Market Overview

The Qatar aeroengine composites market is valued at approximately USD ~ billion in 2025. This market growth is driven by the increasing demand for lightweight, fuel-efficient materials in the aerospace industry. The rising number of aircraft in service and the increasing demand for new aircraft in Qatar, particularly by Qatar Airways and local aerospace manufacturers, is expected to boost the demand for high-performance composite materials. Additionally, the government’s investment in modernizing the aviation industry, along with the expansion of Qatar’s aerospace capabilities, contributes to the continued growth of the market.

Qatar, particularly Doha, is the dominant player in the aeroengine composites market in the region. Doha serves as the commercial and industrial hub for aerospace activities, including Qatar Airways, one of the world’s leading airlines. The presence of significant aerospace companies and maintenance repair operations (MRO) in Doha, combined with the government’s support under Vision 2030, drives the demand for advanced composite materials. Moreover, the growing demand for military aircraft in the region also contributes to the dominance of Qatar in this market.

Market Segmentation

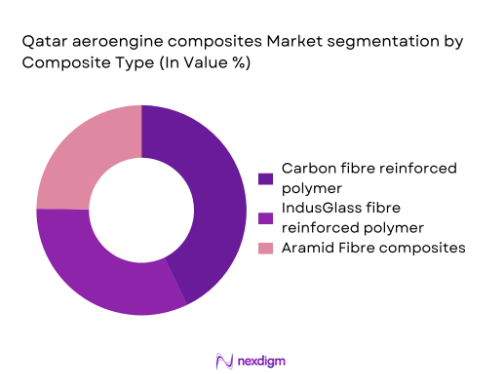

By Composite Type

The Qatar aeroengine composites market is primarily segmented by composite type, including carbon fiber-reinforced polymer (CFRP), glass fiber-reinforced polymer (GFRP), and aramid fiber composites. CFRP is the dominant segment due to its superior strength-to-weight ratio, making it ideal for aerospace applications. It is widely used in engine components, fan blades, and structural parts, where minimizing weight while maintaining strength is critical. CFRP is preferred due to its durability, fuel efficiency, and ability to withstand high operational stress, contributing to its dominance in the market.

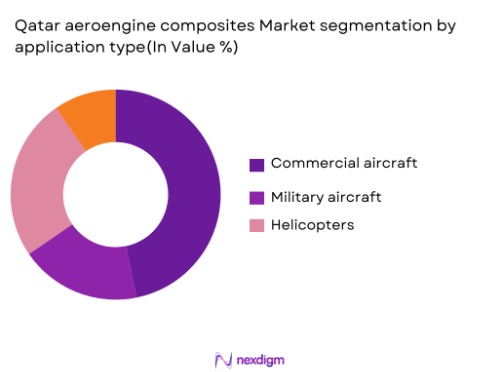

By Application

The Qatar aeroengine composites market is segmented by application into commercial aircraft, military aircraft, and helicopters Commercial aircraft dominate this segment due to the expanding fleet of Qatar Airways and other regional airlines. As the demand for fuel-efficient, lightweight aircraft increases, composites such as CFRP and GFRP play a pivotal role in reducing the overall weight of the aircraft, thereby improving fuel efficiency. The continuous modernization of commercial fleets in Qatar further boosts the demand for composites in this segment.

Competitive Landscape

The Qatar aeroengine composites market is highly competitive, with major players including global manufacturers and suppliers of composite materials. Companies like Hexcel Corporation, Toray Industries, and Solvay dominate the market due to their established product portfolios and innovations in composite materials. Local players such as Qatar Airways Engineering and Qatar Aeronautical College are also contributing to the demand for composite materials through maintenance, repair, and overhaul (MRO) services. These companies are focusing on technology advancements and sustainable material solutions to maintain their competitive edge in the growing aerospace sector.

| Company | Establishment Year | Headquarters | Key Products | Focus Area | Market Contribution |

| Hexcel Corporation | 1948 | USA | ~ | ~ | ~ |

| Toray Industries | 1926 | Japan | ~ | ~ | ~ |

| Solvay | 1863 | Belgium | ~ | ~ | ~ |

| Qatar Airways Engineering | 2006 | Qatar | ~ | ~ | ~ |

| Qatar Aeronautical College | 2008 | Qatar | ~ | ~ | ~ |

Qatar aeroengine composites Market Analysis

Growth Drivers

Increasing Aircraft Fleet Expansion

The expansion of the Qatar Airways fleet is a significant growth driver for the aeroengine composites market in Qatar. Qatar Airways has been increasing its fleet size with an expected addition of up to 50 new aircraft by 2025, which includes a mix of wide-body and narrow-body jets. The increase in fleet size directly translates to higher demand for composite materials used in engine components, landing gear, and airframe structures. In addition to the commercial sector, the growing demand for military and cargo aircraft is boosting the need for advanced composites in Qatar. The rapid growth of aviation activity in the Middle East supports this demand.

Technological Advancements in Composites

Technological advancements in composite materials are critical for the aerospace industry. Qatar’s aerospace sector is adopting high-performance composite materials, such as carbon fiber reinforced polymers (CFRP) and glass fiber reinforced polymers (GFRP), to reduce weight, increase fuel efficiency, and enhance performance. With the global push for reducing carbon emissions, these materials have become the industry standard. Qatar Airways and other local manufacturers are embracing new composite technologies to stay competitive. In particular, composite materials are increasingly being used in engine components to increase fuel efficiency, and Qatar’s investment in R&D is pushing this forward

Market Challenges

High Cost of Composite Materials

The high cost of advanced aeroengine composites is a significant challenge in Qatar’s aerospace industry. Carbon fiber reinforced polymers (CFRP) and glass fiber reinforced polymers (GFRP), though highly effective for reducing weight and enhancing fuel efficiency, come with high production costs. The manufacturing process of these materials, including labor-intensive lay-up techniques and specialized equipment, increases the overall cost. With the need for continuous technological innovation, Qatar’s aerospace sector is looking at cost-effective solutions while striving to meet global standards of aviation safety and efficiency.

Sustainability and Recycling Challenges

Sustainability concerns surrounding the disposal and recycling of composite materials pose a challenge for the aerospace industry in Qatar. The long lifecycle of aircraft, combined with the use of composite materials, creates significant waste when decommissioned. The development of composite recycling technologies has been slow, and Qatar faces challenges in managing the environmental impact of these materials. Efforts to recycle composites have made progress, but cost-effective and scalable recycling solutions are still in the development phase

Opportunities

Expansion of Qatar Airways

The expansion of Qatar Airways presents a significant opportunity for the aeroengine composites market in Qatar. Qatar Airways is continuously adding new aircraft to its fleet, including Boeing 787 Dreamliners and Airbus A350s, both of which utilize high-performance composite materials. The airline’s expansion and modernization plans ensure consistent demand for composite materials in both new aircraft manufacturing and maintenance activities. As the airline seeks to become a global leader in environmental sustainability, demand for lightweight materials to reduce fuel consumption is expected to continue growing.

Government Initiatives in Aerospace Development

The Qatar government has significantly invested in the aerospace sector under its Vision 2030 strategy. Qatar is focusing on enhancing its aviation infrastructure and becoming a regional leader in aerospace manufacturing and MRO services. Government-backed projects, such as the expansion of Hamad International Airport and the creation of a state-of-the-art MRO facility, contribute to the market demand for advanced composite materials. The government’s efforts to modernize the national aviation industry and to support local manufacturing capabilities provide new market opportunities for composite material suppliers

Future Outlook

The future of the Qatar aeroengine composites market is expected to see continued growth, driven by advancements in aerospace manufacturing technologies, and the increasing demand for fuel-efficient and environmentally sustainable aircraft. Qatar’s efforts to develop an advanced aerospace sector under Vision 2030, along with its continued investment in local aircraft fleet expansion and military aircraft modernization, will further contribute to the market’s growth. The integration of lightweight composite materials in aircraft design, coupled with the adoption of 3D printing in aerospace production, presents new opportunities for innovation in the composites market. (Source: Qatar Vision 2030)

Major Players

- Hexcel Corporation

- Toray Industries

- Solvay

- Teijin Limited

- SGL Carbon

- Mitsubishi Chemical Advanced Materials

- Zoltek Companies, Inc.

- Jushi Group

- Qatar Airways Engineering

- Qatar Aeronautical College

- BASF SE

- Cytec Solvay Group

- 3M

- Hyosung Corporation

- Aerospace Composites, Inc.

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Qatar Civil Aviation Authority, Ministry of Transport and Communications)

- Aerospace OEMs

- Aerospace MRO Providers

- Aircraft Component Manufacturers

- Raw Material Suppliers

- Aerospace Research and Development Organizations

- Military Aviation Procurement Agencies

Research Methodology

Step 1: Identification of Key Variables

In this phase, we will identify the key stakeholders within the Qatar aeroengine composites market. This includes OEMs, MRO providers, and material suppliers, with a focus on understanding the market dynamics, supply chains, and demand drivers. We will employ secondary data sources and interviews with industry experts to gather relevant information.

Step 2: Market Analysis and Construction

The next phase will focus on analyzing historical data, trends, and market penetration rates within Qatar’s aerospace sector. We will explore the ratio of aircraft in service, the amount of composites used, and the implications of regional trends on the market.

Step 3: Hypothesis Validation and Expert Consultation

To refine our analysis, we will consult with experts in the aerospace industry, including engineers, aerospace OEMs, and material suppliers. These consultations will ensure that our assumptions and hypotheses align with the current market realities.

Step 4: Research Synthesis and Final Output

The final step will involve synthesizing the findings and creating a comprehensive report detailing market trends, competitive strategies, and the future outlook for the Qatar aeroengine composites market. This final output will provide actionable insights and data-backed recommendations.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Aircraft Fleet Expansion

Technological Advancements in Composites

Growing Demand from Military Sector - Market Challenges

High Cost of Composite Materials

Sustainability and Recycling Challenges

Supply Chain Disruptions - Opportunities

- Expansion of Qatar Airways

Government Initiatives in Aerospace Development

R&D Investments in New Composite Materials - Trends

Lightweight Composites in Aircraft Design

Advanced Manufacturing Techniques (e.g., 3D Printing)

Increase in Environmental Sustainability Focus - Government Regulation

Aerospace Safety Regulations

Environmental Compliance for Aerospace Manufacturing - SWOT Analysis (Highly skilled workforce, government support, High costs of advanced composites, Growing regional aerospace industry, Economic fluctuations affecting aerospace investments)

- Stakeholder Ecosystem

- SWOT Analysis

- Porter’s Five Forces

- Competition Ecosystem

- By Value, 2020-2025

- By Volume, 2020-2025

- By Average Price, 2020-2025

- By Composite Type (In Value %)

Carbon Fiber Reinforced Polymer (CFRP)

Glass Fiber Reinforced Polymer (GFRP)

Aramid Fiber Composites - By Application (In Value %)

Commercial Aircraft

Military Aircraft

Helicopters - By End-User Industry (In Value %)

Aerospace OEMs

Aerospace Maintenance, Repair, and Overhaul (MRO)

Component Suppliers - By Distribution Channel, (In Value %)

Direct Sales to OEMs

Distributors and Retailers

Online Sales Platforms - By Region, (In Value %)

Doha Region

Other Regions

- Global Composite Manufacturers

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Production Plants)

- Detailed profile of Major Players

Hexcel Corporation

Toray Industries

Solvay

Teijin Limited

SGL Carbon

Mitsubishi Chemical Advanced Materials

Zoltek Companies, Inc.

Jushi Group

Qatar Airways Engineering

Qatar Aeronautical College

BASF SE

Cytec Solvay Group

3M

Hyosung Corporation

Aerospace Composites, Inc.

- Aerospace OEMs

- MRO Providers

- Military Aviation

- Component Manufacturers

- Raw Material Suppliers

- By Value, 2026-2035

- By Volume, 2026-2035

- By Average Price, 2026-2035