Market Overview

The Qatar aerobatic aircraft market is valued at approximately USD ~ million, driven by the country’s growing interest in sport aviation, recreational flying, and airshows. Qatar’s government, through entities like the Qatar Civil Aviation Authority (QCAA), continues to enhance the aviation infrastructure, which includes airspace regulations and flying clubs. The growth is also supported by rising tourism and the nation’s ambition to establish itself as a regional hub for aviation events. Furthermore, Qatar Airways and its international connections create a growing ecosystem for private and commercial aerobatic flying, including events like the Qatar International Airshow.

Qatar’s dominance in the aerobatic aircraft market is primarily concentrated in Doha, where most aviation activities, including aerobatic displays, airshows, and flight training, take place. Doha’s modern infrastructure, strong economic growth, and high disposable income have spurred interest in aviation sports. The city’s proximity to other Gulf Cooperation Council (GCC) nations like the UAE and Saudi Arabia enhances its role as a key player in the regional aerobatic and aviation event circuit. Additionally, Qatar’s growing reputation for hosting major international events, such as the Qatar International Airshow, drives the demand for aerobatic aircraft in the region.

Market Segmentation

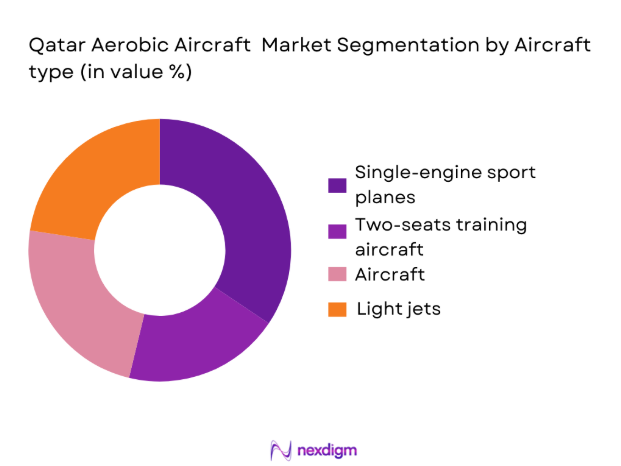

By Aircraft Type

The Qatar aerobatic aircraft market is segmented by aircraft type into single-engine sport planes, two-seat training aircraft, kit-built aerobatic aircraft, and light jets. Recently, single-engine sport planes have dominated the market, particularly models like the Extra 330 and Pitts S-2, which are widely used for aerobatic training and displays. Their dominance is attributed to their affordability, maneuverability, and ease of operation in aerobatic competitions. These aircraft are especially favored by flight schools and recreational pilots due to their durability and low maintenance costs, which makes them the go-to choice for aerobatic flying in Qatar.

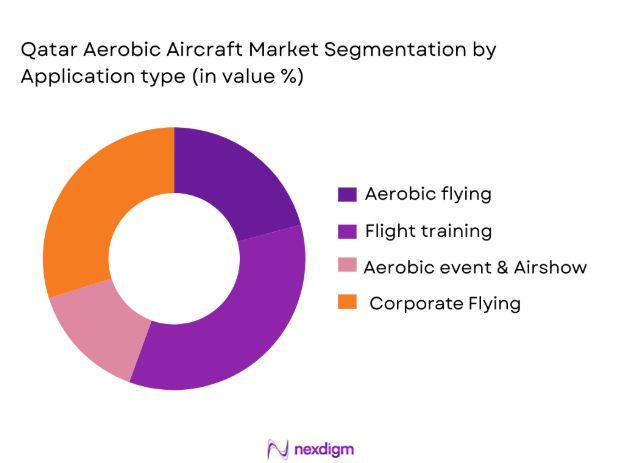

By Application

The market is segmented by application into aerobatic flying, flight training, aerobatic events and airshows, and corporate flying demonstrations. The aerobatic flying segment holds a significant market share due to the increasing number of recreational aerobatic pilots and flying clubs in Qatar. Aerobatic aircraft are popular in Qatar as a recreational activity, supported by local flying schools and private aviation clubs. Additionally, the country’s favorable weather conditions and growing interest in aviation sports drive the demand for aerobatic aircraft for recreational purposes. Furthermore, Qatar’s hosting of major airshows increases the visibility and demand for these aircraft.

Competitive Landscape

The Qatar aerobatic aircraft market is dominated by a few major players, including global manufacturers like Extra Aircraft, Pitts Special Aircraft, and Sukhoi, as well as regional players involved in the importation, training, and servicing of aerobatic planes. Local flying schools and aviation clubs also play a significant role by offering aerobatic training programs and building customer loyalty in Qatar’s aviation ecosystem. The consolidation of these key companies demonstrates the significant influence they have on the regional market.

| Company | Establishment Year | Headquarters | Product Portfolio | Market Segment | Technology | Training Infrastructure | Maintenance Network |

| Extra Aircraft | 1980 | Germany | ~ | ~ | ~ | ~ | ~ |

| Pitts Special Aircraft | 1945 | USA | ~ | ~ | ~ | ~ | ~ |

| Sukhoi | 1939 | Russia | ~ | ~ | ~ | ~ | ~ |

| Van’s Aircraft | 1973 | USA | ~ | ~ | ~ | ~ | ~ |

| Qatar Airways Private Fleet | 1993 | Qatar | ~ | ~ | ~ | ~ | ~ |

Qatar aerobatic aircraft Market Analysis

Growth Drivers

Pilot Training Demand

The demand for pilot training in Qatar has grown steadily, driven by the expansion of general aviation and increased interest in aerobatics. The growing popularity of flight schools and flying clubs in Qatar, coupled with the country’s emphasis on becoming a hub for aviation training in the Gulf region, is contributing to the rise in pilot training. In 2023, Qatar’s aviation industry saw a 5% increase in registered pilot trainees, reflecting a larger trend towards the professionalization of the industry. The Qatar Civil Aviation Authority (QCAA) has supported this demand by relaxing licensing regulations for private flight training. This growing interest supports the continued need for aerobatic aircraft in flight schools.

Rising Recreational Aviation Interests

Recreational aviation has become increasingly popular in Qatar, with more individuals seeking leisure activities like aerobatic flying. Qatar’s economic prosperity, along with a culture of luxury and high-net-worth individuals, has facilitated this trend. In 2024, the number of private pilots and owners of small aircraft in Qatar increased by 7%, according to the Qatar Aviation Club. These aircraft owners often use their planes for recreational aerobatic activities, which is directly driving the demand for aerobatic aircraft. Moreover, Qatar’s favorable weather conditions and its large open spaces provide optimal conditions for recreational flying, making it a growing market for aerobatics.

Market Challenges

Barriers

One of the main barriers to the growth of the aerobatic aircraft market in Qatar is the high cost of aircraft acquisition and maintenance. The average cost of an aerobatic aircraft, such as the Extra 330, can exceed USD 500,000, making them unaffordable for many individuals and small flying clubs. Additionally, the cost of flight training, including necessary certifications and insurance, can be prohibitively expensive for recreational pilots. In 2023, the cost of a private pilot license in Qatar rose by 10% due to inflation and increased costs in aviation fuel and parts, which continues to create a barrier to broader market participation.

Constraints

Another constraint faced by the aerobatic aircraft market in Qatar is the limited availability of suitable airspace for recreational flying. Due to the growing demand for commercial and military airspace in the region, Qatar’s airspace can be congested, particularly near urban centers like Doha. The Qatar Civil Aviation Authority (QCAA) has stringent regulations on flying near populated areas, which limits the locations where aerobatic aircraft can be used for training or recreation. In 2024, the government imposed restrictions on low-level flying over certain regions, which has made it more difficult for aerobatic pilots to practice in open skies.

Opportunities

Latent Demand Vectors

There is a significant latent demand for aerobatic aircraft in Qatar due to the country’s growing interest in aviation as both a sport and a professional pursuit. As Qatar continues to invest in aviation infrastructure, including the development of new airports and flying clubs, the demand for aerobatic aircraft is expected to increase. Qatar’s hosting of high-profile events, such as the Qatar International Airshow, has also increased public awareness and interest in aerobatics. The government’s efforts to diversify its economy and attract international events will likely lead to an increase in tourism and local demand for recreational flying and aerobatic displays.

Development of Electric and Hybrid-Electric Aerobatic Aircraft

An emerging opportunity in the Qatar aerobatic aircraft market lies in the development and adoption of electric and hybrid-electric aerobatic aircraft. As environmental concerns and the push for sustainability grow, there is an increasing interest in green aviation technologies. Qatar, with its commitment to diversifying its economy and adopting cutting-edge technologies, can capitalize on this trend. The global aviation industry is already witnessing a shift towards more sustainable aircraft solutions, and introducing electric or hybrid-electric aerobatic aircraft could position Qatar as a leader in eco-friendly aviation. This would not only reduce operating costs for aerobatic aircraft but also attract environmentally conscious pilots and organizations looking to showcase innovative flying techniques in a sustainable manner.

Future Outlook

Over the next few years, the Qatar aerobatic aircraft market is expected to show significant growth driven by continuous government support for general aviation, advancements in flight training technologies, and increasing demand for airshow displays and recreational flying. Qatar’s aviation infrastructure continues to improve, with developments in private flight services and the country’s ambitions to attract more international aviation events. Moreover, with rising affluence and interest in leisure aviation, Qatar is poised to become a central hub for regional aerobatic competitions and flying events.

Major Players

- Extra Aircraft

- Pitts Special Aircraft

- Sukhoi

- Van’s Aircraft

- Qatar Airways Private Fleet

- Moller’s Aviation

- Aero Vodochody

- Tecnam Aircraft

- Cessna Aircraft

- Beechcraft

- Diamond Aircraft

- Aerosport Aviation

- Waco Aircraft

- Muster Aircraft

- Aero Design Aircraft

Key Target Audience

- Government & Regulatory Bodies

- Aviation Investors

- Aerospace OEMs and Aircraft Manufacturers

- Private Aircraft Owners & Flying Clubs

- Flight Schools & Training Providers

- Event Organizers & Airshow Hosts

- Aviation Equipment Distributors

- Corporate Aviation Services Providers

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying the key factors influencing the Qatar aerobatic aircraft market, such as government aviation policies, recreational aviation growth, and infrastructure expansion. This includes conducting extensive secondary research through government aviation reports and international trade bodies.

Step 2: Market Analysis and Construction

Data is collected and analyzed regarding Qatar’s aviation infrastructure, including flight schools, clubs, and airshow participation. The goal is to build a comprehensive understanding of demand drivers, including pilot training and aircraft purchase trends.

Step 3: Hypothesis Validation and Expert Consultation

In this phase, industry experts, including flight instructors, aircraft owners, and regulatory bodies, will be consulted to validate market hypotheses. Interviews with local flight schools and event organizers will provide insights into real-world aircraft usage and demand.

Step 4: Research Synthesis and Final Output

Data gathered through secondary research and expert consultations will be synthesized to provide a comprehensive overview of Qatar’s aerobatic aircraft market. The final output will include actionable insights for market participants, including OEMs, flying clubs, and investors.

- Executive Summary

- Research Methodology (Market Definitions & Scope, Abbreviations, Data Triangulation Framework, Secondary Data Sources, Primary Interviews with Qatar Civil Aviation Authority & Flying Clubs, Estimation & Forecasting Techniques, Limitations & Confidence Assessment)

- Definition & Scope

- Market Genesis & Evolution

- Qatar Aviation Ecosystem Context

- Regulatory Framework

- Growth Drivers

Pilot training demand

rising recreational aviation interests - Market Challenges

Barriers

constraints

Operational limitations

- Opportunities

Latent demand vectors

Development of Electric and Hybrid-Electric Aerobatic Aircraft

- Technology Trends

Advanced Composite Airframes

Digital Flight Controls & Safety Avionics

Simulation & Virtual Reality Training Integration

- SWOT Analysis

- Stakeholder Ecosystem

Pilot clubs

Academies

Authorities

OEMs & service providers

- Porter’s Five Forces

Competitive intensity

Supplier power

User dynamics

Entry barriers

Qatar Aerobatic Aircraft Market Value, 2020-2025

Deployment Units & Fleet Composition, 2020-2025

Average Operating Cost Parameters, 2020-2025

Revenue Pools, 2020-2025

- By Aircraft Type (In Value %)

Single‑Engine Sport Aerobatic Aircraft

Two‑Seat Training Aerobatic Aircraft

Kit‑Built Aerobatic Planes

Light Jets for Aerobatic Displays

Ultralight Aerobatic Capable Aircraft - By Application Segment (In Value %)

Recreational Aerobatic Flying

Flight Training & Pilot Skill Development

Aerobatic Competition & Airshow Displays

Corporate/Executive Demonstrations

Media/Marketing & Filming Operations - By End User (In Value %)

Flying Clubs & Recreation Entities

Flight Schools & Pilot Training Academies

Corporate & Private Owners

Event Organizers & Airshow Hosts - By Purchase Channel (In Value %)

Direct OEM Purchases

Dealership/Distributor Acquisitions

Flight School Fleet Contracts

Used Aircraft Transactions - By Geographic Dynamic (In Value %)

Doha Region Aviation Market

Northern Qatar Airfield Nodes

Western/Northern Flight Training Zones

Airshow Activity Concentration Zones

Cross‑GCC Aerobatic Engagement Corridors

- Market Share by Value & Operational Base

- Cross Comparison Parameters (Company Profile, Aircraft Performance Metrics, Training Support Network, After‑Sales Service Quality, Regulatory Certifications Held, Airshow Support Capabilities, Flight Training Curriculum Partnerships, Local Distributor Presence)

- Detailed Company & OEM Profiles

Extra Flugzeugproduktions GmbH

Sukhoi Company Aerobatic Division

American Champion Aircraft

Van’s Aircraft (RV Series)

Pacific Aerospace Ltd

Blackwing Sweden

Waco Aircraft Corporation

Tomas Podesva Air

Vans RV Aerobatic Platform

Aerobatic Trainer OEMs (Generic)

Flight Training Service Providers

Flying Club Operators with Aerobatic Expertise

Ultralight Aerobatic Aircraft OEMs

Aerobatic Event Organizers & Airshow Partners

Avionics & Safety Systems Suppliers Supporting Aerobatic Aviation

- Demand Drivers & Utilization Patterns

- Flight Training Economics & Licensing

- Aircraft Ownership & Usage Profiles

- Safety & Regulatory Compliance

- Pilot Profile & Decision Hierarchy

- Qatar Aerobatic Aircraft Market Future Size, 2026-2035

- Forecasted Market Value & Volume, 2026-2035

- Acquisition & Operating Cost Outlook, 2026-2035