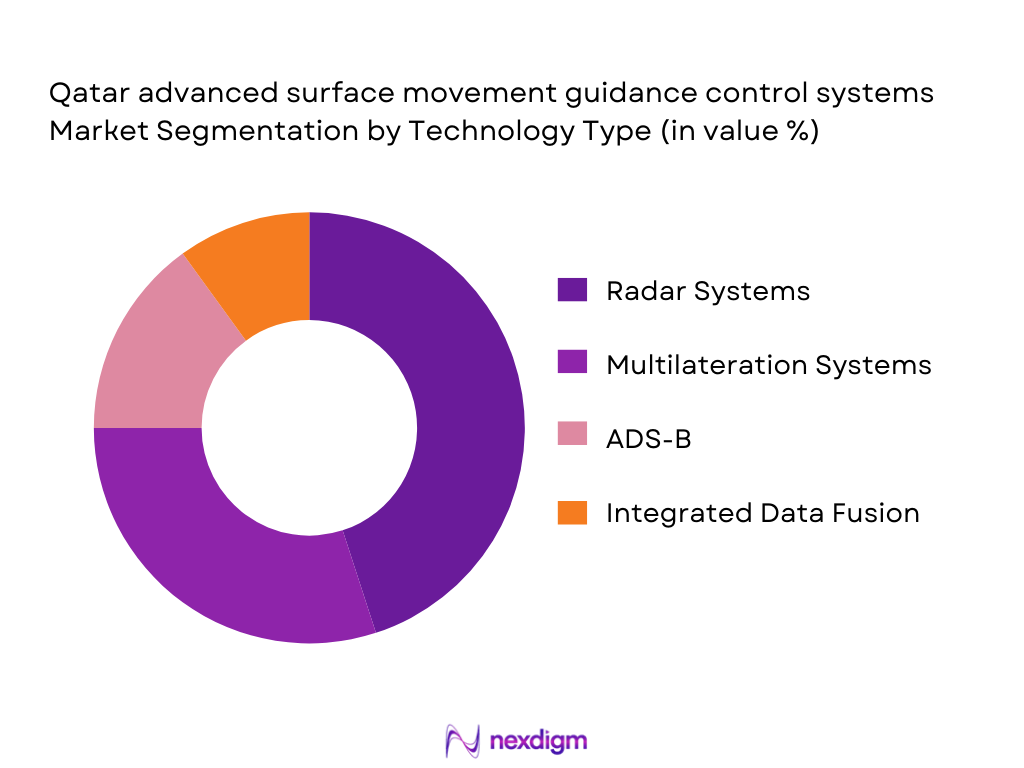

By Technology Type

The Qatar A‑SMGCS market is segmented into radar systems, multiliterate systems, automatic dependent surveillance-broadcast (ADS-B), and integrated data fusion platforms. Radar systems currently dominate the market due to their high reliability in detecting and tracking aircraft movements on the ground. Their ability to operate under various weather conditions and high-density traffic scenarios makes them ideal for large, complex airports like Hamad International. The demand for radar systems is further bolstered by the gradual integration of multiliterate and ADS-B systems, enhancing surveillance capabilities.

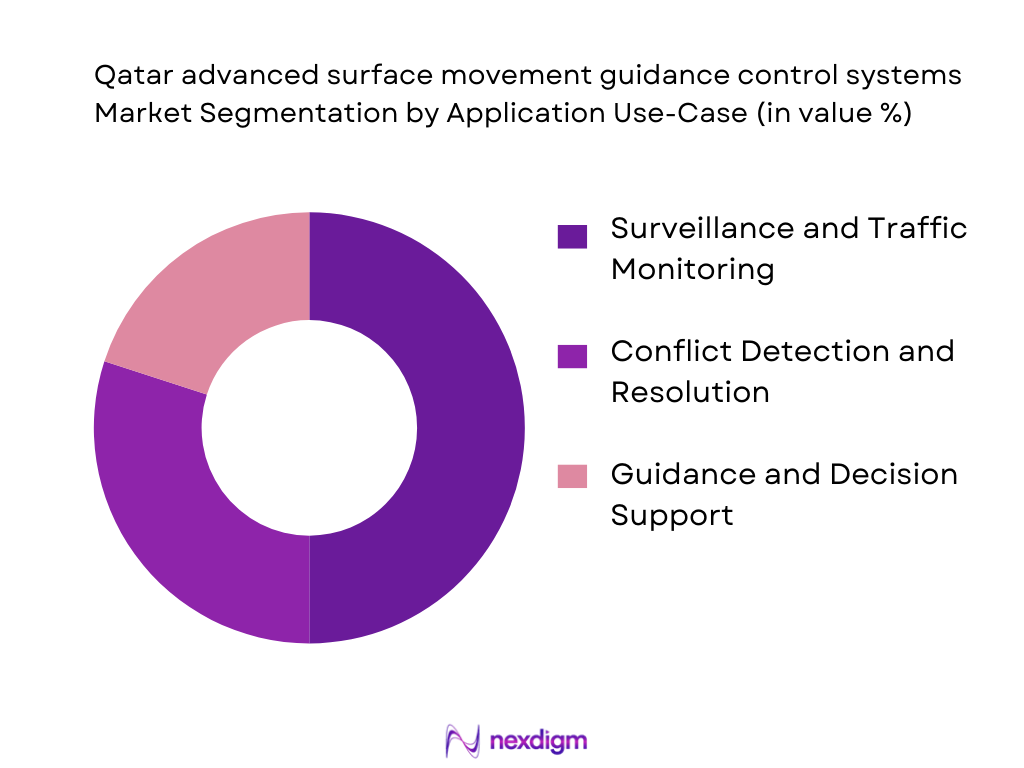

By Application Use-Case

The market is segmented based on its use in surveillance and traffic monitoring, conflict detection and resolution, and guidance and decision support. Surveillance and traffic monitoring are the dominant applications, with systems used for real-time monitoring of aircraft and vehicle movements on the airport’s ground. Qatar’s airports, particularly Hamad International, have a high adoption rate of these systems to ensure safety and efficiency in busy environments. As the need for conflict detection systems increases, applications for guidance and decision support systems are also expanding, particularly with the rise of AI-driven technologies.

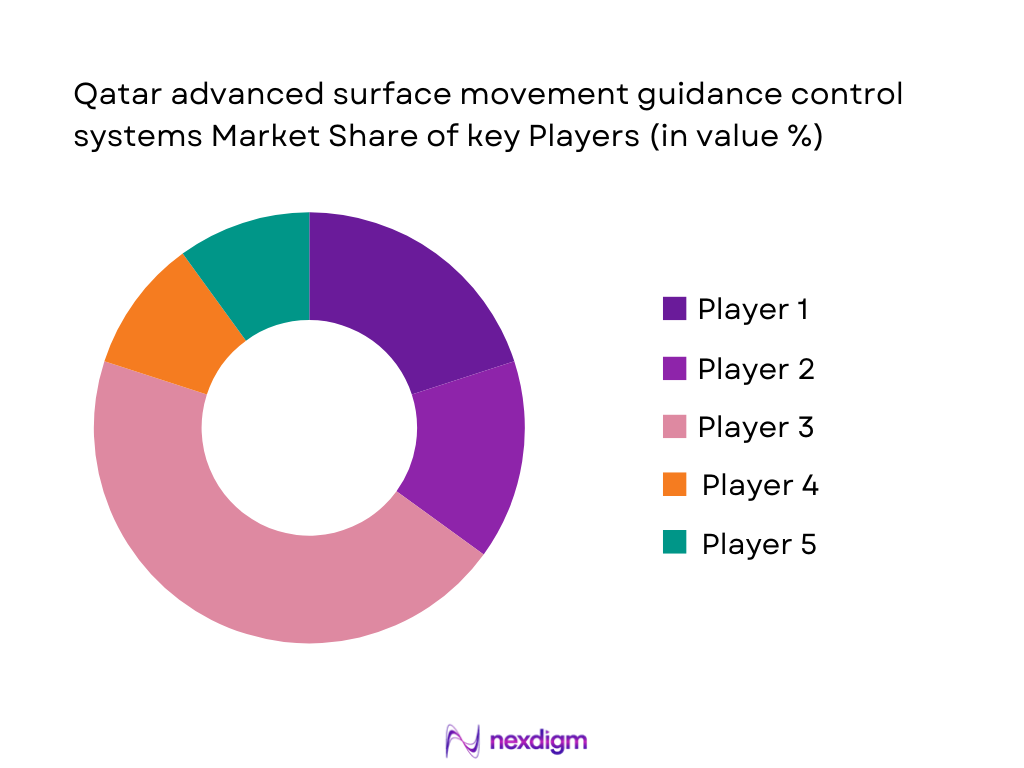

Competitive Landscape

The Qatar A‑SMGCS market is highly competitive, with both local and international players contributing to the development of advanced surface movement solutions. Leading global players like Saab AB, Thales Group, and Honeywell International dominate the market, providing comprehensive solutions that integrate radar systems, multilateration, and decision support platforms. Local players, including those involved in infrastructure development, also play a significant role, as they focus on providing customized solutions tailored to Qatar’s unique operational requirements. This market is characterized by constant innovation and partnerships between airport authorities and technology providers, aimed at enhancing efficiency and safety.

| Company Name | Established | Headquarters | Technology Portfolio | Market Focus | Regional Presence |

| Saab AB | 1937 | Sweden | ~ | ~ | ~ |

| Thales Group | 2000 | France | ~ | ~ | ~ |

| Honeywell International | 1906 | USA | ~ | ~ | ~ |

| ADB SAFEGATE | 1905 | Belgium | ~ | ~ | ~ |

| Frequentis AG | 1947 | Austria | ~ | ~ | ~ |

Qatar Advanced Surface Movement Guidance and Control Systems Market Analysis

Growth Drivers

Urbanization

The rapid urbanization of Qatar is a key driver for the growth of the A‑SMGCS market. As of 2024, Qatar’s urban population reached over ~ % of its total population, according to the World Bank. The increasing urbanization results in a significant rise in air traffic, especially at major airports like Hamad International, which recorded over ~ million passengers in 2024. This surge in air traffic increases the need for advanced surface movement guidance and control systems to enhance operational safety and efficiency. The continuous urban expansion in cities like Doha pushes infrastructure development, promoting the adoption of these advanced systems.

Industrialization

Industrialization in Qatar, especially in sectors like construction and energy, is fueling the demand for enhanced infrastructure solutions, including A‑SMGCS. Qatar’s industrial output has consistently grown, with the energy sector accounting for ~ % of GDP in 2024, as reported by the IMF. This industrial growth has led to an increase in cargo traffic and airport operations. For instance, Qatar’s Doha International Airport has experienced a continuous rise in both passenger and freight volumes, necessitating the need for better surface movement control to ensure smooth airport operations. Industrialization encourages further technological adoption, including radar and multilateration systems, to manage higher traffic.

Restraints

High Initial Costs

The high initial costs associated with the deployment of A‑SMGCS pose a significant restraint to market growth. For instance, the installation of radar systems and data fusion technologies requires significant investment in infrastructure. As of 2024, airport technology expenditures in the GCC region, including Qatar, were reported to exceed USD ~ billion in total infrastructure investment. This large upfront cost can limit the speed of adoption, particularly for smaller airports in Qatar. Additionally, the cost of training personnel and ongoing system maintenance further contributes to the high capital expenditure, presenting a financial barrier for stakeholders in the market.

Technical Challenges

The integration of advanced surface movement guidance and control systems presents technical challenges. The complexity of integrating radar systems, ADS-B, and data fusion platforms across different airport environments in Qatar is considerable. For example, the installation of these systems at Hamad International Airport, one of the busiest airports in the region, requires sophisticated coordination with existing air traffic control technologies. These technical challenges can result in delays and increased operational costs, hindering the adoption of new systems. Furthermore, the lack of standardization in A‑SMGCS technologies across airports worldwide adds another layer of complexity to seamless integration.

Opportunities

Technological Advancements

Technological advancements in artificial intelligence (AI) and machine learning present a significant opportunity for the growth of the A‑SMGCS market. As of 2024, Qatar has been increasing its focus on smart airport initiatives, with the government committing USD ~ billion toward digitizing air traffic management systems, including those used for surface movement. The development of AI-driven predictive analytics and real-time data fusion is poised to transform airport operations by enhancing situational awareness, reducing runway incursion risks, and optimizing aircraft ground movements. With Qatar’s robust investment in digital infrastructure, this trend is expected to expand, driving further demand for advanced A‑SMGCS solutions.

International Collaborations

International collaborations present a unique opportunity for Qatar to leverage global expertise in A‑SMGCS technologies. Qatar has recently entered partnerships with global companies, including Thales Group and Honeywell, to upgrade its air traffic management systems. These collaborations facilitate the adoption of cutting-edge technologies, such as AI, radar systems, and multilateration. With Qatar’s aspiration to become a leading aviation hub, its strategic collaborations with international stakeholders will continue to drive innovation in A‑SMGCS. Additionally, such partnerships provide Qatar with access to best practices from leading global airports, enhancing its own air traffic safety and operational efficiency.

Future Outlook

Over the next 5 years, the Qatar Advanced Surface Movement Guidance and Control Systems market is expected to experience significant growth. The need for enhanced operational safety, particularly at Hamad International Airport, coupled with the rapid adoption of next-generation technologies like AI-driven data fusion and automated decision support systems, will drive market expansion. Additionally, government regulations demanding higher levels of safety, as well as the expansion of regional airports, will contribute to the steady rise of A‑SMGCS demand in Qatar.

Major Players

- Saab AB

- Thales Group

- Honeywell International Inc.

- ADB SAFEGATE

- Frequentis AG

- Indra Sistemas S.A.

- Searidge Technologies Inc.

- Raytheon Technologies Corp.

- Northrop Grumman Corporation

- ERA a.s. (Omnipol)

- Leonardo S.p.A.

- Terma A/S

- Siemens AG

- SITTI S.p.A.

- ATG Airports Ltd.

Key Target Audience

- Government Agencies: Qatar Civil Aviation Authority (QCAA), Ministry of Transport and Communications (MOTC)

- Airport Operators: Hamad International Airport, Doha International Airport

- Air Navigation Service Providers (ANSPs): Qatar ANSP, UAE ANSP

- Defense Contractors: Qatar Defense Ministry, General Dynamics

- Airport Infrastructure Developers: Aéroports de Paris, GMR Airports

- Investments and Venture Capital Firms: Qatar Investment Authority (QIA), Mubadala Investment Company

- Regulatory Bodies: International Civil Aviation Organization (ICAO), Federal Aviation Administration (FAA)

- Aircraft Manufacturers: Airbus, Boeing

Research Methodology

Step 1: Identification of Key Variables

The research begins by constructing an ecosystem map of all major stakeholders in the Qatar A‑SMGCS market. We leverage secondary databases and industry-specific reports to identify the critical variables, such as technological adoption rates, operational safety standards, and government regulations, that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we analyze historical data, focusing on the market penetration of advanced surface movement technologies. We evaluate the ratio of A‑SMGCS system installations in Qatar’s airports and assess the growth in traffic volumes that drive demand for these systems.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be validated through interviews with key stakeholders, including airport operators, ANSPs, and technology providers. These consultations will provide firsthand insights into market trends and operational challenges, refining the data gathered through secondary research.

Step 4: Research Synthesis and Final Output

In the final stage, we engage with manufacturers and service providers to acquire detailed insights into system deployments, customer needs, and future technology adoption. This interaction helps to verify and complement our earlier findings, ensuring a comprehensive market analysis.

- Executive Summary

- Research Methodology (Market Definition (ICAO/Eurocontrol Standards & Airport Surface Management Missions) , Scope of Study (Qatar Airports + Defense Airbases + Commercial Airports), Research Framework (Top‑Down & Bottom‑Up Hybrid), Data Sources (Industry Panels, Airport Authorities, OEMs Data), Primary Research (Stakeholder Interviews Across ANSPs, Airport Ops & Procurement), Secondary Research (Regulatory Filings, Airport Master Plans, Procurement Tenders), Assumptions and Boundary Conditions, Limitations)

- A‑SMGCS Definition and Operational Scope (Surface Safety & Efficiency)

- Role of A‑SMGCS in Qatar’s Airport Safety Architecture

- Evolution of Surface Movement Tech (Surveillance → AI‑Assisted Guidance)

- Sector Value Chain Mapping

- Regulatory Framework (QCAA, ICAO Annex 14, AVOL Standards)

- Growth Drivers

Airport Expansion

Runway Safety Regulations

Digital ATC Enhancements - Market Restraints

High Capex

Integration Costs

Regulatory Approvals - Opportunities

Smart Airport Programs

AI Surveillance

Regional Defense Modernization - Key Trends

Cloud‑Based A‑SMGCS

Cyber‑Sec Hardened Systems

Predictive Analytics - Regulatory & Compliance Impact

ICAO

FAA Best Practices Adoption

- Market Value, 2020-2025

- Volume Consumption Across Subsegments, 2020-2025

- Composite Adoption Intensity, 2020-2025

- By Technology (In Value %)

Radar Systems (Primary SMR & Surface Radars) (Technology Penetration)

Multilateration Systems (Positioning Accuracy)

ADS‑B (Automatic Dependent Surveillance‑Broadcast)

Integrated Data Fusion & AI Analytics Platforms - By Offering (In Value %)

Hardware (Surveillance Sensors, Displays, RTUs)

Software (Control Algorithms, UI/UX Platforms)

Services (Installation, Integration, Support) - By Implementation Level (In Value %)

Level 1 (Basic Surveillance)

Level 2 (Safety Nets + Alerts)

Level 3 (Conflict Detection)

Level 4 (Conflict Resolution & Automated Guidance) - By Airport Size/Traffic Intensity (In Value %)

Major International Hubs (Doha, Hamad)

Secondary Regional Airport

Military/Defense Airfields

Heliports & General Aviation Centers

- Market Share by Vendor

Market Positioning Matrix - Cross Comparison Parameters (Company Overview, Product Portfolio Breadth (Surveillance, Guidance, Alerts), A‑SMGCS Implementation Levels Supported, Regional Deployment Experience (MEA & Qatar Specific), Strategic Alliances & Local Partners, R&D Investment in Surface Safety Tech, Cybersecurity & Interoperability Certifications, After‑Sales Support & Service Coverage in Middle East)

- Detailed Company Profiles

Saab AB – A‑SMGCS & ATC Solutions

Indra Sistemas S.A. – Integrated Air & Surface Management

Thales Group – MLAT & Radar‑Centric Surface Systems

Honeywell International Inc. – Airport Automation Suites

Frequentis AG – Networked ATC & Surface Systems

ADB SAFEGATE – Smart Runway & Guidance Tech

Searidge Technologies Inc. – AI‑Driven Surface Awareness

Terma A/S – Sensor & Integration Solutions

ERA a.s. (Omnipol) – Surveillance Innovation

Raytheon Technologies Corp. – Defense & Civil A‑SMGCS

Northrop Grumman Corporation – High‑end Sensor Systems

ATG Airports Ltd. – Surface Management Platforms

Leonardo S.p.A. – Aviation Systems Integration

Siemens AG – Airport Digital Infrastructure

SITTI S.p.A. – Airport Systems & Radios

- Decision‑Making Process for A‑SMGCS Investments

- Technical evaluation criteria for system capability and scalability

- Stakeholder alignment among airport operations, finance and ATC leadership

- Vendor assessment based on support, training, lifecycle costs and integration

- Forecast by Value & Growth Scenarios, 2026-2035

- Forecast by Volume & Composite Penetration, 2026-2035

- Future Demand by Aircraft Segment, 2026-2035